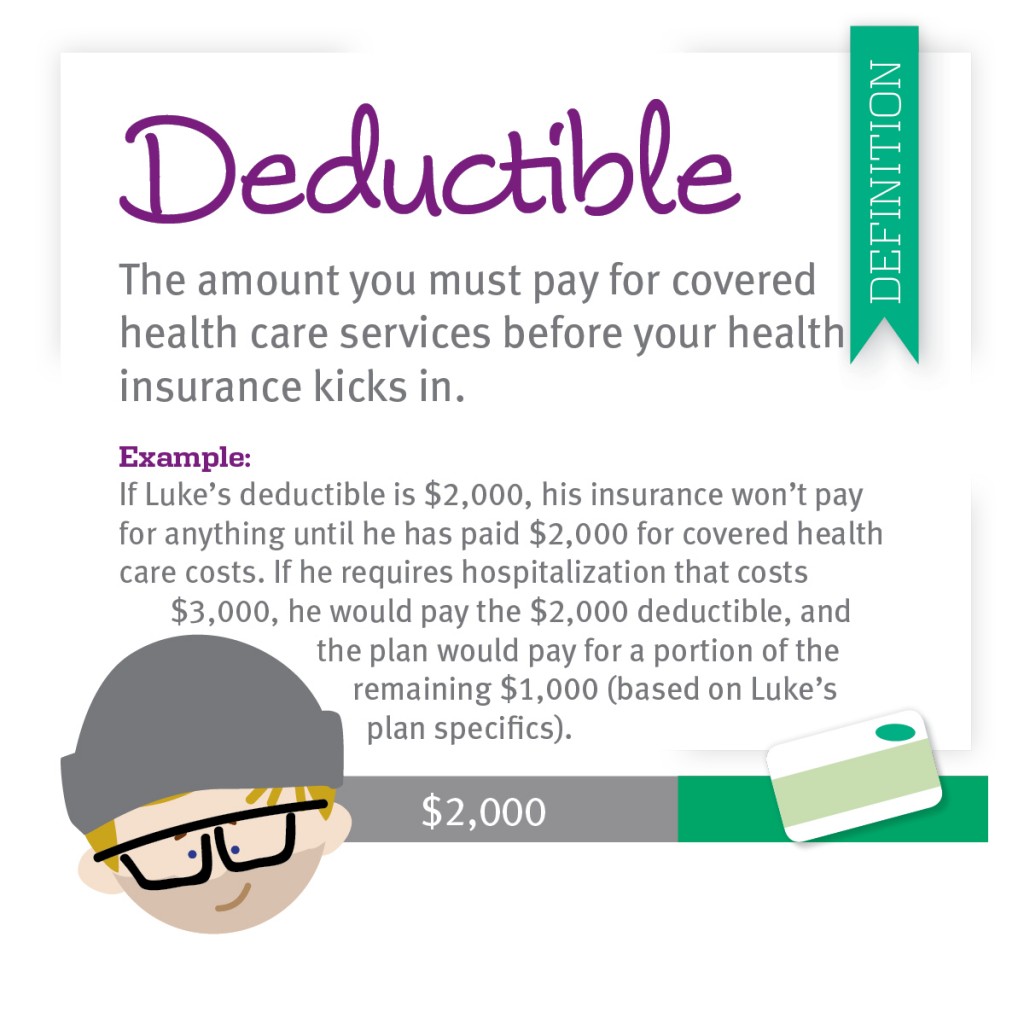

Private Health Insurance Premiums Tax Deductible Cra If you pay premiums for a private health insurance plan you may be eligible for a credit against your taxes Find out how to report these amounts on your income tax return

This plan meets the all or substantially all requirement because 92 70 10 12 of the premiums paid relate to medical expenses that are eligible for the METC while Private health insurance premiums Definition Health insurance coverage provided by a third party This is usually coverage purchased through an advisor and is separate from

Private Health Insurance Premiums Tax Deductible Cra

Private Health Insurance Premiums Tax Deductible Cra

https://www.investingbb.com/wp-content/uploads/2020/09/Untitled1.png

Views Life Insurance Premiums Tax Deductible Smsf Ato Update Broken Curve

https://www.budgetdirect.com.au/blog/wp-content/uploads/2018/06/Tax-Deduction-Table-final-1.png

Are Group Health Insurance Premiums Tax Deductible Loop

https://global-uploads.webflow.com/61b1902b9f28a2a852f7012f/61d688521d599df98e58d0ba_Are-Group-Health-Insurance-Premiums-Tax-Deductible-T.jpg

To find out what the CRA considers a private health services plan PHSP as of January 1 2015 go to New position on private health services plans Questions and answers A business may deduct Private Health Services Plan PHSP or Health Spending Account HSA payments made on behalf of employees and their dependants These payments

