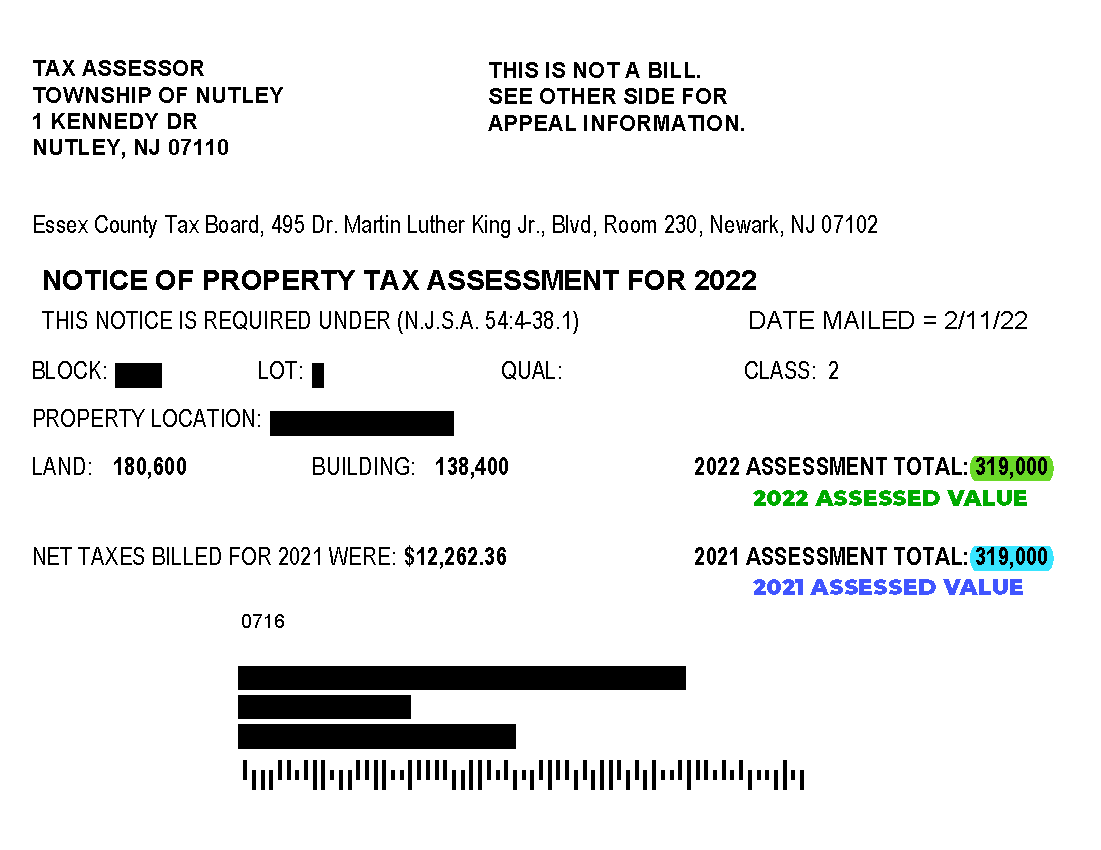

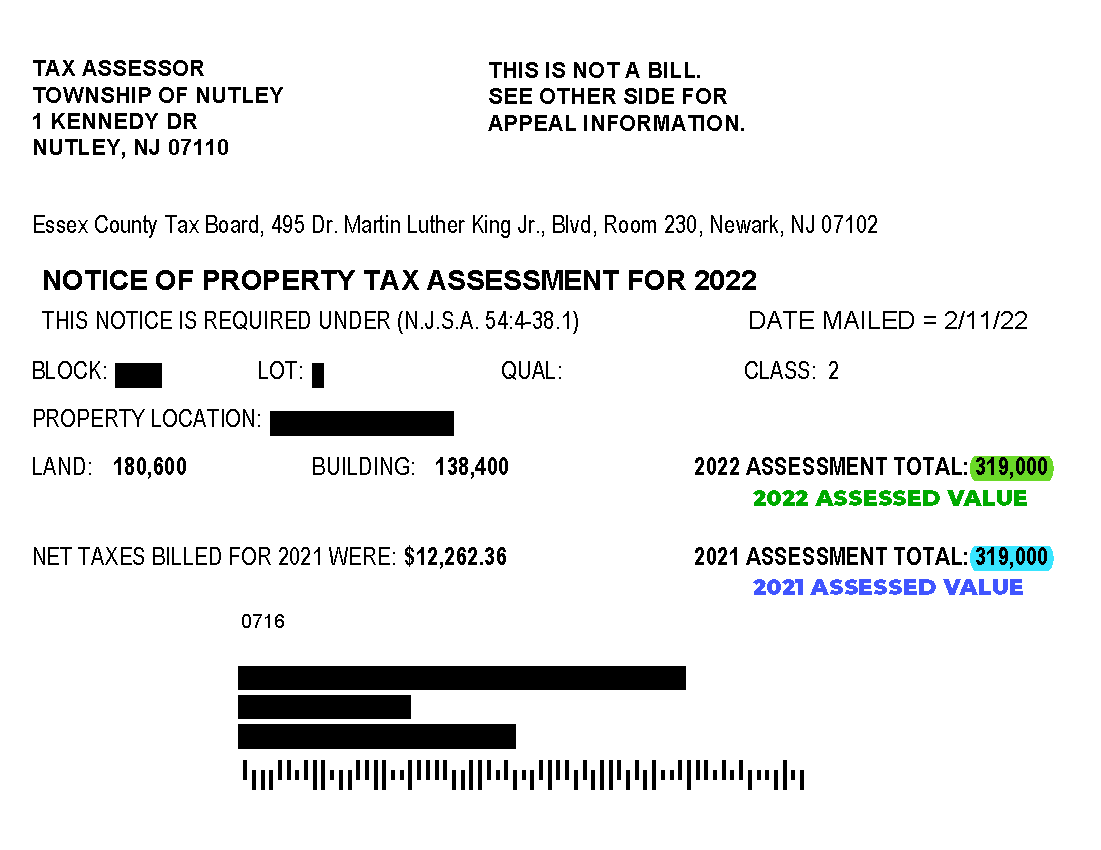

Nj Property Tax Relief Fund Check 2020 Property Tax Reimbursement Inquiry NJ Taxation Taxation Privacy Policy Check the status of your New Jersey Senior Freeze Property Tax Reimbursement If a

Your 2020 New Jersey gross income was not more than 250 000 Filing Information Filing Deadline The filing deadline was December 29 2023 All property Murphy Administration and Legislative Leaders Encourage Eligible Homeowners Renters to Apply for Historic Property Tax Relief through New

Nj Property Tax Relief Fund Check 2020

Nj Property Tax Relief Fund Check 2020

https://storage.googleapis.com/afs-prod/media/5fe324b049764928aa9d96084d397e16/3000.jpeg

NJ 2 Property Tax Relief Programs V1 0

https://s2.studylib.net/store/data/005419817_1-7b61982b2fb1a8f6639d61909c72af8b-768x994.png

