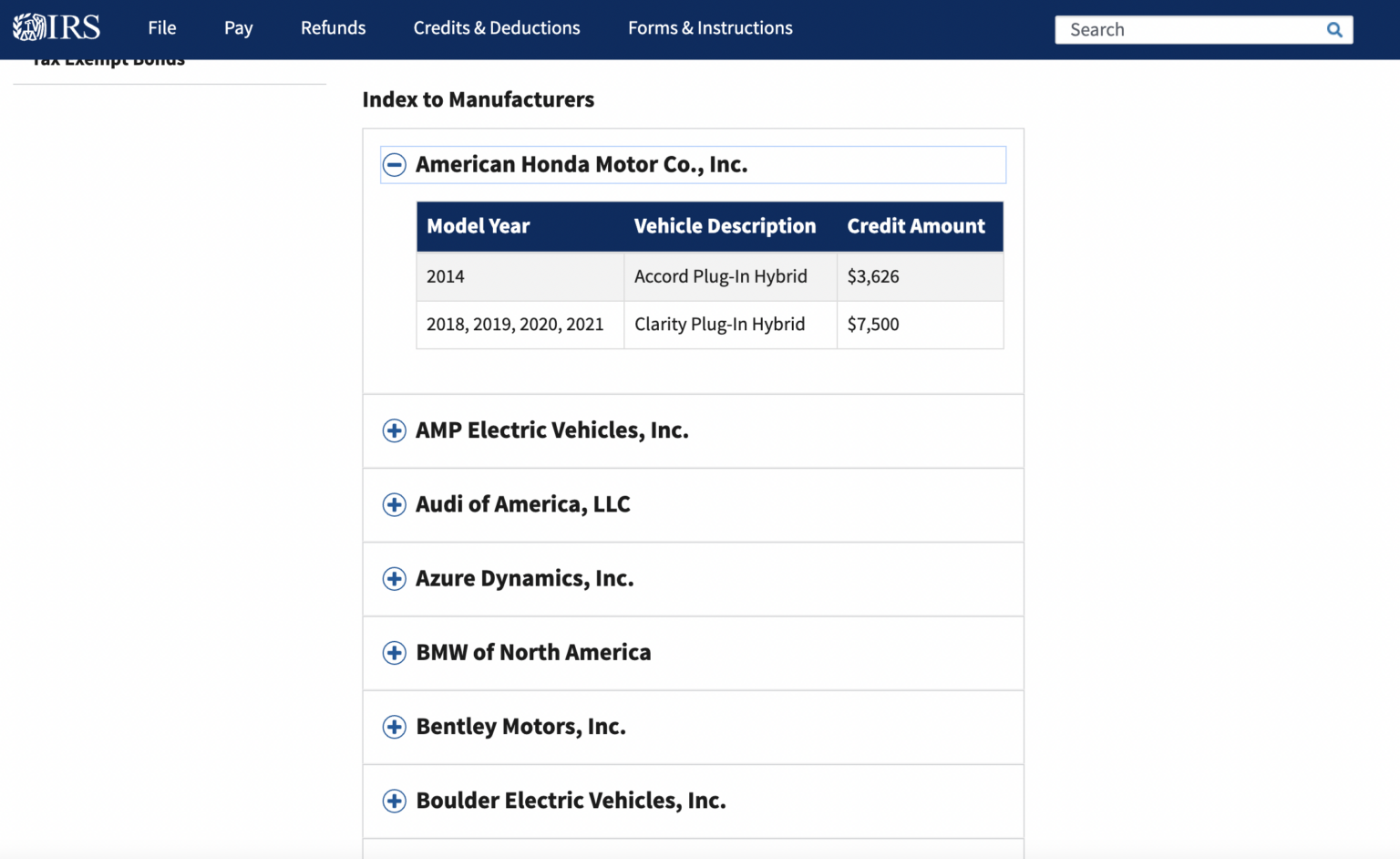

New Vehicle Purchase Federal Tax Credit If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal

For purposes of the New Clean Vehicle Credit a new clean vehicle is a clean vehicle placed in service on or after Jan 1 2023 that is acquired by a taxpayer People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car buyers may qualify for up to 4 000 in tax breaks

New Vehicle Purchase Federal Tax Credit

New Vehicle Purchase Federal Tax Credit

https://www.aesinspect.com/wp-content/uploads/2022/11/AdobeStock_535970711-scaled.jpeg

CHP Federal Tax Credit To Expire In 2024 EnergyLink

https://goenergylink.com/wp-content/uploads/2021/07/AdobeStock_98024254-1536x1022.jpeg

Federal Tax Credit For Redevelopment Introduced REHAB Act Greater

http://static1.squarespace.com/static/59396fee59cc6877bacf5ab5/5947ec9a2985262ece0ebb1e/5e7a6fe1b8ae72565ee2e35a/1631114839305/?format=1500w

The federal EV tax credit worth up to 7 500 is a nonrefundable tax credit that has been an effective way to lower the cost of EV ownership for taxpayers The Up to 7 500 for buyers of qualified new clean vehicles For this credit there are two lists of qualified vehicles those purchased in 2023 or later and those purchased in 2022 or earlier

Today the U S Treasury Department and the IRS released proposed guidance on the new clean vehicle provisions of the Inflation Reduction Act that will All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount

