New Housing Gst Rebate Form To send your new housing rebate claim for an owner built house online using My Account fill out and upload Form GST191 WS Construction Summary Worksheet to My Account before filling out the information from Form GST191 GST HST New Housing Rebate Application for Owner Built Houses

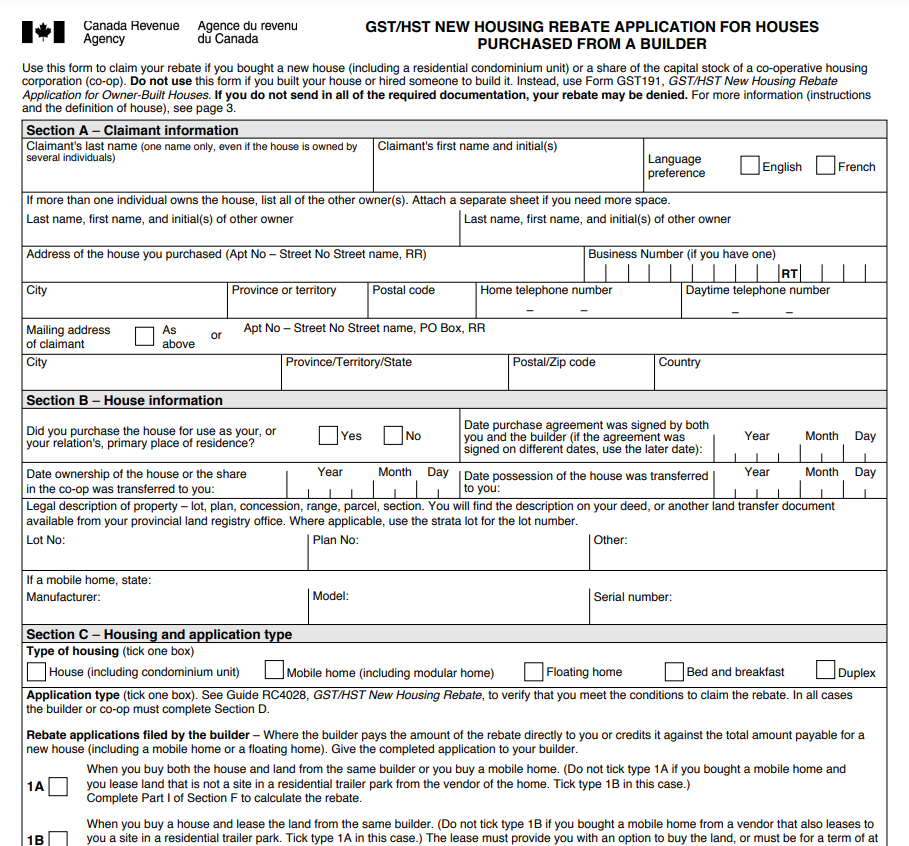

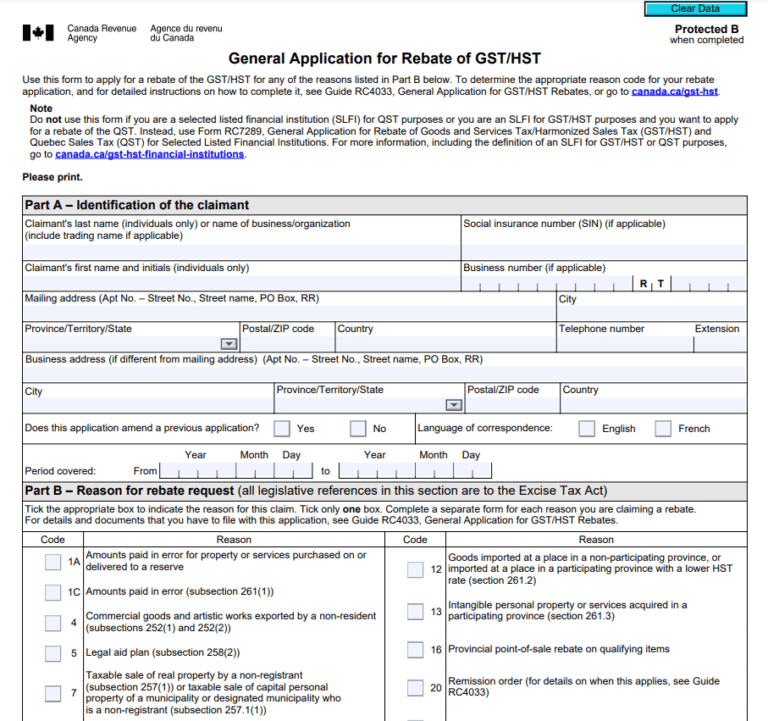

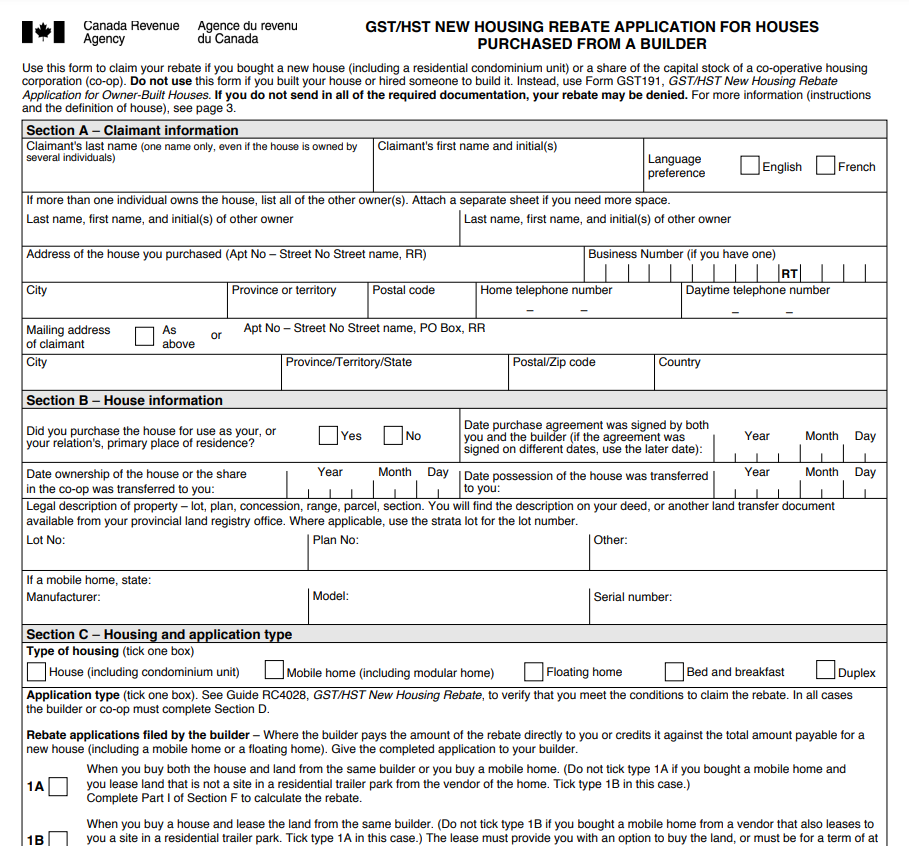

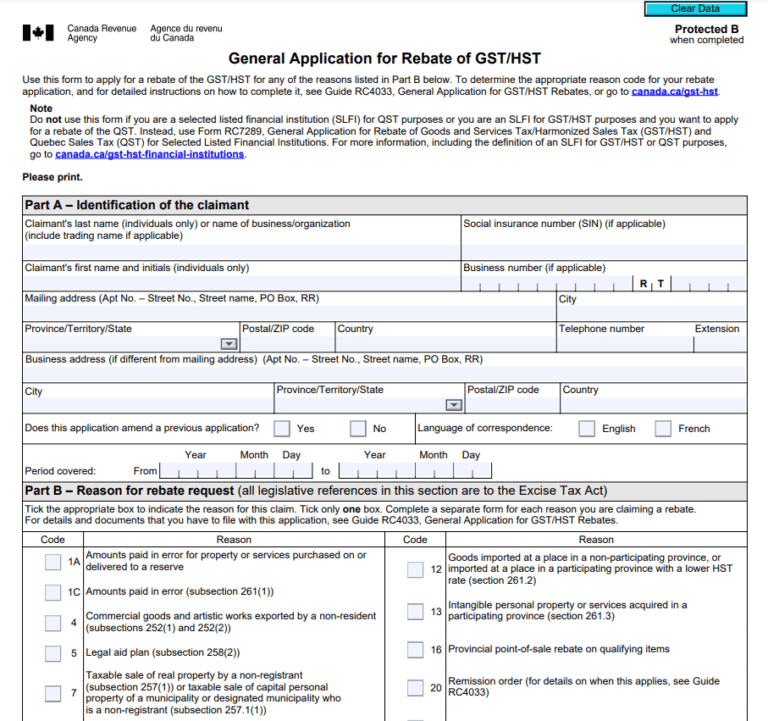

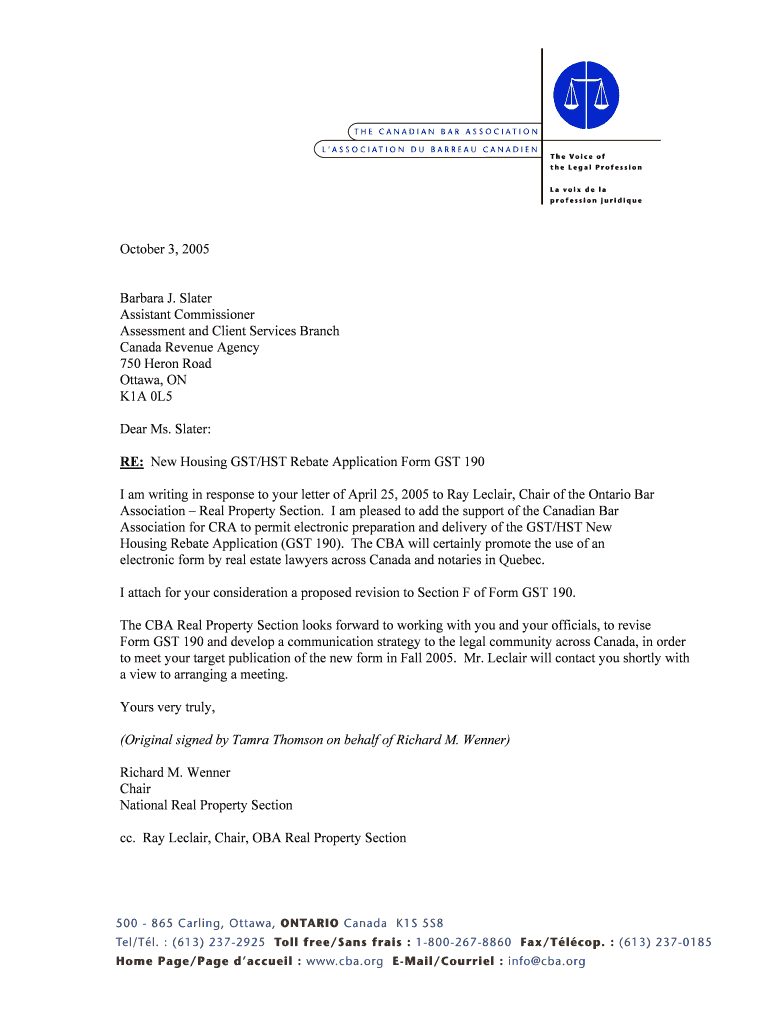

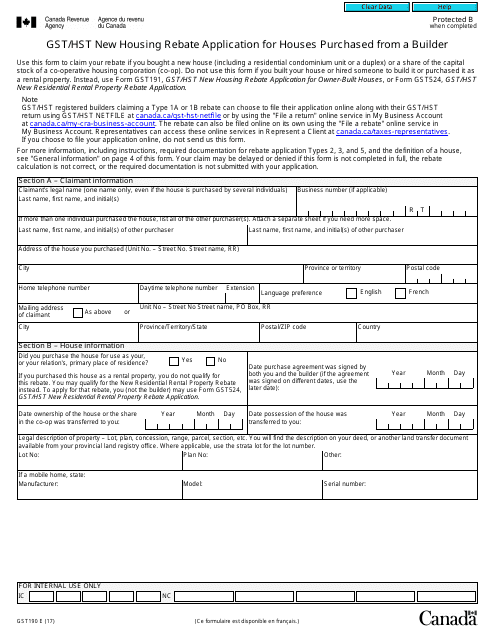

The GST HST new housing rebate allows an individual to recover some of the GST or the federal part of the HST paid for a new or substantially renovated house that is for use as the individual s or their relation s primary place of residence Use this form to claim your rebate if you bought a new house including a residential condominium unit or a share of the capital stock of a co operative housing corporation co op Do not use this form if you built your house or hired someone to build it Instead use Form GST191 GST HST New Housing Rebate Application for Owner Built Houses

