Off Highway Business Use Fuel Tax Credit Use Form 4136 to claim a credit for certain nontaxable uses of fuel the alternative fuel credit and a credit for blending a diesel water fuel emulsion

The IRS uses an average cost per gallon to estimate the fuel costs you paid during the year for permitted farming purposes or off highway business use Complete the following chart to Using Form 4136 businesses can claim a tax credit for federal excise taxes paid on fuel effectively reducing their overall tax liability This can be a substantial saving particularly for transportation construction or agriculture

Off Highway Business Use Fuel Tax Credit

Off Highway Business Use Fuel Tax Credit

https://www.accountancygroup.com.au/wp-content/uploads/fuel-tax.jpg

Streamline Your Fleet s Fuel Tax Reporting With Expert Solutions

https://www.fleetworthy.com/wp-content/uploads/2021/03/AdobeStock_63783559-scaled.jpg

Fuel Tax Credit Calculator Banlaw

https://www.banlaw.com/wp-content/uploads/2022/04/[email protected]

To claim a credit for the federal tax taxpayers file with their tax return Form 4136 Credit for Federal Tax Paid on Fuels If the expense for purchasing the fuel including the tax is What Is the Fuel Tax Credit The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a program that lets some businesses reduce their taxable income dollar for dollar

You can claim a credit for federal excise tax you paid on fuels you used On a farm for farming purposes Ex fuel used to run a tractor while plowing On a boat used for commercial fishing In fact most equipment that doesn t involve powering a vehicle qualifies under off highway business use This could include heavy equipment used for construction projects as

Download Off Highway Business Use Fuel Tax Credit

More picture related to Off Highway Business Use Fuel Tax Credit

5 Transportation Industry Tax Payroll Credits

https://www.smithschafer.com/wp-content/uploads/2020/12/shutterstock_138812753.jpg

How to Claim The Federal Fuel Tax Credit

https://www.whitlockco.com/wp-content/uploads/2017/03/photo-1483728788451-2708e0270131-1024x767.jpg

:max_bytes(150000):strip_icc()/FuelTaxCredit4-3V1-3b25b99dc86b458a877911fb8fea6c80.png)

Fuel Tax Credit Definition

https://www.investopedia.com/thmb/3sJEd4MIrb_d4zhZSOvSwD0vw6I=/750x0/filters:no_upscale():max_bytes(150000):strip_icc()/FuelTaxCredit4-3V1-3b25b99dc86b458a877911fb8fea6c80.png

Certain uses of fuels are untaxed however and fuel users can get a credit for the taxes they ve paid by filing Form 4136 Who qualifies for the credits Not all fuels are taxed by the federal government and there are Fortunately the government recognizes this and has created tax credits to reduce tax liability for businesses that purchase fuel for both on and off highway business use I ll

For example a landscaper who is using gasoline to power lawnmowers will have a legitimate claim to the credit Using the fuel in that manner will qualify for the Off Highway Use category IRS Form 4136 Credit for Federal Tax Paid on Fuels enables certain taxpayers to claim a fuel credit depending on the type of fuels used and the type of business use the credit

FuelCred Streamlines The Ability To Claim Federal Fuel Tax Credit

https://img.totallandscapecare.com/files/base/randallreilly/all/image/2020/01/tlc.shutterstock_157507874240.png?auto=format%2Ccompress&fit=max&q=70&w=1200

