New Jersey Rent Deduction Verkko 31 jouluk 2020 nbsp 0183 32 You are eligible for a property tax deduction or a property tax credit only if You were domiciled and maintained a primary residence as a homeowner or

Verkko 4 jouluk 2023 nbsp 0183 32 Homeowners and renters who pay property taxes on a primary residence main home in New Jersey either directly or through rent may qualify for either a Verkko 4 jouluk 2023 nbsp 0183 32 If you lived in more than one New Jersey residence during the year you must determine the total amount of property taxes and or 18 of rent to use when

New Jersey Rent Deduction

New Jersey Rent Deduction

https://chengco.com.my/wp/wp-content/uploads/2020/04/Special-Tax-Deduction-on-Rental-Reduction-15-June-2020_Eng-Cover-scaled.jpg

5 Year End Medical Plan Tax Deduction Strategies

https://blog.club.capital/hubfs/Blog Banner 5 Year-End Medical Plan Tax Deduction Strategies.png

New Jersey Commercial Rental Lease Application Questionnaire PdfFiller

https://www.pdffiller.com/preview/1/848/1848130/large.png

Verkko 5 jouluk 2023 nbsp 0183 32 Property Tax Deduction Credit Eligibility Indicate whether you live in a home that you owned choose Homeowner or rented choose Tenant Verkko New Jersey renters age 65 and over who are not required to file a New Jersey Gross Income Tax return NJ 1040 are eligible for a Property Tax Credit of up to 50 If you

Verkko 28 tammik 2022 nbsp 0183 32 For homeowners the write off allows them to deduct from their state taxable income the amount paid annually in local property taxes up to 15 000 For Verkko 7 jouluk 2021 nbsp 0183 32 Under existing law New Jersey s renters can deduct 18 of their annual rent payments from their tax bill The measure advanced in the Senate

Download New Jersey Rent Deduction

More picture related to New Jersey Rent Deduction

How DHA Could Pay Up To 3 000 In Back Rent To Your Landlord Oak Cliff

https://oakcliff.advocatemag.com/wp-content/uploads/sites/9/2017/02/for-rent-e1424804267501-1940x1091.jpg

Free New Jersey Standard Residential Lease Agreement Form Word PDF

https://printable-leaseagreement.com/wp-content/uploads/2023/01/free-new-jersey-standard-residential-lease-agreement-form-word-pdf-1.png

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

https://www.hdfcsales.com/blog/wp-content/uploads/2021/06/tax-deduction-on-fixed-deposit.jpg

Verkko 5 jouluk 2023 nbsp 0183 32 New Jersey law provides several gross income tax deductions that can be taken on the New Jersey Income Tax return New Jersey does not allow federal Verkko 22 toukok 2023 nbsp 0183 32 Under current law New Jersey renters can generally take a state income tax deduction worth 18 of their annual rent payments as a form of state

Verkko 4 maalisk 2022 nbsp 0183 32 Key Points New Jersey Gov Phil Murphy has unveiled a property tax relief plan for nearly 1 8 million state residents for fiscal year 2023 Homeowners Verkko 26 helmik 2023 nbsp 0183 32 Owners of rental property generally cannot deduct the property taxes that pertain to rental income earned as part of their personal return but property tax

