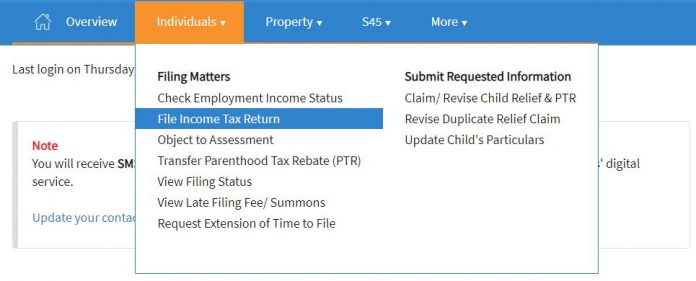

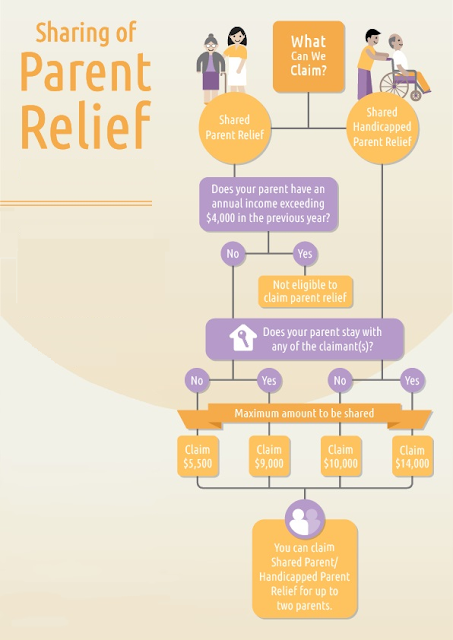

Parent Tax Rebate Singapore Web To claim Parent Relief Handicapped Parent Relief for Year of Assessment 2023 you must satisfy all these conditions in 2022 Parent Relief Handicapped Parent Relief may be

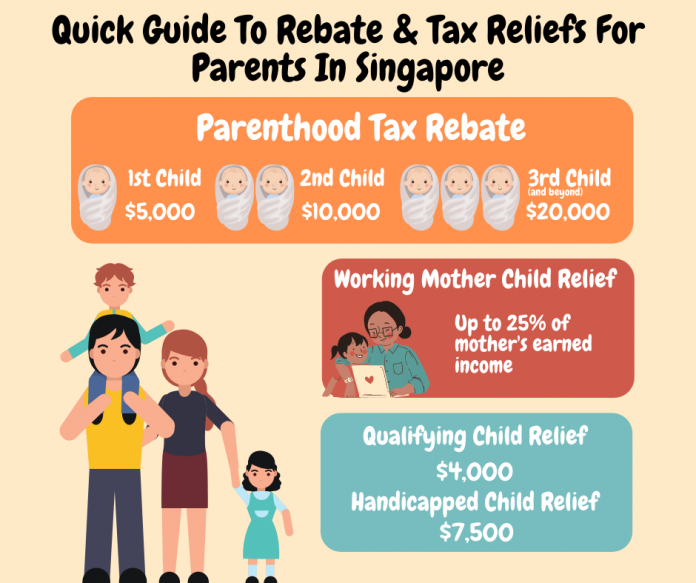

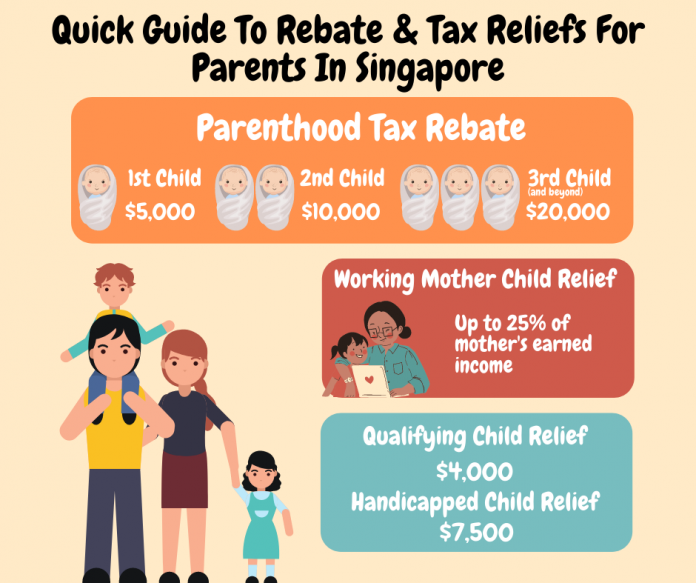

Web Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 Web 27 sept 2022 nbsp 0183 32 The lump sum rebate is given to most Singapore tax residents who may be married divorced or widowed and if you are qualified you can claim up to 20 000 per

