Private Medical Insurance Tax Relief If you have private health insurance you can claim tax relief on the portion of those qualifying expenses not covered by your insurer You cannot claim relief for

As an employer providing medical or dental treatment or insurance to your employees you have certain tax National Insurance and reporting obligations What s included If you take out a business healthcare plan rather than a personal one you could be eligible for tax relief But don t forget when you offer private healthcare cover for employees as

Private Medical Insurance Tax Relief

Private Medical Insurance Tax Relief

https://www.bigstridz.com/wp-content/uploads/2020/03/a9c9f86a9cb75a9bedbe04081752f801.jpeg

Can Private Health Insurance Be Made More Affordable

https://www.2gb.com/wp-content/uploads/sites/2/2019/03/30647796_l.jpg

25 Best Private Health Insurance Companies In The World

https://lovinghomecareinc.com/wp-content/uploads/2021/10/25-Best-Private-Health-Insurance-Companies-In-The-World.png

If you are a limited company you will be able to claim tax relief on your private healthcare premiums as a business expense and it would benefit the business Private health insurance is often not tax deductible in the UK since it cannot be classified as a pure company expenditure Employees may get tax free medical benefits like the

If you are an overseas visitor who is not eligible for Medicare you are not entitled to any private health insurance rebate However you can still purchase a The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased

Download Private Medical Insurance Tax Relief

More picture related to Private Medical Insurance Tax Relief

Rajkotupdates News Tax Saving Pf Fd And Insurance Tax Relief

https://techkari.com/wp-content/uploads/2022/06/Tax-Saving-PF-FD-and-Insurance-Tax-Relief-With-the-commencement-of-the-Income-Tax-Return-ITR.jpg

Private Medical Insurance Morgan Law

https://www.morganlawfinancialservices.co.uk/wp-content/uploads/2016/04/Private-Medical-Insurance-768x512.jpg

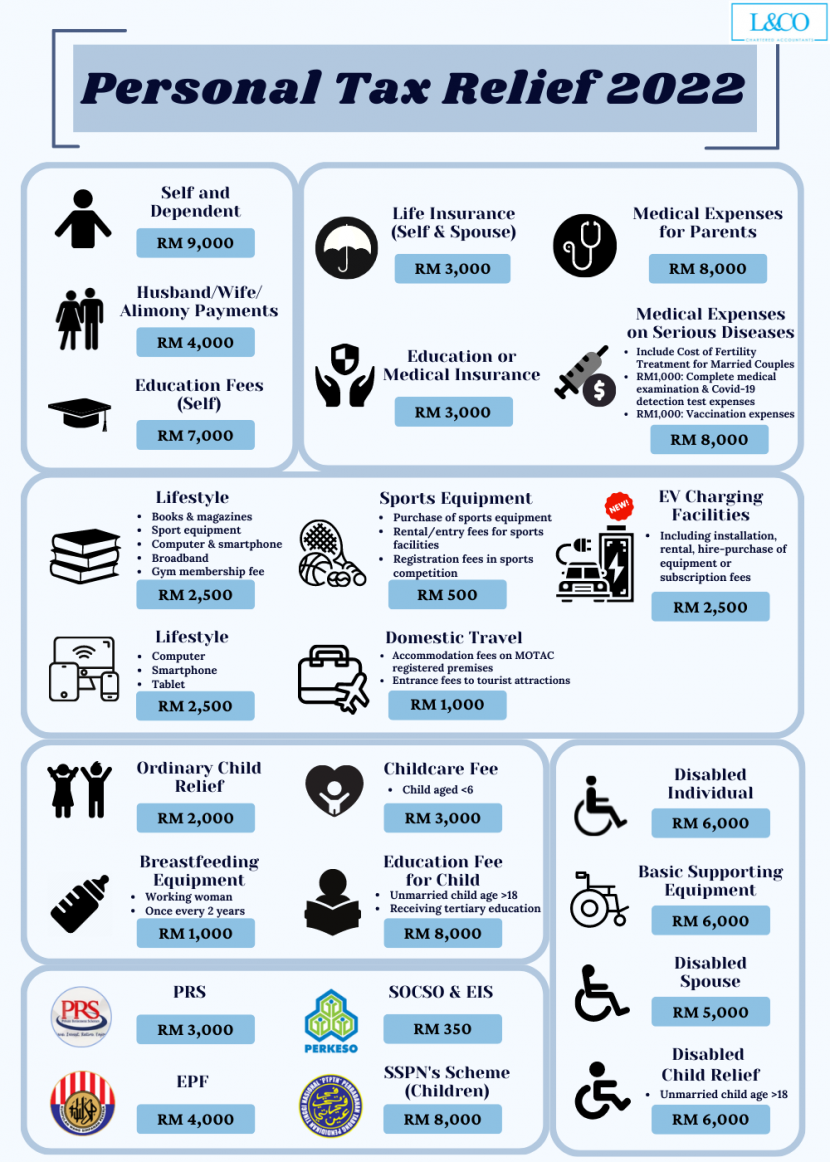

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/Personal-Tax-Relief-2022-1-830x1162.png

Private health insurance rebate The private health insurance rebate is a government contribution to help with the cost of your private health insurance QC 65037 Find out If you claim your rebate as a tax offset in your income tax return we will apply the adjusted rebate percentages to determine your correct private health

You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40 You pay your employee s medical insurance policy of 800 1 000 less tax relief of 200 You must deduct Income Tax PRSI and USC on the gross amount

Tax Relief Malaysia Want To Maximise Tax Relief With Your Medical

https://www.ibanding.my/wp-content/uploads/2017/09/Green-Tax-Jar-min.jpg

Private Medical Insurance Protection Advice GS Mortgage

https://img77.uenicdn.com/image/upload/v1624971146/service_images/shutterstock_1673001205.jpg

https://www.citizensinformation.ie/en/money-and...

