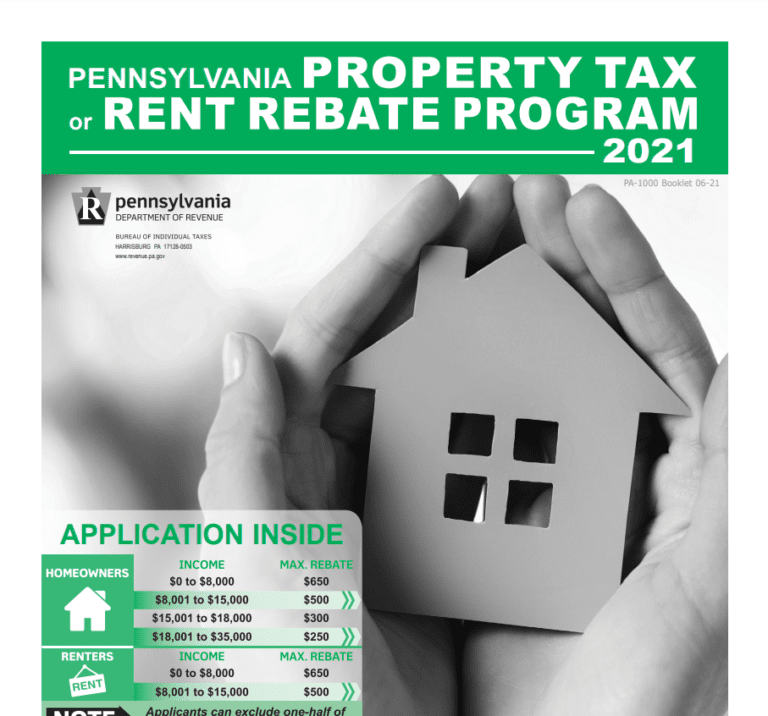

Pa Property Tax Rebate For 2024 PENNSYLVANIA RENT REBATE PROGRAM 2023 PROPERTY TAX or PA 1000 Booklet 04 23 Rebates for eligible seniors widows widowers and people with disabilities HARRISBURG PA 17128 0503 www revenue pa gov IMPORTANT DATES Application deadline JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the

There are three ways to apply for the Property Tax Rent Rebate Program online by mail or in person Applicants are encouraged to apply online for the fastest review process Learn more about your options to ensure your application is submitted correctly by the June 30 2024 filing deadline Apply Online First time filers who have filed by June 1 2024 should expect to receive their rebates between July 1 and September 1 2024 Some rebates may take additional time if DOR needs to correct or verify any information on a rebate application

Pa Property Tax Rebate For 2024

Pa Property Tax Rebate For 2024

https://s3.amazonaws.com/static.beavercountyradio.com/wp-content/uploads/2021/01/25060432/unnamed-7-1536x1024.jpg

