Ontario Tax Rebate Vacation If you re an Ontario resident and stayed at eligible lodging within the province in 2022 you could get back up to 20 per cent of your Ontario accommodation expenses claiming up to 1000

Even though the credit isn t active anymore you can still claim funds for any visits made before 2023 that you haven t claimed yet as well as other deductions through the If you re an Ontario resident who s eligible for the tax credit you can claim up to 20 of your eligible accommodation expenses for 2022 up to a maximum of 200 per person or 400 for couples Step 1 Determine Your Eligibility

Ontario Tax Rebate Vacation

Ontario Tax Rebate Vacation

https://i.pinimg.com/originals/29/bd/b3/29bdb3bfa105b588ba39da3e3ee54d64.jpg

Ontario Tax And Utility Rebates For Eligible Businesses Mann Lawyers

https://www.mannlawyers.com/wp-content/uploads/2021/09/rebate-istock-865584830.jpg

Ontario New Housing Rebate Form By State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/Ontario-New-Housing-Rebate-Form-768x715.png

You can claim the Ontario Staycation Tax Credit for accommodation expenses for a leisure stay of less than a month in Ontario at a short term accommodation or camping accommodation Claim your rebate today with the Ontario staycation tax credit Enjoy local holidays while benefiting from immediate deductions on your taxes This incentive lets you explore your

The Ontario Staycation Tax Credit is a new tax credit for Ontario residents who spend money on eligible leisure accommodation expenses within the province between January 1 2022 and December 31 2022 Thanks to the Ontario staycation tax credit you can get up to a 200 refund or 400 for a family The catch is that you stay in an eligible short term accommodation in Ontario Only the lodging expense is eligible up to a

Download Ontario Tax Rebate Vacation

More picture related to Ontario Tax Rebate Vacation

Midland 2013 02 14 11 01 Ontario Tax Sales

https://ontariotaxsales.ca/wp-content/uploads/Property_Photos/Midland/SOMD11-01S.jpg

Personal Income Tax Brackets Ontario 2022 MD Tax

http://mdtax.ca/wp-content/uploads/2023/02/2022.png

Who Is Eligible For HST New Home Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/HST-Rebate-Form-2021-768x997.png

From Jan 1 to Dec 31 Ontario residents can claim 20 per cent of their accommodation be it a hotel or cosy cabin when filing their 2022 personal income tax and Ontarians who are planning a short term vacation within the province this year could be eligible for a tax refund under the new Ontario Staycation Tax Credit program Introduced in November as part of the 2021

According to the conditions of the credit Ontario residents may get a refund of 20 of their spending on accommodations and other provincial travel related expenses This will apply for vacations that they embark on Announced Nov 4 the credit aims to boost local business by offering people who book overnight stays in Ontario for anytime in 2022 a return of 20 per cent on accommodation

Schreiber 2022 05 12 21 02 Ontario Tax Sales

https://www.ontariotaxsales.ca/wp-content/uploads/TBSR21-02S2.jpg

West Elgin 2022 03 31 19 12 Ontario Tax Sales

https://www.ontariotaxsales.ca/wp-content/uploads/ENWN19-12S1.jpg

https://www.blogto.com › travel › claim...

If you re an Ontario resident and stayed at eligible lodging within the province in 2022 you could get back up to 20 per cent of your Ontario accommodation expenses claiming up to 1000

https://www.springfinancial.ca › blog › lifestyle › ...

Even though the credit isn t active anymore you can still claim funds for any visits made before 2023 that you haven t claimed yet as well as other deductions through the

Janice Plut Minor Ontario Tax Calculator Cobor i In Fiecare Zi Te

Schreiber 2022 05 12 21 02 Ontario Tax Sales

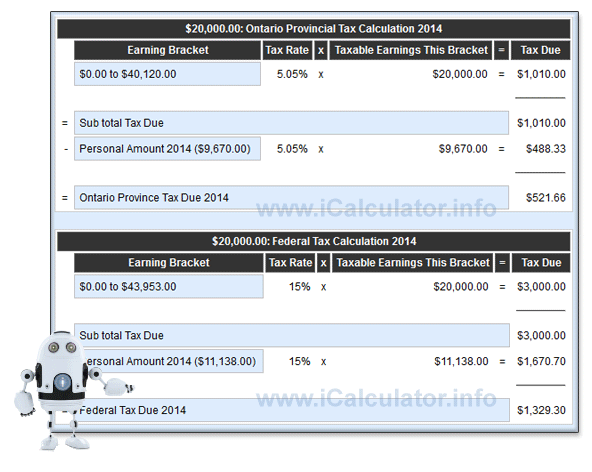

What Is Provincial Tax Canada Tax ICalculator

How Do The New Housing HST Rebate Rules In Ontario Apply To You

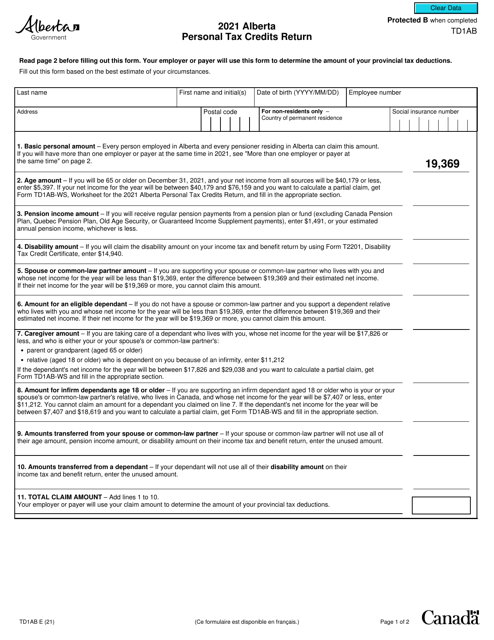

Printable Td1 Form Printable Blank World

Putting Your Canada Tax Refund To Good Use

Putting Your Canada Tax Refund To Good Use

Omdc Bell Fund Ontario Film And Television Tax Credits 930x589 PNG

Ontario Tax Sale Properties Township Of Stirling Rawdon

Personal Income Tax Brackets Ontario 2019 MD Tax Physician

Ontario Tax Rebate Vacation - Claim your rebate today with the Ontario staycation tax credit Enjoy local holidays while benefiting from immediate deductions on your taxes This incentive lets you explore your