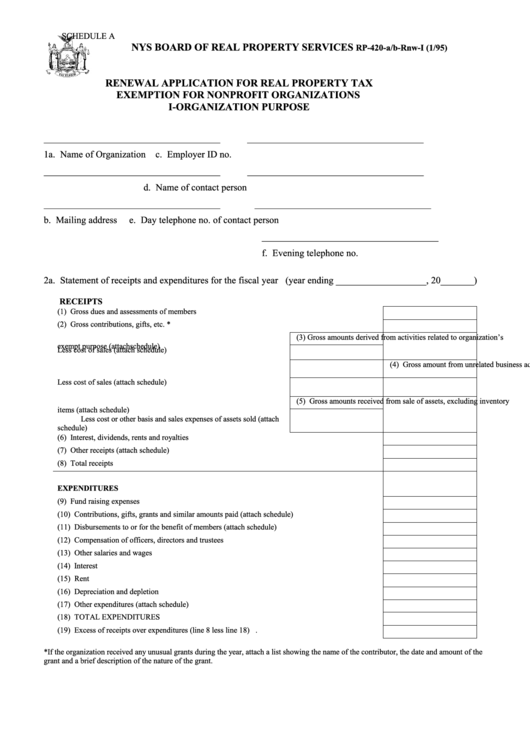

Pennsylvania Property Tax Exemption Nonprofit Information for Purely Public Charities Registration forms Section 9 of the Institutions of Purely Public Charity Act 10 P S 371 et seq requires a nonprofit organization

Nonprofit organizations are eligible for a Real Estate Tax exemption in Philadelphia The property must be used for the organization s tax exempt purpose In Pennsylvania a property owned by a nonprofit entity must qualify for exemption from real estate tax under a completely different legal standard First a

