Ontario Property Tax Rebate Web 22 d 233 c 2021 nbsp 0183 32 Ontario s new benefit will cover up to 50 per cent of the property taxes and energy costs of eligible businesses while they re affected by public health restrictions that

Web To make a payment Learn more about how you can protect yourself from scammers and be scam smart All Ontarians Ontario Staycation Tax Credit Web The maximum 2023 OSHPTG payment is the lesser of 500 and the eligible property tax paid by or for you for 2022 If you are single separated divorced or widowed your 2023

Ontario Property Tax Rebate

Ontario Property Tax Rebate

https://www.zoocasa.com/blog/wp-content/uploads/2019/07/ontario-property-tax-rates-2019-zoocasa.png

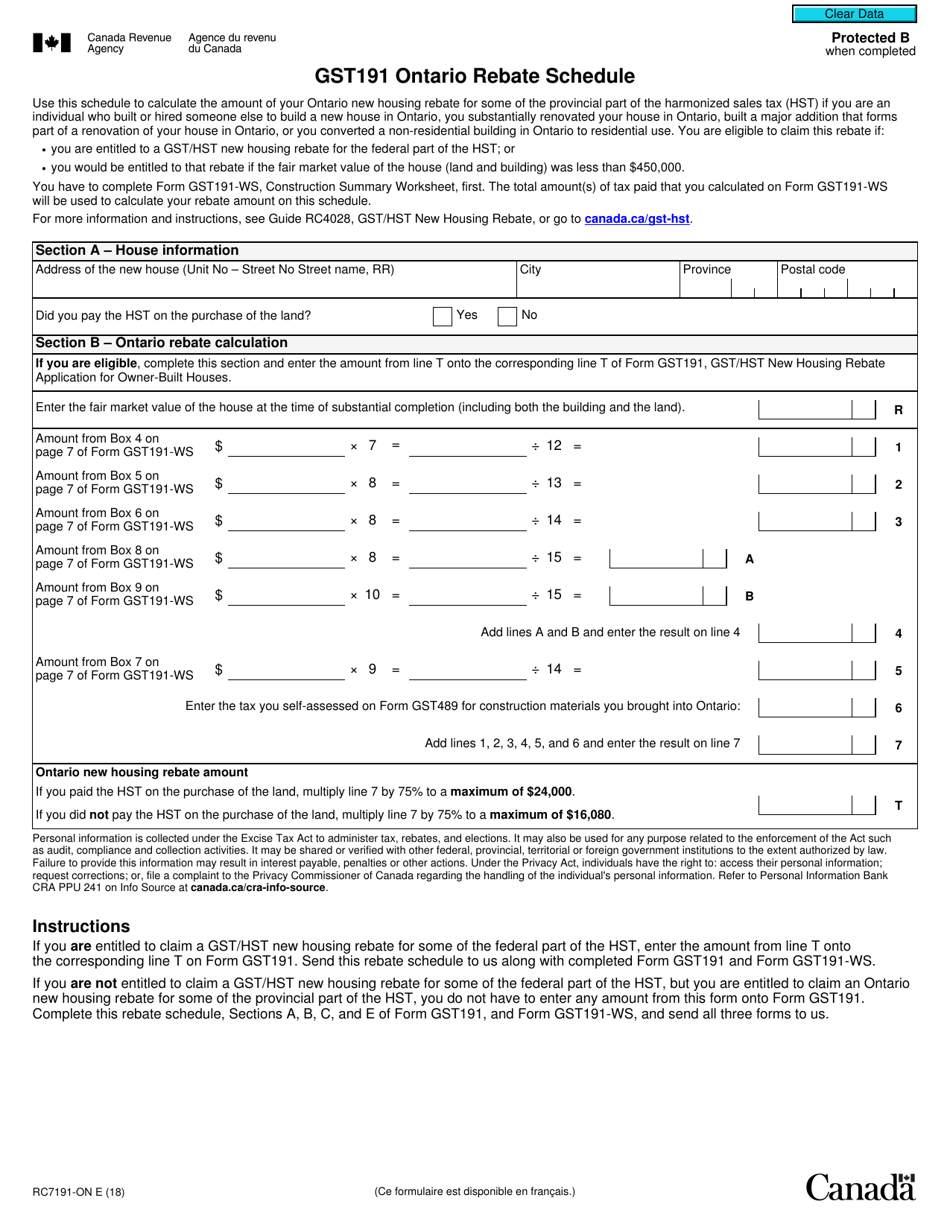

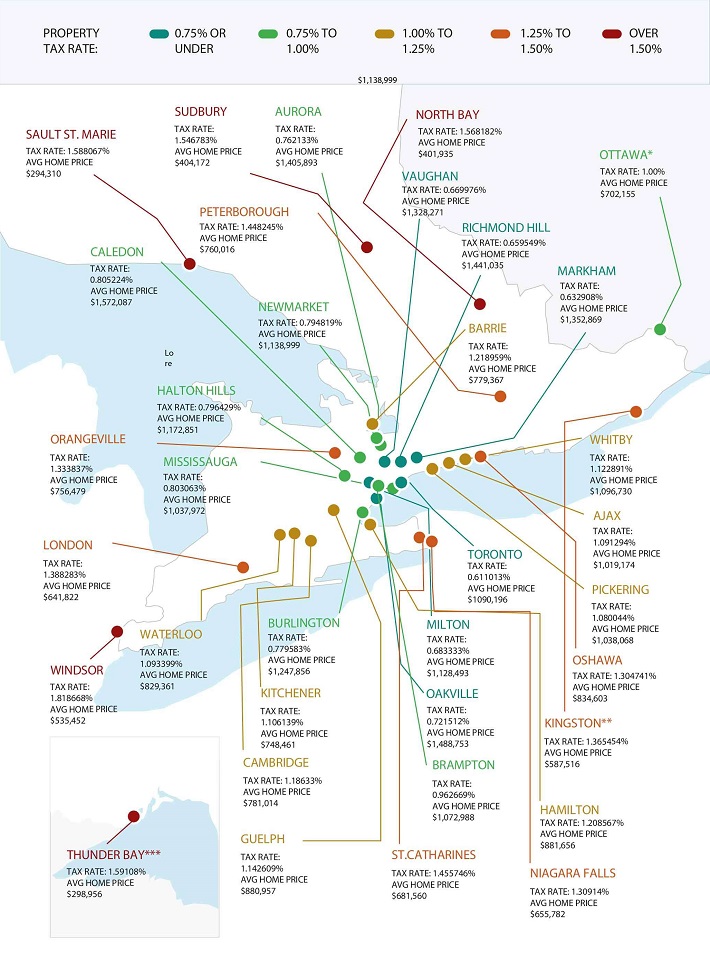

Form RC7191 ON Download Fillable PDF Or Fill Online Gst191 Ontario

https://data.templateroller.com/pdf_docs_html/1929/19299/1929974/form-rc7191-on-gst191-ontario-rebate-schedule-canada_print_big.png