Premiums paid to a private health services plan such as extended health benefits or a dental plan other than those fees paid by an employer qualify as medical expenses for Employer paid premiums for disability income insurance DI personal health insurance and reimbursement style LTCI are not taxable employee benefits For businesses Yes as long as premiums are a reasonable

Download Private Health Insurance Premiums Tax Deductible Cra

More picture related to Private Health Insurance Premiums Tax Deductible Cra

Funeral Expenses Tax Deductible Cra Best Reviews

http://155.138.174.80/wp-content/uploads/2020/04/Funeral-Expenses-Tax-Deductible-Cra-780x470.jpg

Which Is Better Paying Health Insurance Premiums Pre Tax Or Post Tax

https://i1.wp.com/goneonfire.com/wp-content/uploads/2019/12/014b_Which-is-Better_-Paying-Health-Insurance-Premiums-Pre-Tax-or-Post-Tax_.png?fit=1920%2C1280&ssl=1

Are Medicare Premiums Tax Deductible Medicare Insurance

https://www.medicareinsurance.com/wp-content/uploads/2022/04/Are-Medicare-Premiums-Tax-Deductible.png

Did you know you can claim a portion of your family s health expenses and your health insurance premiums on your tax return Here s how it works The CRA considers private health services plan PHSP premiums payable to an insurance company to be deductible and that can include your premiums for your personal health

The CRA accepts that premiums paid for supplemental travel insurance coverage can also qualify for the METC if paid to a private health services plan for hospital or medical care Health care premiums paid to private health service plans are tax deductible medical expenses Taxpayers can claim health care premiums paid to plans that offer a wide

High Deductible Health Plan HDHP Pros And Cons

https://www.singlecare.com/blog/wp-content/uploads/2020/05/HighDeductibleHealthPlan.png

Qualified Business Income Deduction And The Self Employed The CPA Journal

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

https://turbotax.intuit.ca/tips/deducting-premiums...

If you pay premiums for a private health insurance plan you may be eligible for a credit against your taxes Find out how to report these amounts on your income tax return

https://www.canada.ca/.../private-health-services-plan.html

This plan meets the all or substantially all requirement because 92 70 10 12 of the premiums paid relate to medical expenses that are eligible for the METC while

Are Life Insurance Premiums Tax Deductible In Canada

High Deductible Health Plan HDHP Pros And Cons

Private Health Insurance Premiums To Rise By An Extra 140 A Year Sky

Are Medigap Premiums Tax Deductible 65Medicare

Health Care Decoded The Daily Dose CDPHP Blog

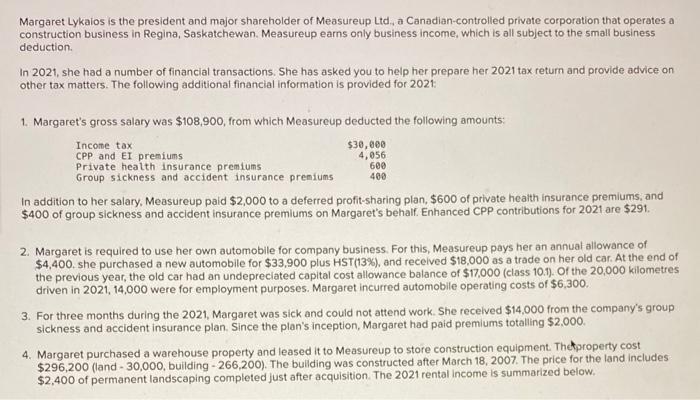

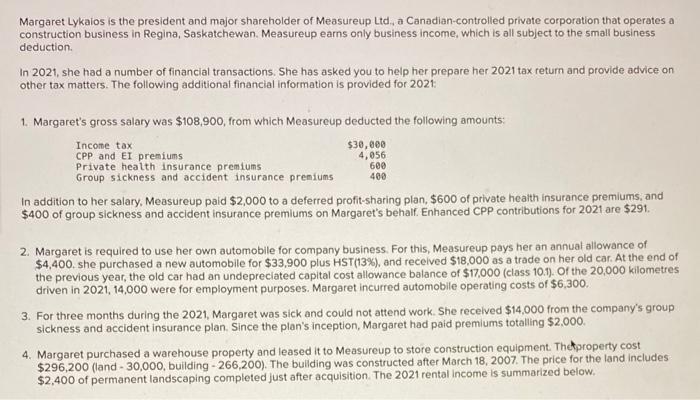

Margaret Lykaios Is The President And Major Chegg

Margaret Lykaios Is The President And Major Chegg

How Much Is Medicare Deductible For 2021 MedicareTalk

Are Health Premiums Tax Deductible Health Insurance FAQs

/universal-health-care-4156211_final-5737902ad86c462e930875d1c0878130.png)

What Is Universal Health Care

Private Health Insurance Premiums Tax Deductible Cra - Health Premiums unequivocally yes you can deduct that as eligible medical expenses LTD however since a payout will be tax free the premiums are also not tax deductible