Parent Tax Rebate Singapore

Parent Tax Rebate Singapore

https://www.raisingangels.sg/wp-content/uploads/2021/11/Untitled-design-7-1-696x583.png

Parenthood Tax Rebate Guide For Singapore Parents

https://www.raisingangels.sg/wp-content/uploads/2021/11/PTR2-696x281.jpg

All About The Parenthood Tax Rebate In Singapore

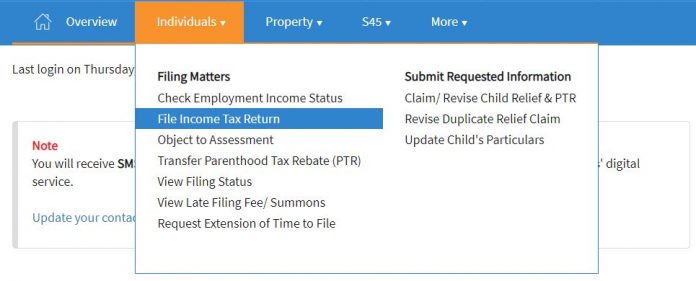

https://www.smartparents.sg/sites/default/files/sites/default/files/inline-images/Parenthood Rebate Claims_0.JPG

Web 11 nov 2021 nbsp 0183 32 The Parenthood Tax Rebate PTR is easily the most available tax rebate for most parents in Singapore The PTR was implemented to encourage families to have Web You are eligible for PTR of 20 000 if you are a Singapore tax resident in the year your child was adopted This PTR may be shared with your spouse if he she is also a

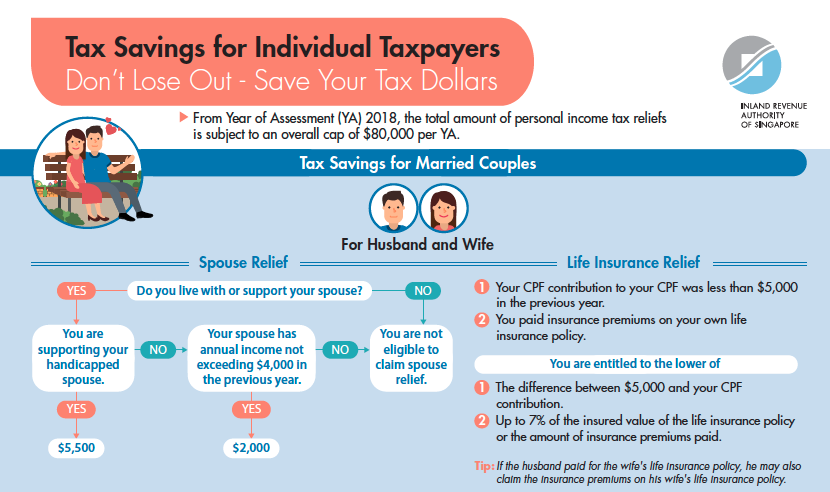

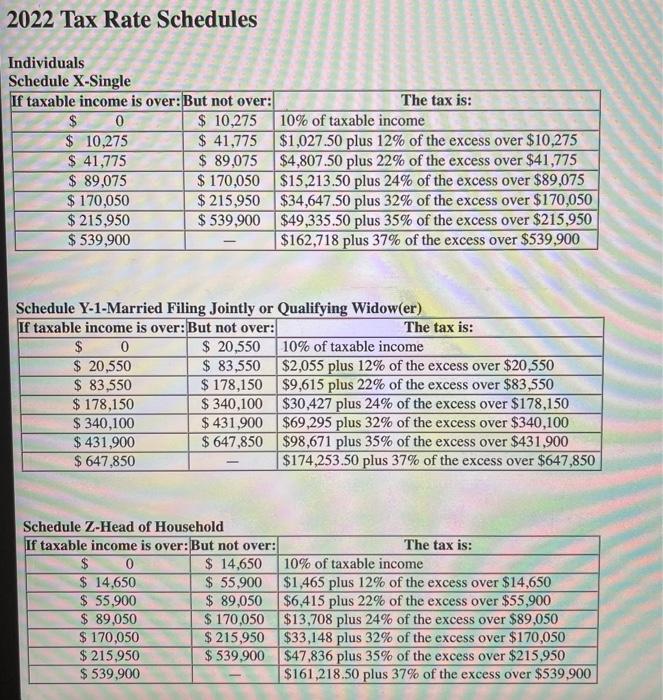

Web 3 mai 2023 nbsp 0183 32 Parenthood tax rebate A rebate against either or both parents tax liability of SGD 5 000 SGD 10 000 and SGD 20 000 is available for the first second and each Web claim Parenthood Tax Rebate PTR if you are a married divorced or widowed tax resident of Singapore who has a a child born to you and your spouse ex spouse in 2016 and

