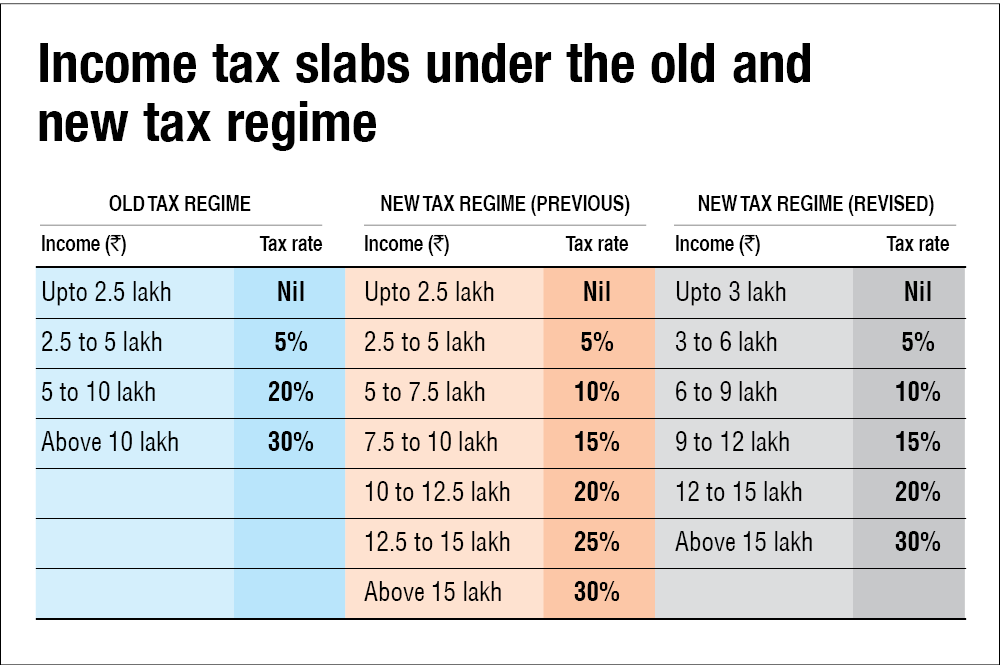

Pf Deduction In New Tax Regime 2023 Web However in Budget 2023 it was announced that the standard deduction benefit of Rs 50 000 will be available for the salaried and pensioners under the new tax regime Similarly family pensioners can claim deduction of

