Tax Rebate On Home Loan In India Web 12 juin 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b

Web 7 janv 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Puri Web Income tax benefit on home loan is available under Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid These home loan tax

Tax Rebate On Home Loan In India

Tax Rebate On Home Loan In India

https://new-img.patrika.com/upload/2022/03/24/home_loan.jpg

Realtors Seek Tax Rebate On House Loans

https://images.assettype.com/dtnext/import/Images/Article/201602090046480107_Realtors-seek-tax-rebate-on-house-loans_SECVPF.gif

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Web 3 mars 2023 nbsp 0183 32 How Much Tax Save on a Home Loan 5 Income Tax Benefits on Home Loan Income Tax Rebate on Home Loan for Interest Paid Income Tax Rebate for Interest Paid on Loan During the Initial Web 10 mars 2021 nbsp 0183 32 Apart from deduction on the principal amount repaid on home loan a tax payer can also claim deduction on the interest paid on the home loan Deduction on the interest paid on a home loan is available

Web Answer An Individual can claim following tax benefits relating to home loan repayment 1 Deduction for interest on housing loan can be claimed u s 24 b under the head Income Web 21 f 233 vr 2023 nbsp 0183 32 Step 2 Submit These Documents to Your Employer If you claim interest on a home loan deduction you must inform your employer so they can adjust your TDS accordingly Therefore you won t have to wait

Download Tax Rebate On Home Loan In India

More picture related to Tax Rebate On Home Loan In India

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Oct 2016 Best Home Loan Interest Rates In 2016

https://myinvestmentideas.com/wp-content/uploads/2016/04/Latest-and-Lowest-Home-Loan-Interest-Rates-in-India-October-2016.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Web 31 mars 2019 nbsp 0183 32 You can claim INR 40 000 as a deduction in FY19 20 FY20 21 FY21 22 FY22 23 and FY23 24 The pre EMI deduction is subsumed under the overall limit of Section 24 and there is no provision to claim Web Income Tax Benefits on Home Loans The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than Web Here s how Section 80C Deductions under this section can help you with tax benefits of up to Rs 1 5 lakhs on the principal amount Section 24 Under this section you are allowed

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

https://theviralnewslive.com/wp-content/uploads/2023/02/income-tax-rebate-home-loan-Savings_11zon.jpg

List Of 100 Home Loan Finance In India 2017 Ideas Funaya Park

https://i.pinimg.com/originals/96/9d/e2/969de2a62cc7345fb0c2ac7f1ada159f.png

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b

https://economictimes.indiatimes.com/wealth/…

Web 7 janv 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Puri

Personal Loans Everything You Need To Know Clic Kado

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Latest Income Tax Rebate On Home Loan 2023

5 Tax Benefits Of Taking NRI Home Loans In India NRI Banking And

Home Loan Tax Benefits In India Important Facts

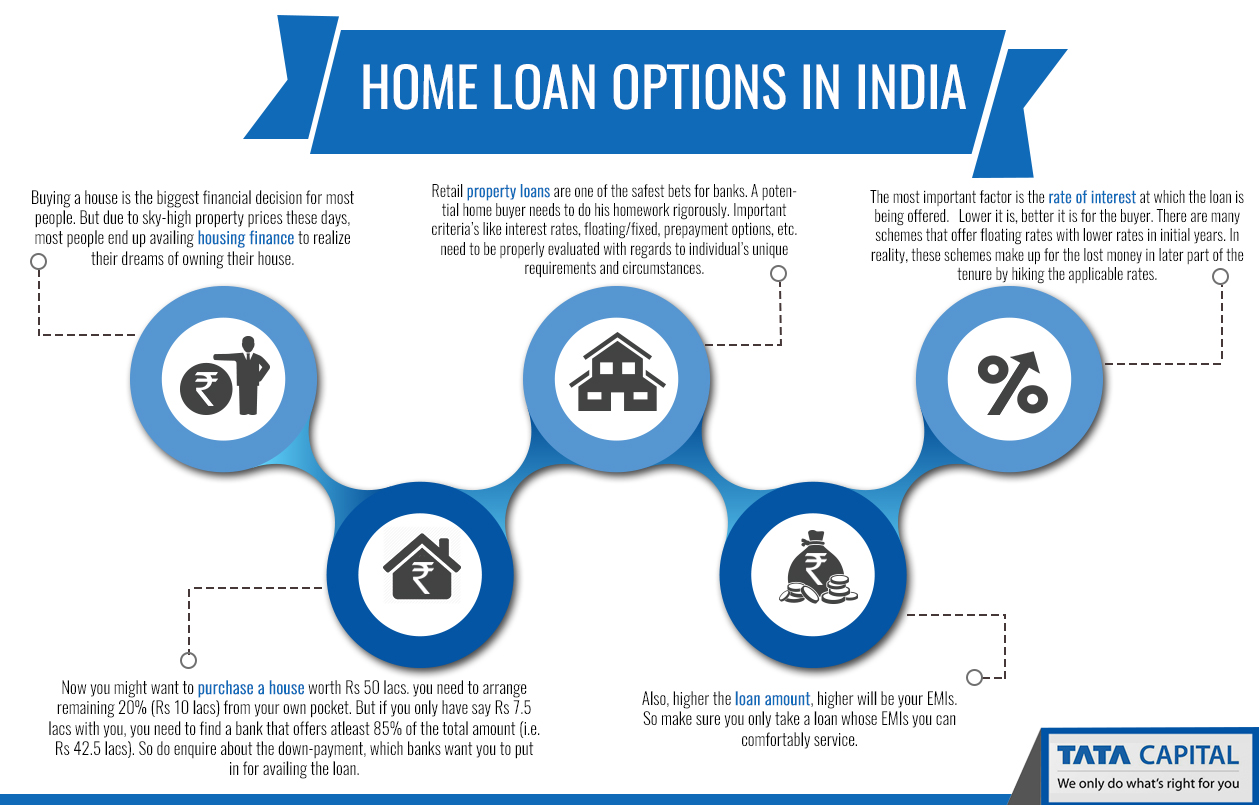

Home Loan Home Loans Online 8 05 Interest Rates Apply Now

Home Loan Home Loans Online 8 05 Interest Rates Apply Now

How Can I Deduct TDS On Home Loan In India Kanakkupillai

Download Home Loan Interest Rates In India Home

Home Loan Tax Rebate 5

Tax Rebate On Home Loan In India - Web 20 mars 2023 nbsp 0183 32 As per this provision a deduction of up to Rs 50 000 can be claimed on the interest paid towards a home loan for first time home buyers To claim this deduction