Polish Tax Laws New general principles consensual forms of resolution of tax disputes and improving the efficiency of tax collection In June 2019 during the previous term of the Polish Parliament the lower house the Sejm received a bill of totally new Tax Ordinance proposed by the

Specific information about Corporate Income Tax CIT entities time limit for registration registering for CIT profits subject to CIT keepin of account tax rates tax exemption Taxes in Poland are levied by both the central and local governments Tax revenue in Poland is 33 9 of the country s GDP in 2017 The most important revenue sources include the income tax Social Security corporate tax and the value added tax which are all applied on the national level Income earned is generally subject to a progressive income tax which applies to all who are in the workforce For the year 2014 two different tax rates on income apply

Polish Tax Laws

Polish Tax Laws

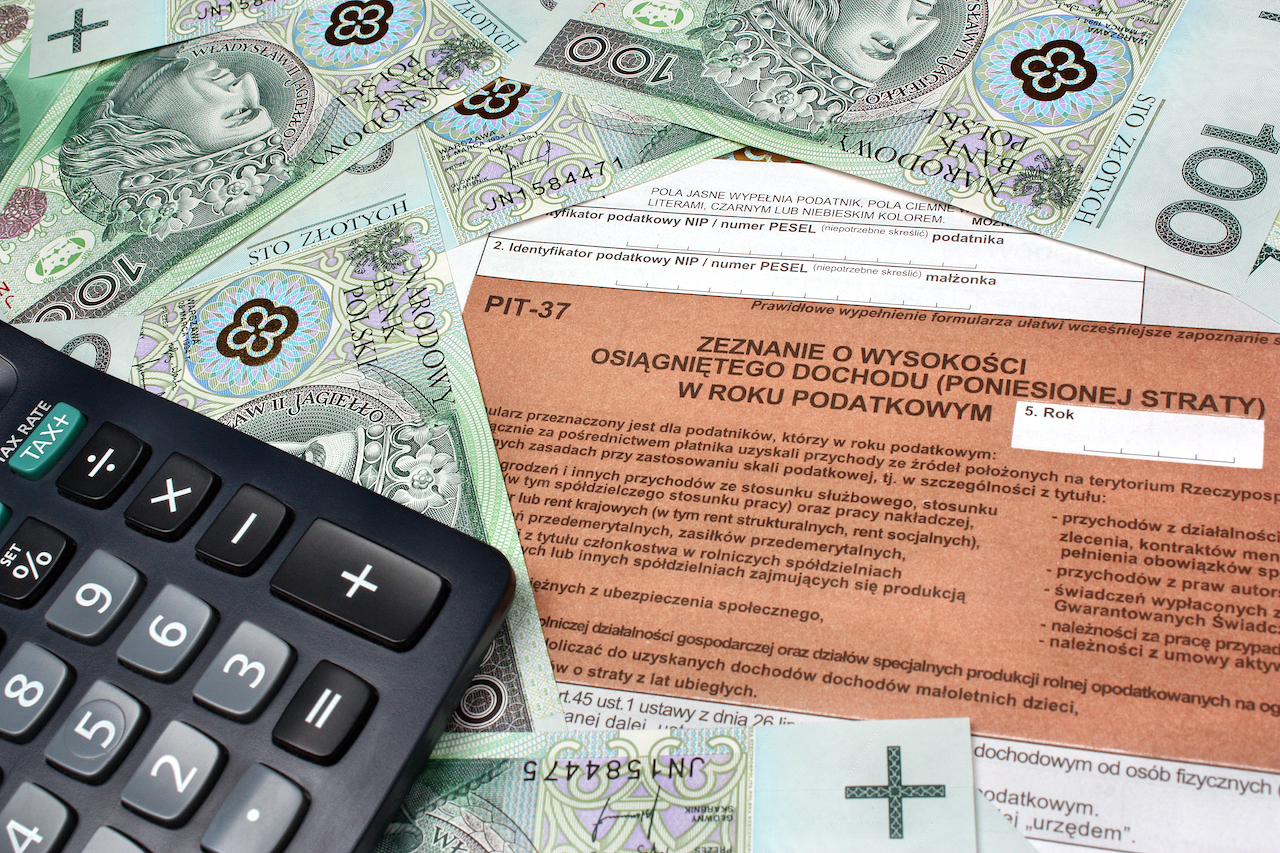

https://emerging-europe.com/wp-content/uploads/2016/09/bigstock-Taxes-In-Poland-59829095.jpg