Pennsylvania Property Tax Exemption Nonprofit

Pennsylvania Property Tax Exemption Nonprofit

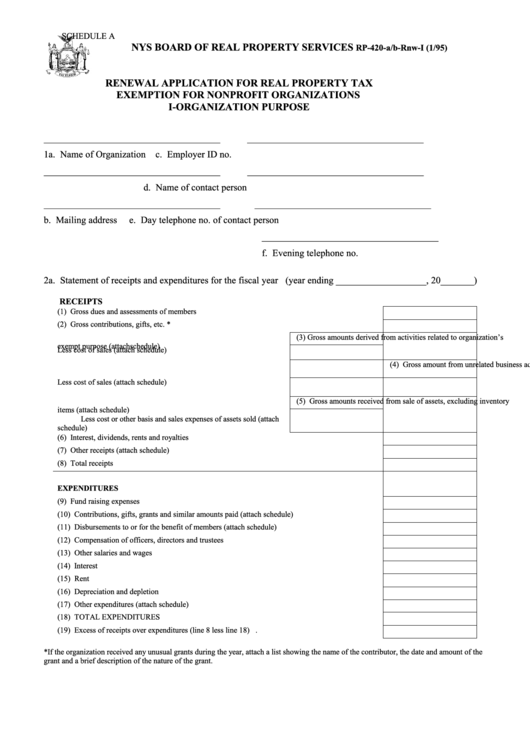

https://data.formsbank.com/pdf_docs_html/235/2359/235946/page_1_thumb_big.png

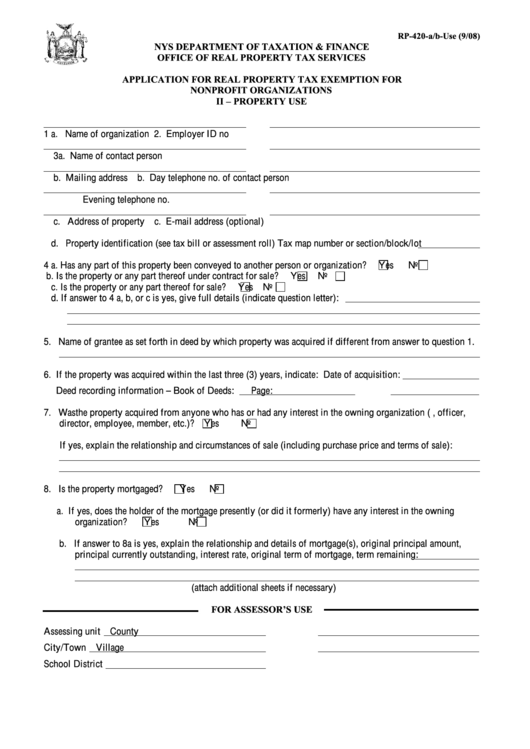

Fillable Form Rp 420 A b Use Application For Real Property Tax

https://data.formsbank.com/pdf_docs_html/336/3365/336587/page_1_thumb_big.png

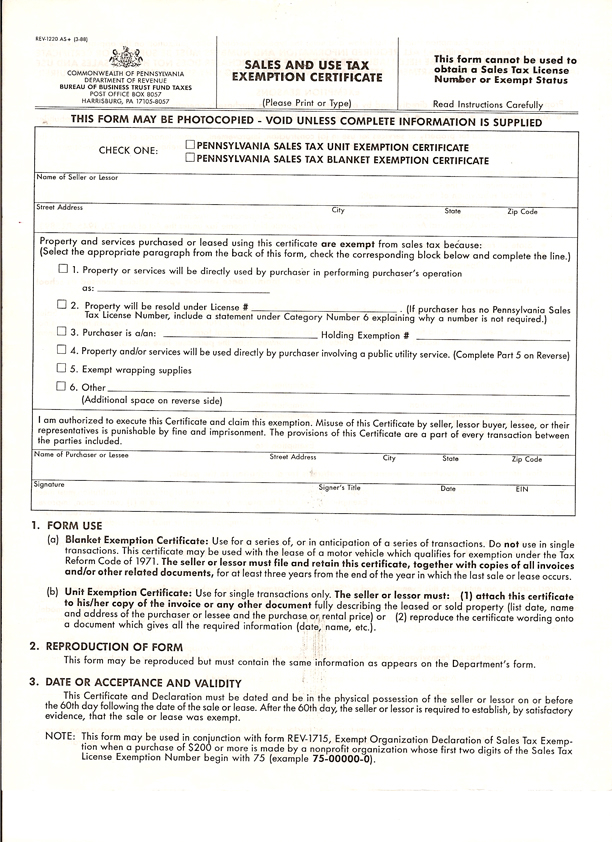

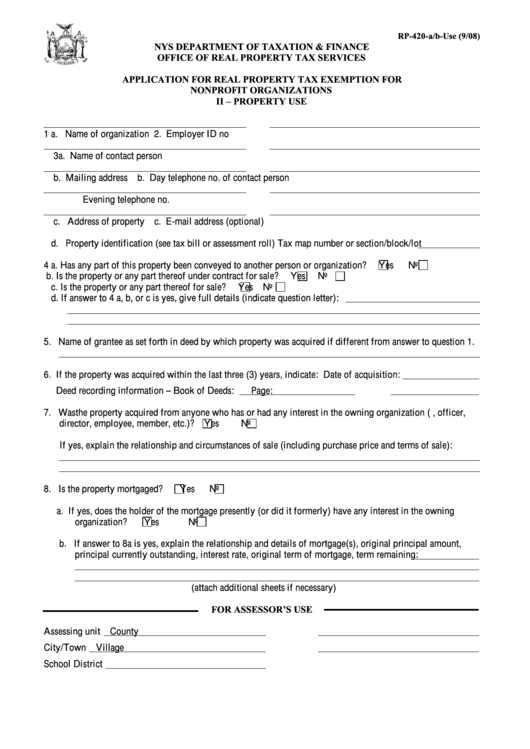

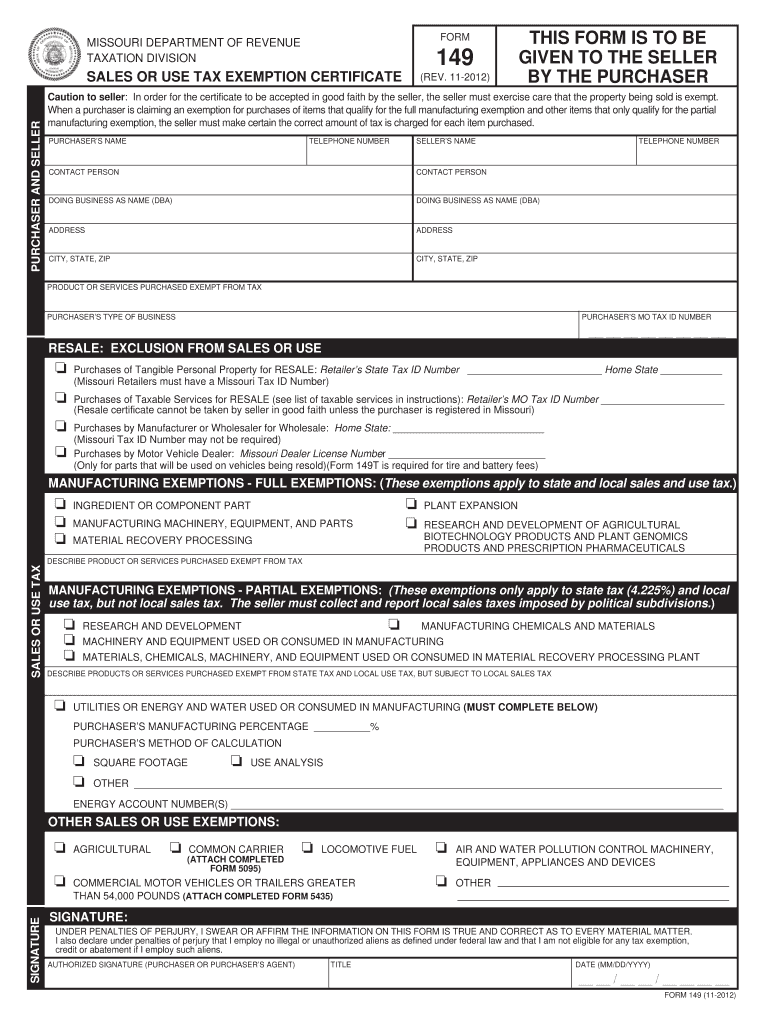

Pa Exemption Certificate Fill Out And Sign Printable PDF Template

https://www.exemptform.com/wp-content/uploads/2022/08/pennsylvania-tax-exempt-1.jpg

Nonprofit entities that own Pennsylvania real property are under relentless attack from local taxing jurisdictions regarding