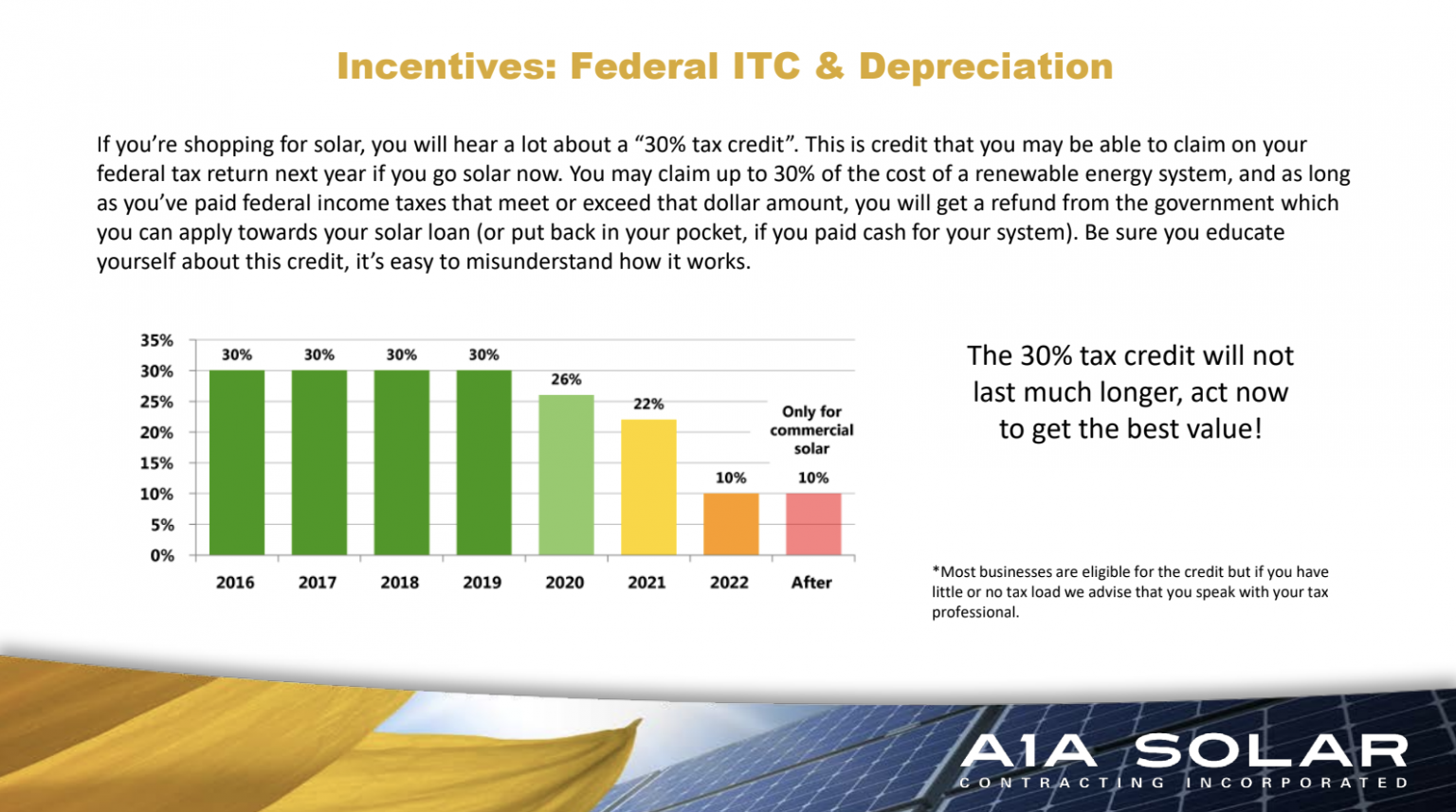

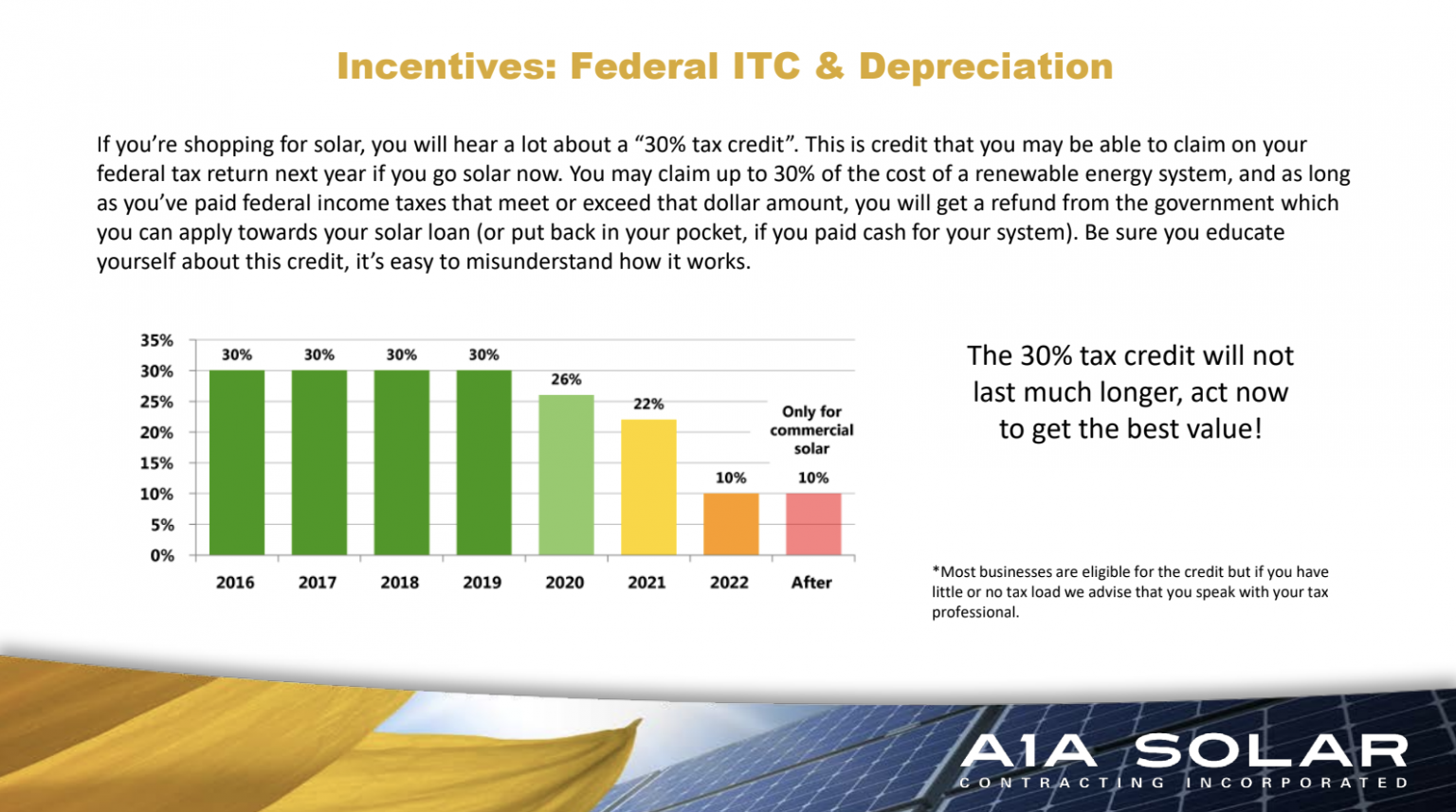

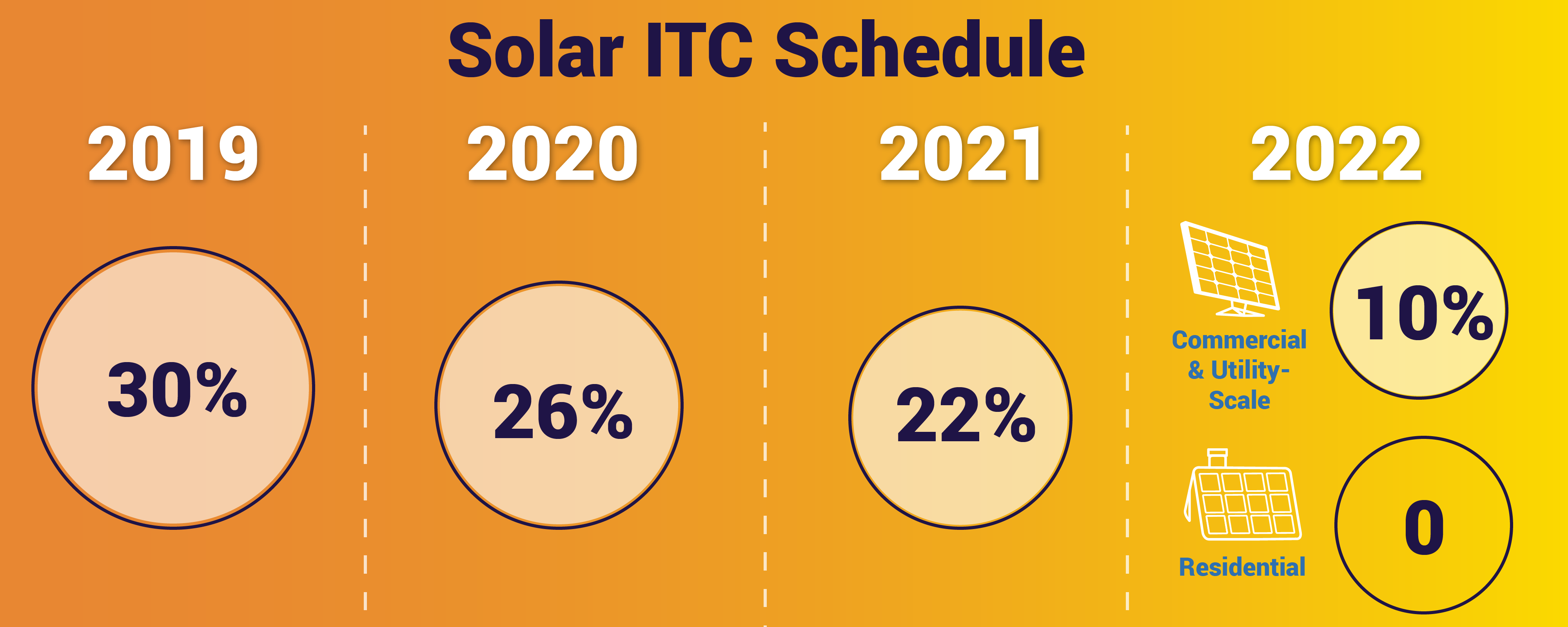

Solar Energy Rebates And Tax Incentives Web 28 ao 251 t 2023 nbsp 0183 32 How It Works The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022

Web The flagship home energy discount included in the IRA is the residential clean energy credit which offers homeowners 30 off the cost of new qualified clean energy Web One of the most valuable incentives in the Inflation Reduction Act is the extension of the 30 Residential Clean Energy credit commonly known as the solar investment tax

Solar Energy Rebates And Tax Incentives

Solar Energy Rebates And Tax Incentives

https://www.credible.com/blog/wp-content/uploads/2021/07/Solar-tax-incentives-available-to-consumers-infographic.png

Federal Solar Tax Credit Save Money On Solar KC Green Energy

https://www.kcgreenenergy.com/content/uploads/2018/08/updated-2020-federal-tax-incentive-for-solar-panels.png