If you have private health insurance you can claim tax relief on the portion of those qualifying expenses not covered by your insurer You cannot claim relief for

https://www.gov.uk/expenses-and-benefits-medical-treatment

As an employer providing medical or dental treatment or insurance to your employees you have certain tax National Insurance and reporting obligations What s included

Malaysia Income Tax Here Are The Tax Reliefs To Claim For YA 2022

Tax Relief Malaysia Want To Maximise Tax Relief With Your Medical

Group Private Medical Insurance

/cdn.vox-cdn.com/uploads/chorus_image/image/63037764/private_healthcare.0.jpg)

Debate Over Eliminating Private Health Insurance Offers A False Choice

Personal Tax Relief 2021 L Co Accountants

Private Health Insurance Agent Why You Don t Need Private Health

Private Health Insurance Agent Why You Don t Need Private Health

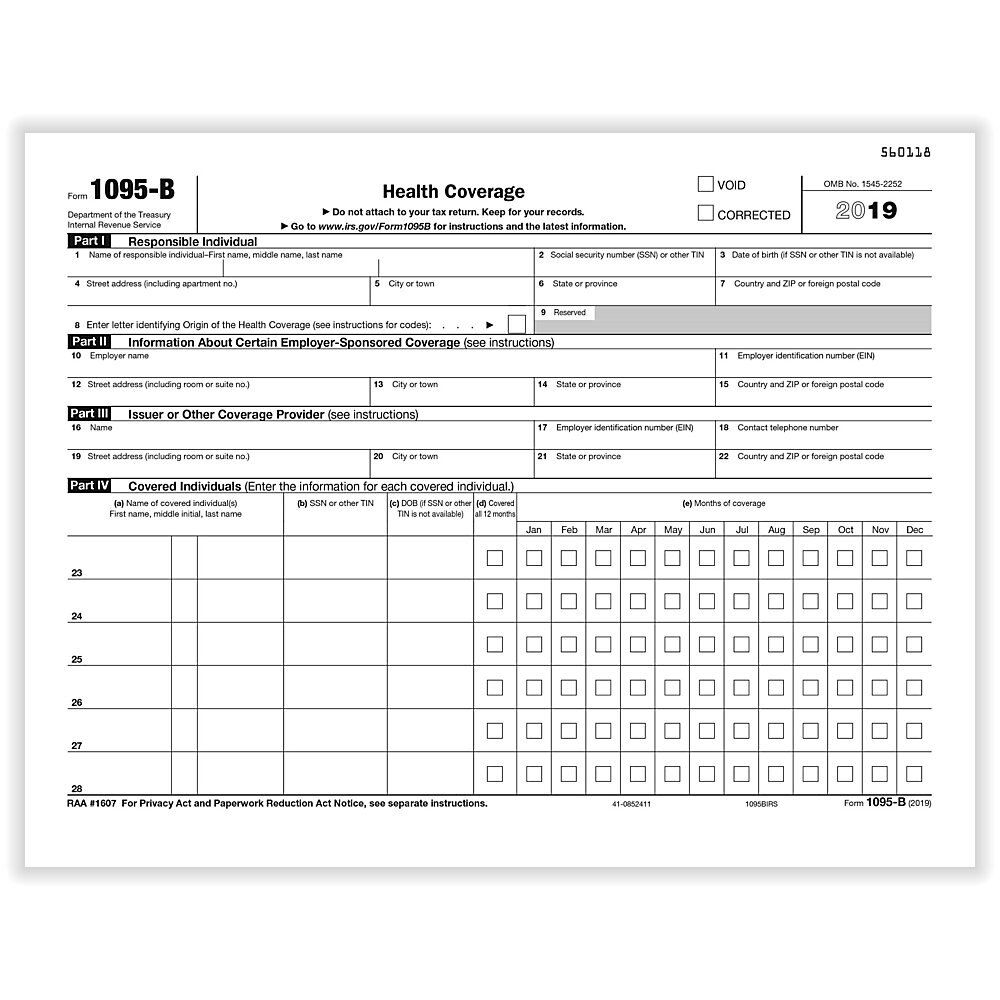

What Tax Forms Do I Need For Employee Health Insurance 2023

10 Common Misconceptions About Private Medical Insurance

Private Health Insurance Uk

Private Medical Insurance Tax Relief - Private health insurance is often not tax deductible in the UK since it cannot be classified as a pure company expenditure Employees may get tax free medical benefits like the