New Housing Rebate Eligibility Housing benefits Information on the GST HST new housing rebate buying a home making

First the new housing rebate equals 36 of the GST that all buyers need to Enter your base date for your filing deadline in Section B of Form GST191 GST HST New Housing Rebate Application for Owner Built Houses Your base date will be the day the construction or renovation of your home has

New Housing Rebate Eligibility

New Housing Rebate Eligibility

https://www.rkbaccounting.ca/wp-content/uploads/2021/01/Home-renovation-contractors-rkb-accounting-1.jpg

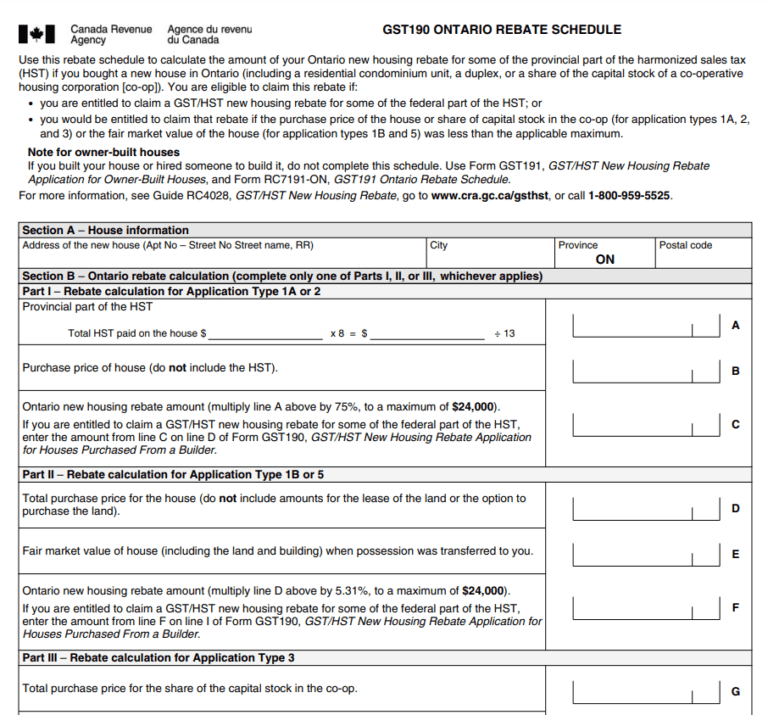

Ontario New Housing Rebate Form By State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/Ontario-New-Housing-Rebate-Form-768x715.png

Rebate Eligibility Home Performance Contractor Network HPCN

https://cdn.fs.guides.co/8iRcoXT0QCCHUPF9BsXB

Which new housing rebate am I eligible for Individuals can claim the GST HST new housing Canada has a new housing rebate known as the GST HST new housing

To help partially offset the GST HST cost related to new housing landlords that use new housing to generate long term residential rent may be eligible for the GST HST new residential rental property rebate Eligibility for Through the Federal and Provincial Government GST HST New Housing Rebate Program you may be eligible to receive a new housing rebate for some of the GST HST paid for new constructed or substantially renovated residential homes

Download New Housing Rebate Eligibility

More picture related to New Housing Rebate Eligibility

How To Calculate The GST HST New Housing Rebate Sproule Associates

https://my-rebate.ca/wp-content/uploads/2021/03/shutterstock_745359235-1-768x509.jpg

Affordable Housing Assessment Tool Australian Housing Data Analytics

https://www.ahdap.org/sites/default/files/AHDAP-01.png

2022 Menards Rebate Forms RebateForMenards

https://i0.wp.com/www.rebateformenards.com/wp-content/uploads/2022/10/2022-menards-rebate-forms.jpg?fit=1024%2C963&ssl=1

The GST HST New Housing Rebate helps Canadian individuals recover some of the GST or the federal part of the HST paid for a new or extensively renovated house The maximum rebate you can receive for the You may qualify for a rebate of part of the GST or HST that you paid on the purchase price or

This guide contains instructions to help you complete Form GST190 It In this comprehensive guide we will explore the eligibility criteria application

GST HST New Housing Rebate

https://s2.studylib.net/store/data/018652884_1-513f72a6deb536e1e7fc71e273780d55-768x994.png

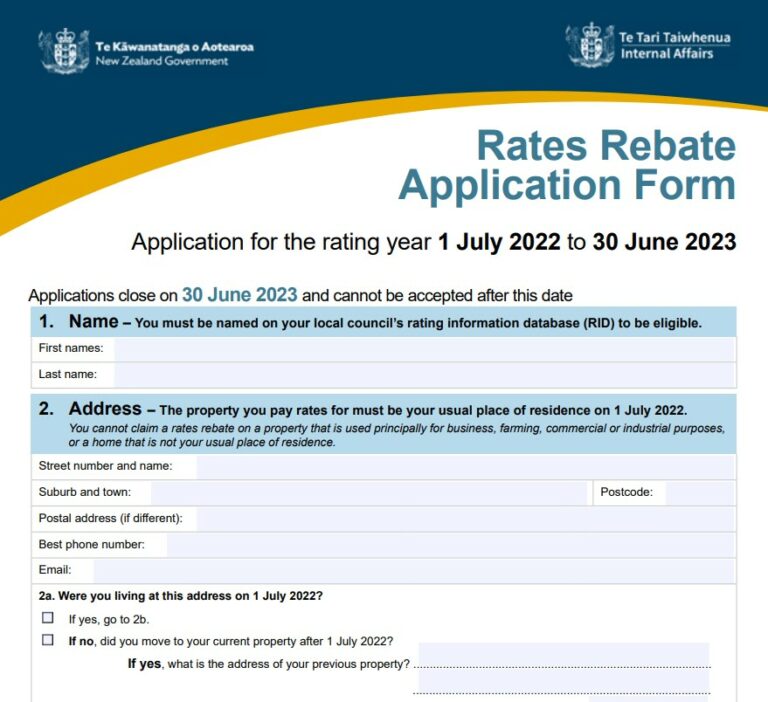

Rebate Application Form Housing PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/02/Housing-Rebate-Form-2023-768x702.jpg

https://www.canada.ca/en/services/benefits/housing.html

Housing benefits Information on the GST HST new housing rebate buying a home making

https://www.ratehub.ca/blog/what-is-the-gsthst-new...

First the new housing rebate equals 36 of the GST that all buyers need to

Traderider Rebate Program Verify Trade ID

GST HST New Housing Rebate

GST HST New Housing Rebate

Check Rebate Eligibility For Up To 40 Solar Merchants Australia s

Pensioner Rebate Doubled To Provide Support Bundaberg Now

Sponsorship Advantages Housing Construction Nepal

Sponsorship Advantages Housing Construction Nepal

PMP Exam Eligibility Checker Easy To Use

Health Officials COVID 19 Eligibility For MS Adults Likely Before May 1

ITBP Recruitment 2022 Check Post Qualification Eligibility And Other

New Housing Rebate Eligibility - To help partially offset the GST HST cost related to new housing landlords that use new housing to generate long term residential rent may be eligible for the GST HST new residential rental property rebate Eligibility for