New York State Real Estate Transfer Tax Form 16 rowsReal estate transfer and mortgage recording tax forms Combined Real

Form TP 584 9 19 Combined Real Estate Transfer Tax Return Credit Line Mortgage Certificate and Certification of Exemption from the Payment of Estimated Personal You must pay the Real Property Transfer Tax RPTT on sales grants assignments transfers or surrenders of real property in New York City You must also pay RPTT for

New York State Real Estate Transfer Tax Form

New York State Real Estate Transfer Tax Form

https://lukinski.de/wp-content/uploads/2020/10/USA-transfer-taxes-state-real-estate-buying-house-costs-coins-paperwork-calculate-money.jpg

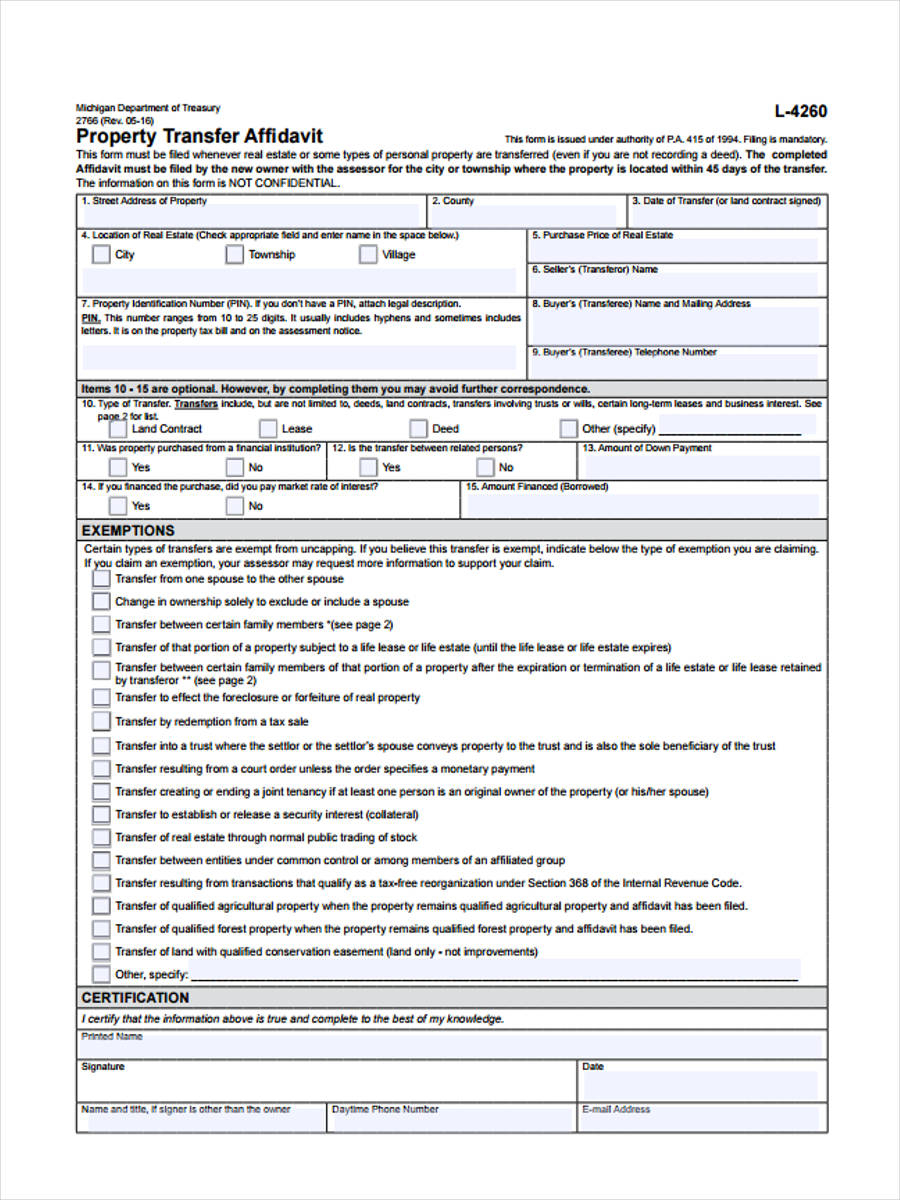

Michigan Real Estate Transfer Tax Valuation Affidavit Form 2023

https://www.printableaffidavitform.com/wp-content/uploads/2022/07/free-10-property-transfer-forms-in-pdf-ms-word-excel.jpg