the exempt status of property In a case that clearly defines the process for determining charitable real estate tax exemption under Pennsylvania law the state s Commonwealth Court has affirmed a

HARRISBURG A Commonwealth Court judge recently revoked a Southeastern Pennsylvania hospital s property tax exemption and denied appeals regarding three others decisions that one expert 7 rowsNonprofit organizations are eligible for a real estate tax exemption from the City of Philadelphia The property must be used for the organization s tax

Download Pennsylvania Property Tax Exemption Nonprofit

More picture related to Pennsylvania Property Tax Exemption Nonprofit

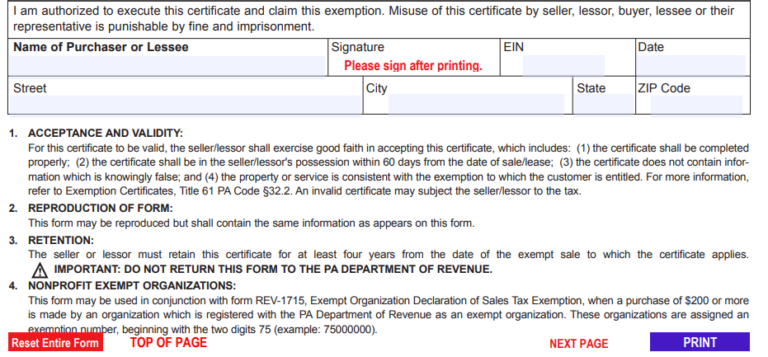

Tax Exempt Form Pa Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/27/100027634/large.png