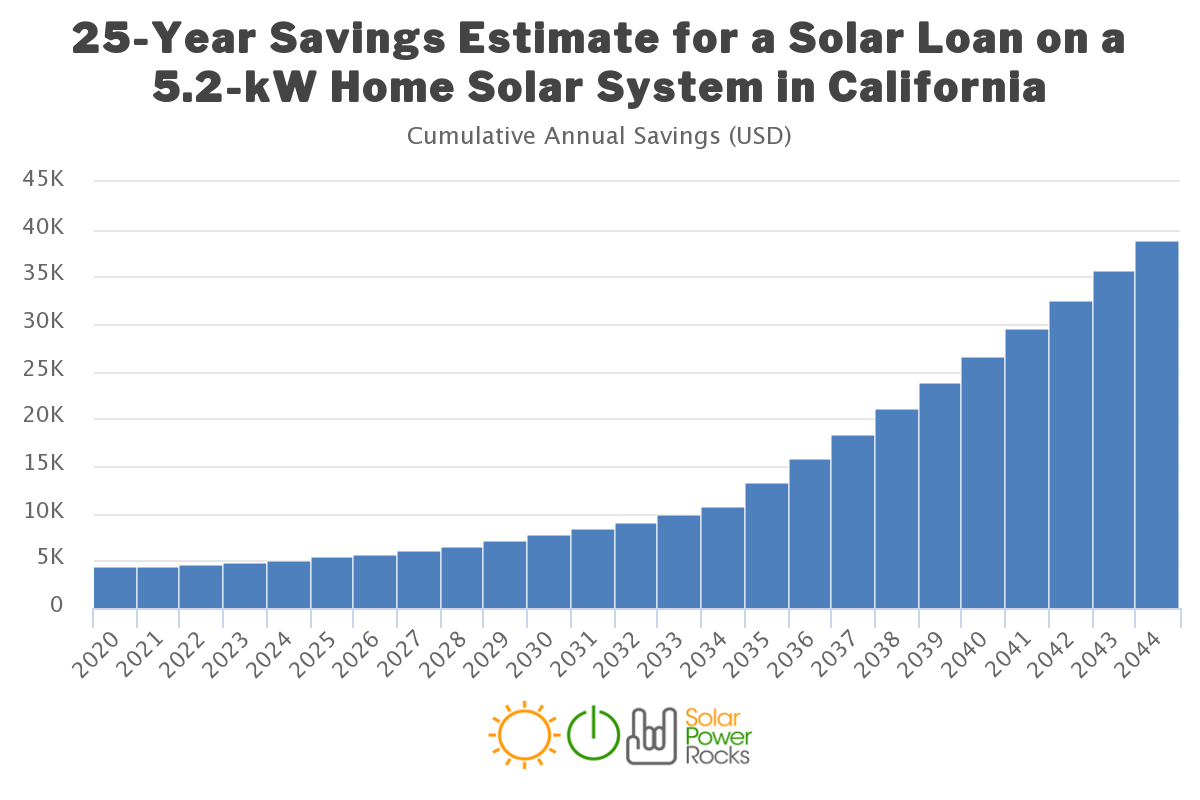

Do Solar Energy Savings Pay Off Creative Solar USA

https://creativesolarusa.com/wp-content/uploads/2020/09/01.04_ITC_extension-1-edited.png