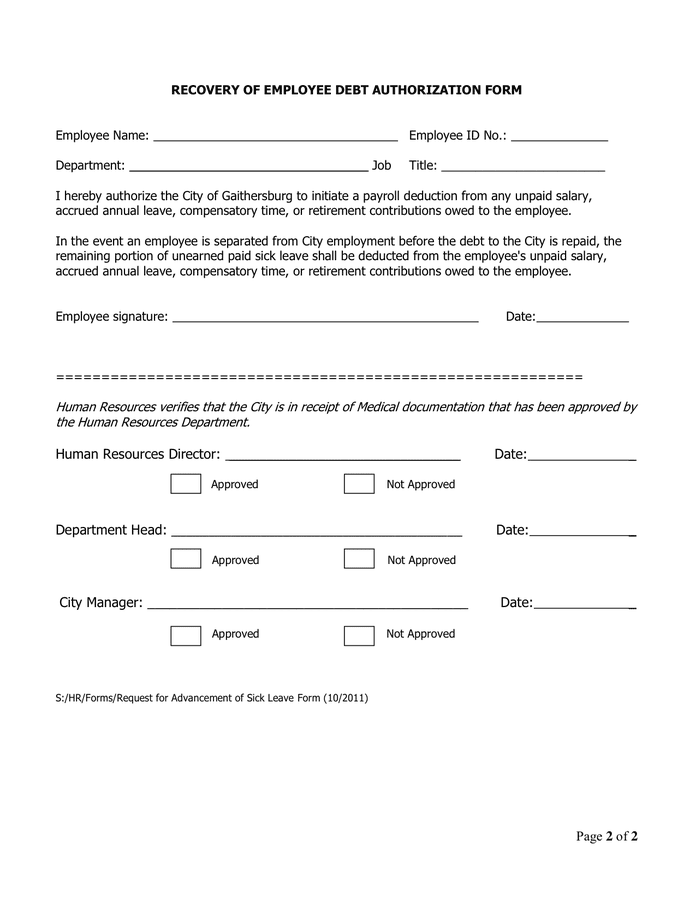

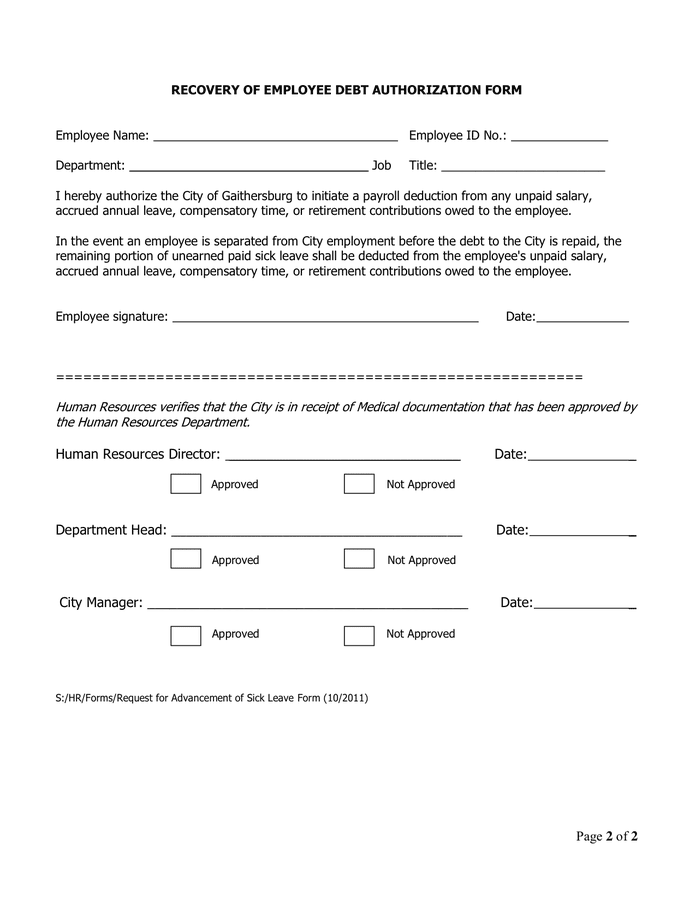

Payroll Deduction Authorization Form In Word And Pdf Formats Page 2 Of 2

https://static.dexform.com/media/docs/2531/payroll-deduction-authorization-form_2.png

Free New Jersey Lease Agreement PDF Word LawDistrict

https://www.lawdistrict.com/static/88eb4640a67cb0629f135931170070d7/residential-lease-agreement-new-jersey-sample.png

https://www.nj.gov/treasury/taxation/proptaxdeduc_credit.shtml

Verkko 31 jouluk 2020 nbsp 0183 32 You are eligible for a property tax deduction or a property tax credit only if You were domiciled and maintained a primary residence as a homeowner or

https://www.nj.gov/treasury/taxation/njit35.shtml

Verkko 4 jouluk 2023 nbsp 0183 32 Homeowners and renters who pay property taxes on a primary residence main home in New Jersey either directly or through rent may qualify for either a

