Professional Tax Deduction Central Government Employees For salaried individuals their respective employers will pay the professional tax on the employee s behalf This professional tax paid by the employer will be visible

Income Tax for Central Government Employees and Pensioners Table of Contents show What is Salary As per section 15 of the Act the following incomes are State governments impose professional taxes on people who work in certain professions or occupations but the central government levies income taxes on people s

Professional Tax Deduction Central Government Employees

Professional Tax Deduction Central Government Employees

https://i.ytimg.com/vi/pym2Epo0fsA/maxresdefault.jpg

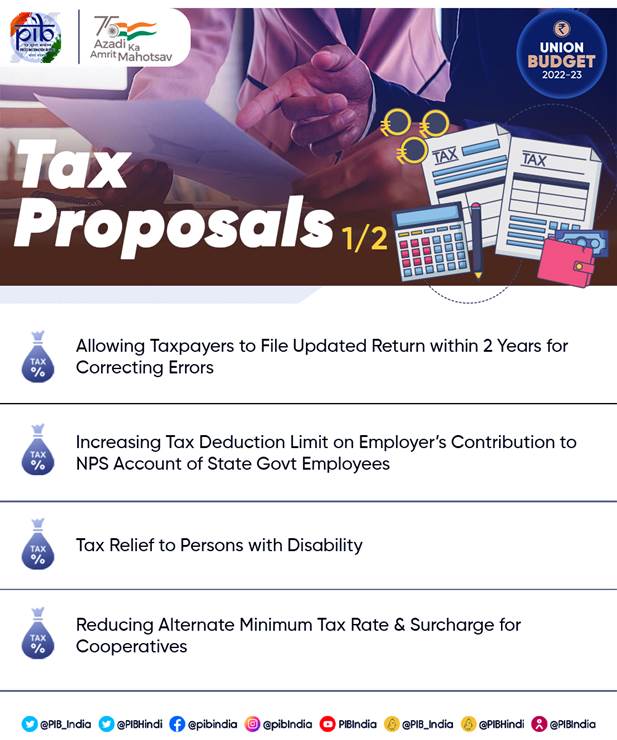

Tax Deduction Limit Increased To 14 On Employers Contribution To NPS

https://www.igecorner.com/wp-content/uploads/2022/02/2.png

7th Pay Commission Central Government Employees Shows Dissatisfaction

https://cdn.zeebiz.com/sites/default/files/2017/07/24/22060-rupee2-ians.JPG

Employers are typically required to deduct professional tax from their employee s salaries and remit it to the state government Moreover Self employed Section 80CCD 2 provides that employees can claim a deduction on the NPS contribution of up to 10 of salary 14 of salary for Central Government made by the employer They can split their NPS

According to this section the professional tax that an employee pays is allowed as a deduction from their gross salary while filing their income tax returns P tax Section 80CCD 2 allows a salaried individual to claim the following deduction Central Government or State Government Employer Up to 14 of their

Download Professional Tax Deduction Central Government Employees

More picture related to Professional Tax Deduction Central Government Employees

Creating Professional Tax Deduction Pay Head

https://help.tallysolutions.com/docs/te9rel49/Payroll/Images/025_creating_professional_tax_deduction_pay_head.gif

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction-913x1024.jpg

Diwali Bonanza Non Productivity Linked Bonus 2022 Approved For Central

https://cdn.zeebiz.com/sites/default/files/2022/10/12/204844-7th-pay-commission-house-building-advance.jpg

Employers deduct the professional tax amount from the employees salaries and remit it to the state government on their behalf The tax amount deducted depends Professional Tax Tax on Profession trade calling and employment Government servant receiving pay from the revenue of the Central Government or any State Government

Further the employer s contribution towards NPS Tier I is eligible for tax deduction under Section 80CCD 2 of the Income Tax Act 14 of salary for government employees This rebate is over and The profession tax is imposed on the people by the particular Municipal corporations and maximum of the Indian states impose this duty or tax The state