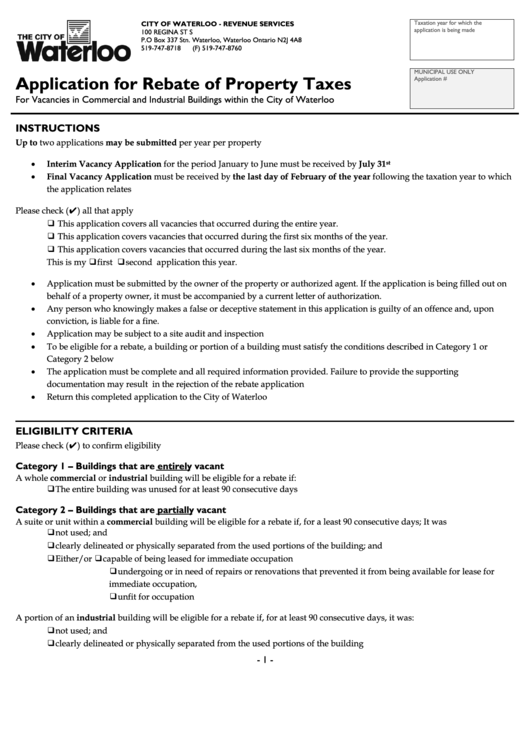

Top 5 Ontario Ministry Of Finance Forms And Templates Free To Download

https://data.formsbank.com/pdf_docs_html/66/666/66606/page_1_thumb_big.png

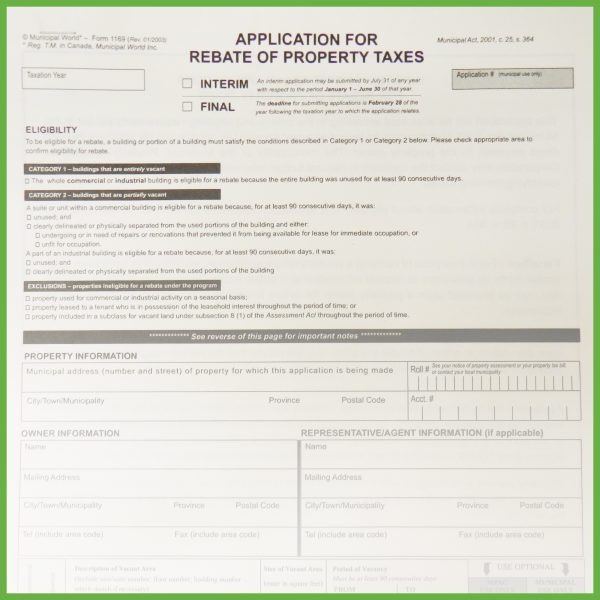

Web 31 d 233 c 2021 nbsp 0183 32 2022 Ontario energy and property tax credit OEPTC calculation sheets Your OEPTC entitlement is calculated on a monthly basis However for all the monthly Web 9 f 233 vr 2021 nbsp 0183 32 Property owners are reminded that the deadline for Ontario property tax rebate applications is rapidly approaching Applications for rebates of municipal

Web 22 d 233 c 2021 nbsp 0183 32 Through the new Ontario Business Costs Rebate Program eligible businesses will receive rebate payments equivalent to 50 per cent of the property tax Web 6 avr 2022 nbsp 0183 32 A rebate is for tax properly paid and is subsequently returned to a business or individual under a rebate provision An application for refund and all

Download Ontario Property Tax Rebate

More picture related to Ontario Property Tax Rebate

Pin On Canada Home Tax Rebate

https://i.pinimg.com/originals/e9/39/8c/e9398cd21460fc812f7644a4047c23cc.png

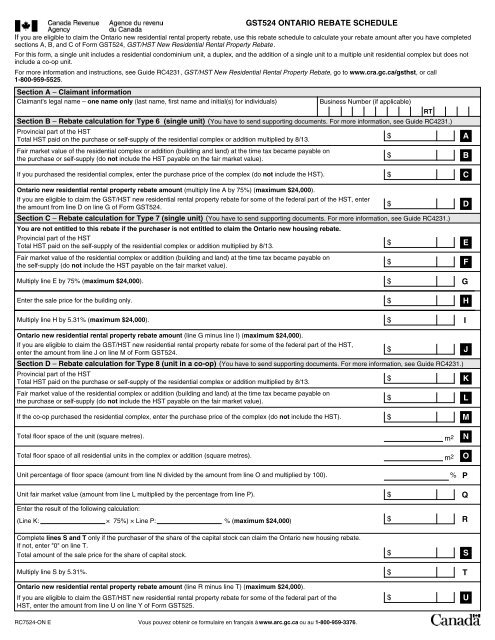

HST Rebate Forms Ontario Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/HST-Rebate-Form-2021-768x997.png

