Nj Taxation Homestead Rebate Web This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits

Web 2020 property taxes were paid on that home and Your 2020 New Jersey gross income was not more than 250 000 New ANCHOR Benefit Confirmation Letter Web To be eligible you must be a beneficiary of the trust occupy the home as your main home on October 1 2020 and meet the income requirements The 2020 property taxes must

Nj Taxation Homestead Rebate

Nj Taxation Homestead Rebate

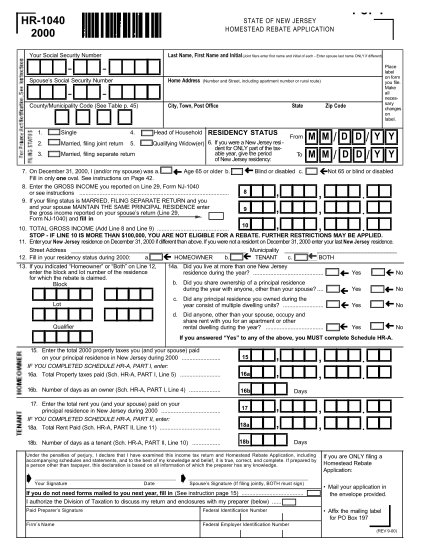

https://cdn.cocodoc.com/cocodoc-form/png/64456293--HR-1040-Homestead-Rebate-Application-State-of-New-Jersey-nj--x-01.png

2018 New Jersey Homestead Rebate Application Fill Out Sign Online

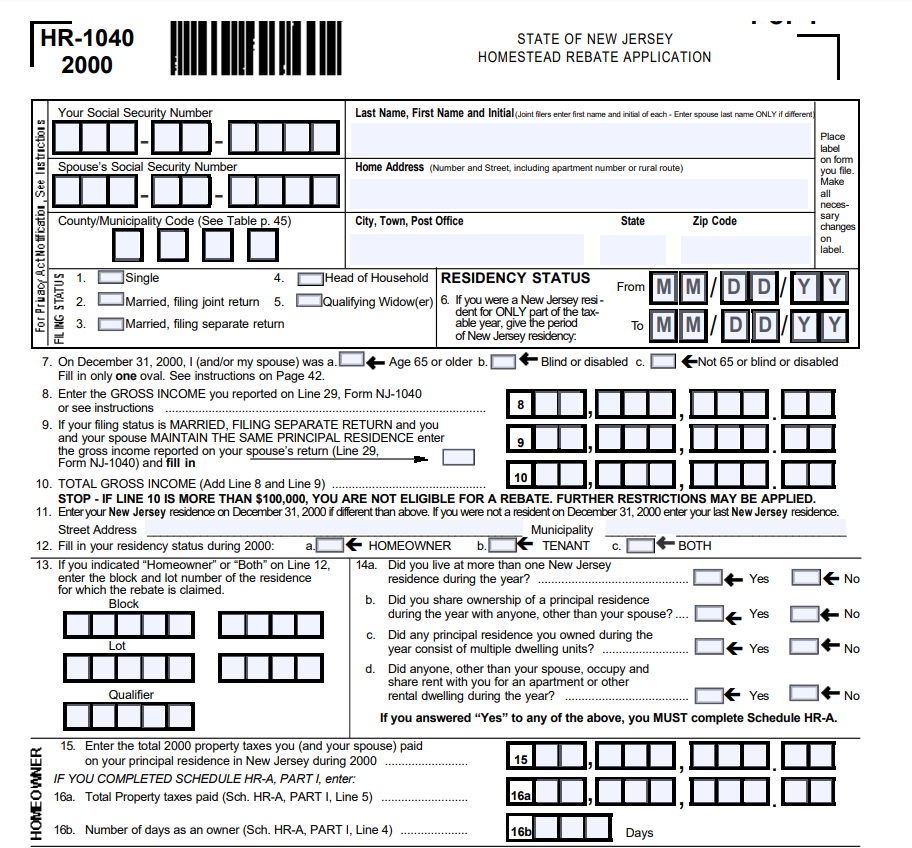

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/2018-new-jersey-homestead-rebate-application-fill-out-sign-online-1.png?w=770&ssl=1