Polish Tax Forms Stock Image Image Of Pit36 Financial 37234489

https://thumbs.dreamstime.com/z/polish-tax-forms-37234489.jpg

Polish Tax Stock Photo Image Of April Banks Count 36382586

https://thumbs.dreamstime.com/z/polish-tax-vertical-image-settlement-taxes-poland-36382586.jpg

On 1st of July 2022 the amendment entered into force changing the provisions from January 2022 under the so called Polish Deal 2 0 The changes assume inter alia reduction of PIT tax from 17 to 12 On 13 June 2022 the President signed an act amending the Personal Income Tax Act and certain other acts referred to as Polish Deal 2 0 The Act was published on 15 June and its effective date is 1 July 2022

From 1 January 2023 the next edition of the Polish Deal will come into force Taxable persons are facing major changes in the corporate income tax It should be emphasised however that the new Polish Deal did not wait for the new year On 7 October 2022 the Lower House of the Polish Parliament examined amendments to the Act amending the Act on Corporate Income Tax and certain other acts commonly referred to as Polish Deal 3 0 proposed by the Senate

Download Polish Tax Laws

More picture related to Polish Tax Laws

Polish Tax And Calculator Stock Photo Image Of Buck 37231706

https://thumbs.dreamstime.com/z/polish-tax-calculator-calculating-taxes-poland-currency-37231706.jpg

Polish Individual Income Tax Stock Image Image Of Bill Forms 50266427

https://thumbs.dreamstime.com/z/polish-individual-income-tax-filling-form-pit-money-pen-50266427.jpg

Tax Income Concept With Polish Tax Form Stock Photo Image Of Sales

https://thumbs.dreamstime.com/z/tax-income-concept-polish-form-forms-pit-word-tiles-means-personal-poland-237898202.jpg

On 26 July 2021 the Polish Ministry of Finance has presented detailed information regarding the planned changes in tax regulations coming into force as from 1 January 2022 all of which being part of the so called On 26 July 2021 the Polish Government announced draft legislation implementing broad tax reform The changes affect several areas of taxation including Corporate Income Tax CIT Personal Income Tax PIT and Value Added Tax VAT

The legislative work on the Polish Deal tax statutes is continuing with the amendments scheduled to take effect on 1 January 2022 The bill now being discussed in Parliament parliamentary document no 1532 sets out many significant changes for The basic tax rates applicable in Poland are 12 and 32 The 12 rate is used if the tax base does not exceed PLN 120 000 The 32 rate is used if the tax based exceeds this amount The tax 12 is additionally reduced by a degressive tax reducing

Polish Individual Income Tax Editorial Stock Image Image Of Money

https://thumbs.dreamstime.com/z/polish-individual-income-tax-filling-form-pit-money-pen-50266489.jpg

Tax Income Concept With Polish Tax Form Stock Photo Image Of Economic

https://thumbs.dreamstime.com/z/tax-income-concept-polish-form-forms-pit-cit-words-tiles-means-personal-company-poland-217324760.jpg

https://kpmg.com/pl/en/home/insights/2020/06/...

New general principles consensual forms of resolution of tax disputes and improving the efficiency of tax collection In June 2019 during the previous term of the Polish Parliament the lower house the Sejm received a bill of totally new Tax Ordinance proposed by the

https://www.podatki.gov.pl/en

Specific information about Corporate Income Tax CIT entities time limit for registration registering for CIT profits subject to CIT keepin of account tax rates tax exemption

Filling In Polish Tax Form Stock Image Image Of Pit37 13289691

Polish Individual Income Tax Editorial Stock Image Image Of Money

Polish Tax Form With Pen Stock Image Image Of Declaration 54270283

334 Polish Individual Income Tax Stock Photos Free Royalty Free

Polish Tax Form Stock Photo Image Of Coin Poland Pit36 37234810

Polish Income Tax Stock Image Image Of Beak Please 37282193

Polish Income Tax Stock Image Image Of Beak Please 37282193

Polish Tax Form With Cash Stock Image Image Of Income 80914541

Polish Tax Form With Cash Stock Image Image Of Business 80914227

Polish Tax Form PIT 36 Editorial Stock Photo Image Of Accountant

Polish Tax Laws - On 7 October 2022 the Lower House of the Polish Parliament examined amendments to the Act amending the Act on Corporate Income Tax and certain other acts commonly referred to as Polish Deal 3 0 proposed by the Senate