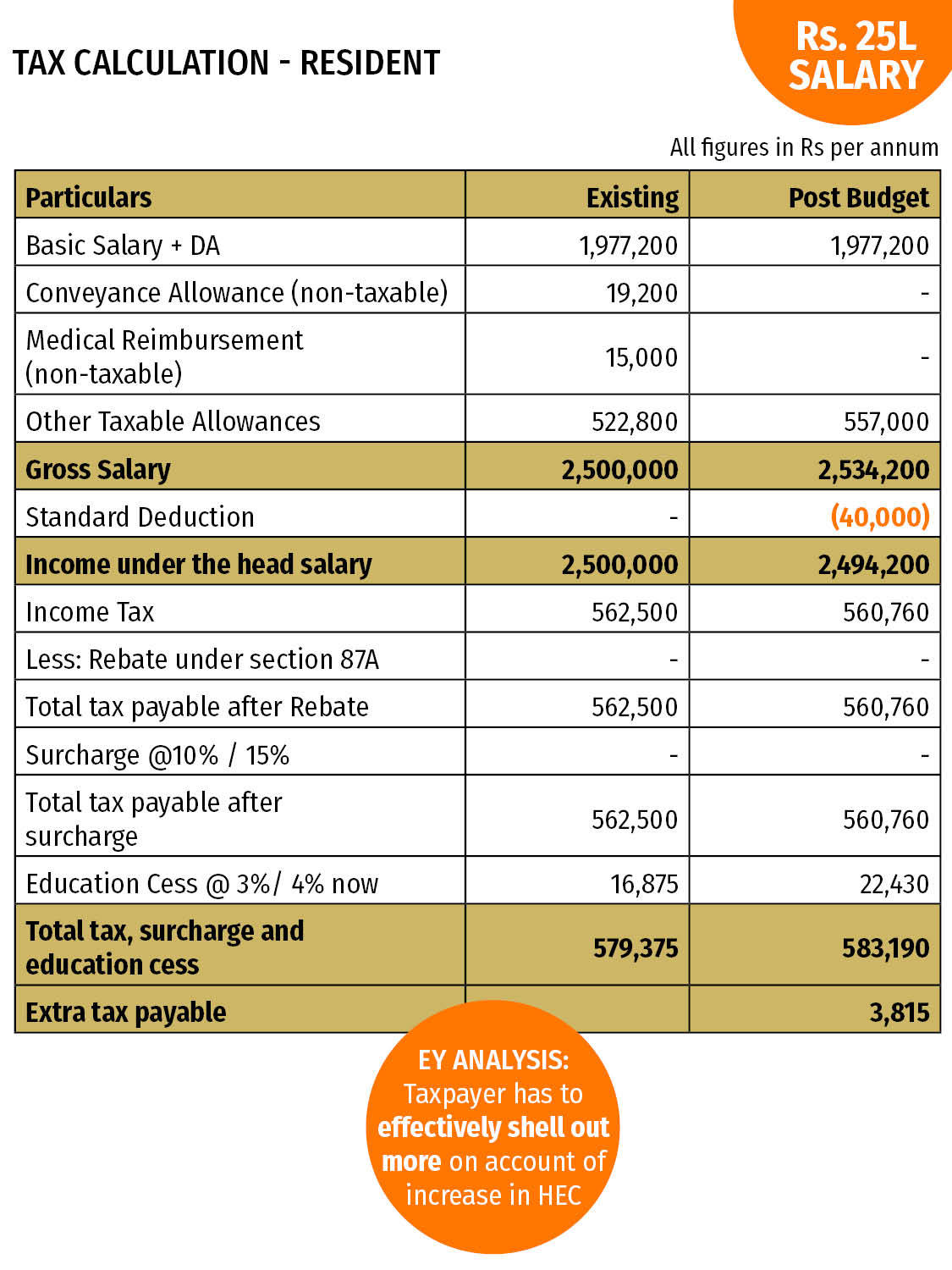

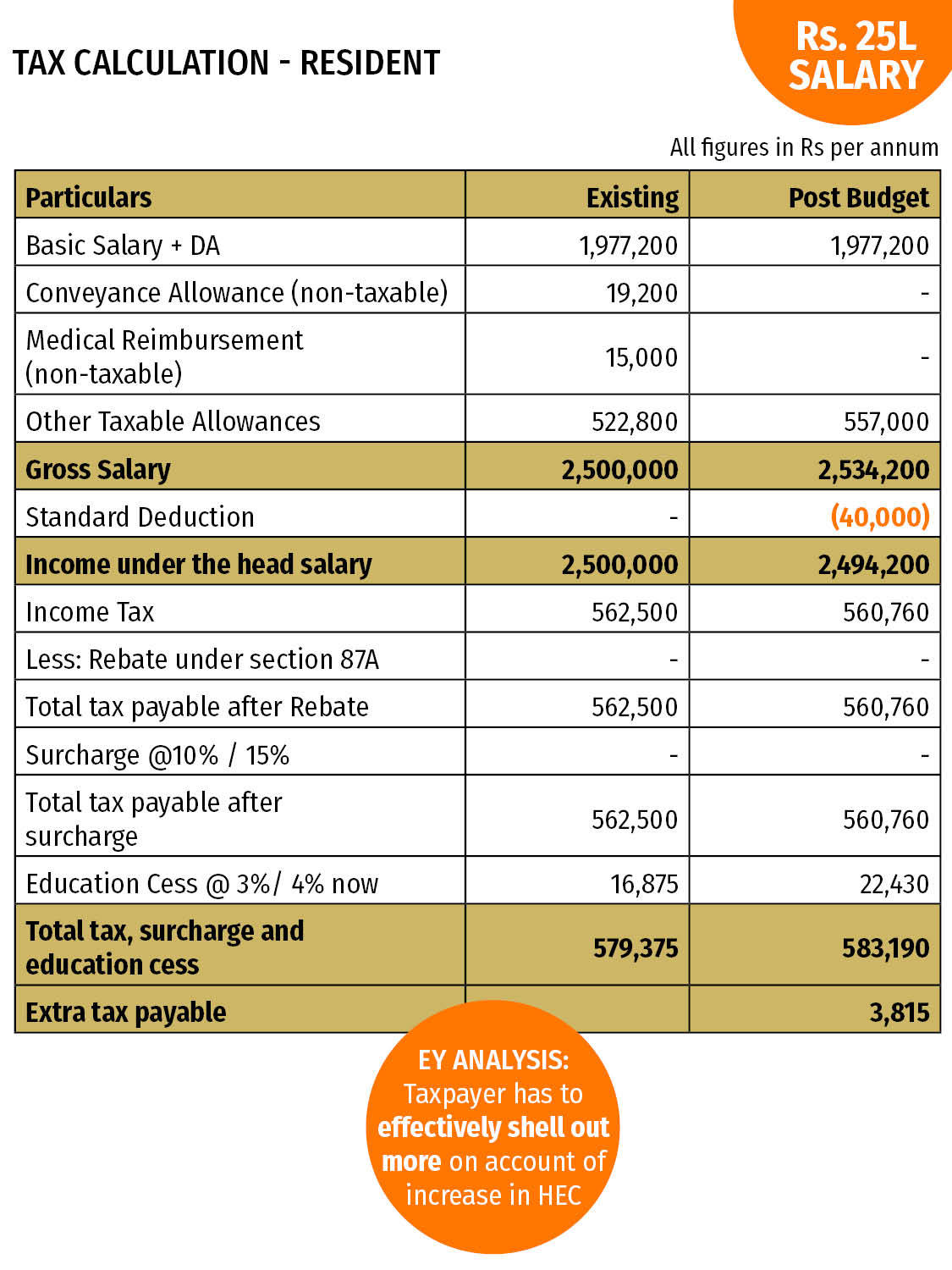

How Does Tax Deduction Work In India Tax Walls

https://img.etimg.com/photo/msid-62914500/resident_gti_25l_salary-std-ded.jpg

7th Pay Commission Pension Calculator For Government Employees

https://teutschool.in/wp-content/uploads/2023/03/7th-Pay-Commission-Pension-Calculator-for-Central-Government-Employees.jpg

https://economictimes.indiatimes.com/wealth/tax/...

For salaried individuals their respective employers will pay the professional tax on the employee s behalf This professional tax paid by the employer will be visible

https://www.igecorner.com/income-tax

Income Tax for Central Government Employees and Pensioners Table of Contents show What is Salary As per section 15 of the Act the following incomes are

What Is A Professional Tax Payment Eligibility To Pay PT

How Does Tax Deduction Work In India Tax Walls

Confederation Of Central Government Employees Workers

Salary Deduction Letter To Employee For Loan Dollar Keg

Confederation Of Central Government Employees Workers

Confederation Of Central Government Employees Workers

Confederation Of Central Government Employees Workers

Tax Deduction Limit Increased To 14 On Employers Contribution To NPS

Centre Increases DA For Government Employees

Confederation Of Central Government Employees Workers

Professional Tax Deduction Central Government Employees - Section 80CCD 2 allows a salaried individual to claim the following deduction Central Government or State Government Employer Up to 14 of their