Personal Tax Benefits Of Electric Cars Electric cars with zero emissions fall into the lowest benefit in kind tax band resulting in lower tax liabilities for employees This makes electric vehicles very attractive for businesses and employees As a comparison the percentage for a petrol or diesel car could be as high as 37

As of the 1st of March 2023 the advisory electricity rate for fully electric cars is 9 pence per mile Meaning you can claim a reimbursement of up to 9p per mile for every business mile travelled tax free Below are a few points regarding the tax deductions reliefs available for EV fuel electricity From 6 April 2020 the benefit in kind for fully electric cars is being reduced to 0 for the tax year 2020 2021 increasing to 1 in 2021 2022 and 2 in 2022 2023 of an EV s taxable list price The government announced in November 2022 that the 2 rate of electric vehicles is set until April 2025 after which it will be

Personal Tax Benefits Of Electric Cars

Personal Tax Benefits Of Electric Cars

https://tblaccountants.co.uk/wp-content/uploads/2020/02/ev-tax-benefits-1024x536.jpg

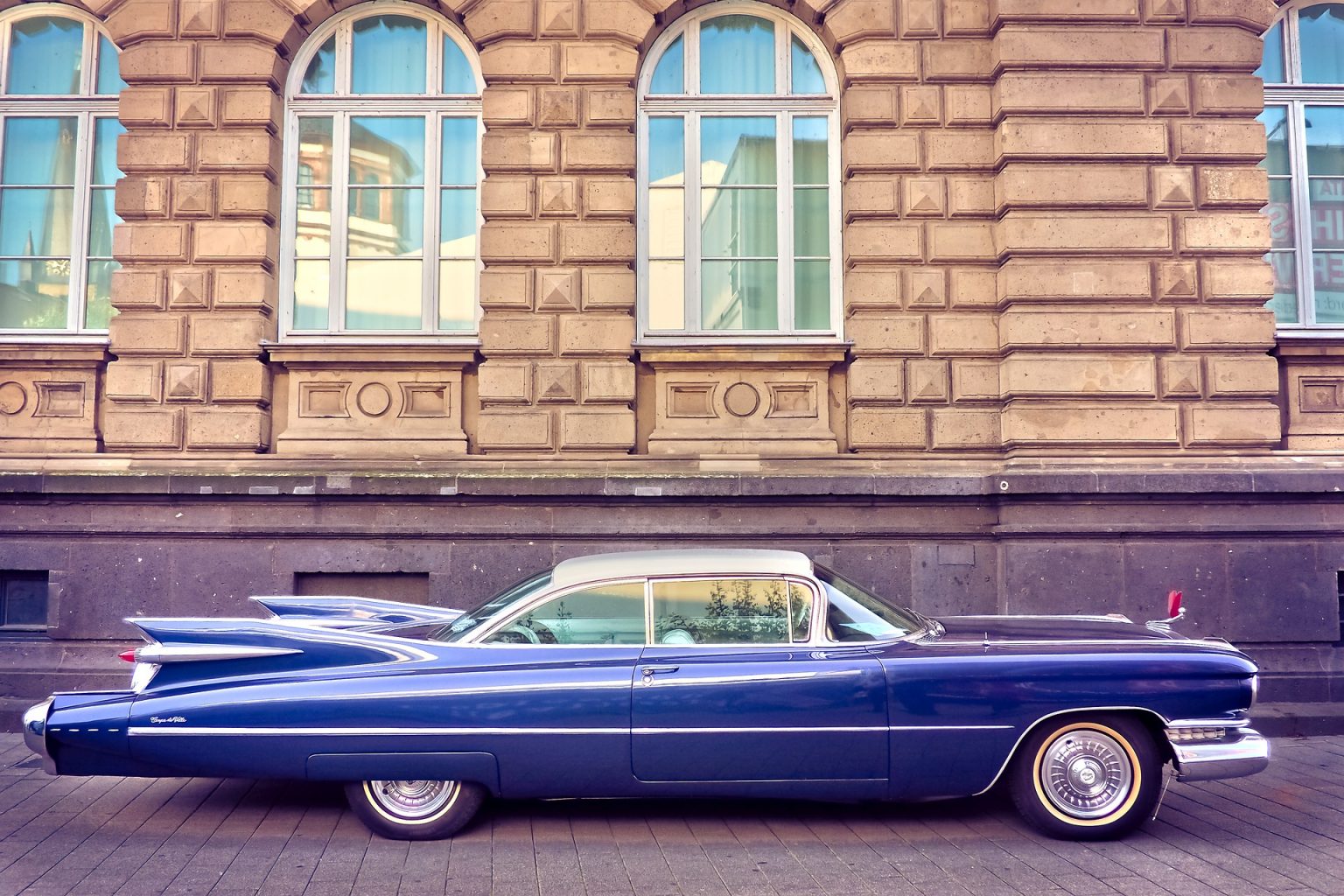

The History Of Electric Cars Goes Back A Long Way Titles For Sale By

https://manorialcounselltd.co.uk/wp-content/uploads/2021/11/255305335_644678076941025_111089562828326286_n.png