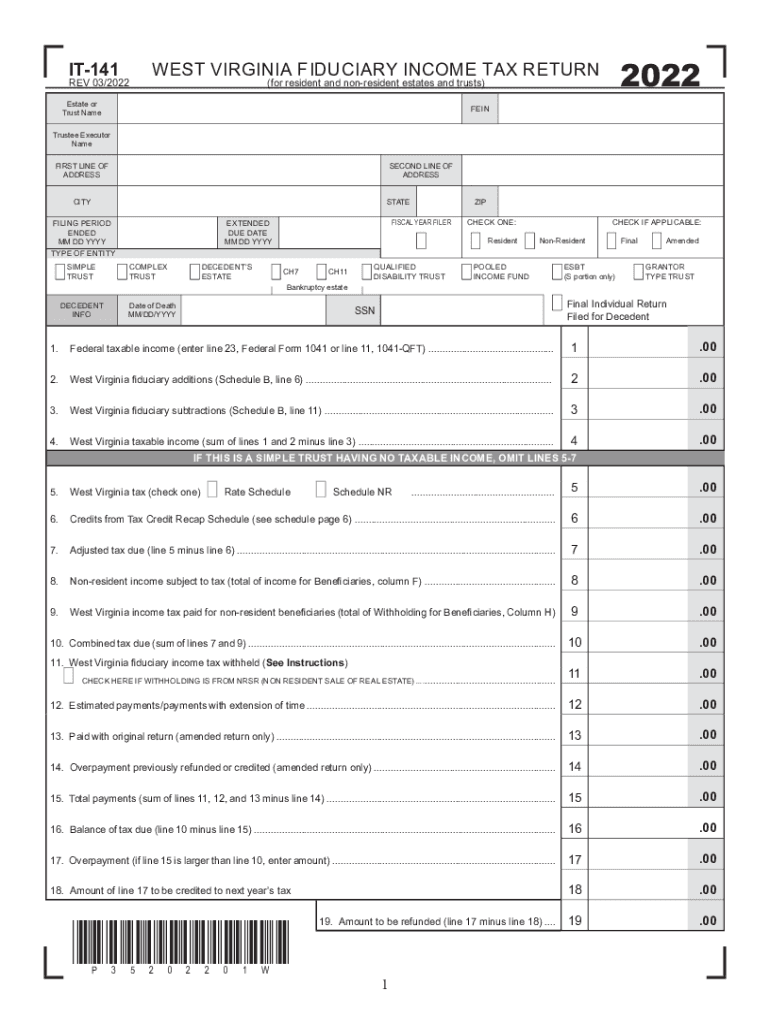

Income Tax Virginia 2022 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/626/980/626980480/large.png

https://www.irs.gov › forms-pubs

Use Form 4136 to claim a credit for certain nontaxable uses of fuel the alternative fuel credit and a credit for blending a diesel water fuel emulsion

https://www.irs.gov › instructions

The IRS uses an average cost per gallon to estimate the fuel costs you paid during the year for permitted farming purposes or off highway business use Complete the following chart to

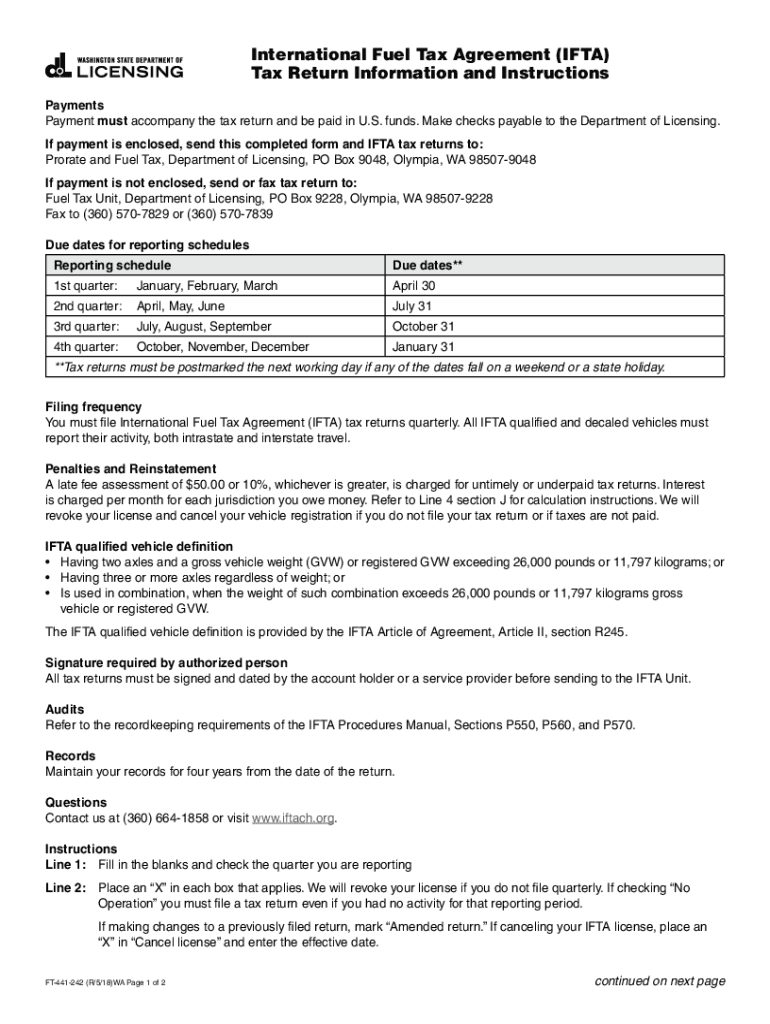

International Fuel Tax Agreement IFTA Tax Return Information And

FuelCred Streamlines The Ability To Claim Federal Fuel Tax Credit

Fuel Tax Credit 2023 2024

Opinion Before We Invest Billions In This Clean Fuel Let s Make Sure

Fuel Tax Advisers

Congestion Pricing Tax Bill And Traffic U2 How We Roll Dec 1 The

Congestion Pricing Tax Bill And Traffic U2 How We Roll Dec 1 The

Fuel Tax Credit Calculation Worksheet

Reduce The Pain Of Soaring Fuel Prices Banlaw

.png#keepProtocol)

Fuel Tax Credits New Credit Rates Update February 2023

Off Highway Business Use Fuel Tax Credit - To claim a credit for the federal tax taxpayers file with their tax return Form 4136 Credit for Federal Tax Paid on Fuels If the expense for purchasing the fuel including the tax is