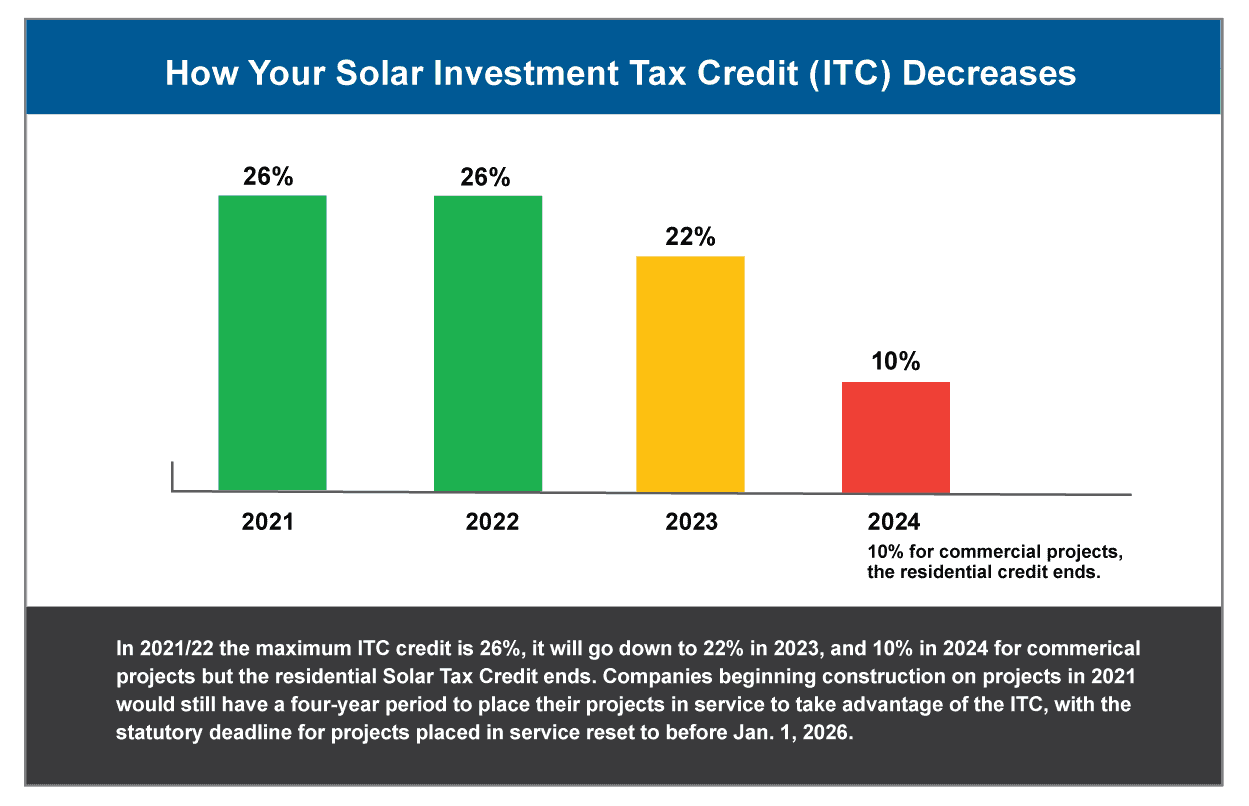

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other Web 8 sept 2022 nbsp 0183 32 Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed