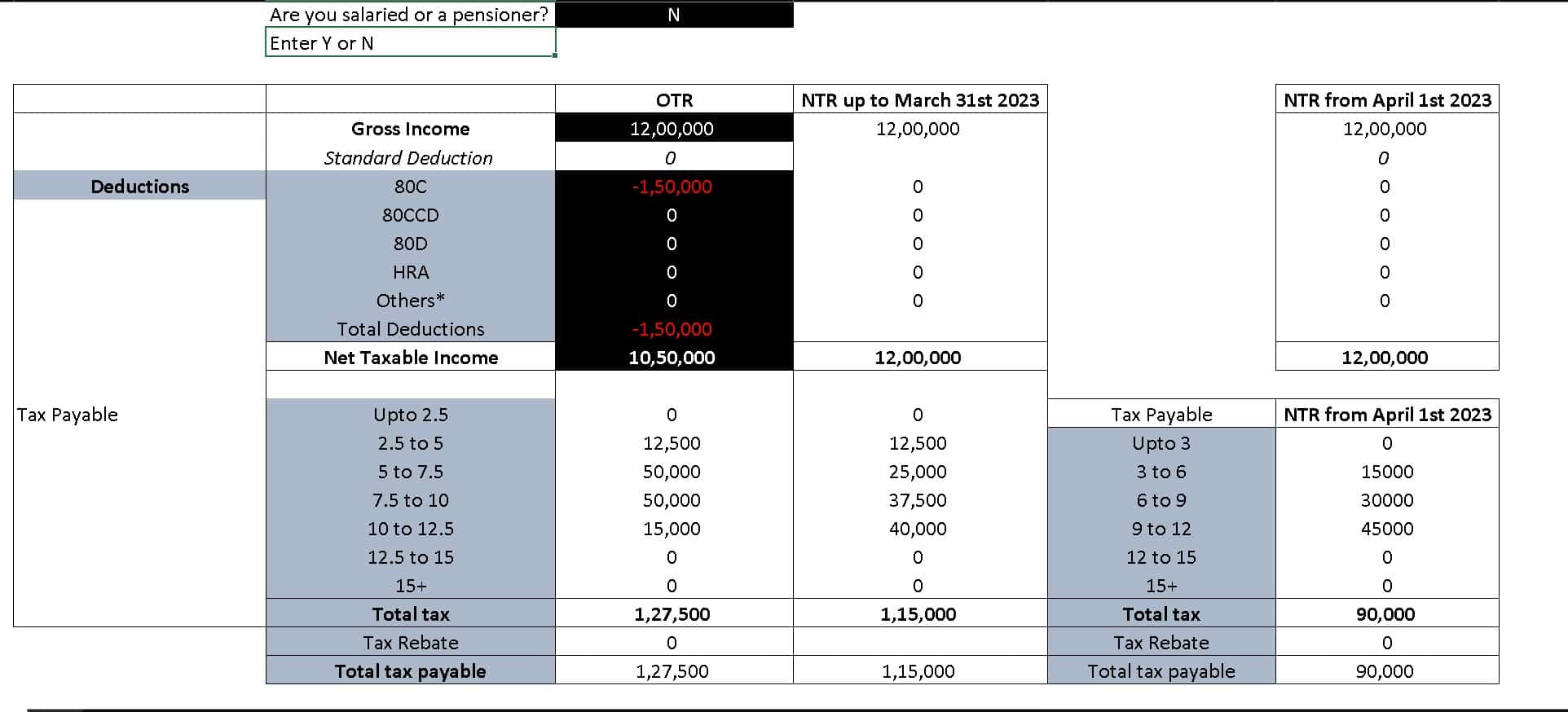

Web 6 Feb 2023 nbsp 0183 32 The employer contributions to EPF will continue to be tax free in the new tax regime current and revised in budget 2023 provided such contributions are less than or equal to Rs 7 5 lakhs in a financial year This limit Web 3 Feb 2023 nbsp 0183 32 To make the new income tax regime more attractive the Budget 2023 has announced certain deductions that will be available from FY 2023 24 The deductions mentioned here include all the ones that are recently introduced as well as those that were previously available

Pf Deduction In New Tax Regime 2023

Pf Deduction In New Tax Regime 2023

https://akm-img-a-in.tosshub.com/indiatoday/images/story/202302/new_tax_slabs-sixteen_nine.jpg?VersionId=x95hc2IliRr1wWwhFQmBXrMp0RCt38tK&size=690:388