Real Estate Transfer Tax What Are They Where Does The Money Go

https://assets.site-static.com/userFiles/2282/image/uploads/agent-1/Transfertax_v2.png

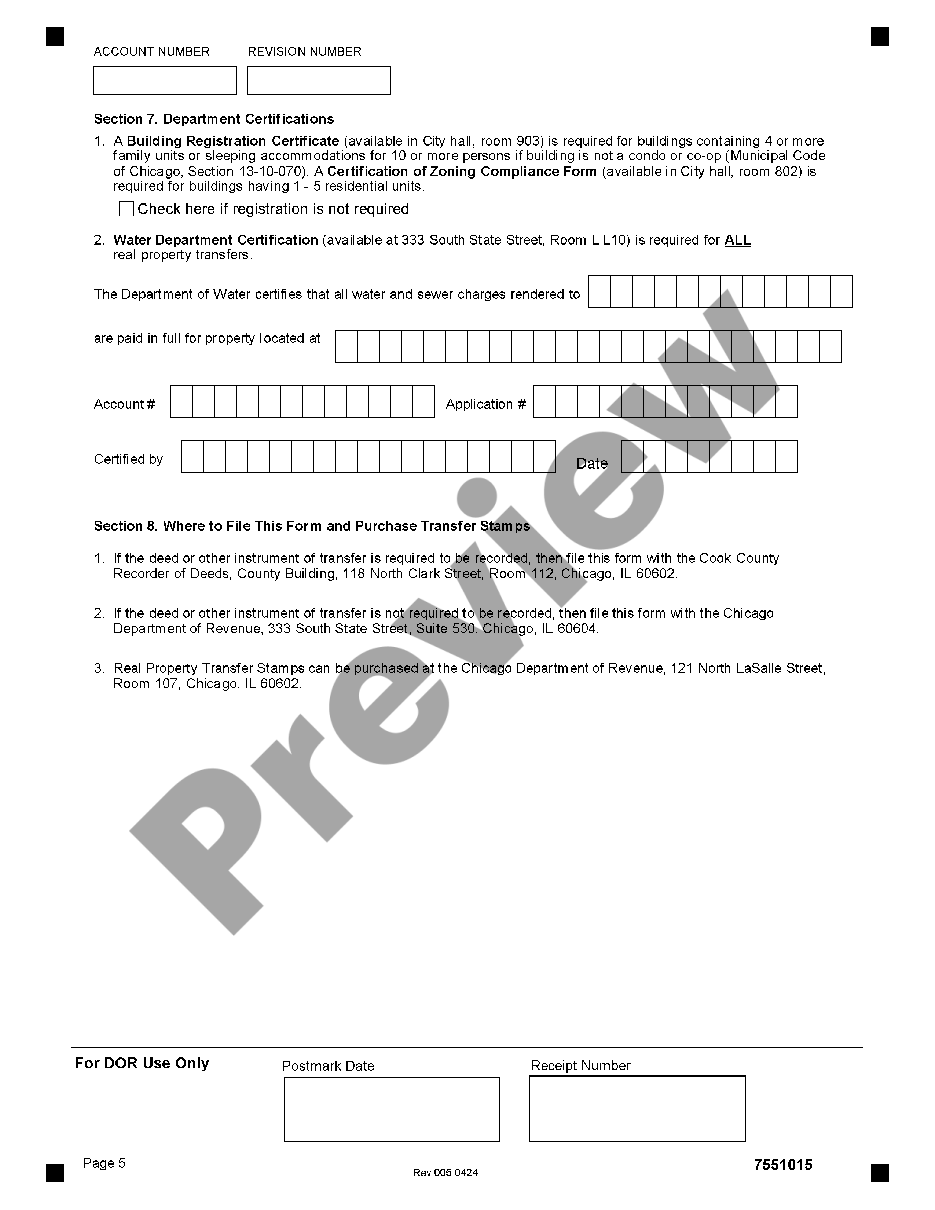

New York State Department of Taxation and Finance Combined Real Estate Transfer Tax Return Credit Line Mortgage Certificate and Certification of Exemption from the Form TP 584 Combined Real Estate Transfer Tax Return Credit Line Mortgage Certificate and Certification of Exemption from the Payment of Estimated Personal Income Tax should be filed with the