Download Parent Tax Rebate Singapore

More picture related to Parent Tax Rebate Singapore

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

https://theindependent.sg/wp-content/uploads/2020/02/Screen-Shot-2020-02-29-at-12.34.17-PM.png

Parenthood Tax Rebate Singapore 2021 How Much You Can Claim

https://s3.ap-southeast-1.amazonaws.com/media.mamahood.com.sg/wp-content/uploads/2021/04/20153036/parenthood-tax-rebate-singapore.jpg

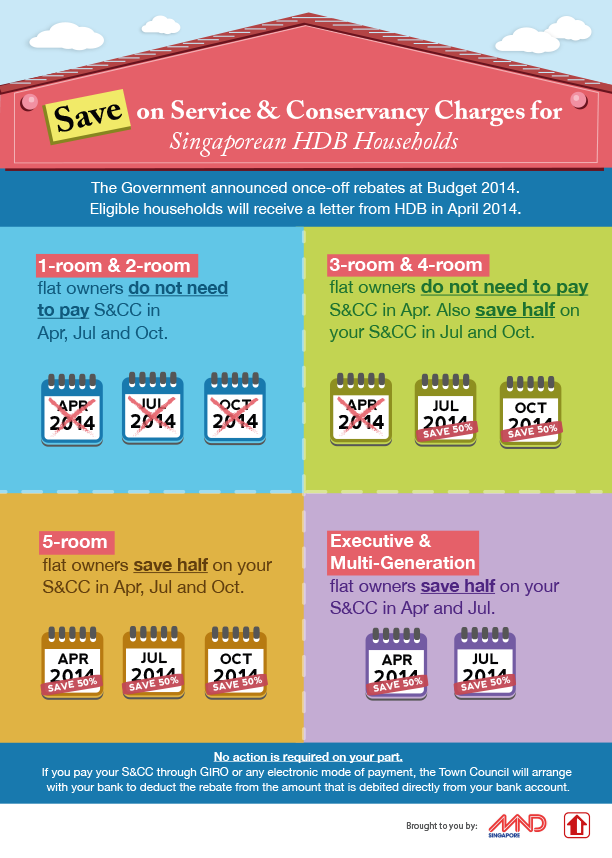

If Only Singaporeans Stopped To Think S CC Rebates Grants Help Lessen

http://3.bp.blogspot.com/-3HE7JfZAc5I/UzzSAmA5urI/AAAAAAAAWD0/6umFqOL-e1g/s1600/S&CC+rebates+800000+HDB+households.png

Web Here s How Singapore s Parenthood Tax Rebate 2023 Can Save You up to 50 000 Tax season in Singapore is here Did you know that you re entitled to a range of parenting Web Parenthood Tax Rebate PTR is provided to tax residents to encourage them to have more children by easing up their expenses In order to qualify you must be a Singapore tax resident who is married divorced or

Web 2 mars 2021 nbsp 0183 32 Tax Reliefs for Parents who are Singapore tax residents Tax Relief For Whom Amount Qualifying Child Relief QCR Mothers and fathers to be shared based Web 27 avr 2018 nbsp 0183 32 Parenthood Tax Rebate PTR The Parenthood Tax Rebate PTR allows married divorced or widowed tax resident parents to claim rebates of up to SGD

Discover The Joy Of Being A Parent With Singapore s Parenthood Tax Rebate

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1cCarR.img?w=670&h=445&m=4&q=84

Parenthood Tax Rebate Guide For Singapore Parents

https://www.raisingangels.sg/wp-content/uploads/2021/11/Depositphotos_97954768_L-1068x713.jpg

https://www.iras.gov.sg/.../tax-reliefs/parent-relief-handicapped-parent-relief

Web To claim Parent Relief Handicapped Parent Relief for Year of Assessment 2023 you must satisfy all these conditions in 2022 Parent Relief Handicapped Parent Relief may be

https://www.madeforfamilies.gov.sg/.../tax-relief-and-rebates

Web Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000

How To Reduce Your Income Tax In Singapore make Use Of These Tax

Discover The Joy Of Being A Parent With Singapore s Parenthood Tax Rebate

Parenthood Tax Rebate Guide For Singapore Parents

SG Budget Babe How To Reduce Your Income Tax In Singapore make Use Of

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Nearly 800 000 Parents California Tax Rebate Fair Game For Garnishing

Nearly 800 000 Parents California Tax Rebate Fair Game For Garnishing

Solved In 2022 Sheryl Is Claimed As A Dependent On Her

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

Guide On Tax Reliefs For First Time Working Parents Heartland Boy

Parent Tax Rebate Singapore - Web What Parenthood Tax Rebate Who can claim Parents Married divorced or widowed Singaporeans Eligibility Your child has to be born a Singapore citizen or become one