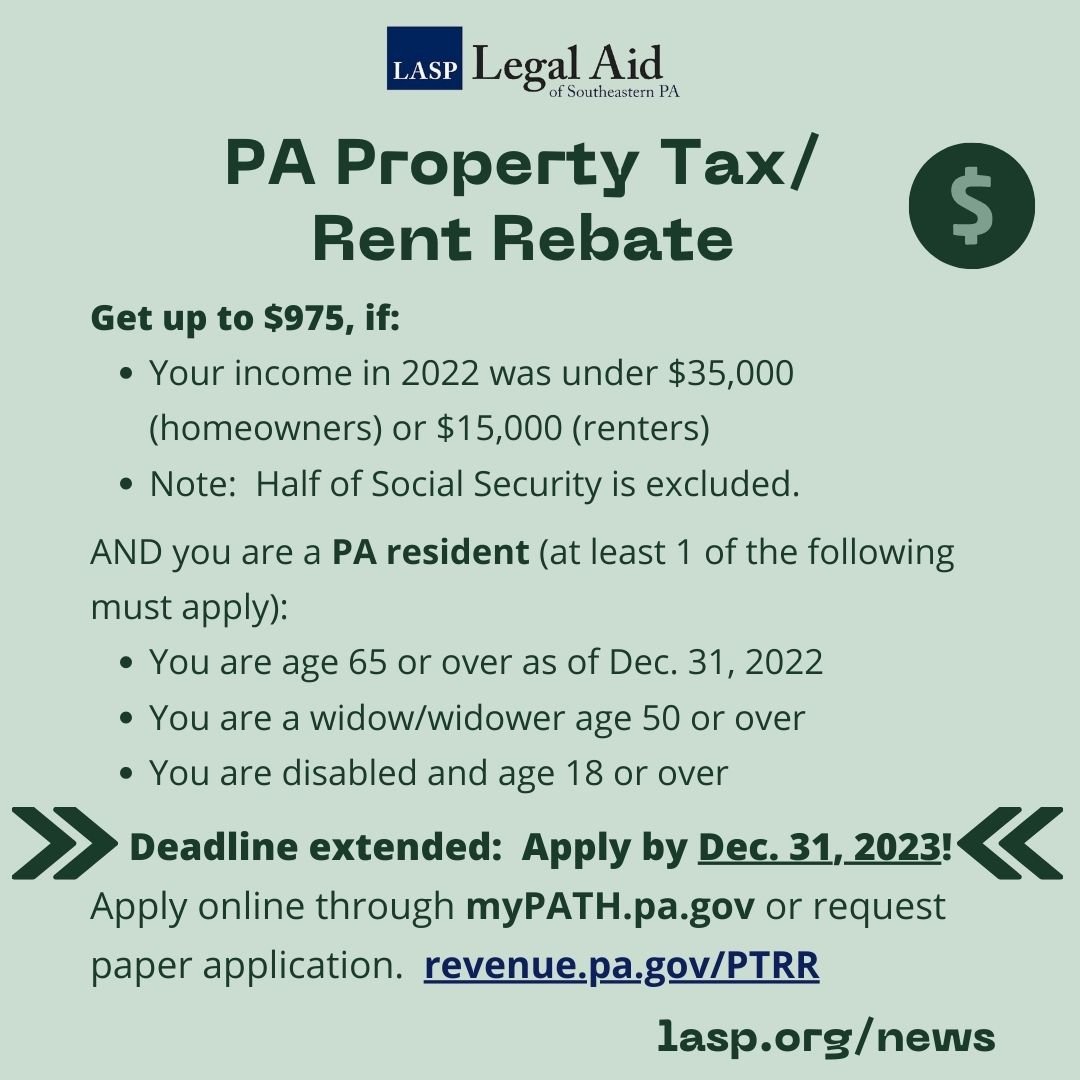

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189550-Z9C3QJVKXYFO4N04VXT7/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_2.jpg