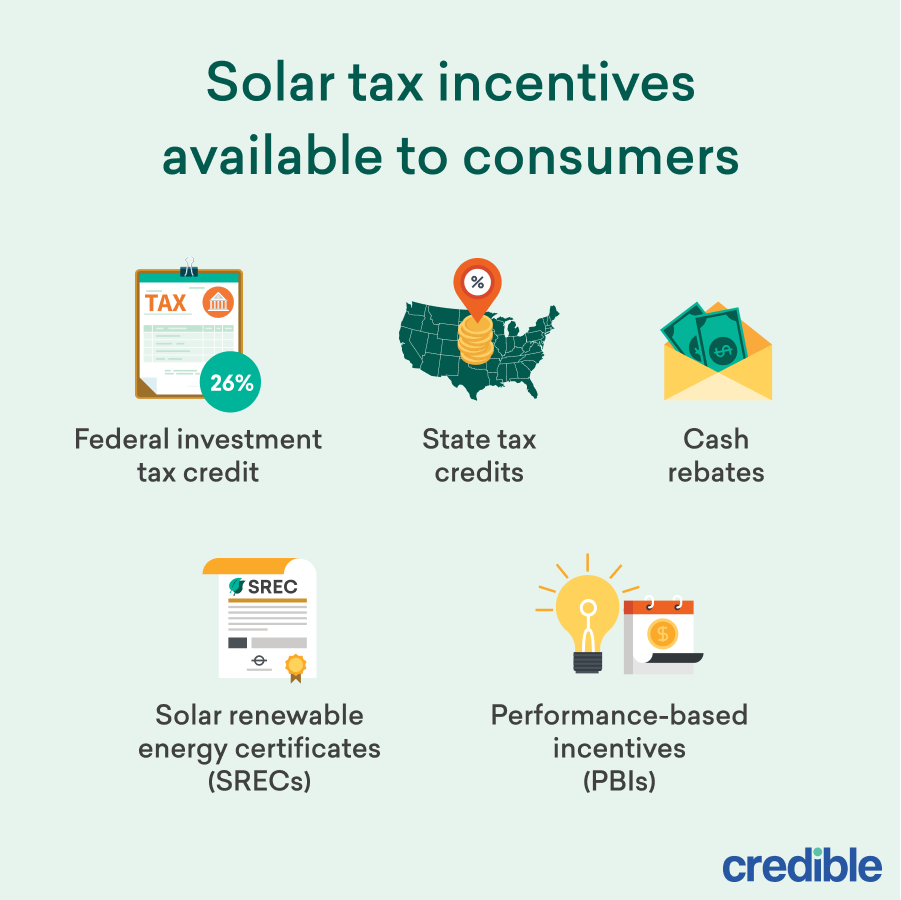

Web What rebates and incentives are available for solar energy SEIA There is a federal investment tax credit ITC for solar energy systems in place until December 31st 2023 Web 30 d 233 c 2022 nbsp 0183 32 The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Americans to make homes and buildings more energy efficient to help reduce energy costs while

Download Solar Energy Rebates And Tax Incentives

More picture related to Solar Energy Rebates And Tax Incentives

Solar Tax Credits Rebates Missouri Arkansas

https://soleraenergyllc.com/wp-content/uploads/2022/07/Graphic-1000x1024.jpg

The Future Of Solar Energy Rebates Solaris

https://cdn10.bigcommerce.com/s-3yc5xwvk/product_images/uploaded_images/federal-rebate-for-solar.png?t=1460888427

Solar Energy Tax Credits By State MD NJ PA VA DC FL

https://www.solarenergyworld.com/wp-content/uploads/2021/01/ITC-chart-horizontal2021-FA.png

Web Rebates and incentives are a crucial way to encourage broader adoption of solar energy and full home electrification across the country These incentives will typically come from Web The investment tax credit ITC is a tax credit that reduces the federal income tax liability for a percentage of the cost of a solar system that is installed during the tax year 1 The production tax credit PTC is a per

Web 8 sept 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal Web 20 juin 2023 nbsp 0183 32 A Decade of Energy Efficiency Tax Credits and Rebates Ahead With the IRA officially law homeowners of all income levels will have access to new and improved

Get A 30 Federal Tax Credit For Your Solar Panel System While You Can

https://a1asolar.com/wp-content/uploads/2018/10/tax-credit-chart-1536x857.png

Massachusetts Solar Tax Incentives Expiring Soon

https://myenergymonster.com/ma/wp-content/uploads/sites/2/2020/08/solar-tax-credit-banner.png

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Web 28 ao 251 t 2023 nbsp 0183 32 How It Works The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022

https://www.cnet.com/home/energy-and-utilities/how-to-get-tax-credits...

Web The flagship home energy discount included in the IRA is the residential clean energy credit which offers homeowners 30 off the cost of new qualified clean energy

Financial Incentives For Getting Solar Sun Pacific Solar

Get A 30 Federal Tax Credit For Your Solar Panel System While You Can

Energy Efficient Rebates Tax Incentives For MA Homeowners

Missouri Solar Incentives StraightUp Solar

Solar Investment Tax Credit ITC SEIA

California Solar Energy Incentives List Solaris

California Solar Energy Incentives List Solaris

Guide To Minnesota Solar Incentives Tax Credits And Rebates In 2023

How Does The Green Investment Tax Allowance GITA Work Solarvest

Solar Rebates Renewable Energy Incentives For California AltE

Solar Energy Rebates And Tax Incentives - Web 8 sept 2022 nbsp 0183 32 Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed