Property Tax Appeal Colorado Springs When you start a property tax assessment appeal you are asking the court to look at the amount of taxes that were assessed on your property For more information about

An appeal of the decision of the County Board of Equalization must be made no later than 30 days after the date the decision was mailed to you 39 8 107 C R S You can file An appeal needs to explain why the value is incorrect or unfair and include supporting documentation That includes comparing the property to similar ones sold prior to the end of June last

Property Tax Appeal Colorado Springs

Property Tax Appeal Colorado Springs

https://bringithomecoloradosprings.com/wp-content/uploads/2021/08/michael-dziedzic-0TPT2B2VsxU-unsplash-1080x675.jpg

Appraisal Of Home For Property Tax Reduction Appeals In The Los Angeles

https://hooksandassociates.com/images/property-tax-appeal.png

Short And Sweet Tips To Win A Property Tax Appeal

https://www.fair-assessments.com/hubfs/win a property tax appeal.jpg

To contest your tax bill you must appeal to the proper tax body at the proper time The below chart provides guidance on the entities that hear tax appeals and the timeframes to appeal County Assessor Please call the BAA at 303 864 7710 or email us at baa state co us with questions or to schedule an in person appointment We are unable to waive jurisdictional filing

In May of re appraisal years a Notice of Valuation NOV is mailed to ALL property owners This is NOT a tax bill The purpose of the NOV is to notify you of any change in your property valuation and inform you of your Hours Monday Friday 8 00 a m 4 30 p m Office Closed Legal Holidays Location Citizens Service Center 1675 W Garden of the Gods Road Suite 2300 Colorado Springs CO 80907 Parcel Search

