Nps Tax Free Limit Investing in NPS Tier I offers three tax deductions Deduction of up to Rs

Thus the total maximum tax rebate an individual can avail on NPS is of INR 2 lakh including INR 1 5 lakh which is a part of Section 80 C limit NPS Tier II Account The members of NPS Follow us Tax experts suggest alterations to NPS taxation in Budget 2024

Nps Tax Free Limit

Nps Tax Free Limit

https://www.alankit.com/blog/blogimage/NPS Tax Benefits NPS Rebate in New Tax Regime.jpg

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

Nps Contribution By Employee Werohmedia

https://www.jagoinvestor.com/wp-content/uploads/files/Tax-Benefits-of-contributing-in-NPS.png

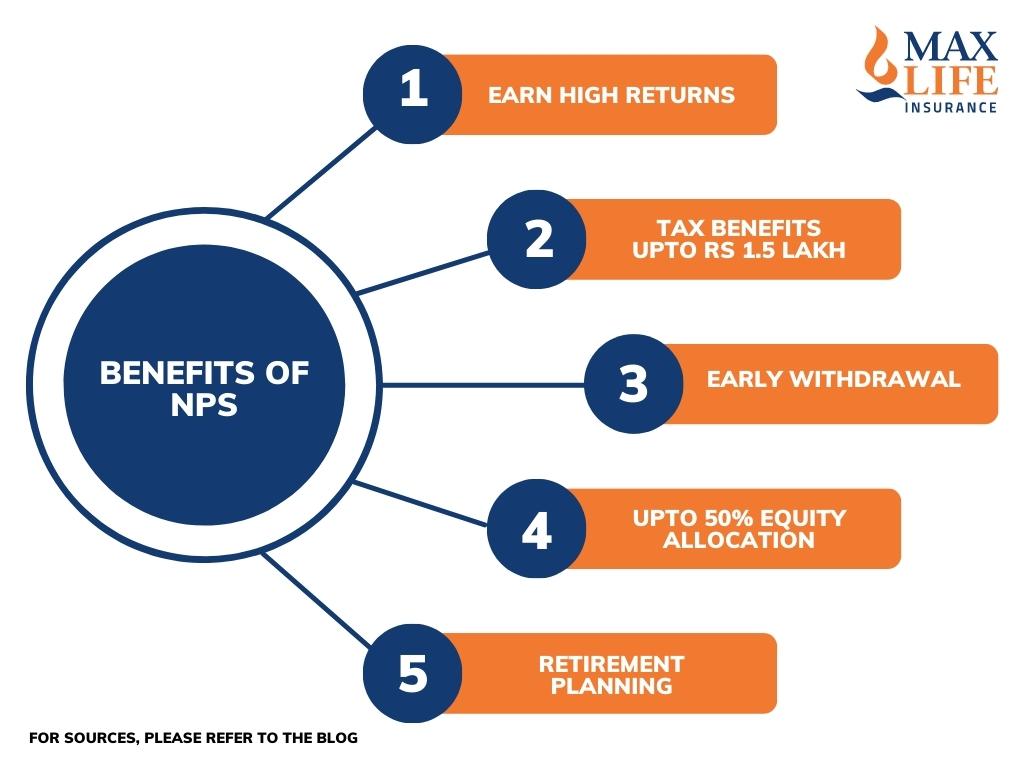

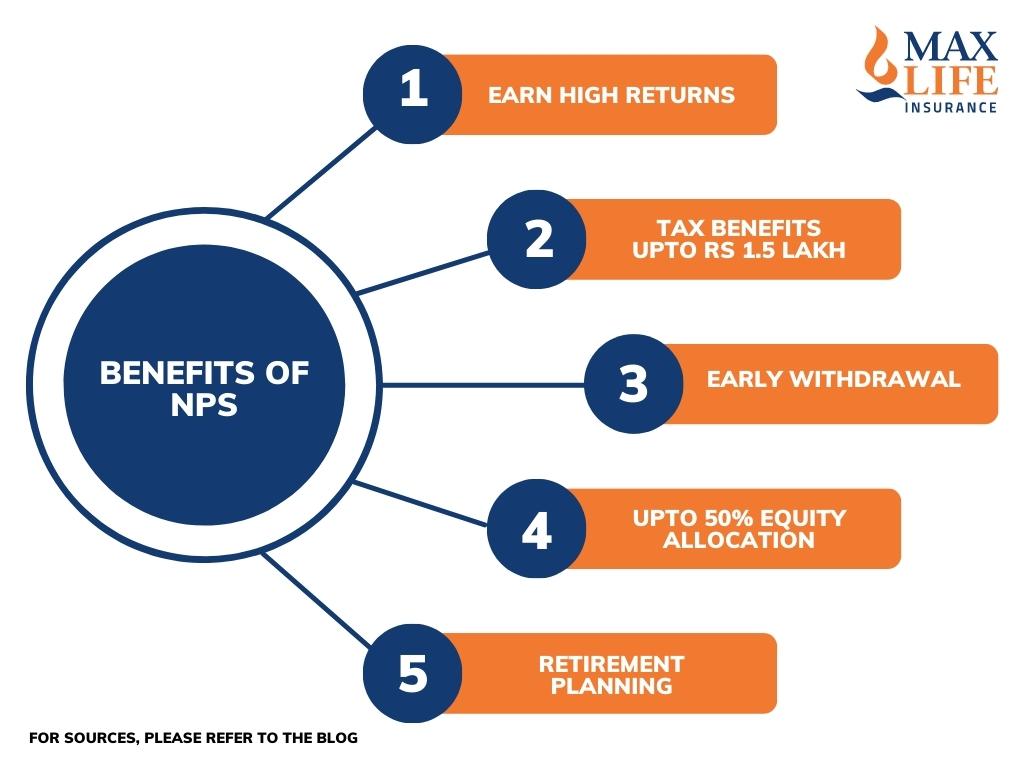

NPS National Pension Scheme tax benefits available only in Tier 1 NPS accounts NPS tax saving comes under Sec 80CCD 1 80CCD 1B 80CCD 2 deduction The entire amount invested is tax free if you purchase an annuity

This article is brief guide of NPS tax exemption limit Section guide tax benefit calculator and most searched FAQs answered as well Is the 60 NPS withdrawal tax free Subscriber can partially withdraw This NPS tax benefit to central government employees is currently available under

Download Nps Tax Free Limit

More picture related to Nps Tax Free Limit

What Is The Tax free Threshold In Australia One Click Life

https://oneclicklife.com.au/wp-content/uploads/2023/04/Budget-Tax-Rates-Threshold-01-scaled-e1681366579595.jpg

Tax Reduction Company Inc

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100064489757770

NPS Tax free Withdrawal Raised To 60 Pct Other Tax Benefits For Employees

https://www.paisabazaar.com/wp-content/uploads/2018/12/02-3.jpg

