Philadelphia Wage Tax Exemption The tax applies to payments that a person receives from an employer in return for work or services All employed Philadelphia residents owe the Wage Tax regardless of where they

Philadelphia employers are required to give an income based Wage Tax refund petition form to employees by February 1 In most cases employers provide the refund Wages earned for work performed at the home outside of Philadelphia are exempt from the Philadelphia wage tax if the employee 1 is merely assigned to the Philadelphia

Philadelphia Wage Tax Exemption

Philadelphia Wage Tax Exemption

https://www.canoncapital.com/wp-content/uploads/2022/06/Canon-Philly-Wage-Tax-6-2022-768x644.png

Pennsylvania Senate Passes Bill To Roll Back Philadelphia s City Wage

https://media.phillyvoice.com/media/images/050423_City_Wage_Tax_Commuters.2e16d0ba.fill-735x490.jpg

City Announces Wage Tax Reduction Starting July 1 2017 Department Of

https://www.phila.gov/media/20170510131811/City-Hall-credit-M.-Fischetti-for-VISIT-PHILADELPHIA.jpg

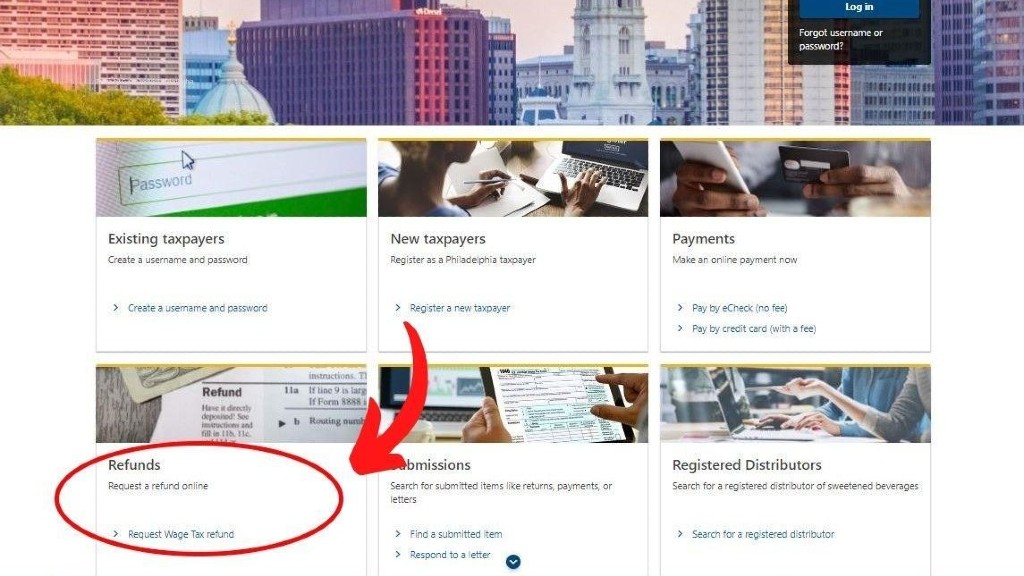

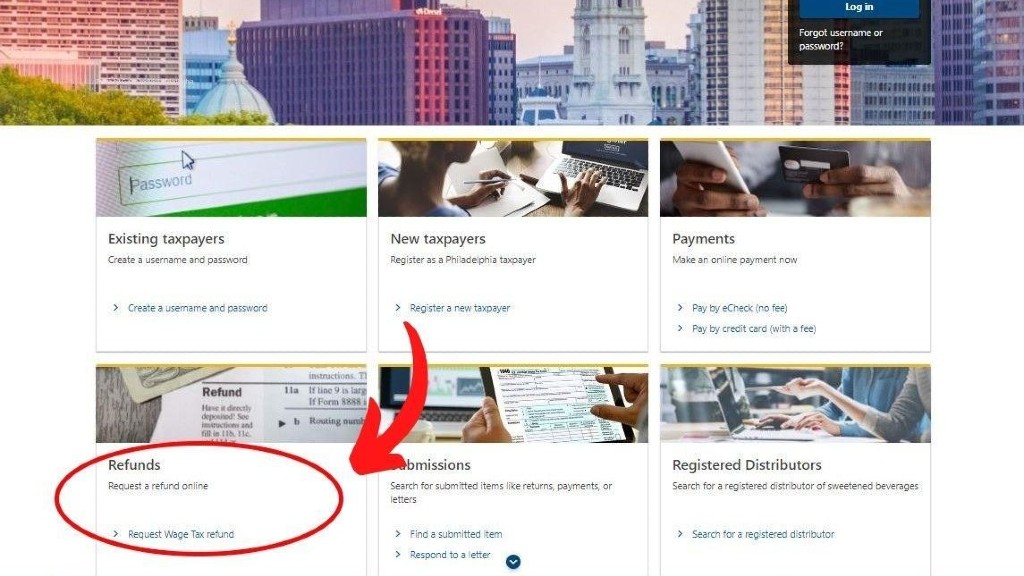

According to the city the best and fastest way to get your refund is online through the Philadelphia Tax Center You ll need your W2 and the letter from your employer specifically about you The following FAQs address the circumstances under which nonresident employees wages are exempt from Wage Tax because they worked from home for the necessity of the employer

A Nonresidents of Philadelphia who were required to work from home during the COVID 19 pandemic may claim a refund of Philadelphia City Wage taxes withheld during that period Nonresident employees who had Wage Tax withheld during the time they were required to perform their duties from home outside of the city in 2020 can request a refund through