Guide Rc4231 Gst Hst New Residential Rental Property Rebate Property

https://img.yumpu.com/6665969/1/500x640/gst524-ontario-rebate-schedule-.jpg

Web 28 f 233 vr 2022 nbsp 0183 32 Eligible businesses will receive rebate payments for a portion of the property tax and energy costs they incur while subject to capacity limits or a Web 22 d 233 c 2021 nbsp 0183 32 Ontario announced new support programs for businesses impacted by public health measures including a 50 rebate on property taxes and energy bills

Web If the rebate is for a property in Ontario once you have filled out Form GST191 WS Form GST191 and if you are entitled to claim the Ontario new housing rebate Form RC7191 Web 28 f 233 vr 2022 nbsp 0183 32 Outside of any existing appeals there may be an additional opportunity for property holders in Ontario to achieve a rebate for the 2021 tax year Property tax

Property Tax Rebate For Seniors In Ontario PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2022/10/ontario-senior-homeowners-property-tax-grant-qualifications-canadian-1.png

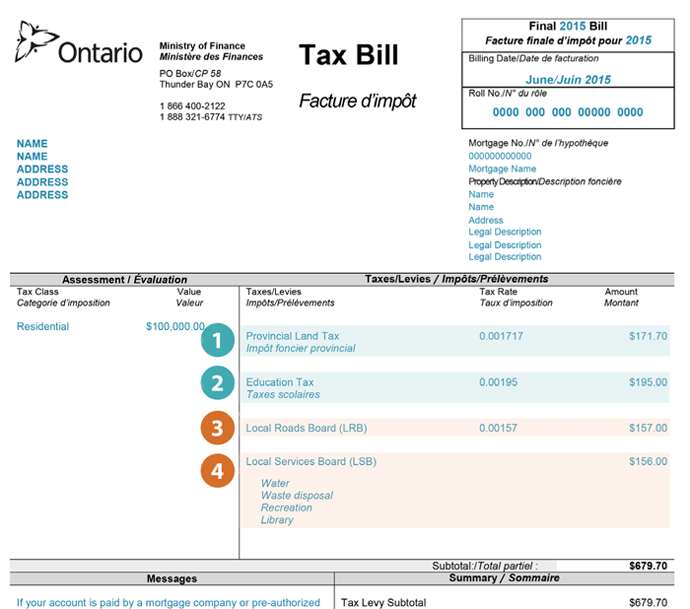

Comprendre Votre Facture D imp t Foncier Et Les Services Qu il Soutient

https://ontario.ca/files/2022-03/mof-plt-understanding-fr-03172022.png

https://www.cbc.ca/news/canada/toronto/covid-ont-supports-1.6295168

Web 22 d 233 c 2021 nbsp 0183 32 Ontario s new benefit will cover up to 50 per cent of the property taxes and energy costs of eligible businesses while they re affected by public health restrictions that

https://www.ontario.ca/page/tax-credits-and-benefits-people

Web To make a payment Learn more about how you can protect yourself from scammers and be scam smart All Ontarians Ontario Staycation Tax Credit

