Nsf Item Fee How Non Sufficient Funds Fees Work Banks often charge NSF fees when a presented check is returned or payment cannot be made due to a lack of funds to cover it NSF Fees average 34 each

The fee your financial institution charges when you bounce a payment is called a nonsufficient funds or NSF fee You may also get hit with an NSF fee if you try to deposit or cash a check and the issuer doesn t have enough money in their account to pay for it A non sufficient funds NSF fee is a common bank fee It occurs when you don t have a sufficient account balance Discover what an NSF fee is and how to avoid it

Nsf Item Fee

Nsf Item Fee

https://images.ctfassets.net/90p5z8n8rnuv/2p0Fhwc6RjjXf0zWUx1yaN/adb880c68013516d1374993fe0c48eca/Non-Sufficient_Funds__NSF__Fees_Asset_-_01.jpg

Service Fees Northern Savings Credit Union

https://www.northsave.com/assets/img/imgs/Lobbysheet_AccountFees_Aug2023.PNG

:max_bytes(150000):strip_icc()/nsf.asp-final-a7e7d586f4cf43abb81b03a6247d8517.png)

Bedeutung Der Beispiel 180 55 ZR 17 73 W 53 OFF

https://www.investopedia.com/thmb/FNxSye1oipMq9VepVpgX3TTCR5E=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/nsf.asp-final-a7e7d586f4cf43abb81b03a6247d8517.png

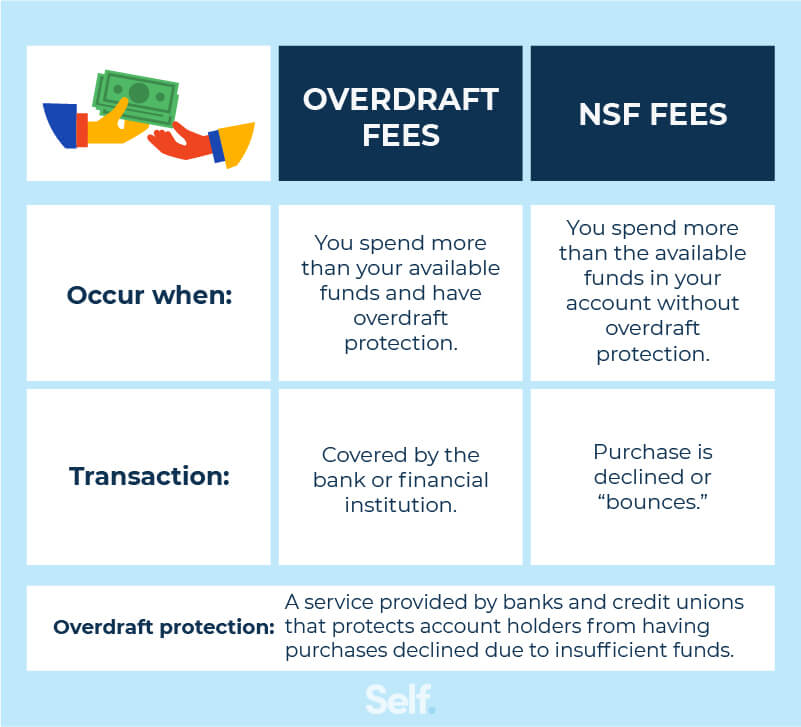

Non sufficient funds NSF sometimes called insufficient funds describe when you don t have enough money in your account to cover an expense You may see a non sufficient funds notice if The average overdraft or NSF fee is around 30 according to the Consumer Financial Protection Bureau According to Forbes Advisor s 2020 checking account fee survey the average overdraft

Learn about nonsufficient funds fees how they compare to overdraft fees and details about how NSF fees work What Is an NSF Fee A non sufficient fund or NSF fee is charged by your financial institution when you don t have enough funds to cover a cheque or pre authorized debit on your bank account This is known as a bounced cheque or bounced payment Banks charge NSF fees on a per item basis so at 45 each multiple NSFs can prove to be costly

Download Nsf Item Fee

More picture related to Nsf Item Fee

NSF Item Fee RBC Avoid Getting Your Balance Below Zero

https://income.ca/wp-content/uploads/Credit-report.jpg

NSF Item Fee RBC Avoid Getting Your Balance Below Zero

https://income.ca/wp-content/uploads/refund-768x624.jpg

NSF Item Fee RBC Avoid Getting Your Balance Below Zero

https://income.ca/wp-content/uploads/calculating-bills.jpg

A nonsufficient funds fee also known as a returned item fee is a penalty a bank charges when there isn t enough money in your account to cover a transaction This might include automatic NSF fees are usually about 34 each according to the Consumer Financial Protection Bureau CFPB Check your account terms to find out your bank s NSF fee policy including the cost per

[desc-10] [desc-11]

NSF Item Fee RBC Avoid Getting Your Balance Below Zero

https://income.ca/wp-content/uploads/Fees.jpg

NSF Item Fee RBC Avoid Getting Your Balance Below Zero

https://income.ca/wp-content/uploads/an-alarm-clock.jpg

https://www.investopedia.com/terms/n/nsf.asp

How Non Sufficient Funds Fees Work Banks often charge NSF fees when a presented check is returned or payment cannot be made due to a lack of funds to cover it NSF Fees average 34 each

https://www.creditkarma.com/money/i/what-is-nsf-fee

The fee your financial institution charges when you bounce a payment is called a nonsufficient funds or NSF fee You may also get hit with an NSF fee if you try to deposit or cash a check and the issuer doesn t have enough money in their account to pay for it

Did Your Bank Charge You An Unfair Return Item Fee Top Class Actions

NSF Item Fee RBC Avoid Getting Your Balance Below Zero

NSF Item Fee RBC Avoid Getting Your Balance Below Zero

What Is A NSF Fee Integra Credit

F e

What s An NSF Fee And Why Do Banks Charge It Credit Karma

What s An NSF Fee And Why Do Banks Charge It Credit Karma

F e

F e

Venmo NSF Fee Item Returned Avoiding NSF Item Returned Fees 2024

Nsf Item Fee - [desc-12]