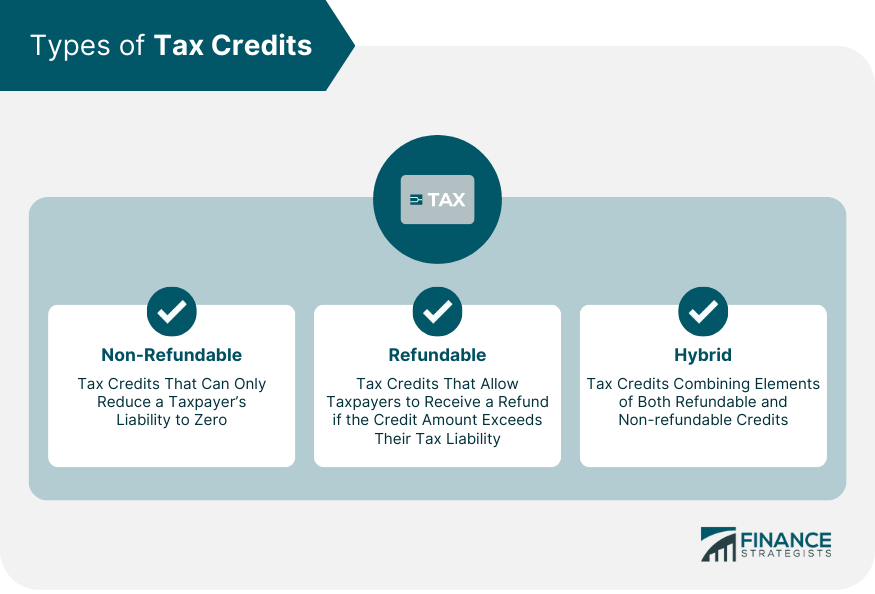

Non Refundable And Refundable Tax Credit A nonrefundable credit is subtracted from your income tax liability up to the total amount you owe But unlike a refundable tax credit a nonrefundable credit cannot reduce your tax balance beyond zero Any unused portion of a nonrefundable tax credit will expire in the year the credit is claimed and cannot be carried over

Nonrefundable tax credits can reduce the amount of tax you owe but they do not increase your tax refund or create a tax refund when you wouldn t have already had one Refundable tax credits can result in a tax refund if the total of these credits is greater than the tax you owe Not all tax credits are refundable however For nonrefundable tax credits once a taxpayer s liability is zero the taxpayer won t get any leftover amount back as a refund There are a wide range of tax credits and

Non Refundable And Refundable Tax Credit

Non Refundable And Refundable Tax Credit

https://www.wesselcpa.com/wp-content/uploads/2019/04/543881659.jpg

When Is A Deposit Truly Non Refundable

https://enterpriselegal.com.au/images/Enterprise-Legal-Non-Refundable-Depost-Law.png

What Is The Difference Between Non refundable And Refundable Tax

https://cdn.taxory.com/wp-content/uploads/2020/12/refundable-and-non-refundable-tax-credits.jpg

Taxpayers subtract both refundable and nonrefundable credits from the income taxes they owe If a refundable credit exceeds the amount of income taxes owed the difference is paid as a refund If a nonrefundable credit exceeds the amount of income taxes owed the excess is lost A nonrefundable tax credit is a type of state or federal credit that offsets your tax bill dollar for dollar It s called nonrefundable because once your tax bill

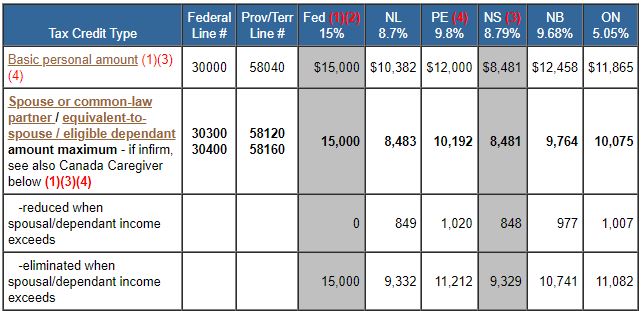

Non refundable tax credits reduce income taxes owed only while refundable tax credits might not only reduce the income taxes owed but also increase the tax refund This would be the case if the tax credit amount is larger than the income taxes owed October 10 2022 ADVERTISER DISCLOSURE By Adageorge Reviewed by Canada Buzz Editorial Refundable and non refundable tax credits are two tax paying terms Canadians will often come across during tax season Understanding what these terms mean is crucial even if you don t do your taxes yourself

Download Non Refundable And Refundable Tax Credit

More picture related to Non Refundable And Refundable Tax Credit

Maximizing Your Refundable And Non Refundable Tax Credits

https://torontoaccountant.ca/wp-content/uploads/2014/04/TaxCredits-1484x742.png

Refundable Vs Non Refundable Tax Credits

https://heavencpa.com/wp-content/uploads/2019/04/tax-credits.jpg

Refundable Vs Non refundable Tax Credits Caras Shulman

https://www.carasshulman.com/wp-content/uploads/2023/03/iStock-1410271656-scaled.jpg

