Paris Tax Rate Calculator The personal income tax system in France is a progressive tax system This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at

Calculate your income tax in France and salary deduction in France to calculate and compare salary after tax for income in France in the 2024 tax year The France Tax Calculator below is for the 2024 tax year the calculator allows you to calculate income tax and payroll taxes and deductions in France This includes

Paris Tax Rate Calculator

Paris Tax Rate Calculator

https://i.ytimg.com/vi/e3fBMuZFFcs/maxresdefault.jpg

Calculator Tax Rate

https://i.pinimg.com/736x/c3/9e/82/c39e825ed301a9f4f95e28f1fe9f5f56.jpg

How To Calculate Your Capital Gains Tax Rate Reef Point LLC

https://reefpointusa.com/wp-content/uploads/2021/11/How-to-Calculate-Your-Capital-Gains-Tax-Rate-Reef-Point-LLC-1024x694.jpg

French Income Tax Calculator is an online tool that can help you Calculate Salary After Tax France Fill in gross income and hours per week select the period and the salary after tax FR calculator will do The Effective Tax Rate represents the average rate at which your income is taxed providing a broad view of your overall tax burden It is calculated by dividing the total tax

Calculate you Annual salary after tax using the online France Tax Calculator updated with the 2024 income tax rates in France Calculate your income tax social security and Income simulator for employees Simulation data is automatically updated when you modify a field Total employer cost Spent by the company Gross salary Gross reference

Download Paris Tax Rate Calculator

More picture related to Paris Tax Rate Calculator

Website Conversion Rate Calculator StoryBrand Guide StoryBrand Websites

https://resultsandco.com/wp-content/uploads/2021/02/website-conversion-rate-calculator.png

Tax Rate Analyzer Analysis Of Group Tax Rate PwC Store

https://store.pwc.de/en/media-assets/101887/1687870222-tax-rate-analyzer.svg?auto=format&fit=max&w=1200

Charge What You re Worth Billable Rate Product Pricing Calculator

https://mollyhicks.com/wp-content/uploads/2022/02/Billable-Rate-Calculator-from-Molly-Hicks-Brand-Strategist-in-google-sheet-and-mobile-friendly.png

SalaireNetBrut is a salary calculator tool that estimates your gross income net income and after tax income in France Our calculation of the fiscal net is similar to the French The salary calculator for France provides you with your monthly take home pay or annual income taking into account various factors such as taxes Social Insurance and other

Individual Sample personal income tax calculation Last reviewed 06 September 2023 Example T EUR 70 000 N 2 married taxpayers T N EUR 35 000 I 0 30 Rates are progressive from 0 to 45 plus a surtax of 3 on the portion of income that exceeds 250 000 euros EUR for a single person and EUR 500 000 for a married

Abraz Logitics Rate Calculator Page

https://abrzlogistics.com/assets/img/bg/rate.jpg

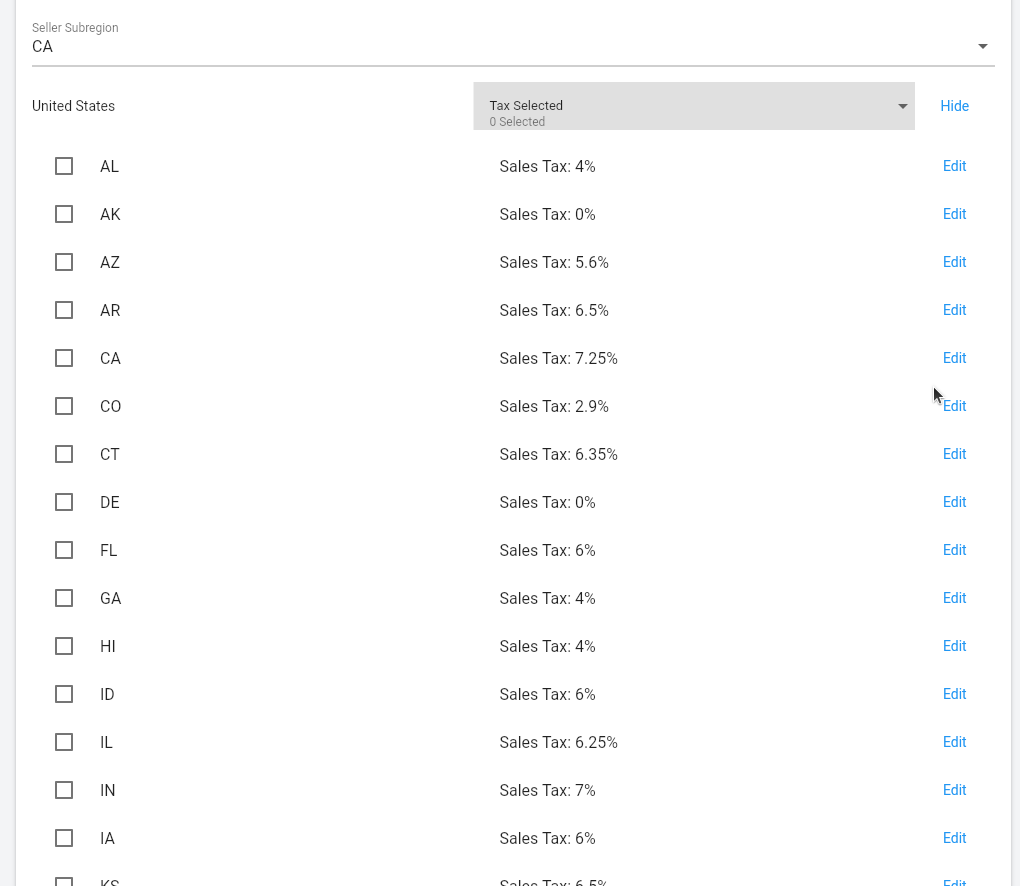

Setup Tax Rates For Invoicing

https://cdn.filestackcontent.com/Mt1PLGTYS5GUUyTCcWv6

https://investomatica.com/income-tax-c…

The personal income tax system in France is a progressive tax system This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at

https://fr.icalculator.com/salary-calculator.html

Calculate your income tax in France and salary deduction in France to calculate and compare salary after tax for income in France in the 2024 tax year

PDF How Mark to Market Taxation Can Lower The Corporate Tax Rate And

Abraz Logitics Rate Calculator Page

What Is The Conversion Rate Definition Of Conversion Rate InfoComm

Exploring Financial Havens The World s Lowest Tax Rate Countries

Tax App

Discount Rate Calculator Using WACC Formula Colonial Stock

Discount Rate Calculator Using WACC Formula Colonial Stock

Rate Calculator

Free Source Available Invoicing Expenses Time Tracking Invoice Ninja

What s Your Tax Rate R PoliticalSatire

Paris Tax Rate Calculator - Income simulator for employees Simulation data is automatically updated when you modify a field Total employer cost Spent by the company Gross salary Gross reference