Download New Vehicle Purchase Federal Tax Credit

More picture related to New Vehicle Purchase Federal Tax Credit

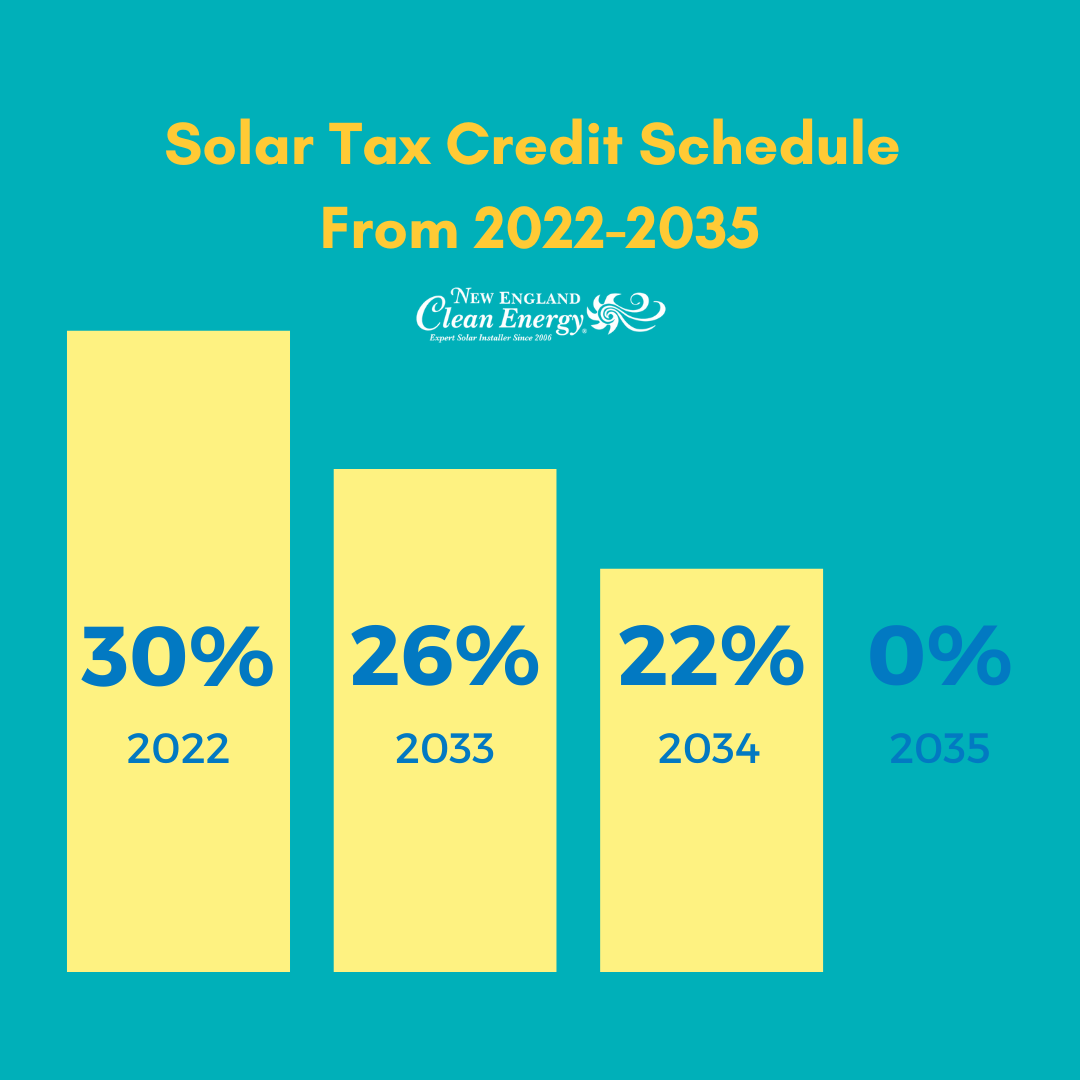

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

The Federal Tax Credit For Electric Cars How To Save 7 500

https://evroom.com/wp-content/uploads/2022/11/Screen-Shot-2022-10-22-at-8.37.36-PM-1536x942.png

Treasury and the Internal Revenue Service released guidance and FAQs with information on how the North America final assembly requirement will work so The minimum credit for vehicles placed in service from January 1 to April 17 2023 will be 3 751 The credit amount for vehicles placed in service after April 18

Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to Federal EV Tax Credit for New Car Buyers New car buyers who meet the law s income restrictions and who buy new vehicles that meet the Act s numerous

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

https://www.irs.gov/credits-deductions/...

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal

https://www.irs.gov/newsroom/topic-a-frequently...

For purposes of the New Clean Vehicle Credit a new clean vehicle is a clean vehicle placed in service on or after Jan 1 2023 that is acquired by a taxpayer

Invictus Solar Power

The Electric Car Tax Credit What You Need To Know OsVehicle

HMRC Company Car Tax Rates 2020 21 Explained

Federal Tax Credit Calculation

Act Fast The Solar Tax Credit Will Soon Expire

30 Federal Tax Credit Solar PV New Mexico Sol Luna Solar

30 Federal Tax Credit Solar PV New Mexico Sol Luna Solar

Used Vehicle Automotive Bill Of Sale Purchase Agreement 2 Part Auto

How Does The Federal Solar Tax Credit Work CRJ Contractors

Solar Tax Credit How Do I Get It New England Clean Energy

New Vehicle Purchase Federal Tax Credit - The federal EV tax credit worth up to 7 500 is a nonrefundable tax credit that has been an effective way to lower the cost of EV ownership for taxpayers The