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

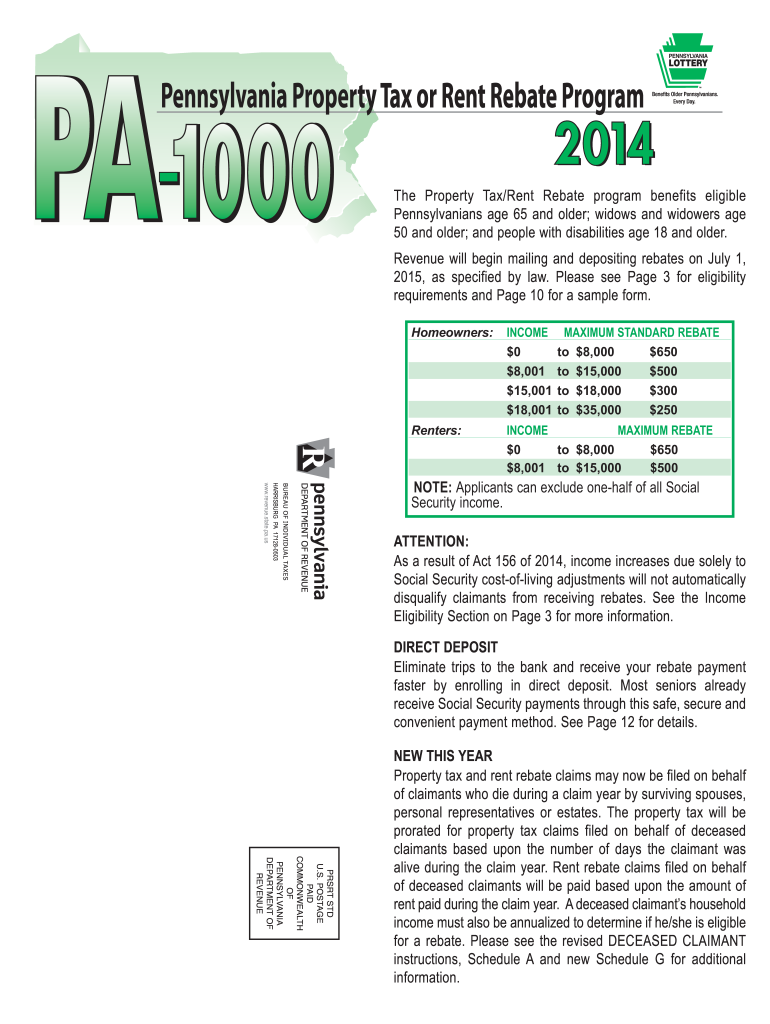

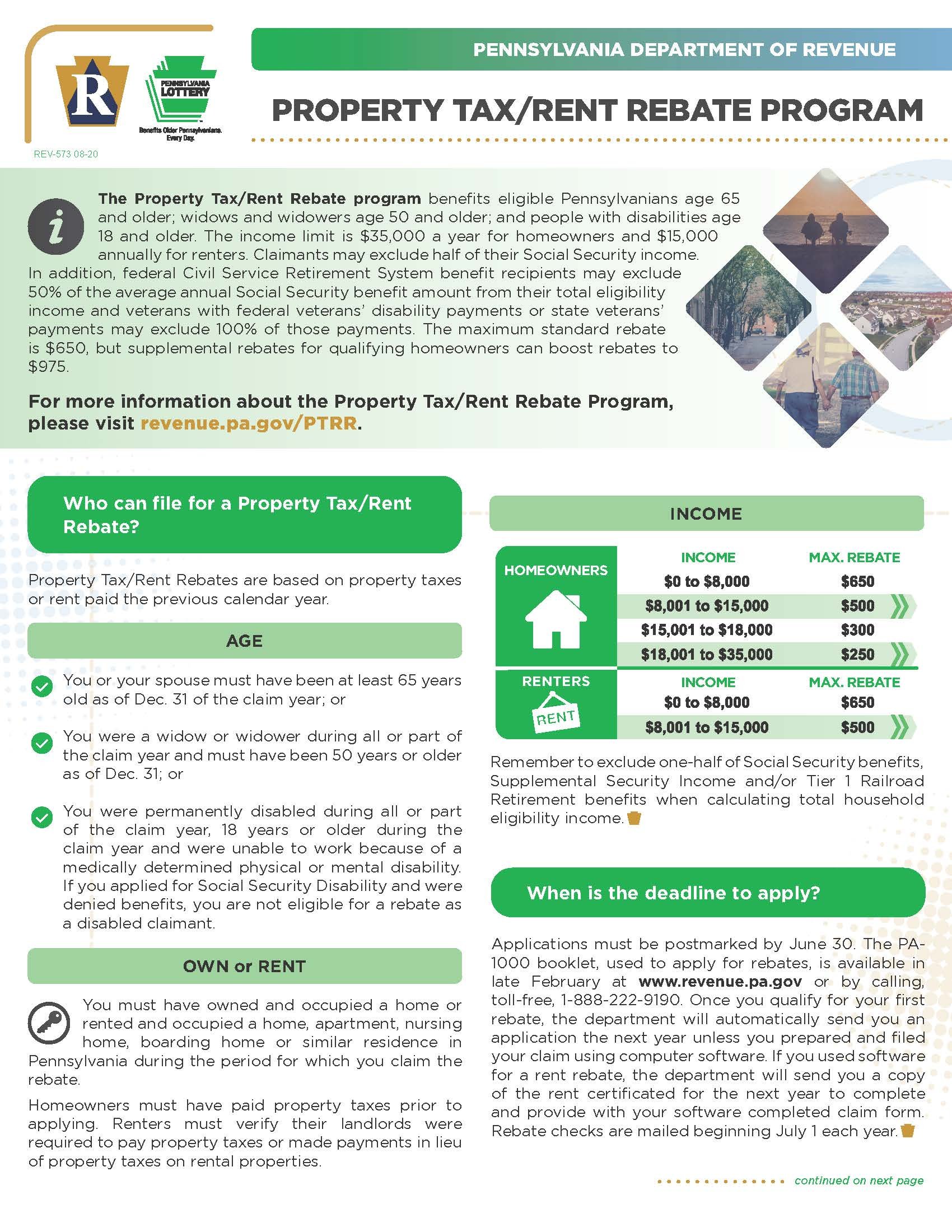

Governor Shapiro s expansion of the Property Tax Rent Rebate program delivered the largest targeted tax cut for seniors in nearly two decades expanding access to nearly 175 000 more Pennsylvanians and increasing maximum rebate from 650 to 1000 More people are now eligible for rent and property tax rebates in Pennsylvania Here s what to know The state s rent and property tax rebate program now includes more older adults and adults with disabilities for the first time in years An expansion of the state s property tax and rent rebate program is now up and running

Governor Josh Shapiro delivered on a promise he made to older Pennsylvanians when he signed a new law Act 7 of 2023 that significantly expands the Property Tax Rent Rebate PTRR program This historic legislation delivers the largest targeted tax cut for Pennsylvania seniors in nearly two decades What s New Coming Soon for 2023 Claim Year House Bill 1100 signed August 2023 Maximum Eligibility Income increased to 45 000 Maximum Standard Rebate increased to 1 000 Future years will see increase based on annual inflation New Eligibility Table Supplemental Rebates for 2023 No changes to supplemental income eligibility under new law

