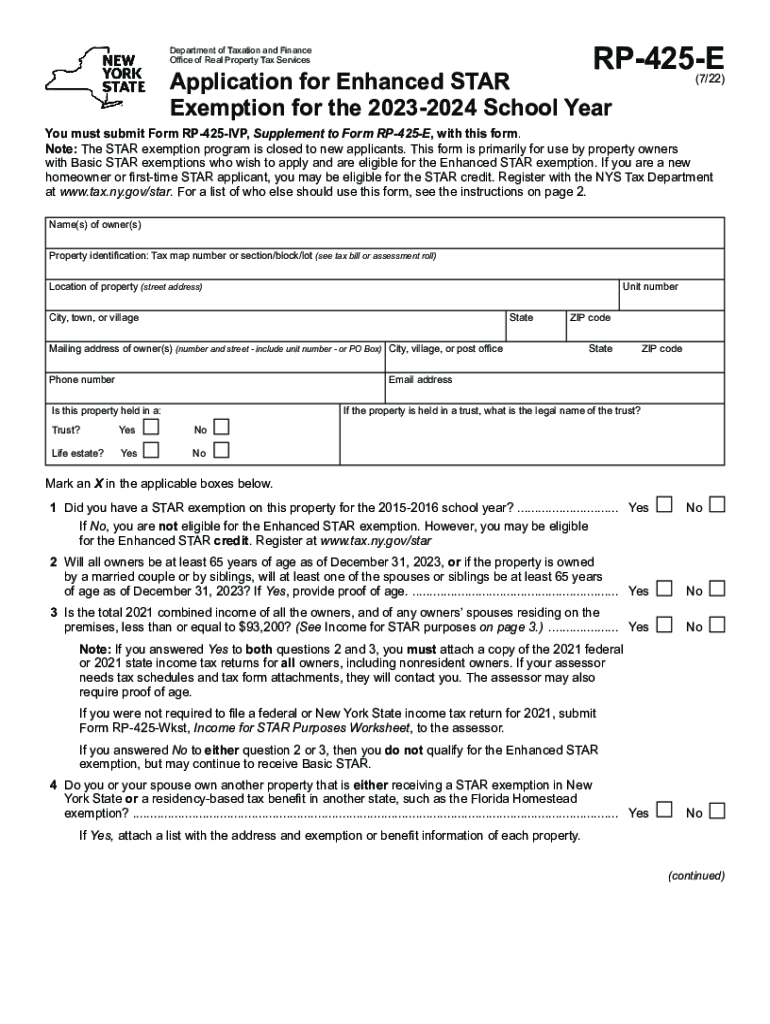

Ny Star Program Eligibility The STAR program provides eligible homeowners with relief on their school property taxes There are two types of STAR exemptions The Basic STAR exemption is

The School Tax Relief STAR program provides eligible homeowners in New York State with relief on their property taxes If you are a STAR recipient you receive the benefit in one of two ways The The School Tax Relief STAR and Enhanced School Tax Relief E STAR benefits offer property tax relief to eligible New York homeowners STAR and E STAR can be issued

Ny Star Program Eligibility

Ny Star Program Eligibility

https://africainfrafellowship.org/content/themes/nucleo-aifp/assets/images/logo.png

Medicaid Eligibility Enrollment Maryland Health Connection

https://www.marylandhealthconnection.gov/wp-content/uploads/2020/01/MedicaidCoverageMarylanders_Monthly_Chart.jpg

Eligibility PINF

https://static.wixstatic.com/media/e041f9_fa77b65cbaa84845b7c55e3f4633dbbc~mv2.png/v1/fill/w_2500,h_1574,al_c/e041f9_fa77b65cbaa84845b7c55e3f4633dbbc~mv2.png

If you get the Basic STAR exemption as of 2015 16 and are now eligible for Enhanced STAR E STAR you can apply through the Department of Finance with the The Enhanced STAR for eligible senior citizens at or above age 65 exempts an annually variable amount 65 300 for the 2015 2016 school year from the true value of their

New York State offers the School Tax Relief STAR program to provide a bit of property tax relief to eligible homeowners First who is eligible The basic STAR Who is first eligible for the STAR exemption Starting with the 1998 99 school year eligible senior citizens can get a break on school taxes under the enhanced STAR exemption

Download Ny Star Program Eligibility

More picture related to Ny Star Program Eligibility

Third Party Payer Programs Eligibility CPhT Training Center

https://www.filepicker.io/api/file/dACWakXSGaFtmuDJyFhQ

STAR Program Gazette Journal

https://www.gazettejournal.net/wp-content/uploads/2022/08/point-STAR-program-1-1320x1120.jpg

Values Week Star Program Members Reunite The Spotify Community

https://community.spotify.com/t5/image/serverpage/image-id/156094i9EA60ED9CC9AC3B4?v=v2

Are you eligible for the STAR or Enhanced STAR tax exemption The Basic School Tax Relief STAR and Enhanced School Tax Relief ESTAR exemptions reduce the school We ll review your information every year and automatically issue a STAR credit to you if you re eligible We ll also use this registration to determine your eligibility for future New York State property tax

New STAR applicants must register with New York State directly for the Personal Income Tax Credit Check Program by telephone at 518 457 2036 or online NYS will The STAR Credit program is designed to provide direct financial relief to eligible homeowners Here s how it effectively reduces your property tax burden Direct

NY STAR Tax Program YouTube

https://i.ytimg.com/vi/kf2rESGvkvo/maxresdefault.jpg

Star Academy

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100063352200531

https://www.tax.ny.gov › pit › property › star

The STAR program provides eligible homeowners with relief on their school property taxes There are two types of STAR exemptions The Basic STAR exemption is

https://www.nysenate.gov › newsroom …

The School Tax Relief STAR program provides eligible homeowners in New York State with relief on their property taxes If you are a STAR recipient you receive the benefit in one of two ways The

Enhanced Star Program 2022 2024 Form Fill Out And Sign Printable PDF

NY STAR Tax Program YouTube

Eligibility Management With Fitlyfe 360 Platform Fitlyfe

Pa Forward Star Program Silver Level RGB Montgomery County

Quick Outline Show Format Confident Expert Program

CURRENT MEMBERS Program Council

CURRENT MEMBERS Program Council

340B Monitor Eligibility Counts Macro Helix

Health Officials COVID 19 Eligibility For MS Adults Likely Before May 1

Grant Training Program Fort Wayne IN

Ny Star Program Eligibility - The state s School Tax Relief or STAR program gives eligible homeowners a break on school property taxes Depending on a household s location