Plug In Car Tax Credit You may qualify for a clean vehicle tax credit up to 7 500 if you buy a new qualified plug in electric vehicle or fuel cell electric vehicle

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the tax credit Beginning January 1 2023 eligible vehicles may qualify for a

Plug In Car Tax Credit

Plug In Car Tax Credit

https://www.ai-online.com/wp-content/uploads/2021/10/Plug-in-car-enquiries-surge-by-550-in-September-reports-carwow.jpg

Government Scraps Plug in Car Grant With Immediate Effect

https://www.nationalworld.com/jpim-static/image/2022/06/14/10/mattmot MGZSEV-41.jpg?width=1200&auto=webp&quality=75&crop=3:2,smart

US Sen Warnock Electric Car Tax Credit Needs flexibility WREG

https://wreg.com/wp-content/uploads/sites/18/2022/09/7fa01e2a8c464a8887fc3dbae01aa9c3.jpg?w=1280

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle

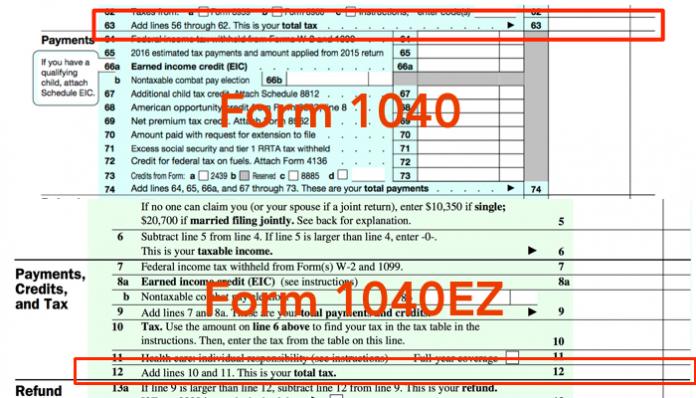

The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel cell vehicles and associated equipment such as Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit is an IRS form that allows the owners of certain electric vehicles to claim a tax credit on their tax return The form can

Download Plug In Car Tax Credit

More picture related to Plug In Car Tax Credit

UK Cuts Electric Vehicle Grants By 500 Nhllp

https://nhllp.files.wordpress.com/2021/04/plug-in-car-blog-post.jpg?w=1024

UK Plug in Car Grant What Is It And How Much Can You Save On An

https://cdn.mos.cms.futurecdn.net/DBSJysuXHwNBj5QAe5NRCH-970-80.jpg

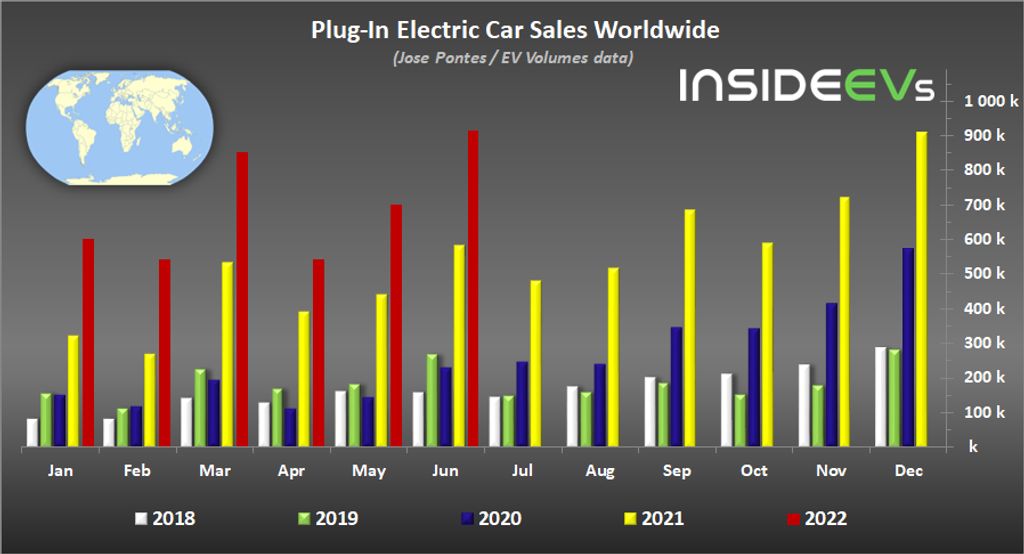

China Plug In Car Sales Amaze Despite Lockdown In April 2022

https://cdn.motor1.com/images/custom/thumbnail/plug-in-electric-car-sales-in-china-april-2022.png

As of late 2023 just seven plug in hybrids are eligible for a federal tax credit but there s a workaround The electric vehicle tax credit or the EV credit is a nonrefundable tax credit offered to taxpayers who purchase qualifying electric vehicles or plug in hybrid vehicles Nonrefundable

Our experts show you how to qualify for a federal tax credit of up to 7 500 by leasing an electric vehicle or plug in hybrid If you buy a new all electric plug in hybrid or fuel cell electric vehicle in 2023 or after you can claim a clean vehicle tax credit of up to 7 500 The tax credit is available to both

Plug in Car Grant Slashed To 2 500 Cars Over 35 000 Now Excluded

https://i0.wp.com/www.techdigest.tv/wp-content/uploads/2021/01/EV-1024x615-1.jpg?resize=1024%2C615&is-pending-load=1#038;ssl=1

Plug in Car Grant Scrapped Everything You Need To Know Which News

https://media.product.which.co.uk/prod/images/ar_2to1_1500x750/eb3896fd8ce1-plug-in-car-grantlead.jpg

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a clean vehicle tax credit up to 7 500 if you buy a new qualified plug in electric vehicle or fuel cell electric vehicle

https://www.consumerreports.org/cars/hybrids-evs/...

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

Adapter For Charging Cable Type 2 To Car With Type 1 Socket Evston

Plug in Car Grant Slashed To 2 500 Cars Over 35 000 Now Excluded

Global Plug In Electric Car Sales Reached New Record In June 2022 Over

UK Plug in Car Grant What Is It And How Much Can You Save On An

Plug in Vehicles And Tax Planning It s That Time Again Torque News

See Plug In Electric Car Adoption Map For All US States In 2021

See Plug In Electric Car Adoption Map For All US States In 2021

What Is The Plug In Car Grant PiCG Cangaf Accountants And

Check Out The Number Of Plug In Cars Per Capita In Your State

Government Axes Plug In Car Grant For All Electric Cars

Plug In Car Tax Credit - The Inflation Reduction Act of 2022 changed which new fully electric and plug in hybrid vehicles were eligible for federal tax credits starting on April 18 2023