New Tax Rates 2024 The Income tax rates and personal allowances in Ghana are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the Ghana Tax Calculator 2024

GRA will also develop administrative guidelines and practice notes on the implementation of the Amendments where necessary Kindly note that payroll deductions for January 2024 should reflect the new rates provided in the Income Tax Amendment No 2 Ghana s Parliament has approved five new tax bills to boost revenue collection following the 2024 budget The Finance Committee said the bills were necessary to extend the coverage of VAT to other sectors He said the entire Minority members of the committee supported the zero rating of VAT on materials for the production of sanitary

New Tax Rates 2024

New Tax Rates 2024

https://i2.wp.com/www.pinoymoneytalk.com/wp-content/uploads/2020/06/income-tax-rates-bir-train-law-2023.png

TDS Rate Chart AY 2023 2024 FY 2022 2023 Sensys Blog

http://www.sensystechnologies.com/blog/wp-content/uploads/2022/04/20220429_120210.jpg

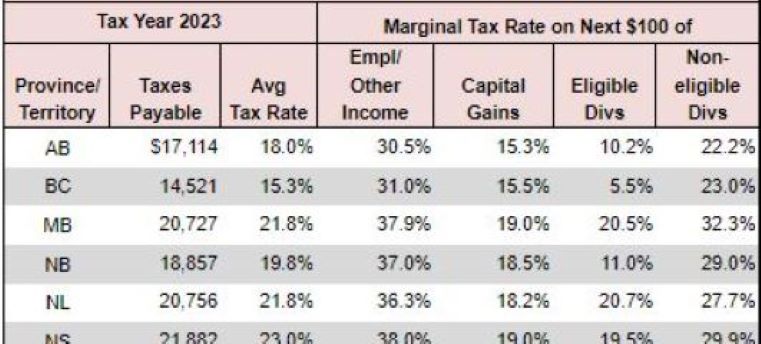

Capital Gains On Sale Of Vacant Land Canadian Money Forum

https://www.taxtips.ca/calculators/enhanced-basic/2023-basic-tax-calculator-rates.jpg

The effective date of the new tax rates is 1 January 2024 Please contact your Mercans services delivery team for any additional information regarding the implications of the above change View PDF Ghana Implementation of New Tax Laws and Amendments The Ghana Revenue Authority GRA announces for the information of the general public the coming into force of amendments to the following Tax Laws and the introduction of the Emissions Levy Act 2023 Act1112 Read More

The 2024 edition of our Tax Facts and Figures publication provides an overview of the direct and indirect tax regime of Ghana as at the date of this publication This publication is intended to serve as quick reference material on taxation in Ghana Executive summary Ghana s Parliament has enacted or amended five laws together the Acts affecting individual and business taxpayers These Acts were enacted as part of the various fiscal measures introduced under the 2024 Budget Statement and Economic Policy the 2024 Budget

Download New Tax Rates 2024

More picture related to New Tax Rates 2024

Old Tax Regime Vs New Tax Regime For The Assessment Year 2024 25

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhFzJwJHyVBIaFv0G0rI9CycAztACJH2ffDNgtSG3IRxDkB8E8neD3ScVZdjeaFsEGlRNFOqKLdxATPyE6sMa7P2WhsdLZv3UJrW1PuAJqOiUXvDtJ4GGzrXO4yvVbUK8NRVEwbATdQ9KZblStNks1dIgMF8yCHF-iAGrgmOApYakwfpsgcIG_WKP3T/s633/Tax Slab for A.Y.2024-25.jpg

