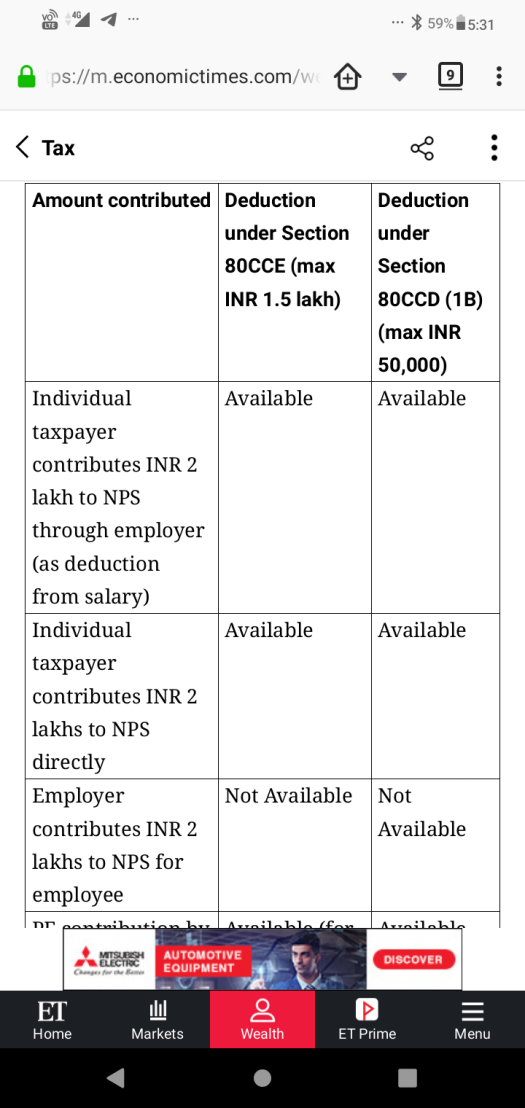

Nps 50000 Tax Rebate Section Web 8 f 233 vr 2019 nbsp 0183 32 You can now claim a deduction of Rs 2 00 lakhs i e Rs 1 50 lakhs under Sec 80C and Rs 50 000 under Section 80CCD 1B About NPS NPS or National

Web 30 mars 2023 nbsp 0183 32 Additional deduction of up to Rs 50 000 under Section 80CCD 1B of the Income Tax Act exclusively available through NPS investment The third deduction is in Web 30 janv 2018 nbsp 0183 32 Ever since Budget 2015 introduced an additional deduction of Rs 50 000 for investment only in the National Pension System NPS