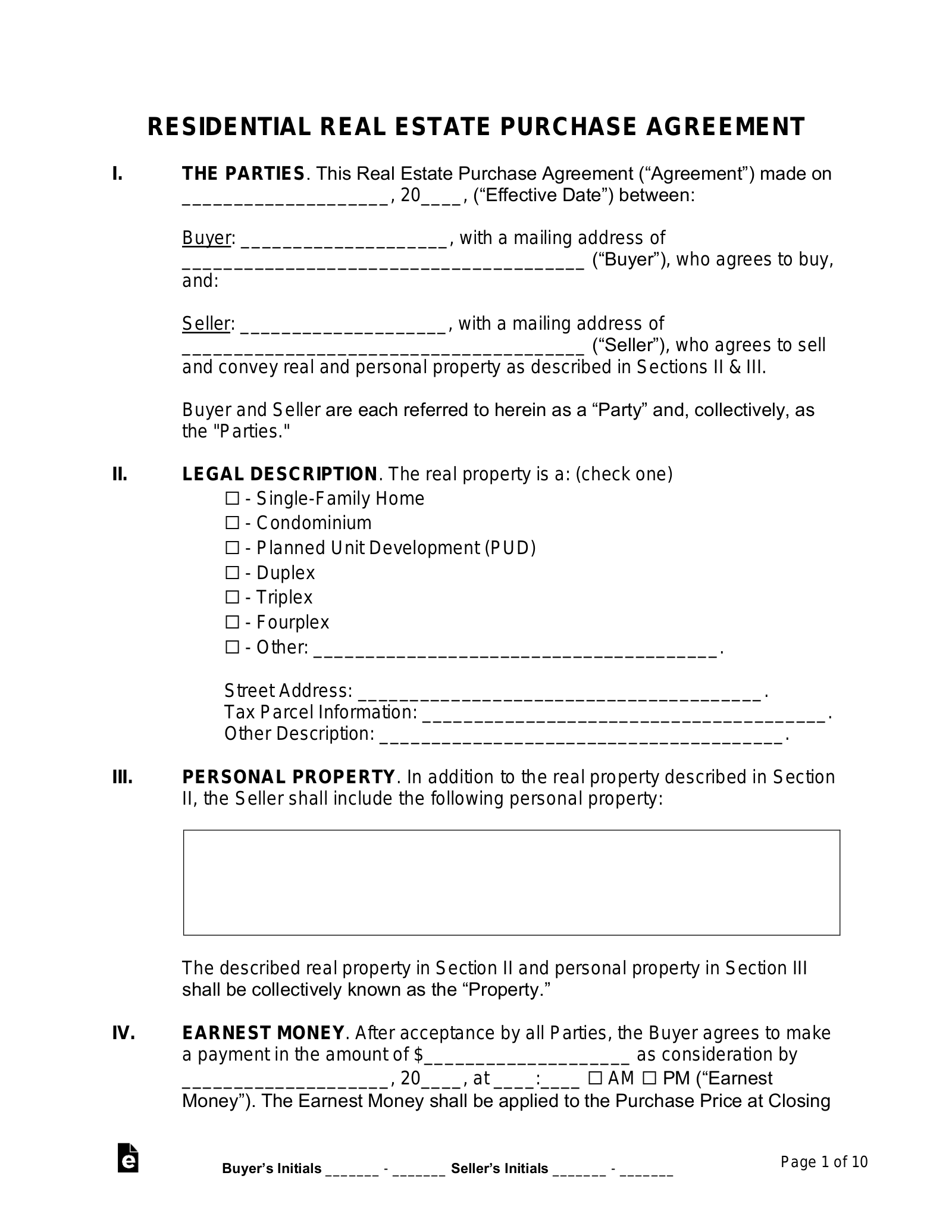

Transferring a deed or transferring your ownership of a property in New York requires multiple steps to make sure that the transfer is legally recorded and properly executed This includes a variety of Use Form IT 2663 Nonresident Real Property Estimated Income Tax Payment Form to compute the gain or loss and pay the estimated personal income tax due from the sale

Download New York State Real Estate Transfer Tax Form

More picture related to New York State Real Estate Transfer Tax Form

New York State Real Estate License Online Course INFOLEARNERS

https://infolearners.com/wp-content/uploads/2022/05/new-york-state-real-estate-license-online-course.jpg

Latest News Insights On New York Real Estate Market

https://www.nyrealestatetrend.com/wp-content/uploads/2023/03/what-is-new-york-state-real-estate-transfer-tax.jpg

Foreign Buyers Only Account For 5 Metro Vancouver Real Estate Sales

https://images.dailyhive.com/20160707130220/Property-transfer-Tax-form-1200x722.png

CPAs will now need to be aware of four components of the New York transfer tax when clients buy and sell property in New York City the previous base tax the new additional base tax the 1 Form RP 5217 PDF Real Property Transfer Report RP 5217 PDF Form Instructions RP 5217 PDF FAQ RP 5217 Filing Fee Use the downloadable bar coded PDF document for transfers of Real

New York s current transfer tax rate is 2 00 per 500 for homes under 1 million So for a house worth 478 973 the median home price in the state the You must pay the Real Property Transfer Tax RPTT on sales grants assignments transfers or surrenders of real property in New York City You must also pay RPTT for