3 Marketing Benefits Of Electric Cars EV Connect EV Connect

https://images.squarespace-cdn.com/content/v1/5f3b08d4515c242514c95656/1632151128656-1L0KQBY49GUUHP6NV5A9/3-marketing-benefits-of-electric-cars.jpg

The government will continue to use the tax system to support the transition to electric vehicles including using favourable first year VED rates for the lowest emission cars favourable They re liable to vehicle tax and you can pay anything between 0 180 per year depending on the levels of CO2 emissions All cars registered between 1st March 2001 and 31st March 2017 with CO2 emissions less than

As a higher rate taxpayer you could save the income tax on that 12 000 a year at 40 which is 4 800 plus that National Insurance saving In other words you could save yourself more than 5 000 by leasing a vehicle through your employer Employee BiK For the 2021 22 tax year where the car is 100 electric the BiK charge is just 1 of the list price of the car This rises to 2 for each of the next three tax years This charge covers all the costs incurred by the company in connection with the car except for the provision of a chauffeur or

Download Personal Tax Benefits Of Electric Cars

More picture related to Personal Tax Benefits Of Electric Cars

About Us LionCharge

http://www.lioncharge.tech/images/Banner-Benefits-Mo.jpg

The Tax Benefits Of Electric Cars

https://media-exp1.licdn.com/dms/image/D4E12AQFKja7x2bTrfQ/article-cover_image-shrink_720_1280/0/1662025136459?e=2147483647&v=beta&t=m8vhlp7ChECHDk7_ENnXRihgOoGyZNEXIlLcbj1SIyM

Car Donation Tax Deduction Tax Benefits Of Donating A Car

https://www.goodwillcardonation.org/wp-content/uploads/2016/06/auto-goodwill-car-donation--1536x1024.jpg

The EV Plug in Grant Road tax exemption Benefit in Kind BIK Salary sacrifice schemes Capital allowances Workplace Charging Scheme WCS Each one is unique and offers either an EV driver or business owner a certain amount of financial relief for owning or driving an EV Let s take a look at each one in more detail For example a vehicle costing 36 000 with CO2 levels of 32 g km and an electric only range of between 30 and 39 miles will have a benefit rate of 12 in 2021 22 and be classified as having a taxable benefit of 4 320 This is the benefit value that needs to be included on the P11D form for company cars Salary sacrifice and e cars

Electric and low emission cars registered on or after 1 April 2025 You will need to pay the lowest first year rate of vehicle tax which applies to vehicles with CO2 emissions 1 to 50g km Summary of Electric Car Tax Benefits A battery electric vehicle BEV has 2 Benefit in Kind BIK in 2023 2024 and 2024 2025 From 1 April 2020 until 31 March 2025 all zero emission vehicles are exempt from the Vehicle Excise Duty expensive car supplement

Can You Get Tax Benefit On Purchase Of An Electric Vehicle HSCO

https://hscollp.in/wp-content/uploads/2021/12/HSCo-Blog-10122021.jpg

What Are The Tax Benefits Of Electric Cars PKB Accountants

https://www.pkb.co.uk/wp-content/uploads/2023/03/iStock-1357830952-980x627.jpg

https://www.taxassist.co.uk/resources/articles/the...

Electric cars with zero emissions fall into the lowest benefit in kind tax band resulting in lower tax liabilities for employees This makes electric vehicles very attractive for businesses and employees As a comparison the percentage for a petrol or diesel car could be as high as 37

https://www.crunch.co.uk/knowledge/article/what...