Nps 50000 Tax Rebate Section

Nps 50000 Tax Rebate Section

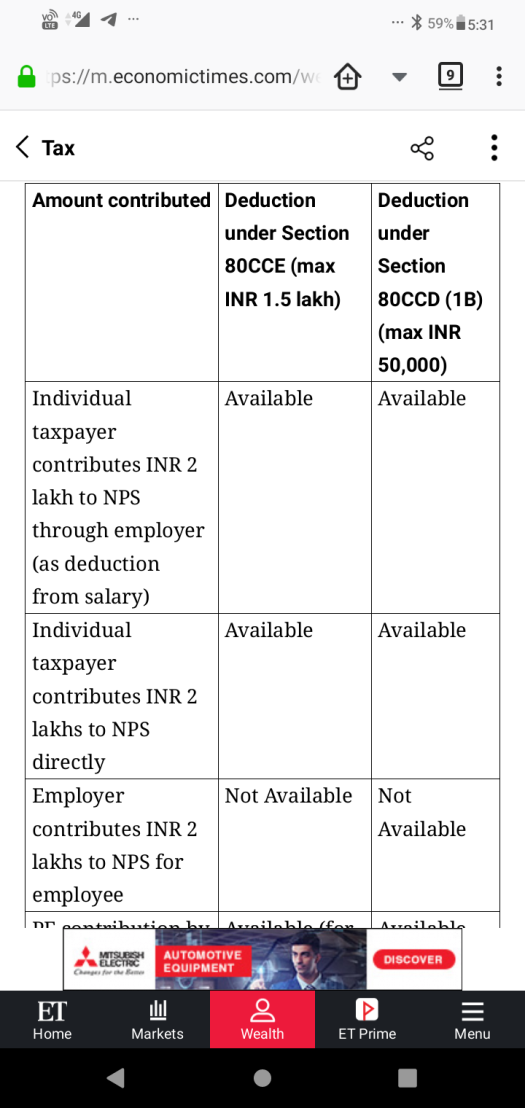

https://befinexpert.files.wordpress.com/2019/12/screenshot_20191216-1731459053301389216939998.png?w=525

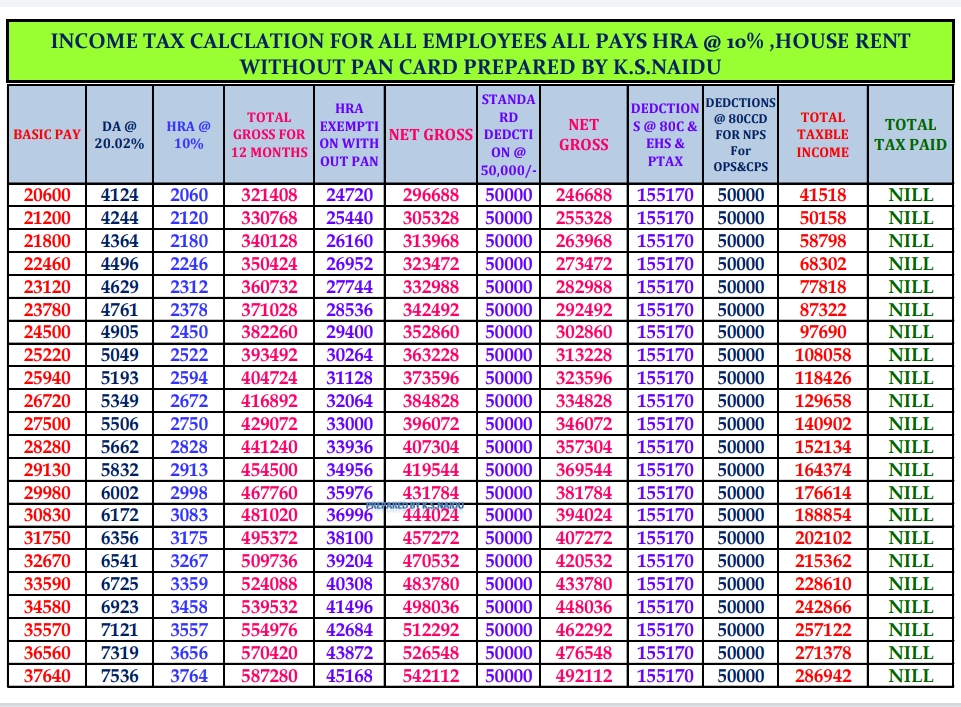

APTF VIZAG Income Tax Calculation For All Employees And Teachers With

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhSlo2-1Jap1rrwuyAxM-K-yODIeCrd6DU8b1SFFVGOeKPYlczIfKmOzTbuineEucmBezKwBNqCIhfWOEky1jihX1Pu66ix97eD4421QsRGLh64fSnHqjNGmc6jKbL6rZ7KlWiZdqOe-kTC2fOLUIn9IRBpZb9N_q50hkURrCrQEQEVnH_ogbZqELoWFw/s961/Screenshot_2023-01-16-18-38-32-50_e2d5b3f32b79de1d45acd1fad96fbb0f.jpg

