New Residential Rental Property Rebate Calculator Ontario Use our calculator to find out whether you are eligible for a GST HST New Residential Rental Rebate you can quickly get up to 30 000

Fill out this Ontario rebate schedule to calculate your rebate amount for the Ontario new residential rental property rebate for single unit unit in a co op or a unit in a multiple unit residential complex or addition This guide provides information for landlords of new residential rental properties on how to apply for the GST HST new residential rental property rebate It includes instructions for completing Form GST524 GST HST New Residential Rental Property Rebate

New Residential Rental Property Rebate Calculator Ontario

![]()

New Residential Rental Property Rebate Calculator Ontario

https://turbotax.intuit.ca/tips/images/rawpixel-1053187-unsplash-683x470.jpg

New Residential Rental Property Rebate Calculator PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/how-to-calculate-the-gst-hst-new-housing-rebate-sproule-associates.jpg

HST Rebate The New Residential Rental Property Rebate

https://truecondos.com/wp-content/uploads/2011/12/Featured-Image61.png

The HST Rebate is calculated as Ontario home buyers may be eligible for a credit of 75 of the Ontario portion 8 of the HST and 36 of the federal portion 5 of the HST paid For example buyers of a new 600 000 home would pay slightly more than 69 000 in HST 75 of the provincial portion of the HST which is approximately 42 500 is The GST HST New Residential Rental Property rebate is a powerful tool for Canadian real estate investors looking to reduce initial costs on new or substantially renovated rental properties By qualifying for this rebate investors can enjoy improved cash flow lower tax burdens and a stronger return on investment

To get a clearer idea try our New Rental Property HST Rebate Calculator below You ll need to input details like where your property is its price and its value when you bought it The calculator can also estimate the rebate you can get If you re trying to figure out how to calculate the GST HST new residential rental property rebate use the Rebate4U calculator and find out how much money you are eligible to get back Landlords across Ontario with rental properties will be eligible

Download New Residential Rental Property Rebate Calculator Ontario

More picture related to New Residential Rental Property Rebate Calculator Ontario

2023 PA Rent Rebate Form Your Key To Financial Relief Rent Rebates

https://i0.wp.com/www.rentrebates.net/wp-content/uploads/2023/05/2023-PA-Rent-Rebate-Form.jpg

HST New Rental Property Rebate Program HST Rebate For Landlords

https://www.stratosconsultants.ca/wp-content/uploads/bb-plugin/cache/HST-New-Rental-Property-Rebate-Program-1024x683-landscape.jpg

The Benefits Of Purchasing A New Residential Rental Property

https://my-rebate.ca/wp-content/uploads/2021/11/image1-1.jpeg

The HST rebate for new residential rental properties is calculated based on the HST paid upfront by the buyer The rebate is a partial refund of the HST amount paid and helps level the playing field between used and new rental properties To qualify for the New Residential Rental Property Rebate you or your corporation will need to rent out the property for at least one year In this article we break down how doctors can get at least 24 000 back from the government on new rental properties they purchase

Did you buy or built a new home in Ontario in the last 2 years You may be eligible for some of the money back Use our New Home HST Rebate Calculator to Please use our HST Rebate Calculator for an estimate of your HST New Housing Rebate HST Rental Rebate or HST Rebate Owner Built Home Please complete the HST Rebate Calculator form below Your property is located in which province Ontario Quebec Other Choose the scenario that applies to you

Calam o Hst Rebate On New Residential Rental Property In Ontario

https://p.calameoassets.com/180330173708-8cfcc8d7db36f5b9ce1c9ef69c5570c6/p1.jpg

Residential Rental Property AM Accounting

https://www.amaccountingonline.com/wp-content/webpc-passthru.php?src=https://www.amaccountingonline.com/wp-content/uploads/2021/10/home-768x768.jpg&nocache=1

https://www.dashpm.ca/hst-rebate-calculator

Use our calculator to find out whether you are eligible for a GST HST New Residential Rental Rebate you can quickly get up to 30 000

https://www.canada.ca/en/revenue-agency/services/...