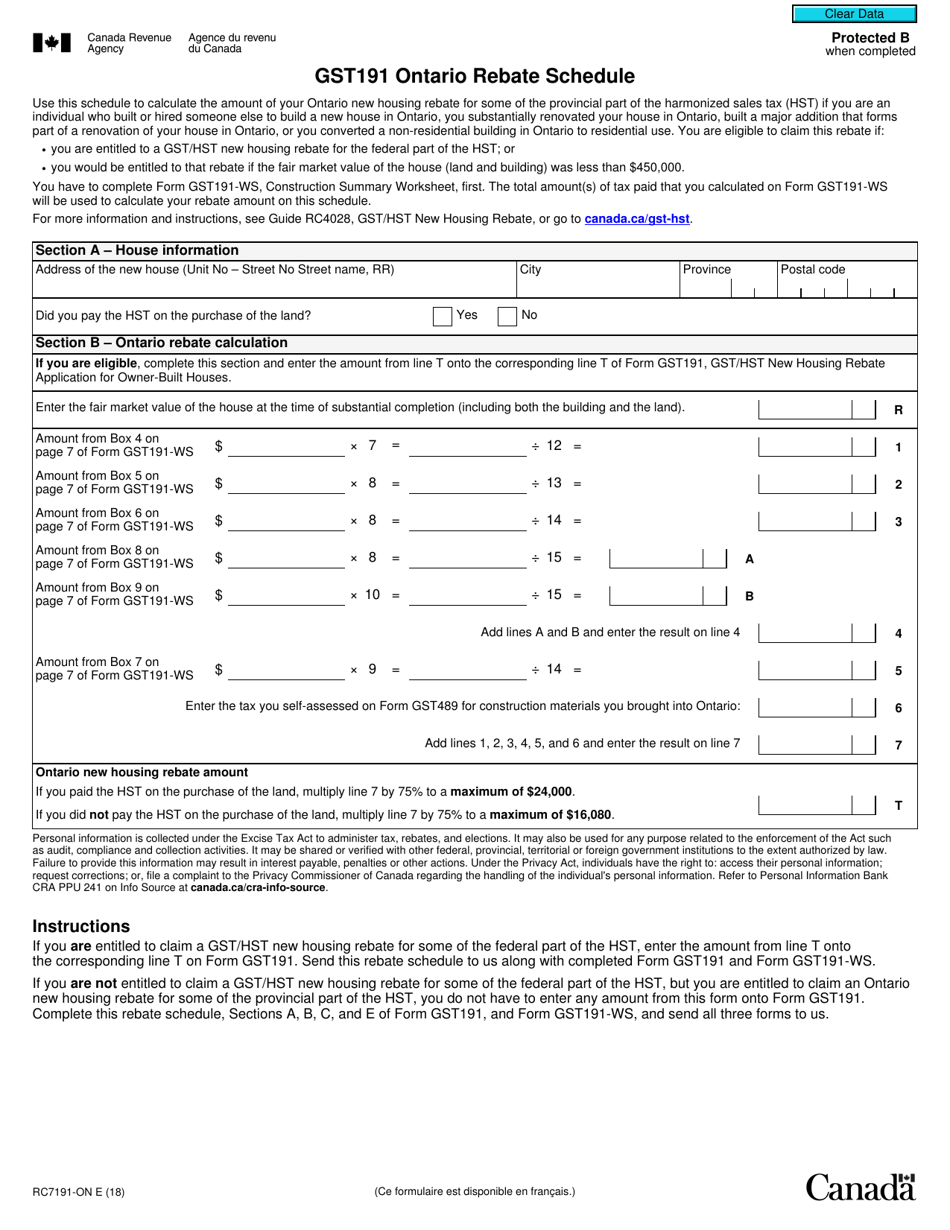

Ontario Cities With The Highest And Lowest Property Tax Rates Canada Info

Property Tax Rebate For Seniors In Ontario PropertyRebate

Who Pays The Least Property Tax In Ontario The Answer May Surprise You

Here s Where Barrie s Property Taxes Rank In Ontario Barrie 360

Proposal To Update Ailing PA Rent Property Tax Rebate Program Would

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

How To Get Property Tax Rebate PropertyRebate

Ontario Property Tax Rates Calculator Awakenmag Taxes In

Application For Rebate Of Property Tax 2 Pages Verification Sheet

Ontario Property Tax Rebate - Web Property Tax Water amp Solid Waste Relief and Rebate Programs You can now use the City s new online portal to submit your application and to find out which rebate programs