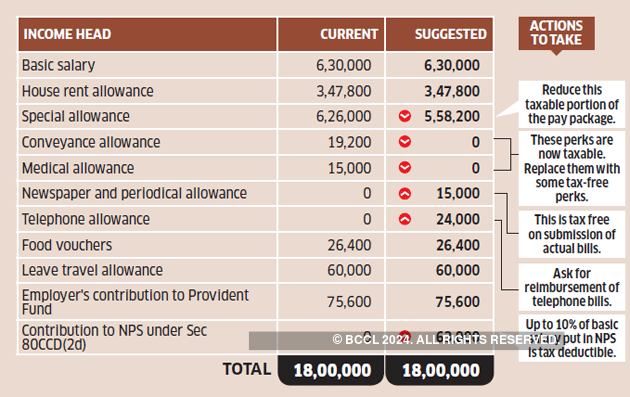

Income Tax Saving Tax Optimiser Salaried Kumar Can Save Rs 50 000

https://img.etimg.com/photo/msid-69268356/26-1.jpg

Web Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax deduction under sec 80 CCD Web 3 juil 2020 nbsp 0183 32 NPS gives extra 50 000 income tax deduction 5 updates Contribution towards NPS tier 1 account allows you to claim an exclusive deduction of 50 000 under

Web 18 f 233 vr 2023 nbsp 0183 32 Section 80CCD 1b This section allows an additional deduction of Rs 50 000 for the investment made in the National Pension System NPS in a financial year This deduction is over and above the Web 24 mars 2022 nbsp 0183 32 Investors can enjoy tax exemption at the time of maturity Accumulated amount is also exempted from income tax One can avail income tax exemption at the time of investment You receive exclusive