New Housing Gst Rebate Form

New Housing Gst Rebate Form

https://sqicpa.com/wp-content/uploads/2018/09/GST-HST-Rebate-1-e1537821386125.png

GST New Housing Rebate Form Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2022/08/Gst-New-Housing-Rebate-Form.png

GST HST New Housing Rebate

https://s2.studylib.net/store/data/018652884_1-513f72a6deb536e1e7fc71e273780d55-768x994.png

Use this form to calculate and claim your GST HST new housing rebate if you are an individual who built a new house You can also claim the rebate for a substantial renovation of your house a major addition that forms part of a renovation of your house and for a conversion from non residential to residential use The house must Use this form to claim your new housing rebate if you bought a new house including a residential condominium unit or a duplex or a share of the capital stock of a co operative housing corporation co op The house must be the primary place of residence for you or a

Enter your base date for your filing deadline in Section B of Form GST191 GST HST New Housing Rebate Application for Owner Built Houses Your base date will be the day the construction or renovation of your home has concluded You must claim your rebate within 24 months of the sale or renovation This rebate allows individuals to reclaim part of the goods and service tax GST or the federal portion of the harmonized sales tax HST paid on the home However only individuals who satisfy all of the conditions for claiming the rebate which can be found online may apply

Download New Housing Gst Rebate Form

More picture related to New Housing Gst Rebate Form

How Do I Claim GST HST Housing Rebate RKB Accounting Tax Services

https://www.rkbaccounting.ca/wp-content/uploads/2021/01/Home-renovation-contractors-rkb-accounting-1.jpg

Ontario New Housing Rebate Form By State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/Ontario-New-Housing-Rebate-Form-768x715.png

Rebate Application Form Housing PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/02/Housing-Rebate-Form-2023-768x702.jpg

Fill out this form to calculate and claim the GST HST new housing rebate if you built a new house or substantially renovated or added a major addition to your house as part of a renovation of your existing house or converted your house from non residential use to residential use The GST HST new housing rebate allows an individual to recover some of the GST or the federal part of the HST paid for a new or substantially renovated house that is for use as the individual s or their relation s primary place of residence

The GST HST New Housing Rebate helps Canadian individuals recover some of the GST or the federal part of the HST paid for a new or extensively renovated house The maximum rebate you can receive for the GST portion is 36 of the GST tax you paid up to a maximum of 6 300 For new homes with a price of 350 000 or less you are able to receive a maximum HST rebate of 30 000 while for homes between 350 000 and 450 000 there is a sliding scale refer to the CRA s reference for HST New Housing Rebate Calculator

How To Fill Out Hst Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/How-To-Fill-Out-HST-Rebate-Form-768x721.png

GST HST New Housing Rebate

https://gardhousefinancial.com/wp-content/uploads/2021/12/New-Housing-Rebate-Finn.png

https://www.canada.ca/en/revenue-agency/services...