Download Property Tax Appeal Colorado Springs

More picture related to Property Tax Appeal Colorado Springs

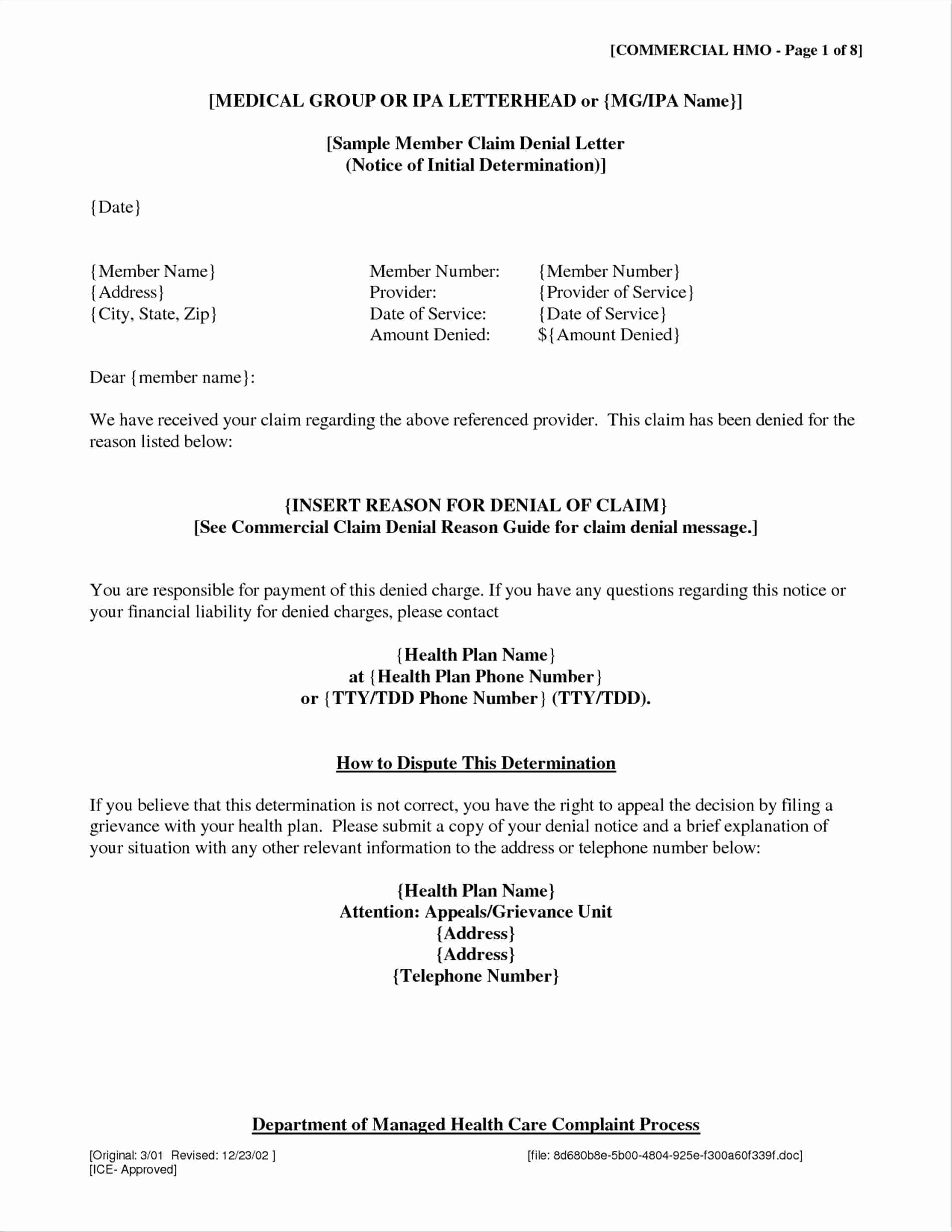

Sample Appeal Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/497/330/497330247/large.png

Top Rated Property Tax Appeal Appraisals Services In St Louis By

https://image.isu.pub/230314075606-cd1a09cbc84290ee34fd02308c7661d6/jpg/page_1.jpg

County Property Taxes On The Rise The Oglethorpe Echo

https://www.theoglethorpeecho.com/sites/theoglethorpeecho.com/files/2022-06/Property Tax Appeal_0.jpg

Lawyers can file your appeal undertake comparative analysis of your home s value against your neighbors and account for individual allowances that are not considered by the Tax A You can submit an appeal by June 8 online by finding your property in the link above and clicking on the appeals link in person or by mail to assessor s office

Taxpayers may appeal a CBOE decision to the BAA district court or binding arbitration A taxpayer who has opted to file an appeal with the BAA will provide a copy of the If you re grappling with a property tax appeal our experienced Realtors are here to help you By leveraging their market expertise they can effectively guide you

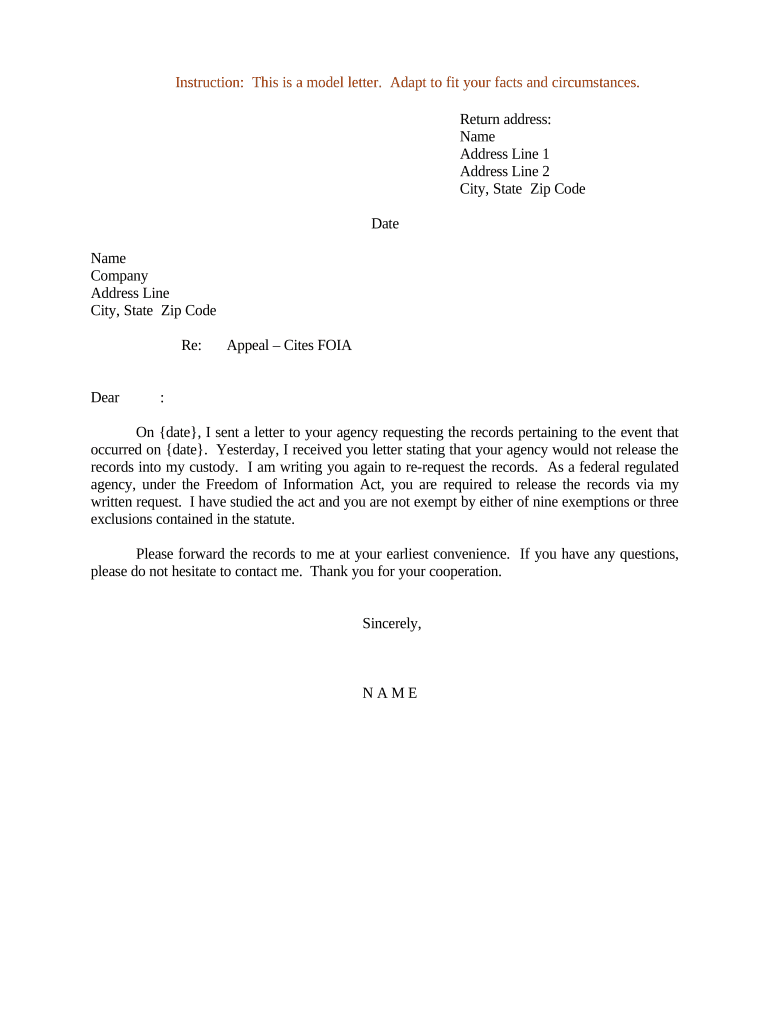

Tax Appeal Letter Sample

https://www.doctemplates.net/wp-content/uploads/2021/02/Property-Tax-Appeal-Letter-Sample-03_.jpg

Property Tax Cut In Colorado From Coronavirus Colorado Hard Money

https://coloradohardmoney.com/wp-content/uploads/2020/07/flat-tops-wildflowers.jpg

https://www.coloradojudicial.gov/self-help/property-tax-appeal

When you start a property tax assessment appeal you are asking the court to look at the amount of taxes that were assessed on your property For more information about

https://www.coloradojudicial.gov/sites/default...