Download Nps 50000 Tax Rebate Section

More picture related to Nps 50000 Tax Rebate Section

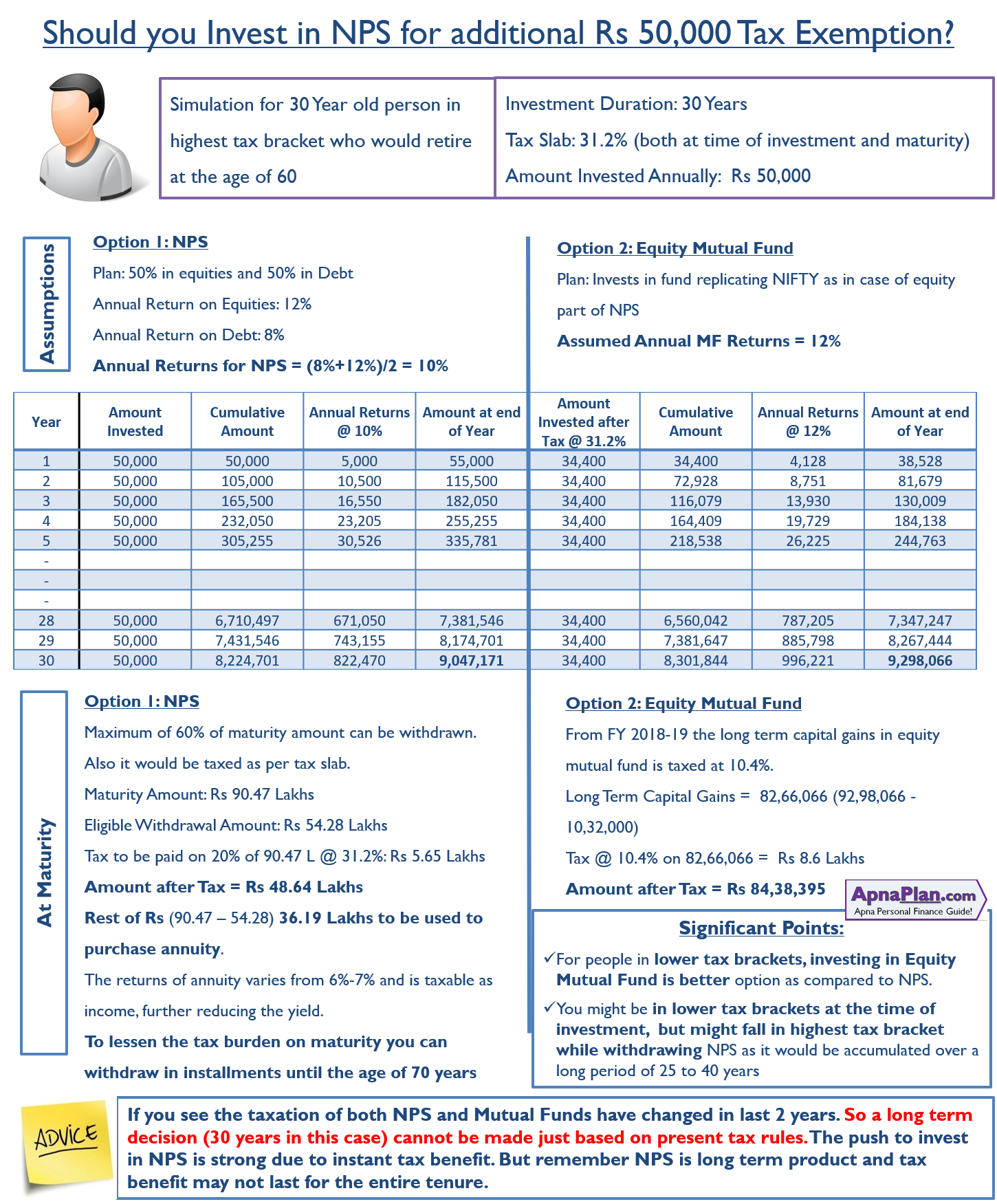

Invest Rs 50 000 In NPS To Save Tax U s 80CCD 1B updated For Budget

https://www.apnaplan.com/wp-content/uploads/2018/01/Should-you-Invest-in-NPS-to-Save-Tax.png