To send your new housing rebate claim for an owner built house online using My Account fill out and upload Form GST191 WS Construction Summary Worksheet to My Account before filling out the information from Form GST191 GST HST New Housing Rebate Application for Owner Built Houses

https://www.canada.ca/.../new-housing-rebate.html

The GST HST new housing rebate allows an individual to recover some of the GST or the federal part of the HST paid for a new or substantially renovated house that is for use as the individual s or their relation s primary place of residence

Top 5 Questions About The GST HST Housing Rebate

How To Fill Out Hst Rebate Form Printable Rebate Form

Fillable Online New Housing GST HST Rebate Application Form GST 190 Fax

GST New Housing Rebate Pinnacle Accountants Advisors

GST HST New Housing Rebate What You Need To Know Loans Canada

Gst190 Fillable Form Printable Forms Free Online

Gst190 Fillable Form Printable Forms Free Online

Gst191 Fillable Form Printable Forms Free Online

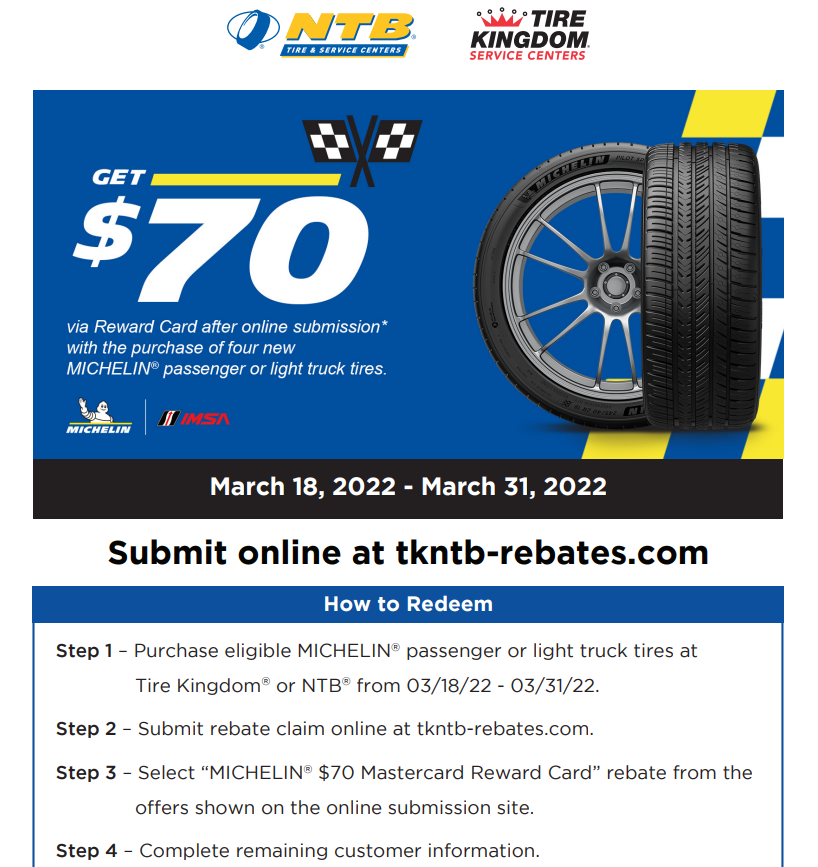

Tkntb Rebates PrintableRebateForm

What Is The GST HST New Housing Rebate Rental Rebate And How To Receive

New Housing Gst Rebate Form - Enter your base date for your filing deadline in Section B of Form GST191 GST HST New Housing Rebate Application for Owner Built Houses Your base date will be the day the construction or renovation of your home has concluded You must claim your rebate within 24 months of the sale or renovation