Fill out this Ontario rebate schedule to calculate your rebate amount for the Ontario new residential rental property rebate for single unit unit in a co op or a unit in a multiple unit residential complex or addition

HST Rebate Calculator GST HST Rebate Experts Sproule Associates

Calam o Hst Rebate On New Residential Rental Property In Ontario

The New Residential Rental Property HST Rebate LRK Tax LLP The New

GST HST New Residential Rental Property Rebate Jenna Lee Law

How Long Does It Take To Get HST Housing Rebate

Gst190 Form Fill Out And Sign Printable PDF Template SignNow

Gst190 Form Fill Out And Sign Printable PDF Template SignNow

Eligibility For The New Residential Rental Property Rebate

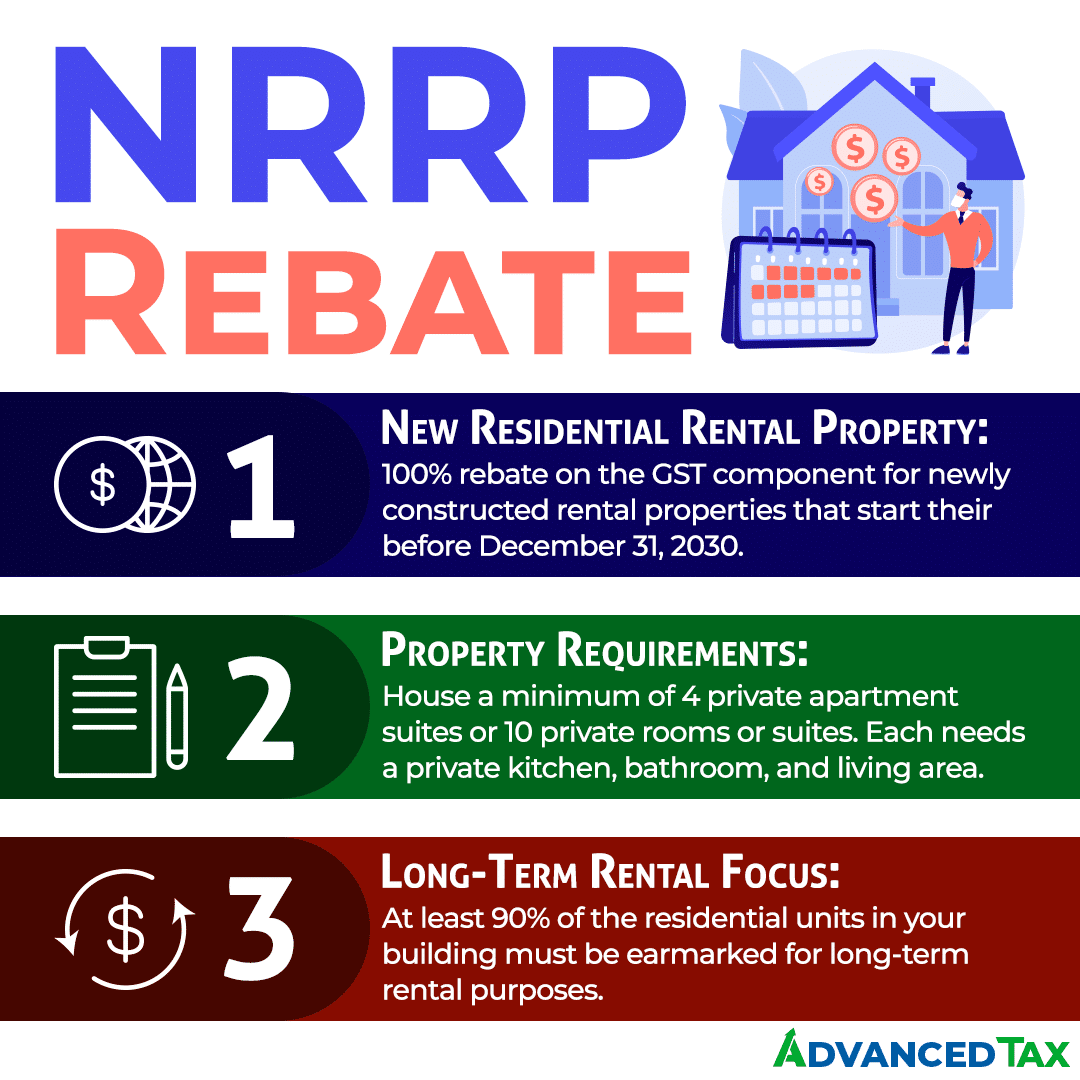

New Residential Rental Property Rebate Advanced Tax Services

Don t Forget To File Your New Residential Rental Property Rebate

New Residential Rental Property Rebate Calculator Ontario - To get a clearer idea try our New Rental Property HST Rebate Calculator below You ll need to input details like where your property is its price and its value when you bought it The calculator can also estimate the rebate you can get