An appeal of the decision of the County Board of Equalization must be made no later than 30 days after the date the decision was mailed to you 39 8 107 C R S You can file

Tax Season Tips From Sars Springs Advertiser

Tax Appeal Letter Sample

Colorado s Low Property Taxes Colorado Fiscal Institute

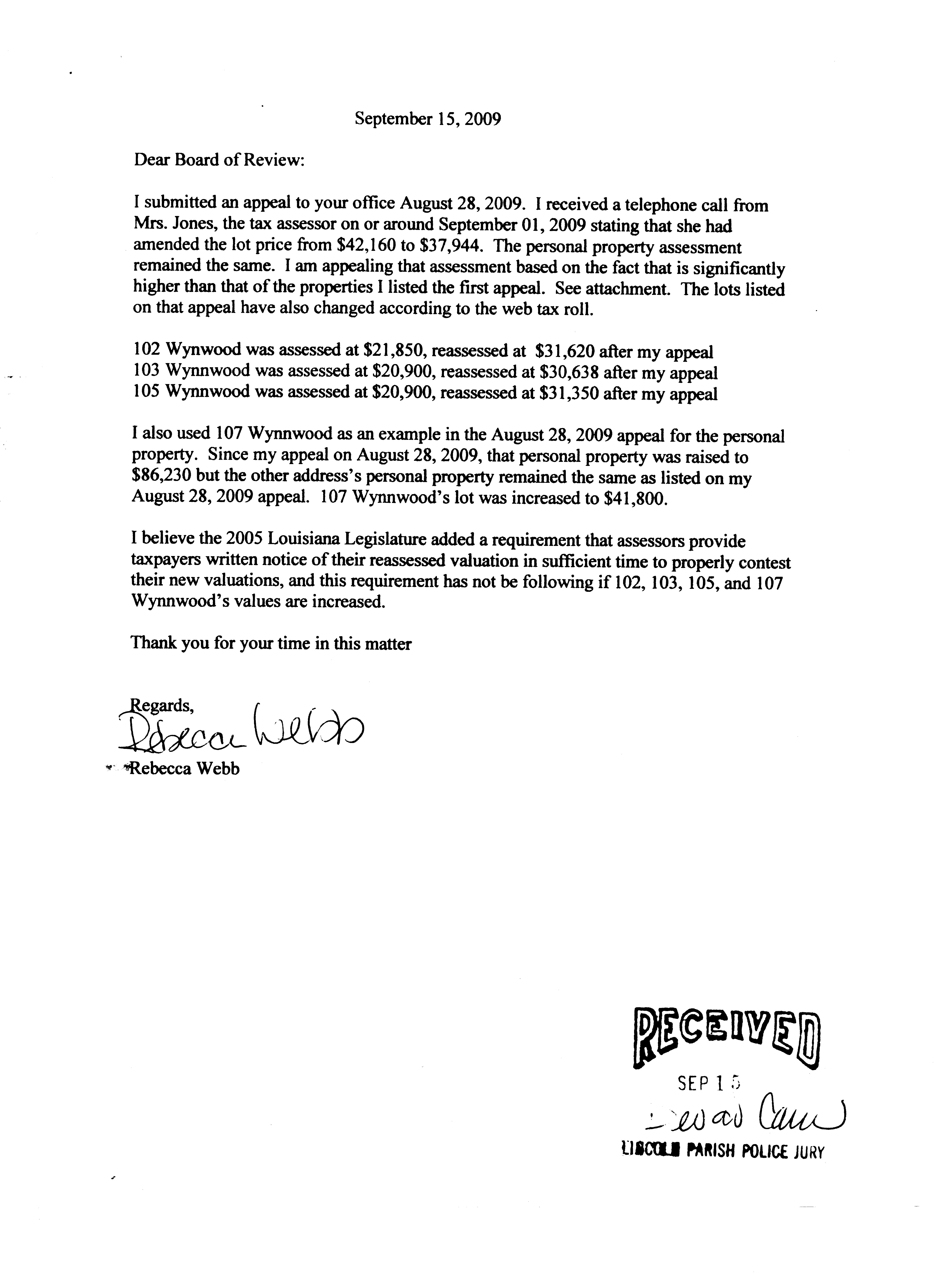

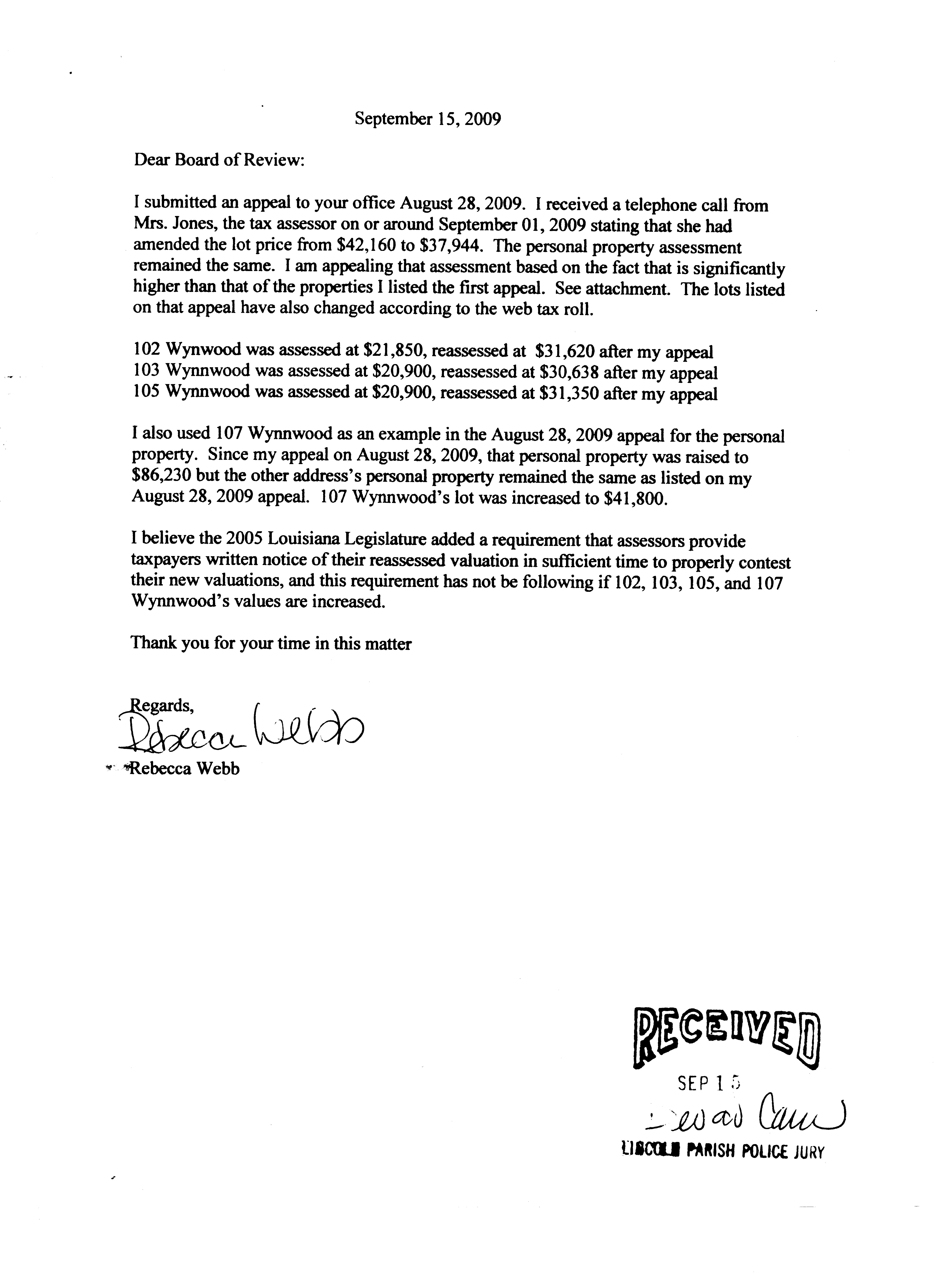

Property Tax Appeal Letter Template Collection Letter Template

Property Tax Appeals 2022 Board Of Review Opens Group 2 Kensington

Property Tax Appeal Letter Template Collection Letter Template

Property Tax Appeal Letter Template Collection Letter Template

Pin On East Colorado Springs

Property Tax Appeal Letter Template Collection Letter Template

Property Tax Appeals Definition Reasons For Appeal Process

Property Tax Appeal Colorado Springs - Please call the BAA at 303 864 7710 or email us at baa state co us with questions or to schedule an in person appointment We are unable to waive jurisdictional filing