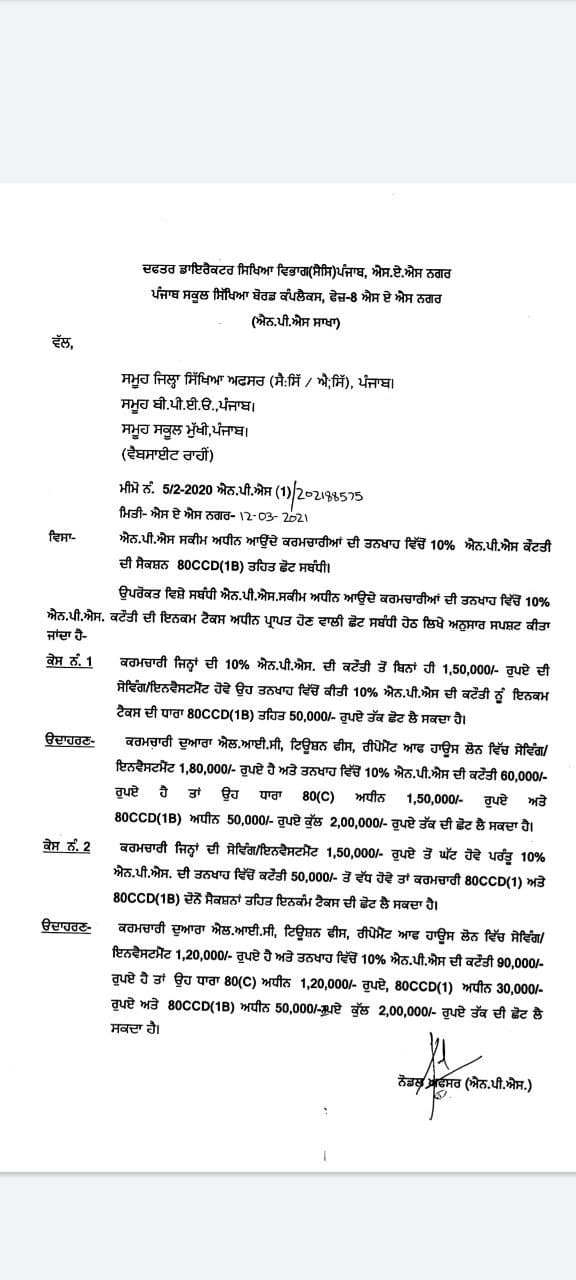

Regarding Income Tax Rebate For Employees Under NPS Scheme Letter Dated

https://blogger.googleusercontent.com/img/a/AVvXsEhM6qED-mJB4mkwLc42SP7PMEWTfjgaEIPlg7ozDq97SfAE_7aW9-n5Hh_A_5KLwutFrT7hBiZuPBdc1U6p3PAYm6HavxRG48zo5rWW0f1GiLiRpnw-21wAV-NjgQJ5LTz2xmt_5XqzObsoyu_rGVmInxxwvjt94BVM-NH1Me2qI2Hdz282UaH6AHvl=s16000

All Proceedings About CPS NPS 50 000 Extra Saving Benfit In Income Tax

https://lh3.googleusercontent.com/-ECWsZCiKE14/WnuhDY_htwI/AAAAAAAALlk/dqMcRPJ68bsBnwAUuf5SKSzF60EhzWYaQCHMYCw/s1600/Screenshot_20180208-052724.png

Web 24 juin 2020 nbsp 0183 32 NPS additional Rs 50 000 tax benefits Some additional tax benefits are also allowed under NPS rules Both salaried and self employed individuals can claim an additional deduction for investment up to Rs Web 12 janv 2020 nbsp 0183 32 1 min read 12 Jan 2020 06 36 AM IST Edited By Surajit Dasgupta NPS contribution statement for this year can be downloaded from NSDL website An NPS subscriber can submit the transaction

Web 17 juil 2023 nbsp 0183 32 Eligible for tax deductions up to 1 50 000 under section 80CCD 1 Like NPS additional investment of up to 50 000 is eligible for tax deduction under section 80CCD Web 5 f 233 vr 2016 nbsp 0183 32 Tax savings The Rs 50 000 extra deduction on NPS is useful for those in the highest tax bracket of 30 who can make an additional saving of Rs 16 000 in taxes

I Never Invested In NPS For 50000 Tax Rebate YouTube

https://i.ytimg.com/vi/U4RDV3BkgOk/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGD0gZShgMA8=&rs=AOn4CLAWDTvVNxRfyUiftQq4E9sAZxRXlA

