New Hvac System Tax Credit 2023 How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax

Energy Tax Credit 2023 Limits The total limit for an efficiency tax credit in one year is 3 200 The limit includes a maximum credit of 1 200 for any combination of home The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through

New Hvac System Tax Credit 2023

New Hvac System Tax Credit 2023

https://callthepolarbear.com/wp-content/uploads/2020/06/outside-ac-unit.jpg

4 Signs It s Time For To Replace Your HVAC System

http://www.samahvac.com/wp-content/uploads/2018/09/replace-HVAC-system.jpeg

Georgia And Federal Tax Credits For HVAC 2023 Reliable Heating Air

https://octanecdn.com/reliableairnew/reliableairnew_782044049.png

IR 2023 97 May 4 2023 WASHINGTON The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could qualify them The Inflation Reduction Act amended the credit to be worth up to 1 200 per year for qualifying property placed in service on or after January 1 2023 and before January 1

30 of project cost 600 maximum amount credited This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to The 2023 tax credit program offers incentives for energy efficient home improvements making it the perfect time to consider replacing your old HVAC unit

Download New Hvac System Tax Credit 2023

More picture related to New Hvac System Tax Credit 2023

Benefits Of A New HVAC System OHA Home Service

https://fixmyair.com/wp-content/uploads/2020/11/benefits-of-a-new-hvac-system.jpg

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

What Does An HVAC Contractor Do Anon International Contractors

http://www.anonic.org/wp-content/uploads/2021/10/AdobeStock_308334869_adobespark.jpeg

Starting in 2023 the tax credit provides homeowners up to 30 of the installation costs for qualified expenditures This tax credit program lasts until December The Renewable Energy tax credits have also been extended and now will be available through the end of 2023 These include incentives for Geothermal Heat Pumps Residential Wind Turbines Solar Energy

1 Go Renewable One of the best ways to save money on electricity is by generating your own Under the Inflation Reduction Act you can get a tax credit for 30 Beginning with the 2023 tax year the credit is equal to 30 of the costs for all eligible home improvements made during the year It is also expanded to cover the

SAVE BIG With HVAC Tax Credits Sun Heating Cooling Inc

https://www.sunheating.com/media/hvac-tax-credits.jpg

36 Best New Home Hvac Systems Info

https://i.pinimg.com/originals/9f/3d/79/9f3d7930ea806975a102032bf99dd994.jpg

https://todayshomeowner.com/hvac/guides/hvac-tax-credit

How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax

https://www.hvac.com/expert-advice/energy-tax...

Energy Tax Credit 2023 Limits The total limit for an efficiency tax credit in one year is 3 200 The limit includes a maximum credit of 1 200 for any combination of home

What HVAC System Qualifies For Tax Credit 2023 Makeoverarena

SAVE BIG With HVAC Tax Credits Sun Heating Cooling Inc

HVAC Tax Credit For Jackson TN Residents 2023 Cagle Service Heating

Homeowners What You Should Know About Different HVAC Types HVAC

What Can You Expect When You Have Your HVAC Unit Replaced SandS

Rheem Integrated HVAC And Water Heating System Powered By Tankless

Rheem Integrated HVAC And Water Heating System Powered By Tankless

Should You Purchase A New HVAC System For The Tax Credit

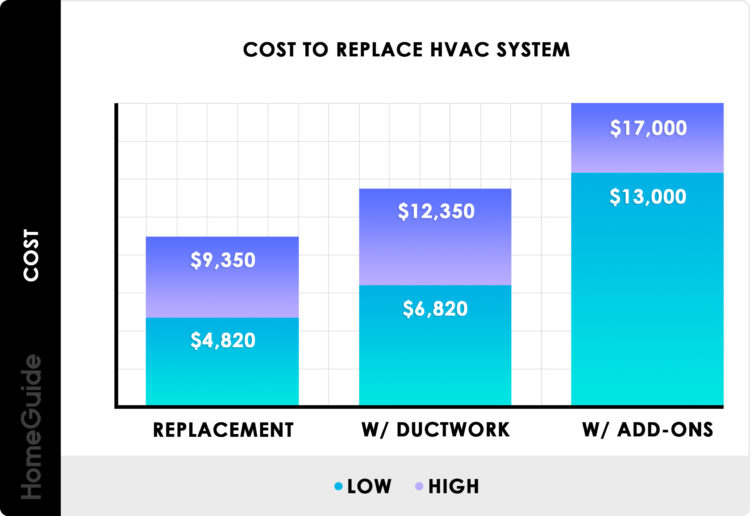

How Much Should A New HVAC System Cost Interior Magazine Leading

What To Ask When You Buy A New HVAC System Hvac Hvac Unit Hvac

New Hvac System Tax Credit 2023 - 30 of project cost 600 maximum amount credited This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to