Rent Maximaal Huur Een Bestelbus Voor Al Uw Transportbehoeften

Payroll Deduction Authorization Form In Word And Pdf Formats Page 2 Of 2

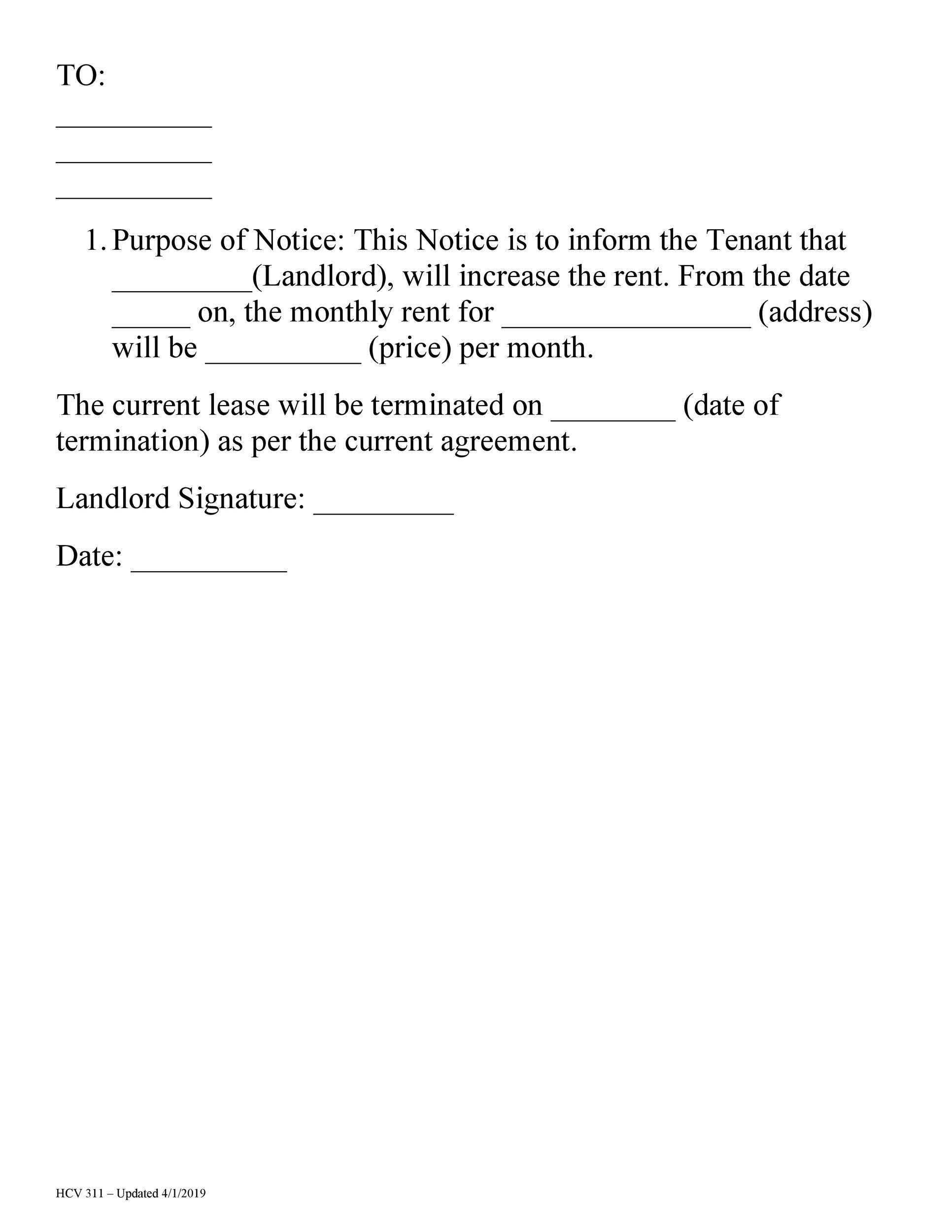

Free Rent Increase Letter Template Nisma Info

Balance Due Letter KathleenOlivarez Blog

Local Rent Yangon

Tax Deduction Exemption And Credit Vector Concept Metaphors Stock

Tax Deduction Exemption And Credit Vector Concept Metaphors Stock

Standard Deduction 2020 Self Employed Standard Deduction 2021

Kristof Cars

Free Of Charge Creative Commons Property Tax Deduction Image Real

New Jersey Rent Deduction - Verkko 28 tammik 2022 nbsp 0183 32 For homeowners the write off allows them to deduct from their state taxable income the amount paid annually in local property taxes up to 15 000 For