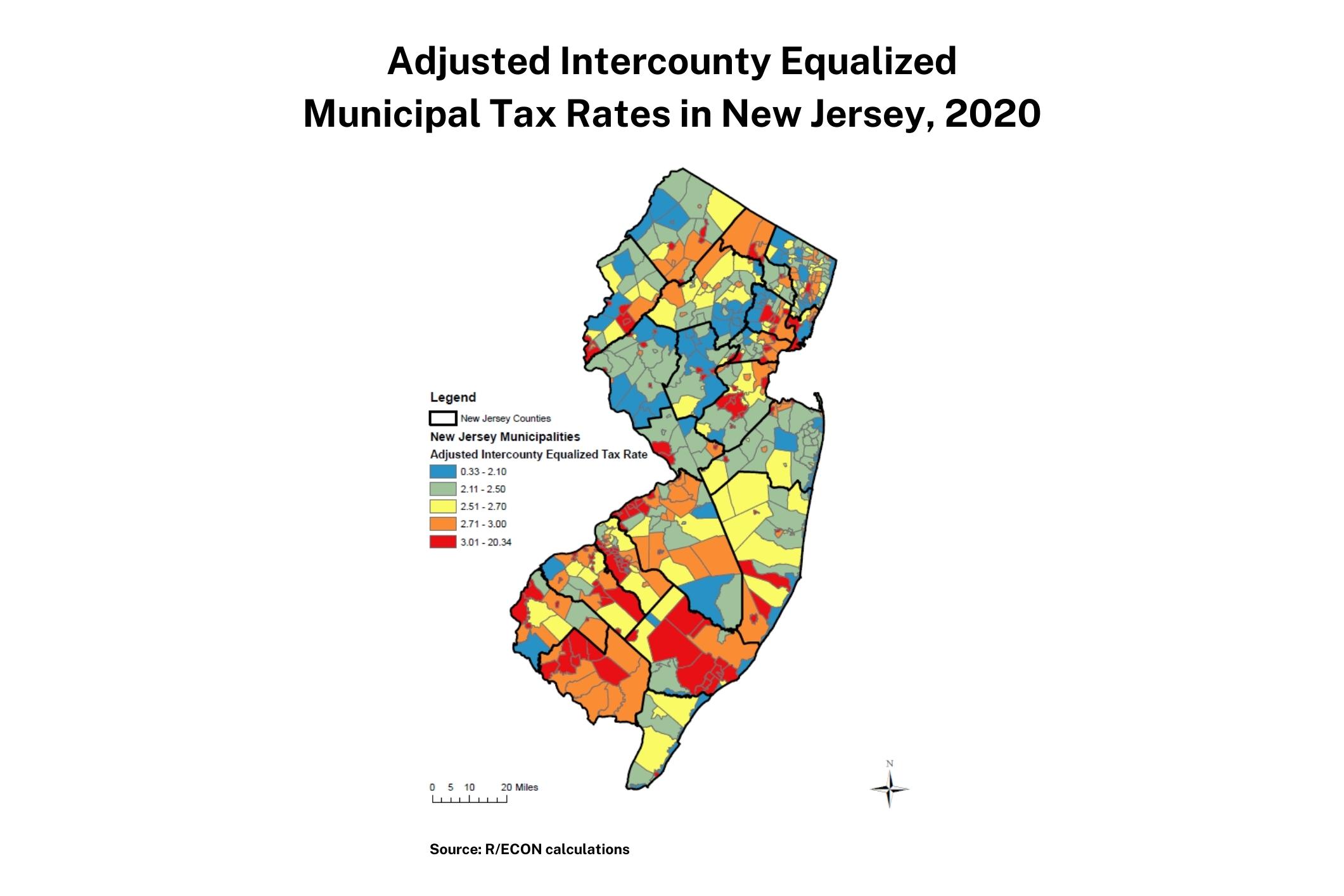

Report Release What Influences Differences In New Jersey s Municipal

https://policylab.rutgers.edu/wp-content/uploads/2022/09/Municipal-Tax-Rates.jpg

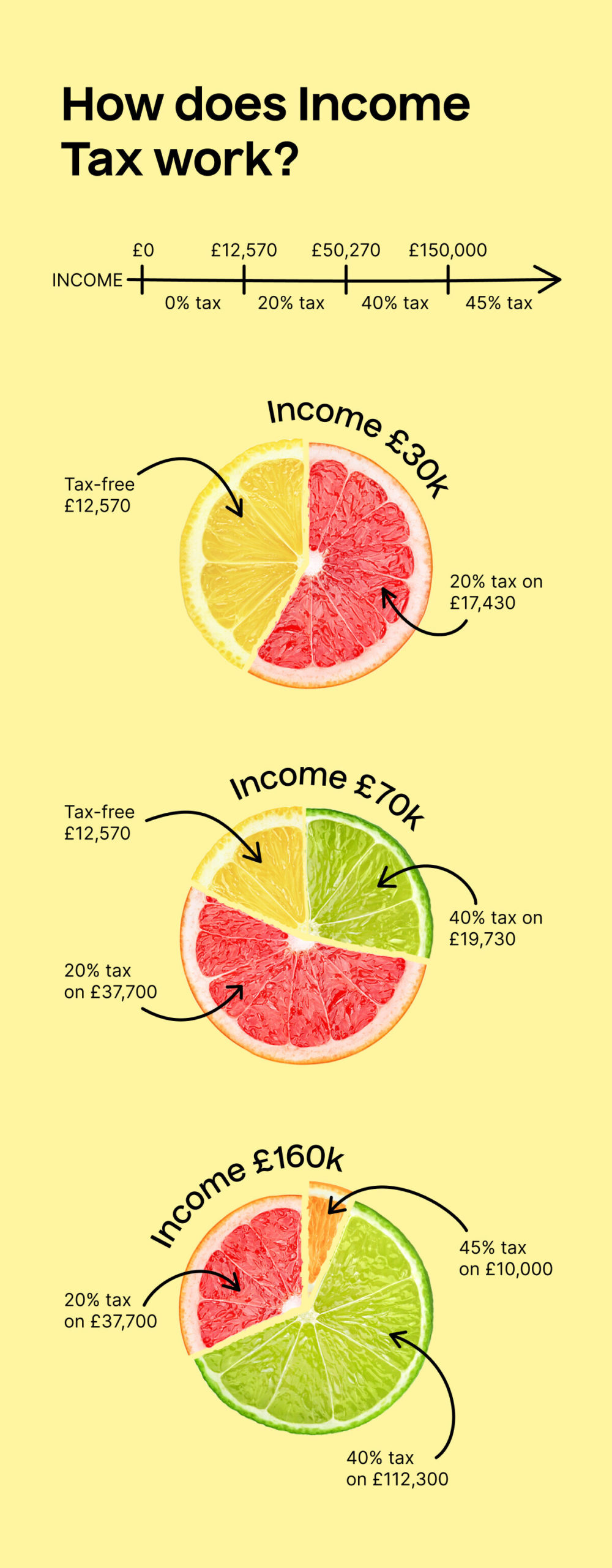

Torment Flap Edge Wage And Tax Calculator Improve Every Time Director

https://taxscouts.com/wp-content/uploads/Infographic-1-scaled.jpg

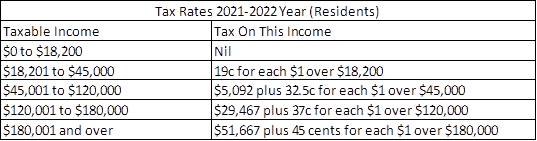

The calculator is updated with the latest tax rates and brackets as per the 2024 tax year in Ghana This tool is designed for simplicity and ease of use focusing solely on income tax calculations For a more detailed assessment including other deductions or specific tax advice consult a tax professional What are the new stage 3 tax cut brackets Here s how the new tax brackets look at a glance Earn up to 18 200 pay no tax Pay a 16 per cent tax rate on each dollar earned between 18 201 45 000

[desc-10] [desc-11]

2024 US Tax Rates And Allowances Guide

https://www.buzzacott.co.uk/cdn/w_1200/h_627/crop/dpr_20/2024-us-tax-rates-and-allowances-guide.png

How Tax Rates In Canada Changed In 2022 Loans Canada 2022

https://i0.wp.com/loanscanada.ca/wp-content/uploads/2020/07/How-Tax-Rates-Changed-in-2020.png

https://gh.icalculator.com/income-tax-rates/2024.html

The Income tax rates and personal allowances in Ghana are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the Ghana Tax Calculator 2024