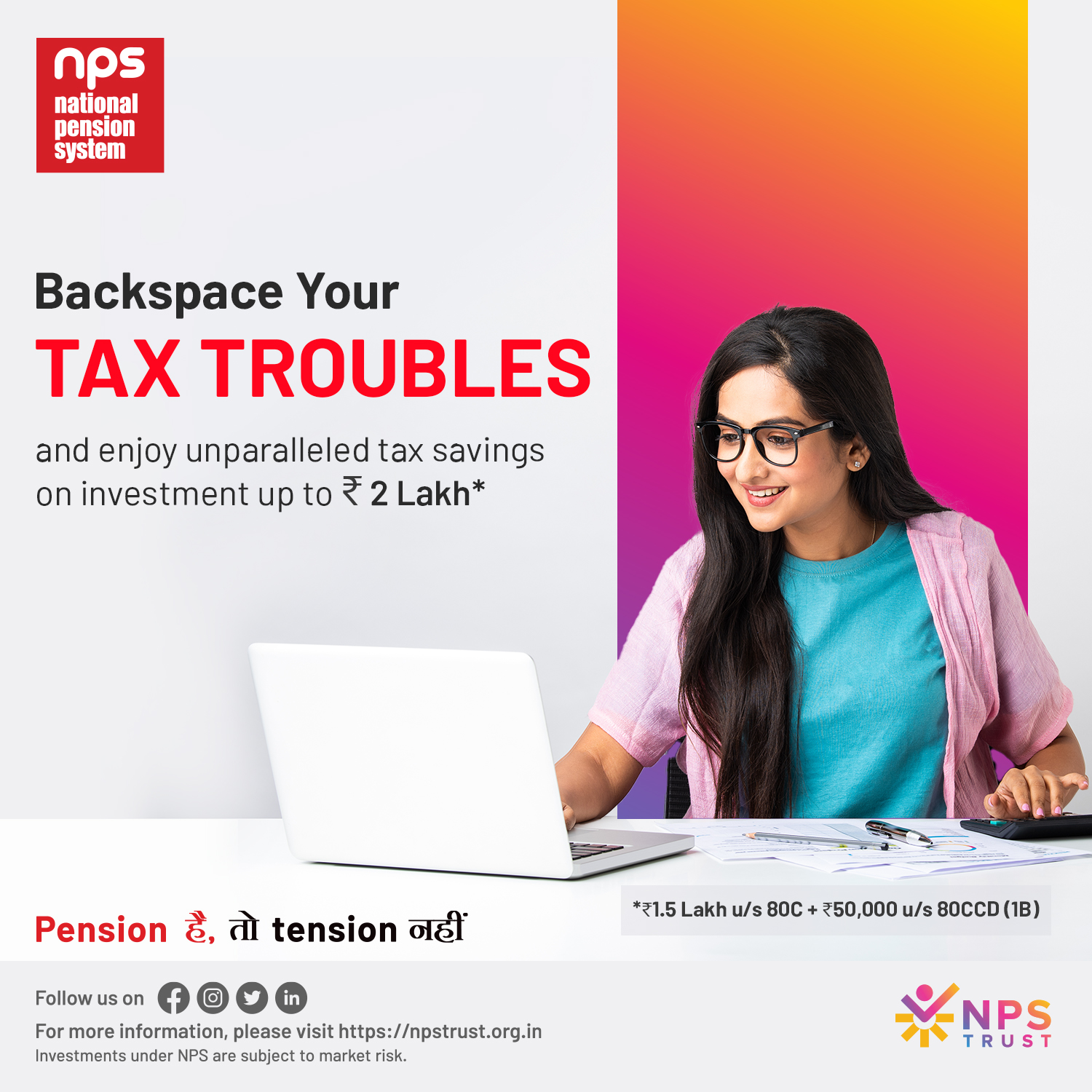

Sim Veng CSC On Twitter RT nps trust Delete All Your tax related

https://pbs.twimg.com/media/FpeRqa-acAElutR?format=jpg&name=large

https://cleartax.in/s/section-80-ccd-1b

Web 8 f 233 vr 2019 nbsp 0183 32 You can now claim a deduction of Rs 2 00 lakhs i e Rs 1 50 lakhs under Sec 80C and Rs 50 000 under Section 80CCD 1B About NPS NPS or National

https://www.valueresearchonline.com/stories/52395/what-should-i-do...

Web 30 mars 2023 nbsp 0183 32 Additional deduction of up to Rs 50 000 under Section 80CCD 1B of the Income Tax Act exclusively available through NPS investment The third deduction is in

All Proceedings About CPS NPS 50 000 Extra Saving Benfit In Income Tax

I Never Invested In NPS For 50000 Tax Rebate YouTube

Income Tax Calculation On Salary I Benefits Rs 50000 I Rebate 87A I

NPS Scheme National Pension Scheme NPS Tax Rebate In NPS YouTube

CSCeGov On Twitter Invest In NPS Today Gain Additional Tax Benefit

NPS 50 000

NPS 50 000

How To Save Tax Via NPS By Investing Rs 50 000 Additionally Gsoftnet

Tax Saving Is An Art There Are 100 Legal Ways To Reduce Your Income

-50000.jpg?itok=WhAz0TLB)

NPS Tax Benefit Under Sec 80CCD 1b Of Rs 50 000 Business HimSky

Nps 50000 Tax Rebate Section - Web 3 juil 2020 nbsp 0183 32 NPS gives extra 50 000 income tax deduction 5 updates Contribution towards NPS tier 1 account allows you to claim an exclusive deduction of 50 000 under