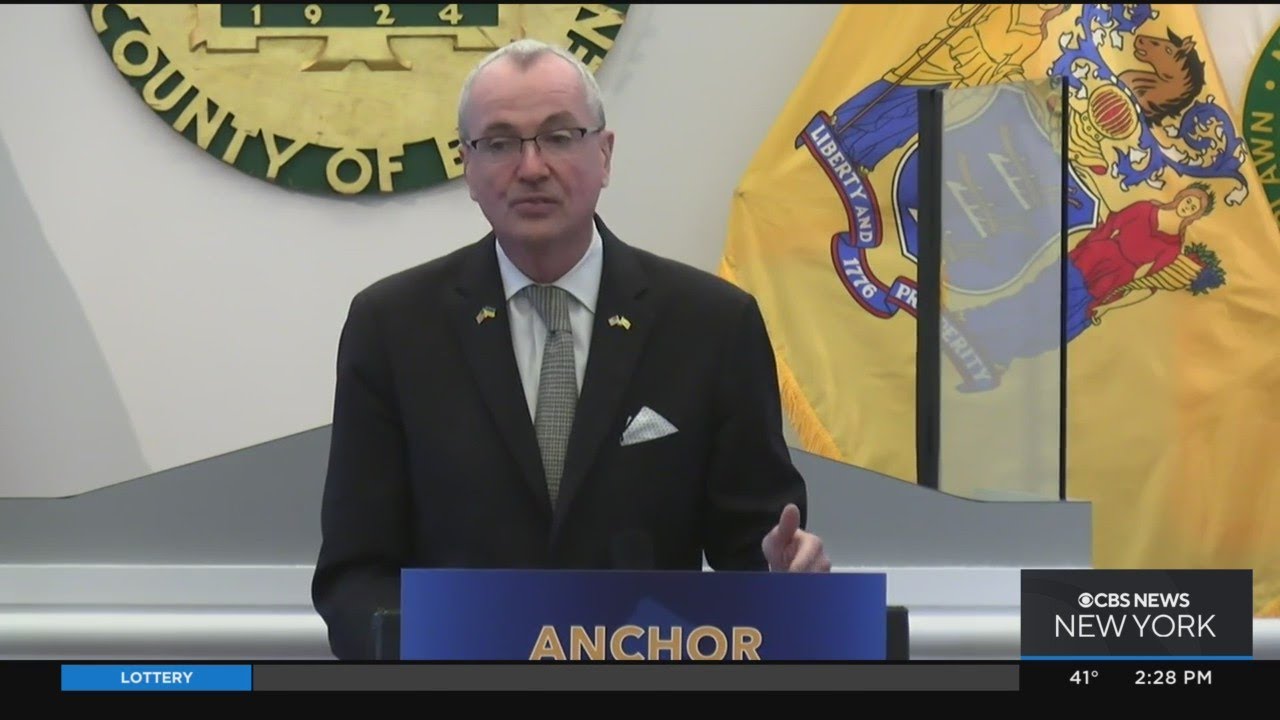

NJ Still Considering Millionaire s Tax To Get Property Tax Relief YouTube

https://i.ytimg.com/vi/MSXSOgw0gSY/maxresdefault.jpg

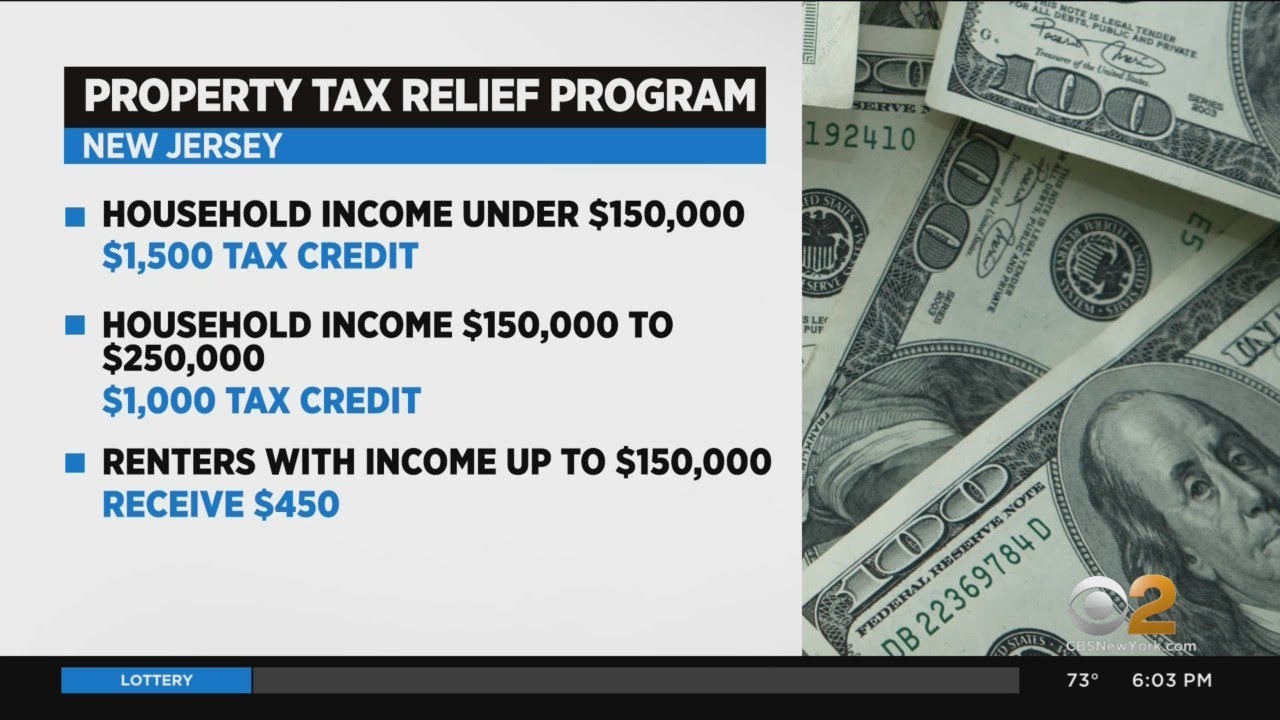

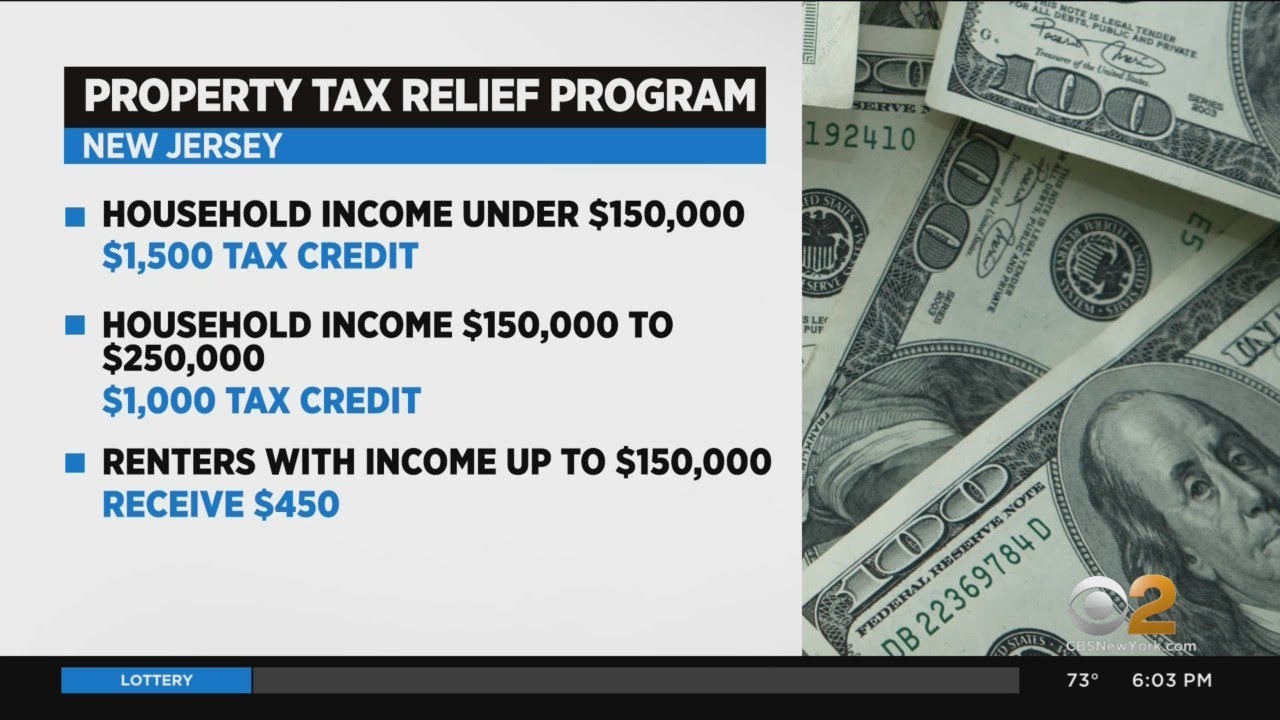

About two million New Jersey homeowners and renters will get property tax rebates in the coming year under a new 2 billion property tax relief program included Homeowners As noted above the ANCHOR proposal would extend property tax relief to households earning between 75 000 and 250 000 well into the top 15

The Affordable New Jersey Communities for Homeowners and Renters ANCHOR property tax relief program was instituted last year by the Governor and By Karin Price Mueller NJ Advance Media for NJ The state has started to send out 2 billion in property tax relief through the ANCHOR program for

Download Nj Property Tax Relief Fund Check 2020

More picture related to Nj Property Tax Relief Fund Check 2020

NJ ANCHOR Property Tax Relief Program Application Deadline Extended To

https://middletownship.com/wp-content/uploads/2022/11/315868169_675151700647024_4862430220857408753_n.jpg