New Extension For REAL ID Deadline Announced By DHS Stamford Daily Voice

https://cdn.dailyvoice.com/image/upload/c_fill,dpr_2,f_auto,q_auto:eco,w_640/New_York_REAL_ID_license_kycutk

Transfer Tax In The Philippines Lumina Homes

https://www.lumina.com.ph/assets/news-and-blogs-photos/Real-Estate-101-Transfer-Tax-in-the-Philippines/Real-Estate-101-Transfer-Tax-in-the-Philippines/OG-Real-Estate-101-Transfer-Tax-in-the-Philippines.png

https://www.tax.ny.gov/forms/real_prop_tran_cur_forms.htm

16 rowsReal estate transfer and mortgage recording tax forms Combined Real

https://www.tax.ny.gov/pdf/current_forms/property/...

Form TP 584 9 19 Combined Real Estate Transfer Tax Return Credit Line Mortgage Certificate and Certification of Exemption from the Payment of Estimated Personal

San Francisco Real Estate Transfer Tax Patrick Lowell

New Extension For REAL ID Deadline Announced By DHS Stamford Daily Voice

Leaseholds And The Applicability Of New York State Real Estate Transfer

Free New York Real Estate Purchase Agreement Template PDF WORD

Joliet City Of Chicago Illinois Real Estate Transfer Tax Declaration

What Do I Need To Know About Property Transfer Tax Silver Law

What Do I Need To Know About Property Transfer Tax Silver Law

Free Printable Simple Real Estate Purchase Agreement Free Printable

Real Estate Transfer Taxes In New York SmartAsset

NY Real Estate Transfer Tax Changes To Liability Provisions

New York State Real Estate Transfer Tax Form - The transfer of real property is a transfer of a fee simple interest to a person or persons who held a fee simple interest in the real property whether as a joint tenant a tenant in