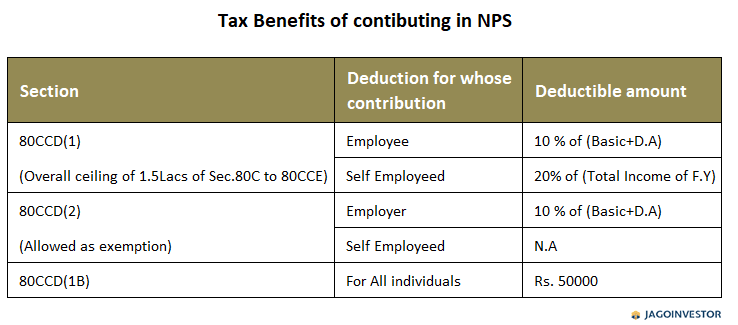

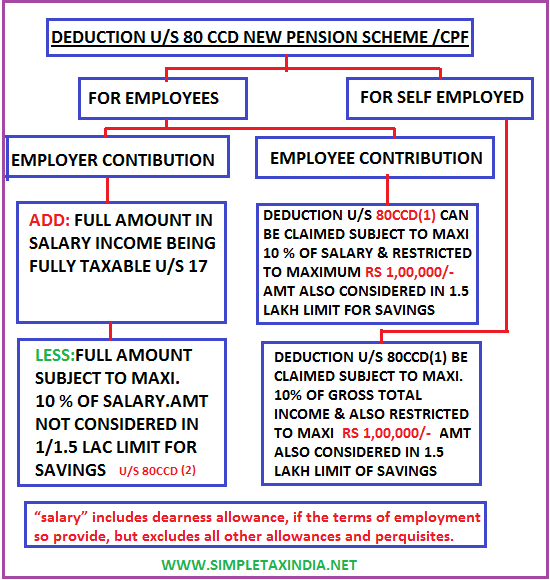

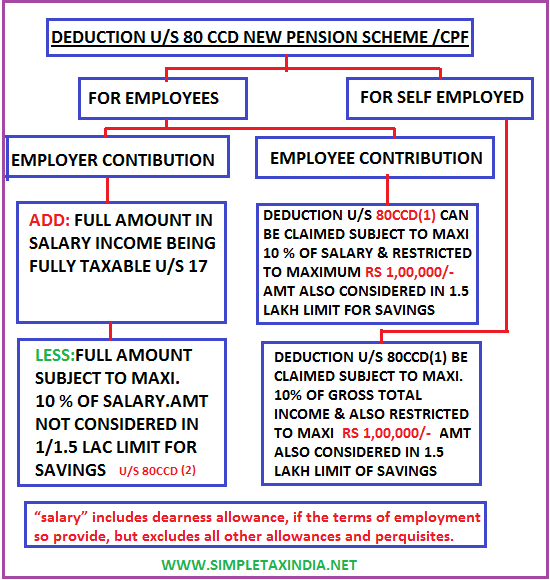

Nps Employer Contribution Deduction Limit Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such

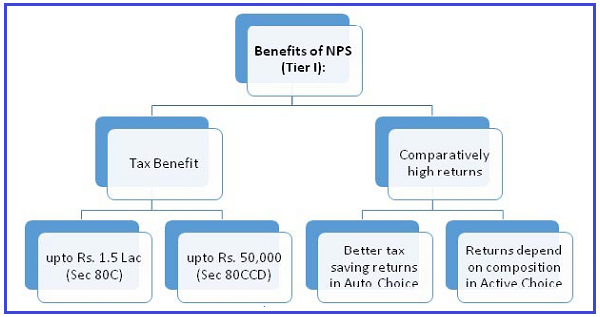

Section 80CCD 1B gives an additional deduction of Rs 50 000 on their NPS contributions Section 80CCD 2 provides that employees can claim a deduction National Pension Scheme NPS NPS contribution limit for employer in private sector raised from 10 to 14 of the employees basic salary For both private

Nps Employer Contribution Deduction Limit

Nps Employer Contribution Deduction Limit

https://blog.saginfotech.com/wp-content/uploads/2020/11/employer-contribution-under-nps.jpg

Nps Contribution By Employee Werohmedia

https://www.jagoinvestor.com/wp-content/uploads/files/Tax-Benefits-of-contributing-in-NPS.png

How To Make Online Contributions To NPS Tier I And Tier II Accounts

https://freefincal.com/wp-content/uploads/2015/12/Online-contribution-NPS.jpg

What are the tax benefits of NPS to employees on Employer contribution As per Section 80 CCD 2 if your employer is also contributing to your NPS account then The employer s contribution up to a limit of 10 percent of the salary 14 percent for government employees which includes the basic salary and dearness

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 Effectively an employee can claim deduction upto Rs 7 50 lakhs for employer s contribution to his NPS account in a year How is employer s contribution to

Download Nps Employer Contribution Deduction Limit

More picture related to Nps Employer Contribution Deduction Limit

Income Tax Rule Change Tripple Tax Benefits On NPS Know How It Works

https://cachandanagarwal.com/wp-content/uploads/2022/03/Income-Tax-NPS.jpeg

NPS National Pension System Contribution Online Deduction Charges

https://www.paisabazaar.com/wp-content/uploads/2018/10/NPS-Contribution-1024x559.png