Download Pa Property Tax Rebate For 2024

More picture related to Pa Property Tax Rebate For 2024

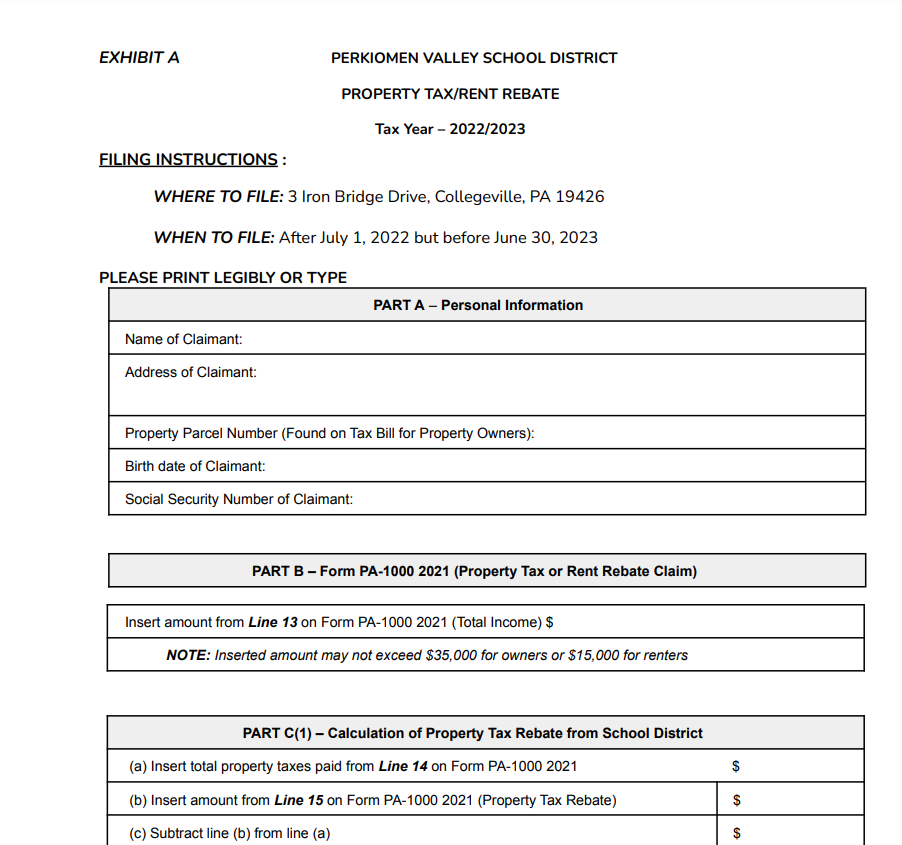

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

Where To Mail Pa Property Tax Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/Where-To-Mail-Pa-Property-Tax-Rebate-Form-768x716.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

First the maximum standard rebate will increase from 650 to 1 000 Meanwhile the income limits for renters and homeowners will be made equal and both increase to 45 000 the first time since 2006 that the income limits have been increased Starting in 2024 the maximum standard rebate will increase from 650 to 1 000 Also in 2024 the household income limit for property tax rebates will increase to 45 000 up from the current 35 000 limit The household income limit for rent rebates will also increase to 45 000 up from 15 000 Half of Social Security income is excluded

Online filing for the Property Tax Rent Rebate Program is now available for eligible Pennsylvanians to begin claiming rebates on property taxes or rent paid in 2022 Learn More PA Tax Talk PA Tax Talk is the Department of Revenue s blog which informs taxpayers and tax professionals of the latest news and developments from the department Enter the total property tax rent paid during the claim year and select Next Provide the personal information for the claimant and spouse in the required fields Select the Verify Address button after entering the claimaint s address Select the County from the drop down menu Indicate whether the rebate should be direct deposited If yes

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

2023 Rent Rebate Form Printable Forms Free Online

https://www.pdffiller.com/preview/47/686/47686220/large.png

https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PTRR/Documents/2023_pa-1000_inst.pdf

PENNSYLVANIA RENT REBATE PROGRAM 2023 PROPERTY TAX or PA 1000 Booklet 04 23 Rebates for eligible seniors widows widowers and people with disabilities HARRISBURG PA 17128 0503 www revenue pa gov IMPORTANT DATES Application deadline JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRentRebateProgram/Ways-to-Apply

There are three ways to apply for the Property Tax Rent Rebate Program online by mail or in person Applicants are encouraged to apply online for the fastest review process Learn more about your options to ensure your application is submitted correctly by the June 30 2024 filing deadline Apply Online

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

Property Tax Rebate Pennsylvania LatestRebate

PA Property Tax Rebate What To Know Credit Karma

2022 Pa Property Tax Rebate Forms PropertyRebate

PA Property Tax Rebate Fillable Form Printable Rebate Form

Pa 2022 Property Tax Rebate PropertyRebate

Pa 2022 Property Tax Rebate PropertyRebate

Older Disabled Residents Can File For Property Tax Rent Rebate Program Lower Bucks Times

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word PropertyRebate

Increase The Threshold For Qualifying For Tax Forgiveness PennLive Letters Pennlive

Pa Property Tax Rebate For 2024 - What s New Coming Soon for 2023 Claim Year House Bill 1100 signed August 2023 Maximum Eligibility Income increased to 45 000 Maximum Standard Rebate increased to 1 000 Future years will see increase based on annual inflation New Eligibility Table Supplemental Rebates for 2023 No changes to supplemental income eligibility under new law