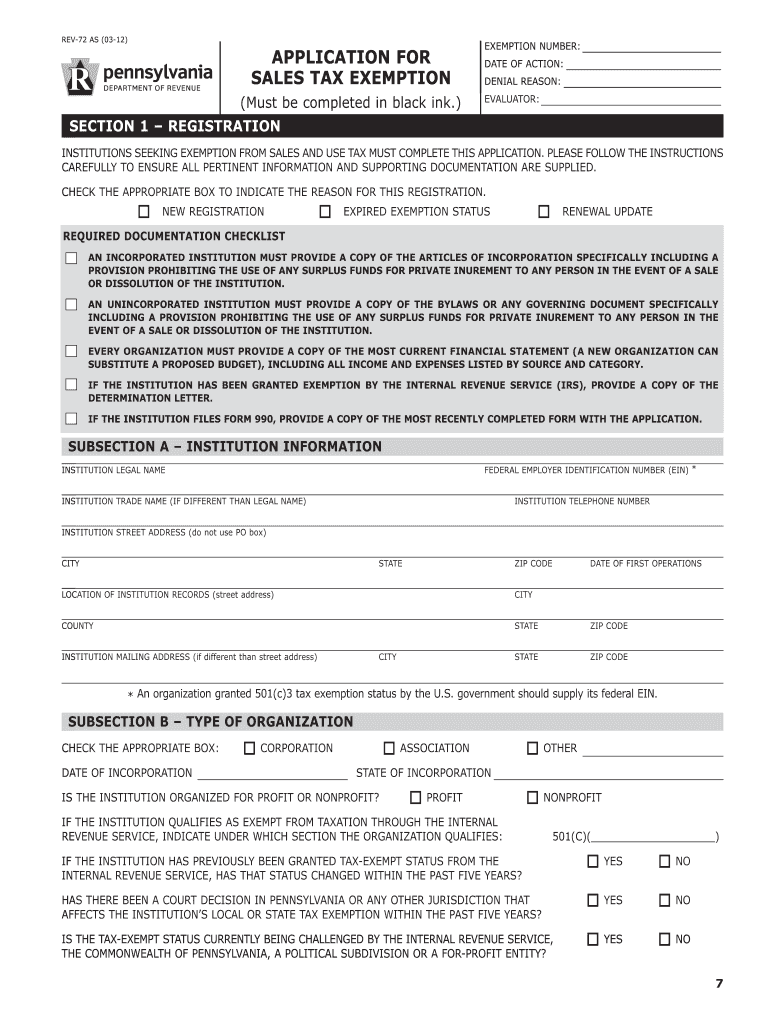

How To Get An Exemption Certificate In Pennsylvania Step By Step Business

https://stepbystepbusiness.com/wp-content/uploads/2022/07/Pennsylvania-Exemption-Certificate-purchase-information-768x357.png

Nonprofit Tax Exemptions Harbor Compliance

https://i.harborcompliance.com/images/types-of-501c-organizations.jpg

This case study briefly traces the evolution and current status of Pennsylvania s property tax exemption debate Over the past 30 years court cases On February 10 2023 the Pennsylvania Commonwealth Court the Court issued four related but distinct opinions the Tower Cases which it is reasonable to expect may be

Like the court ruling the law says that a purely public charity must meet a five prong test To be considered a purely public charity nonprofits must 1 advance In Pennsylvania a nonprofit organization must prove it is a purely public charity to qualify for a property tax exemption The state Supreme Court in a 1985 ruling

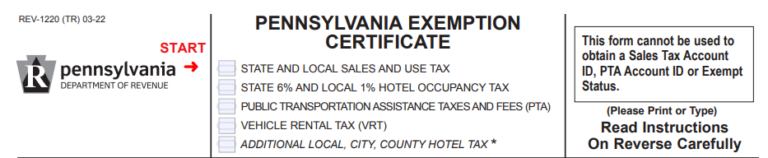

Pennsylvania Exemption Certificate TUTORE ORG Master Of Documents

https://s3-us-west-2.amazonaws.com/display-templates/resale-cert/pa-cert.png

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

http://static1.squarespace.com/static/5d8d4c603aab2563d4a30208/t/62ebf2c02ff2b767de17f485/1659630272071/2022-8-4+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg?format=1500w

https://www.pa.gov/en/agencies/dos/programs/...

Information for Purely Public Charities Registration forms Section 9 of the Institutions of Purely Public Charity Act 10 P S 371 et seq requires a nonprofit organization

https://www.phila.gov/.../get-a-nonprofit-real-estate-tax-exemption

Nonprofit organizations are eligible for a Real Estate Tax exemption in Philadelphia The property must be used for the organization s tax exempt purpose

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download

Pennsylvania Exemption Certificate TUTORE ORG Master Of Documents

How To Get An Exemption Certificate In Pennsylvania Step By Step Business

Pennsylvania Tax Exempt Application

Pa Tax Exempt Form Rev 1220 ExemptForm

2023 Pa Tax Exempt Form Printable Forms Free Online

2023 Pa Tax Exempt Form Printable Forms Free Online

Form Rev 1220 As Pennsylvania Exemption Certificate 2006 Printable

Pennsylvania Exemption Certificate REV 1220 PA Department Of

Non profit Organization Property Tax Exemption Notice Meridian Source

Pennsylvania Property Tax Exemption Nonprofit - HARRISBURG A Commonwealth Court judge recently revoked a Southeastern Pennsylvania hospital s property tax exemption and denied appeals regarding three others decisions that one expert