As of the 1st of March 2023 the advisory electricity rate for fully electric cars is 9 pence per mile Meaning you can claim a reimbursement of up to 9p per mile for every business mile travelled tax free Below are a few points regarding the tax deductions reliefs available for EV fuel electricity

Maximize Tax Savings With Electric Vehicles Tax Benefits Of Buying An EV

Can You Get Tax Benefit On Purchase Of An Electric Vehicle HSCO

What Are The Tax Benefits Of Electric Vehicles For Farmers In NI

Tax Benefits Of Electric Vehicles I LibAbun

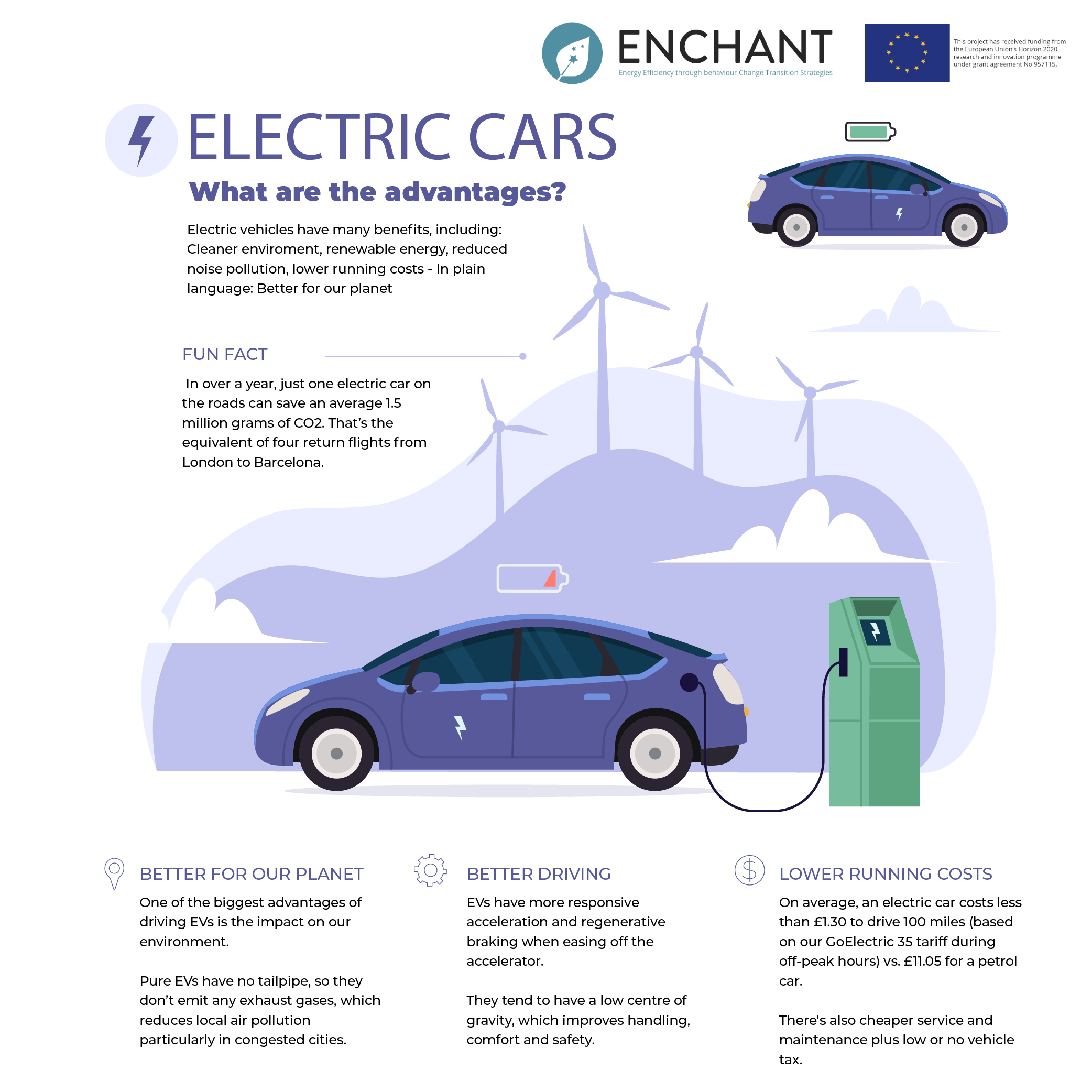

Electric Cars What Are The Advantages Enchant

Electric Car Tax Benefits Explained Fuel Card Services

Electric Car Tax Benefits Explained Fuel Card Services

Is It The End Of The Road For Us With Our Troublesome All electric Cars

The Tax Benefits Of A Partial Roth Conversion Plancorp

Tax Benefits Of Switching To Electric Cars ECOVIS

Personal Tax Benefits Of Electric Cars - As a higher rate taxpayer you could save the income tax on that 12 000 a year at 40 which is 4 800 plus that National Insurance saving In other words you could save yourself more than 5 000 by leasing a vehicle through your employer