Quick Answer Both refundable and nonrefundable tax credits lower your tax bill dollar for dollar Nonrefundable credits only apply to your tax liability while refundable tax credits can wipe out your tax bill and provide a Non refundable tax credits aren t issued as refunds Both refundable and non refundable credits can result in lower tax bills and contribute to refund amounts Refundable tax credits A

A refundable tax credit is a credit you can get as a refund even if you don t owe any tax Tax credits are amounts you subtract from your bottom line tax due when you file your tax return Most tax credits can reduce your tax only until it reaches 0 Refundable credits go beyond that to give you any remaining credit as a refund Non refundable tax credits differ in that they can only reduce the tax liability to zero These credits won t result in a tax refund In general non refundable tax credits can lower your tax liability but won t provide any additional refund beyond the

Refundable Non Refundable Tax Credits YouTube

https://i.ytimg.com/vi/_58zVuDiEtg/maxresdefault.jpg

TaxTips ca 2023 Non Refundable Personal Tax Credits Tax Amounts

https://www.taxtips.ca/nrcredits/2023-personal-tax-credits.jpg

https://www.irs.com/en/refundable-vs-non-refundable-tax-credits

A nonrefundable credit is subtracted from your income tax liability up to the total amount you owe But unlike a refundable tax credit a nonrefundable credit cannot reduce your tax balance beyond zero Any unused portion of a nonrefundable tax credit will expire in the year the credit is claimed and cannot be carried over

https://turbotax.intuit.com/tax-tips/tax...

Nonrefundable tax credits can reduce the amount of tax you owe but they do not increase your tax refund or create a tax refund when you wouldn t have already had one Refundable tax credits can result in a tax refund if the total of these credits is greater than the tax you owe

How To Cancel Non Refundable Bookings Hotels Tours

Refundable Non Refundable Tax Credits YouTube

What Are Refundable Tax Credits YouTube

Refundable Vs Nonrefundable Tax Credits Experian

Non refundable And Co financing Instruments Internationalization

Investopedia On Twitter A Non refundable Tax Credit Explained Https

Investopedia On Twitter A Non refundable Tax Credit Explained Https

Tax Credits Definition Types Qualifications And Limitations

TaxMan Non refundable Tax Credit YouTube

Refundable Tax Credits

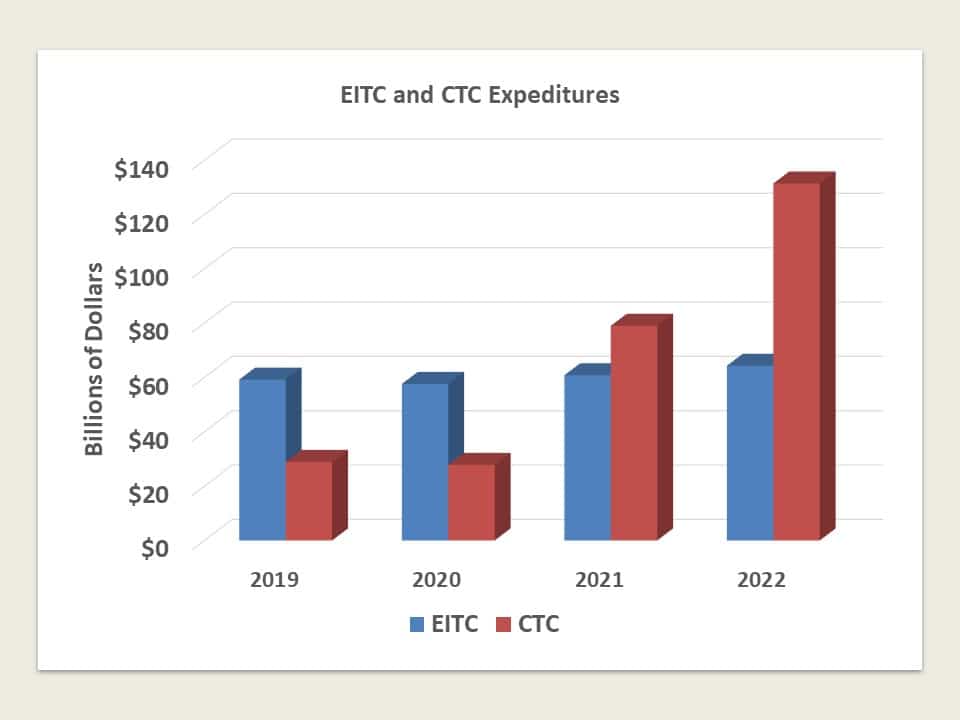

Non Refundable And Refundable Tax Credit - It looks like refundable credits are accounted for in the same lines as payments so non refundable credits are calculated first