NJ Homestead Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/File-NJ-Homestead-Rebate-Form-Online.png

Web 20 juin 2022 nbsp 0183 32 New Jersey homeowners pay the highest property taxes in the nation and the average bill statewide hit 9 284 in 2021 an increase of 172 over the previous year Web Electronic Services The inquiry system will tell you if your application is in processing we have no record of processing your application the date we issued a benefit including if it

Web 29 mars 2023 nbsp 0183 32 New Jersey s latest iteration of property tax relief is the Anchor program the successor to the Homestead Benefit program It extends eligibility to renters for the first time in more than a decade and Web The total amount of all property tax relief benefits you receive Homestead Benefit Senior Freeze Property Tax Deduction for senior citizens disabled persons and Property Tax

Download Nj Taxation Homestead Rebate

More picture related to Nj Taxation Homestead Rebate

New Jersey Homestead Rebate 2023 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/2018-new-jersey-homestead-rebate-application-fill-out-sign-online.png

New Jersey Scraps Homestead Rebate Implements ANCHOR Program TaxBuzz

https://img.particlenews.com/img/id/3govbI_0iJuAleB00?type=thumbnail_1600x1200

Can I Appeal My Homestead Rebate Application NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2019/07/house-2332156_1920-1-700x467.jpg

Web 18 juil 2022 nbsp 0183 32 Under the ANCHOR program homeowners would be eligible for an average first year rebate of 700 if income does not exceed 250 000 he said In late June Web ANCHOR Benefit Online Filing Electronic Services Welcome to the ANCHOR filing system Please select the answer to the following question and choose continue On

Web 13 sept 2022 nbsp 0183 32 More than 870 000 homeowners with incomes up to 150 000 will receive 1 500 in relief more than 290 000 homeowners with incomes between 150 000 and 250 000 will receive 1 000 and more Web 24 avr 2023 nbsp 0183 32 More than 1 7 million New Jersey residents applied for the ANCHOR rebate program including 1 25 million homeowners and more than 514 000 renters Most of the

Business Report Lingering Financial Challenges Homestead Rebate

https://www.njspotlightnews.org/wp-content/uploads/sites/123/2021/09/RhondaBizJ20210922_FS-BIZ-Recovered.jpg

Can I Qualify For The Homestead Rebate If A Trust Owns My Condo Nj

https://www.nj.com/resizer/CSsRqnnhfZgKnX0qCL2rTateEpg=/1280x0/smart/arc-anglerfish-arc2-prod-advancelocal.s3.amazonaws.com/public/WLTTETQJCZEB3KZCLMQOR775T4.jpg

https://nj.gov/treasury/taxation/anchor/index.shtml

Web This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits

https://www.state.nj.us/treasury/taxation/anchor/home.shtml

Web 2020 property taxes were paid on that home and Your 2020 New Jersey gross income was not more than 250 000 New ANCHOR Benefit Confirmation Letter

Nj Homestead Rebate 2022 Renters RentersRebate

Business Report Lingering Financial Challenges Homestead Rebate

Fortune Salaire Mensuel De Nj Budget 2022 Homestead Rebate Combien

Out of Date Data Shortchanges Recipients Of Homestead Tax Rebates NJ

Is There A Nj Homestead Rebate For 2023 Rebate2022

NJ Tax Rebate The ANCHOR Program Formerly Homestead Rebates

NJ Tax Rebate The ANCHOR Program Formerly Homestead Rebates

NJ s New 2B Tax Rebate Program Underway How To Get Your Cut Across

State Homestead Rebate Applications In The Mail Due November 30

NJ Property Tax Rebate Thousands Waiting For ANCHOR Credit

Nj Taxation Homestead Rebate - Web 25 oct 2021 nbsp 0183 32 The income used for the Homestead Rebate is from the New Jersey gross income reported on Line 29 of your NJ 1040 D Agostini said If you do not have any