NPS Tax Queries Can You Claim Deduction For NPS Contribution Made By

https://img.etimg.com/thumb/msid-64076610,width-1070,height-580,imgsize-22470,overlay-etwealth/photo.jpg

What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible In case of employer s contribution to the NPS account an employee can claim a tax deduction under the income tax laws The maximum deduction that can be

Employer s NPS contribution for the benefit of employee up to 10 per cent of salary Basic DA is deductible from taxable income up to 7 5 Lakh the NPS Employer s Contribution Limit Employers can contribute up to 10 of the employee s basic salary and dearness allowance DA Maximum Limit The maximum allowable

NPS Investment Proof How To Claim Income Tax Deduction Mint

https://images.livemint.com/rf/Image-621x414/LiveMint/Period2/2019/01/12/Photos/Processed/[email protected]

Creating NPS Contribution Pay Head For Employers Payroll

https://help.tallysolutions.com/docs/te9rel63/Payroll/Images1/5_NPS_Employer_contribution.gif

https://cleartax.in/s/nps-national-pension-scheme

Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such

https://cleartax.in/s/section-80-ccd-1b

Section 80CCD 1B gives an additional deduction of Rs 50 000 on their NPS contributions Section 80CCD 2 provides that employees can claim a deduction

What Is The Maximum Employer 401k Contribution For 2020 401kInfoClub

NPS Investment Proof How To Claim Income Tax Deduction Mint

Tax Savings Deductions Under Chapter VI A Learn By Quicko

What s The Maximum 401k Contribution Limit In 2022 MintLife Blog

2023 Plan Contribution Limits Announced By IRS Abbeystreet

Deduction U s 80CCD For CPF NPS Upper Limit One Lakh Only SIMPLE

Deduction U s 80CCD For CPF NPS Upper Limit One Lakh Only SIMPLE

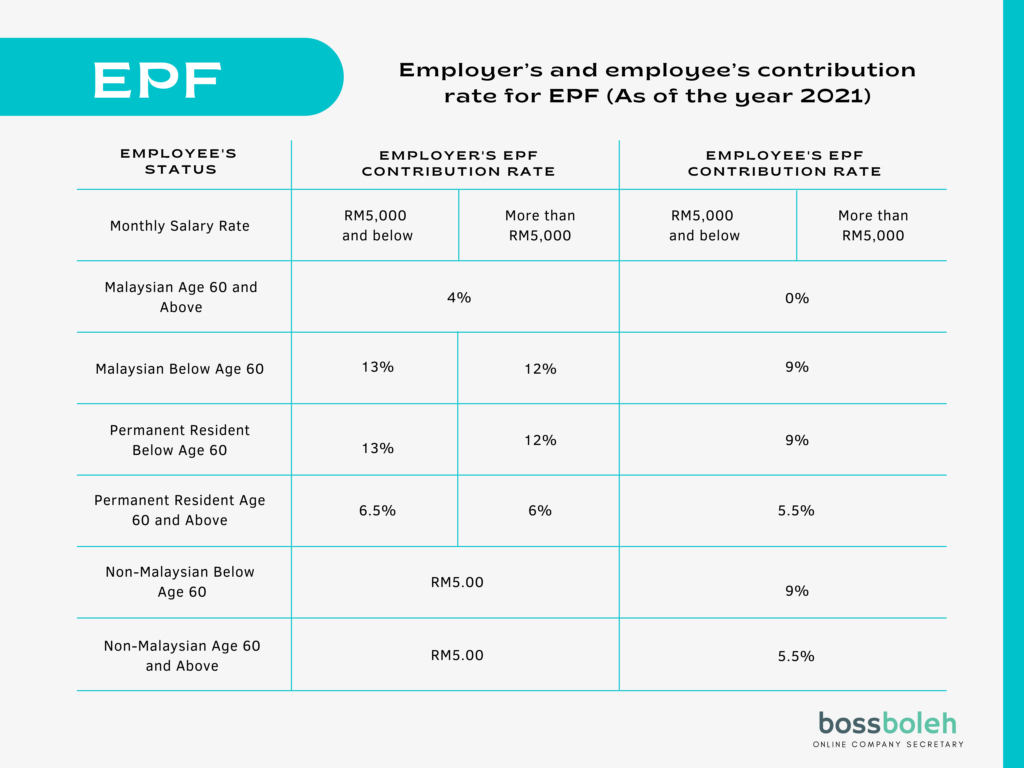

Contribution On EPF SOCSO EIS In Malaysia As An Employer BossBoleh

Finance Fridays Ep 3 Section 80CCD 2 Employer s Contribution To

TAX BENEFIT OF NPS SIMPLE TAX INDIA

Nps Employer Contribution Deduction Limit - Effectively an employee can claim deduction upto Rs 7 50 lakhs for employer s contribution to his NPS account in a year How is employer s contribution to