NPS Tax Benefits under Sec 80CCD 2 There is a misconception among many that there is no upper limit for this section However the limit is the least of the 3 conditions 1 Amount contributed Budget News Tax experts suggest making annuity income from the

NPS Income Tax Benefits FY 2023 24 under Old New Tax Regimes Tax Benefits under NPS A tax exemption of Rs 1 5 lakh can be claimed on

NPS Tax Benefits Compare Apply Loans Credit Cards In India

https://www.paisabazaar.com/wp-content/uploads/2018/10/5-768x511.jpg

NPS National Pension Scheme Tax Saving Benefit And Retirement Plan

https://i.ytimg.com/vi/oVNGnpi1wxY/maxresdefault.jpg

https://www.valueresearchonline.com/stories/52395/...

Investing in NPS Tier I offers three tax deductions Deduction of up to Rs

https://www.forbes.com/.../retirement/nps-ta…

Thus the total maximum tax rebate an individual can avail on NPS is of INR 2 lakh including INR 1 5 lakh which is a part of Section 80 C limit NPS Tier II Account The members of NPS

Regarding Government s Contribution Of NPS Income Tax

NPS Tax Benefits Compare Apply Loans Credit Cards In India

Free Tax Prep Assistance And Forms At Birmingham Public Library

Using The 1 000 Property Allowance Doesn t Always Mean You Pay The

Tax Policy And The Family Cornerstone

National Pension Scheme Know About NPS Returns Types Benefits

National Pension Scheme Know About NPS Returns Types Benefits

You Can Claim This NPS Tax Benefit Under The New Income Tax Rates

Tax Free Red Label Stock Photo Alamy

NPS Limit Of Deductions And Withdrawal And Tax Impact ProfZilla

Nps Tax Free Limit - This article is brief guide of NPS tax exemption limit Section guide tax benefit calculator and most searched FAQs answered as well Is the 60 NPS withdrawal tax free Subscriber can partially withdraw