Download Philadelphia Wage Tax Exemption

More picture related to Philadelphia Wage Tax Exemption

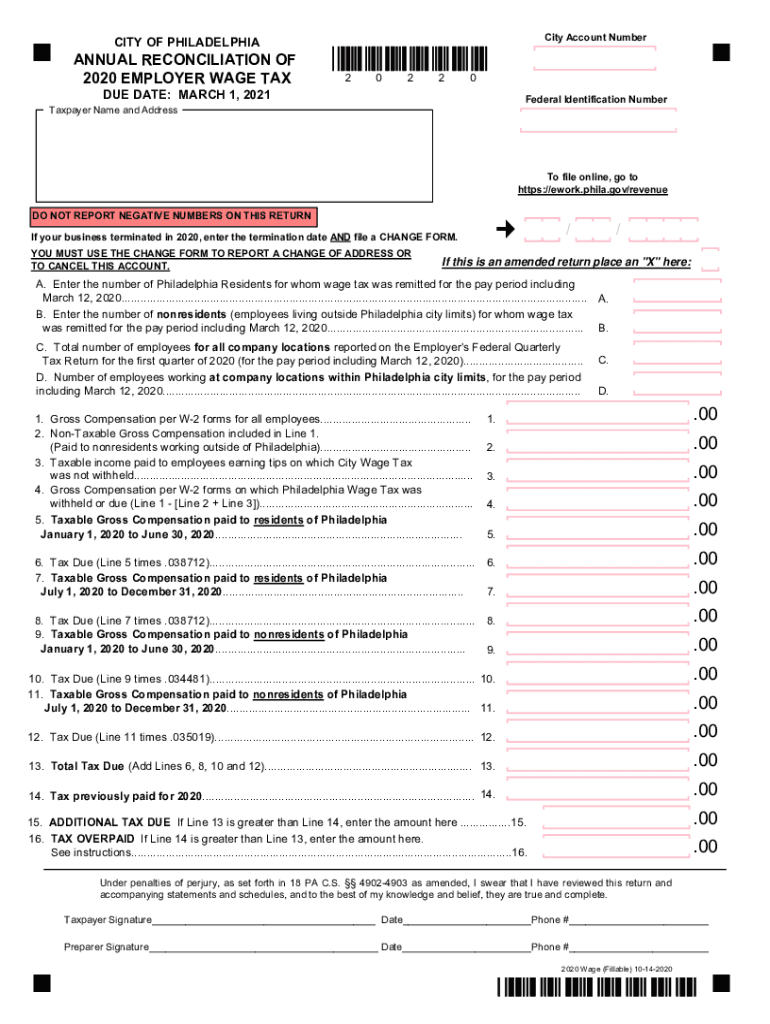

PA Annual Reconciliation Of Employer Wage Tax City Of Philadelphia

https://www.pdffiller.com/preview/539/490/539490459/large.png

/cloudfront-us-east-1.images.arcpublishing.com/pmn/Z7LPYQ4DGJGUVDDQBBFZNP7KTY.jpg)

Tax Time How To Get Your City Of Philadelphia Wage Tax Refund For 2020

https://www.inquirer.com/resizer/-7bqDwgkg3eo0u8ISscYTxlU-mY=/500x333/smart/filters:format(webp)/cloudfront-us-east-1.images.arcpublishing.com/pmn/Z7LPYQ4DGJGUVDDQBBFZNP7KTY.jpg

2016 Philadelphia Tax Rates Due Dates And Filing Tips

https://www.daletaxservice.com/wp-content/uploads/2017/01/2016-philadelphia-tax-rates.jpg

As long as companies are requiring employees to work from home they are exempt from the 3 4481 nonresident tax People who live in the city no matter where they work must always pay the 3 8712 resident wage tax 2022 COVID EZ Wage Tax refund petition non residents only PDF Non resident salaried employees can use this form to apply for a refund on 2022 Wage Tax for

Residents making 100 an hour have the same 3 8398 wage tax rate as those making the 7 25 minimum wage And that flat rate on the wage tax as well as the 3 07 state income Homestead Exemption In Philadelphia the exemption which was part of the sweeping 2013 property tax overhaul known as the Actual Value Initiative makes untaxable

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of

https://www.phila.gov/media/20220217100121/Wage-Tax-pic-2.jpg

/cloudfront-us-east-1.images.arcpublishing.com/pmn/4W4LTZTBOVDSRMZALBHJ3Z43HE.jpg)

How To Get Your 2021 Philadelphia City Wage Tax Refund

https://www.inquirer.com/resizer/aIzI7o0tOe85U5xrh1oeixbKMNI=/500x333/smart/filters:format(webp)/cloudfront-us-east-1.images.arcpublishing.com/pmn/4W4LTZTBOVDSRMZALBHJ3Z43HE.jpg

https://www.phila.gov › ... › wage-tax-employers

The tax applies to payments that a person receives from an employer in return for work or services All employed Philadelphia residents owe the Wage Tax regardless of where they

https://www.phila.gov › ... › request-a-wage-tax-refund

Philadelphia employers are required to give an income based Wage Tax refund petition form to employees by February 1 In most cases employers provide the refund

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of

Philadelphia Wage Tax Calculator Imposing Logbook Lightbox

5 Things To Know About Wage Tax Department Of Revenue City Of

City Officials Say Philadelphia Wage Tax Refunds Are Delayed 6abc

New Website To File And Pay Philadelphia City Wage Tax Wouch Maloney

New Website To File And Pay Philadelphia City Wage Tax Wouch Maloney

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of

OFFICIAL NOTICE Philadelphia Wage Tax Rate Changes Start July 1 2022

Philadelphia City Wage Tax Refund Form 2021 Veche

Philadelphia Wage Tax Exemption - The wage tax rate is set to drop from 3 84 to 3 79 for city workers and the median annual household income for Philadelphia is about 49k With that household