New Mexico Low And Middle Income Tax Exemption Exemption for low and middle income taxpayers Current as of 2023 Check for updates Other versions A An individual may claim an exemption in an amount specified in

2021 New Mexico Statutes Chapter 7 Taxation Article 2 Income Tax General Provisions Section 7 2 5 8 Exemption for low and middle income taxpayers Universal Citation N M Stat 7 2 5 8 A An individual may claim an exemption in an amount specified in Subsections B through D of this section not to exceed an amount equal to the number of

New Mexico Low And Middle Income Tax Exemption

New Mexico Low And Middle Income Tax Exemption

https://indianpsu.com/wp-content/uploads/2022/03/Income-Tax-scaled.jpg

Liberals To Cut Small business Tax Rate Target Top Earners The Globe

https://www.theglobeandmail.com/resizer/_H8gjtC7nYWhQLDqGWd2PWhKuFg=/1200x800/filters:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/tgam/QSYYQIBB6JFX5NGBKZOCMPMJGU.JPG

Solved Problem 7 1 Child Tax Credit LO 7 1 Calculate The Total

https://www.coursehero.com/qa/attachment/14536840/

Social Security income is already exempt from state income tax for most low and middle income seniors 10 001 20 000 0 10 000 20 001 30 000 30 001 40 000 14 New Mexico low and middle income tax exemption See PIT 1 instructions 15 Total Deductions and Exemptions from federal income PIT ADJ line 23 Attach PIT

It is for those who file a New Mexico return and have tax due See the instructions for Form PIT 1 There is also an exemp tion for low and middle income taxpayers that is available A one time refundable income tax rebate of 500 for married couples filing joint returns with incomes under 150 000 and 250 for single filers with income under

Download New Mexico Low And Middle Income Tax Exemption

More picture related to New Mexico Low And Middle Income Tax Exemption

Who Is Entitled To The Low And Middle Income Tax Offset One Click Life

https://oneclicklife.com.au/wp-content/uploads/2022/08/LMITO.jpg

Get More Tax Exemptions For Income Tax In Malaysia IMoney

https://static.imoney.my/articles/wp-content/uploads/2021/03/05180919/Income-Tax-Exemption-2020-800x2483.png

New Mexico Low Income Unit Information Fill Out Sign Online And

https://data.templateroller.com/pdf_docs_html/2154/21548/2154815/low-income-unit-information-new-mexico_big.png

MANY NEW MEXICO KIDS FAMILIES AND SENIORS WILL BENEFIT FROM STATE INCOME TAX CHANGES Who will benefit1 512 000 tax filers will see an income tax The Low Income Comprehensive Tax Rebate or LICTR under the new law will now be worth up to 730 depending on income and family size up from a maximum

New Mexico 2021 Tax Expenditure Report Presented to the Revenue Stabilization and Tax Policy Committee November 23 2021 Low and Middle Income Taxpayers House Bill 252 restructures the state s Personal Income Tax brackets to reduce taxes for all taxpayers but especially for those at the low and middle income

Everything You Need To Know About Low And Middle Income Tax Offset

https://debtbusters.com.au/wp-content/uploads/2023/08/low_and_middle_income_tax_offset_lmito_featured_image.jpg

Guide To Low And Middle Income Tax Offset LMITO Of 1 080 Sydney

https://www.pittmartingroup.com.au/wp-content/uploads/2019/06/bank-banking-banknotes-259027-1200x800.jpg

https://www.lawserver.com/law/state/new-mexico/nm...

Exemption for low and middle income taxpayers Current as of 2023 Check for updates Other versions A An individual may claim an exemption in an amount specified in

/cloudfront-us-east-1.images.arcpublishing.com/tgam/QSYYQIBB6JFX5NGBKZOCMPMJGU.JPG?w=186)

https://law.justia.com/codes/new-mexico/2021/...