https://gra.gov.gh/implementation-of-new-tax-laws...

GRA will also develop administrative guidelines and practice notes on the implementation of the Amendments where necessary Kindly note that payroll deductions for January 2024 should reflect the new rates provided in the Income Tax Amendment No 2

2022 Tax Brackets MeghanBrannan

2024 US Tax Rates And Allowances Guide

1040 444k Salary After Tax In Illinois US Tax 2023

GST Rates In 2023 List Of Goods Service Tax Rates Slabs

How Much Taxes Are Taken Out Of A Paycheck In Ky Teressa Robles

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F24124031%2FAP22292525602363.jpg)

IRS Tax Breaks How It Will Affect Your 2023 Tax Return Deseret News

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F24124031%2FAP22292525602363.jpg)

IRS Tax Breaks How It Will Affect Your 2023 Tax Return Deseret News

Be A Winner In The Fixed rate Price War The Financial Planning Group

Historical Income Tax Rates Chart SexiezPicz Web Porn

Your Mortgage Your Terms A Deep Dive Into Rate Lock Strategies In

New Tax Rates 2024 - Executive summary Ghana s Parliament has enacted or amended five laws together the Acts affecting individual and business taxpayers These Acts were enacted as part of the various fiscal measures introduced under the 2024 Budget Statement and Economic Policy the 2024 Budget