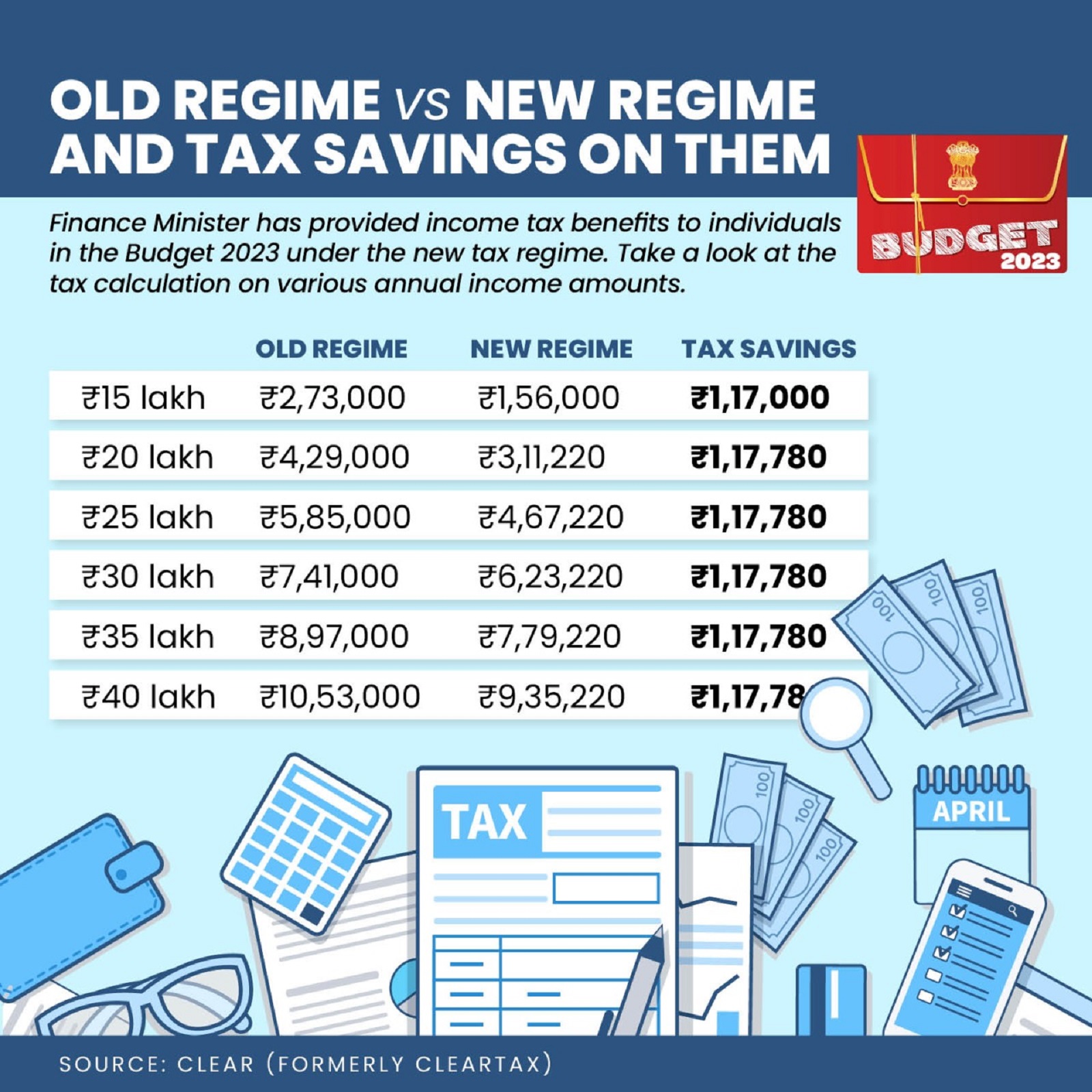

Brief Comparison Between New Tax Regime And Old Tax Regime FY 2023 24

https://studycafe.in/wp-content/uploads/2023/04/Brief-comparison-between-New-Tax-Regime-and-Old-Tax-Regime-1.jpg

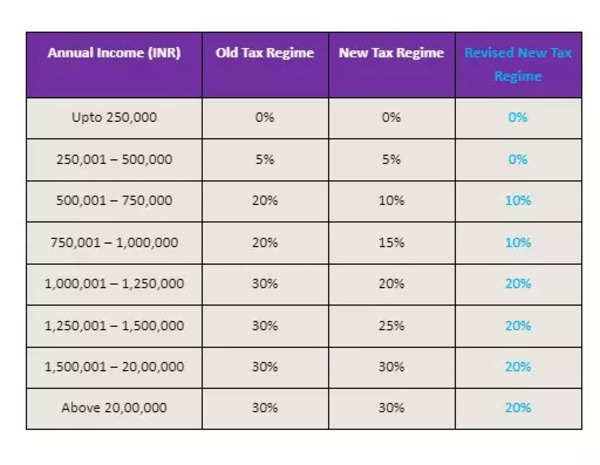

Changes In New Tax Regime All You Need To Know

https://www.taxhelpdesk.in/wp-content/uploads/2023/03/Changes-In-New-Tax-Regime-2.png

Web 20 Jan 2023 nbsp 0183 32 While it is expected that the above provisions on EPF taxation may not change in the 2023 Union Budget there is an expectation that the limit of deduction available under Section 80C may be Web Vor 3 Tagen nbsp 0183 32 Salary income The standard deduction of 50 000 which was only available under the old regime has now been extended to the new tax regime as well This along with the rebate makes 7 5 lakhs as your tax free income under the new regime