ANCHOR And Other NJ Property Tax Relief Programs YouTube

https://i.ytimg.com/vi/X5weXiTIuvw/maxresdefault.jpg

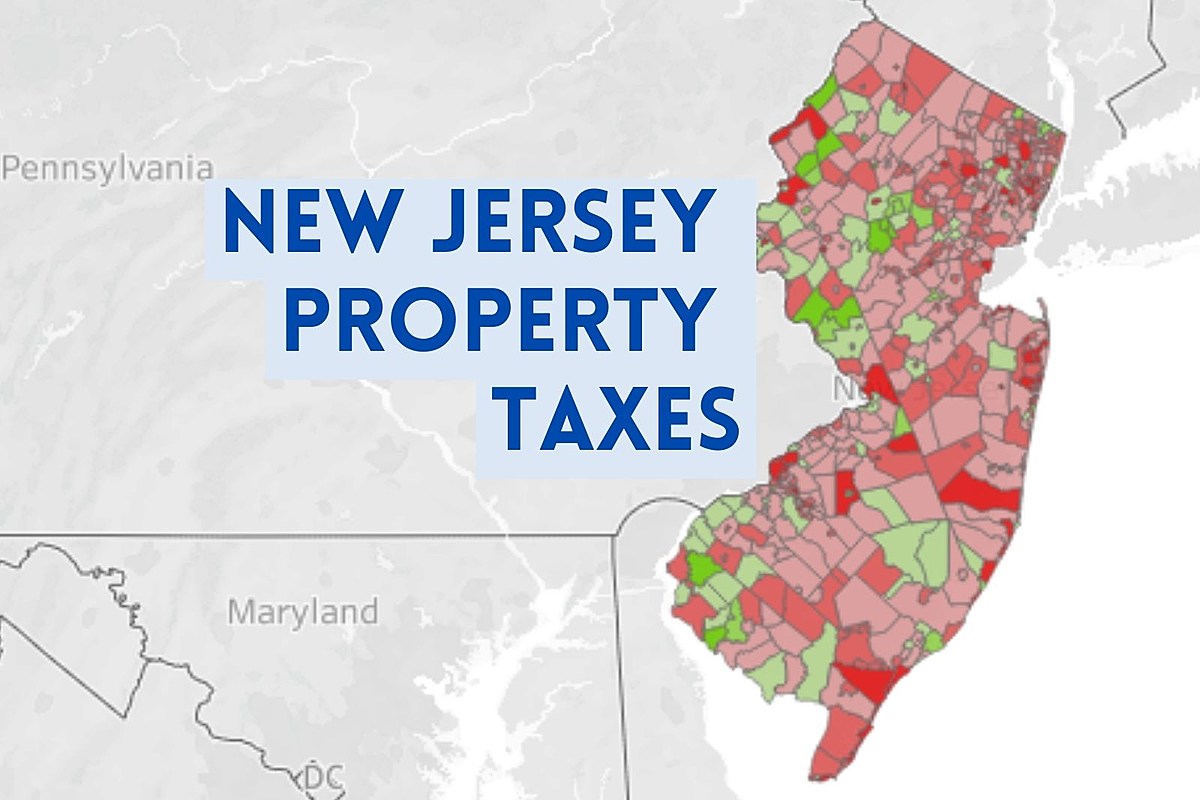

Average NJ Property Tax Bill Near 9 300 Check Your Town Here

https://townsquare.media/site/385/files/2022/01/attachment-New-Jersey-property-taxes.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

The program was restored in the approved budget that went into effect on October 1 2020 The 2021 property tax credits are based on one s 2017 income and Among the initiatives in line for more funding is the property tax relief program that lets New Jersey homeowners deduct from their state income taxes the full

Officials in New Jersey are urging people to apply for property tax relief under the new ANCHOR program before the Jan 31 2023 deadline Qualified There are property tax relief programs that are available to homeowners in NJ who may qualify for tax relief depending on age income level and other factors

Millions Could Receive Property Tax Relief In New Jersey YouTube

https://i.ytimg.com/vi/PtNBk1VLWuM/maxresdefault.jpg

Nj Property Tax Relief Check 2020 Dorathy Davila

https://i.pinimg.com/originals/99/2e/0e/992e0e2a9318dcf4986fd94a760b62a3.jpg

https://www20.state.nj.us/TYTR_PTR_INQ/jsp/PTRLogin.jsp

Property Tax Reimbursement Inquiry NJ Taxation Taxation Privacy Policy Check the status of your New Jersey Senior Freeze Property Tax Reimbursement If a

https://nj.gov/treasury/taxation/anchor/eligibility.shtml

Your 2020 New Jersey gross income was not more than 250 000 Filing Information Filing Deadline The filing deadline was December 29 2023 All property

2019 NJ Anchor Program 1 500 1 000 To Home Owners 405 For

Millions Could Receive Property Tax Relief In New Jersey YouTube

Interactive Map Tracking Results Of Property Tax Uptick Across NJ NJ

Reminder Of NJ Property tax Relief Programs NJ Spotlight News

NJ Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Check 2021 Gwyneth Stuart

Nj Property Tax Relief Check 2021 Gwyneth Stuart

Real Estate Tax Relief Program Official Website Of Arlington County

Property Tax Relief Available For New Jersey Homeowners Renters

Property Tax Relief LinkedIn

Nj Property Tax Relief Fund Check 2020 - For 870 000 homeowners with incomes up to 150 000 it would mean savings up to 1 500 and 290 000 households with incomes between 150 000 and