2021 New Mexico Statutes Chapter 7 Taxation Article 2 Income Tax General Provisions Section 7 2 5 8 Exemption for low and middle income taxpayers Universal Citation

Low And Middle Income Earner Tax Offset Everything You Need To Know

Everything You Need To Know About Low And Middle Income Tax Offset

High COPD Prevalence In Low And Middle Income Countries With Trishul

IPCHS Integrated People Centred Health Services Blog Site Blog

Valuing Health Systems A Framework For Low And Middle Income Countries

Resolution Foundation On Twitter It s Hard To Overstate The Scale Of

Resolution Foundation On Twitter It s Hard To Overstate The Scale Of

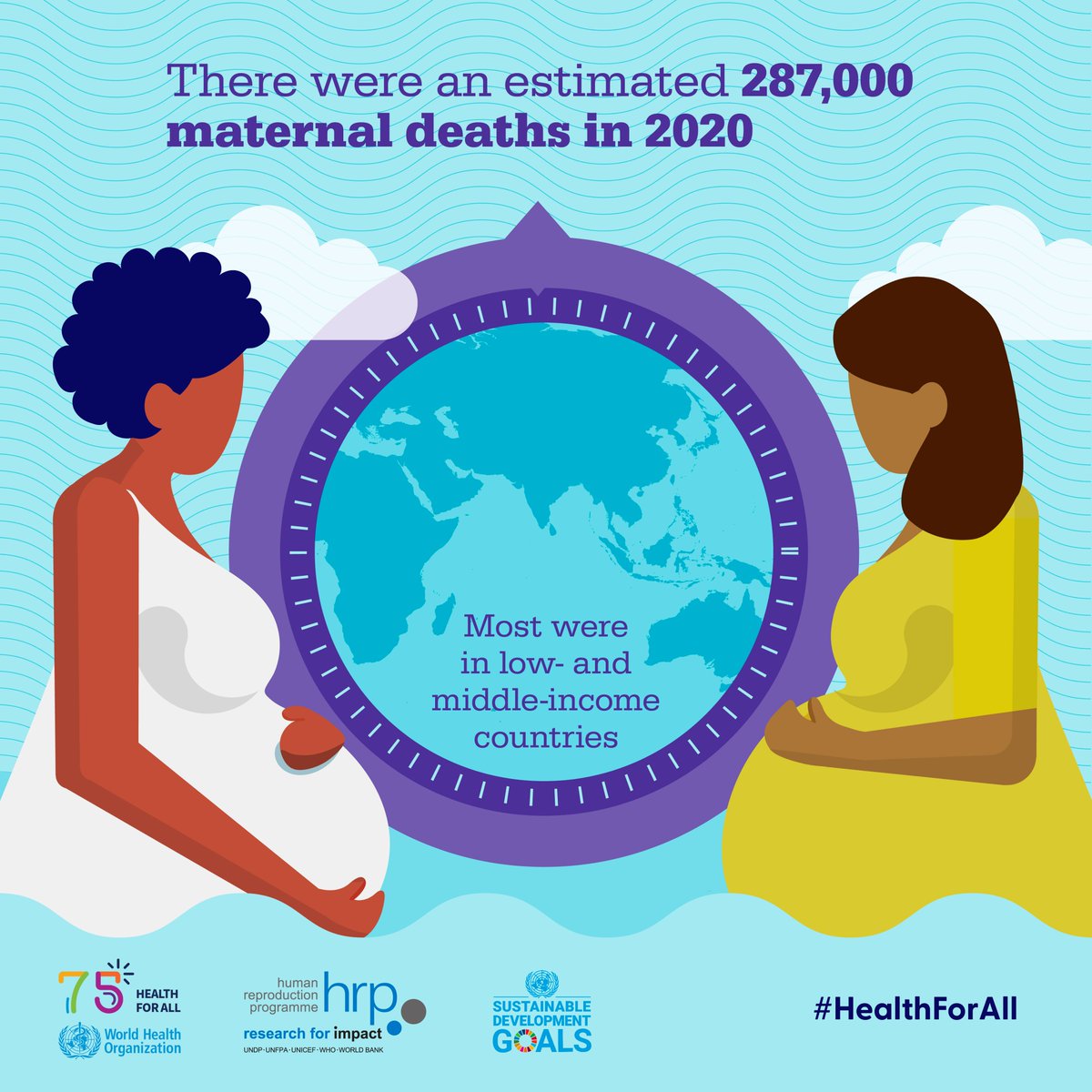

World Health Organization WHO On Twitter There Were An Estimated

Federal Budget Low To Middle Income Tax Offset Extended Inspire

Low And Middle Income Earners About To Be Hit With A Massive Tax

New Mexico Low And Middle Income Tax Exemption - 14 New Mexico low and middle income tax exemption See PIT 1 instructions 15 Total Deductions and Exemptions from federal income PIT ADJ line 23 Attach PIT

/cloudfront-us-east-1.images.arcpublishing.com/tgam/QSYYQIBB6JFX5NGBKZOCMPMJGU.JPG)