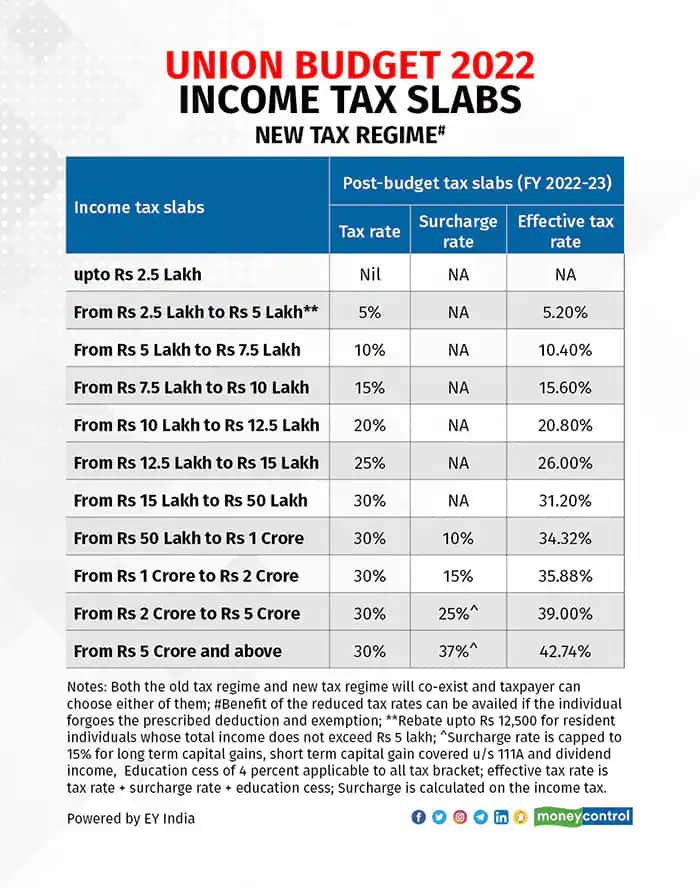

Web The following deductions under New Tax Regime are still available for tax payers The Standard Deduction of Rs 50 000 for salaried individuals and pensioners The deduction for employer s contribution made towards employee s Web 7 Juni 2023 nbsp 0183 32 The New Tax Regime for 2023 24 One of the highlights of budget 2023 24 was the overhaul of the new taxation structure for individuals and corporations Compared to the old regime the new tax structure incorporated several benefits for salaried individuals Additionally you might notice that the income tax slabs for the new

Download Pf Deduction In New Tax Regime 2023

More picture related to Pf Deduction In New Tax Regime 2023

Income Tax Rates 2023 Individual Deduction 2023 PELAJARAN

https://www.paisabazaar.com/wp-content/uploads/2020/02/tax.jpg

Income Tax Slabs Comparison After Budget 2023 Taxes Under Old Regime

https://images.news18.com/ibnlive/uploads/2023/02/old-regime-vs-new-regime-budget-2023-1.jpeg?impolicy=website&width=0&height=0

Budget 2023 Income Tax New Vs Old Tax Regime What Lies Ahead Times

https://static.toiimg.com/thumb/imgsize-23456,msid-97495963,width-600,resizemode-4/97495963.jpg

Web Vor 3 Tagen nbsp 0183 32 IT alerts see big jump 3 million taxpayers asked to explain discrepancy in returns After the new tax regime was sweetened in the Budget for 2023 24 revenue secretary Sanjay Malhotra estimated Web 6 Apr 2022 nbsp 0183 32 Here are key things to know about the new PF tax rule Any interest credited to the provident fund account of an employee will be tax free only for contributions up to 2 5 lakh every year and any

Web Vor 6 Tagen nbsp 0183 32 gt Standard deduction under New Tax Regime The standard deduction of Rs 50 000 which was earlier restricted to the Old Tax Regime was extended to the new tax regime in Union Web New tax regime 2023 Budget 2023 announced a few changes in the new income tax regime and revised tax slabs to make it more attractive for taxpayers Here we have answered a few important questions regarding the revised new tax regime 2023 Benchmarks Nifty 21 517 35 148 46 FEATURED FUNDS Canara Robeco

Budget 2023 Old Tax Regime And New Tax Regime Explained In 3 Scenarios

https://c.ndtvimg.com/2023-02/hfvfqj2o_income-tax-slab_625x300_02_February_23.jpg

Standard Deduction In New Tax Regime Budget 2023 Standard Deduction

https://i.ytimg.com/vi/ghLUWQFoxoc/maxresdefault.jpg

https://economictimes.indiatimes.com/wealth/tax/new-tax-regime-2023...

Web However in Budget 2023 it was announced that the standard deduction benefit of Rs 50 000 will be available for the salaried and pensioners under the new tax regime Similarly family pensioners can claim deduction of

https://freefincal.com/is-e

Web 6 Feb 2023 nbsp 0183 32 The employer contributions to EPF will continue to be tax free in the new tax regime current and revised in budget 2023 provided such contributions are less than or equal to Rs 7 5 lakhs in a financial year This limit

Old Or New Which Tax Regime Is Better After Budget 2023 24 Value

Budget 2023 Old Tax Regime And New Tax Regime Explained In 3 Scenarios

New And Old Tax Regime Comparision For FY 2023 24 Income Tax Slab FY

Budget 2023 Income Tax Slabs Explained New Tax Regime Vs Existing New

New Income Tax Slab FY 2023 24 AY 2024 25 Old New Regime

Income Tax Calculator FY 2023 24 Excel DOWNLOAD FinCalC Blog

Income Tax Calculator FY 2023 24 Excel DOWNLOAD FinCalC Blog

Should I Switch To The New Tax Regime From 1st April 2023

Budget 2023 What Could The FM Do To Make The New Regime Attractive To

New Tax Regime Vs Old Tax Regime 2023 Tds Deduction Calculation On

Pf Deduction In New Tax Regime 2023 - Web Vor 3 Tagen nbsp 0183 32 Salary income The standard deduction of 50 000 which was only available under the old regime has now been extended to the new tax regime as well This along with the rebate makes 7 5 lakhs as your tax free income under the new regime