Property Tax Deduction Limit 2022 Married Filing Jointly The maximum deduction allowed for state local and property taxes combined is 10 000 So if you paid 5 000 in state and local taxes and 10 000 in property taxes you can deduct 5 000 of the

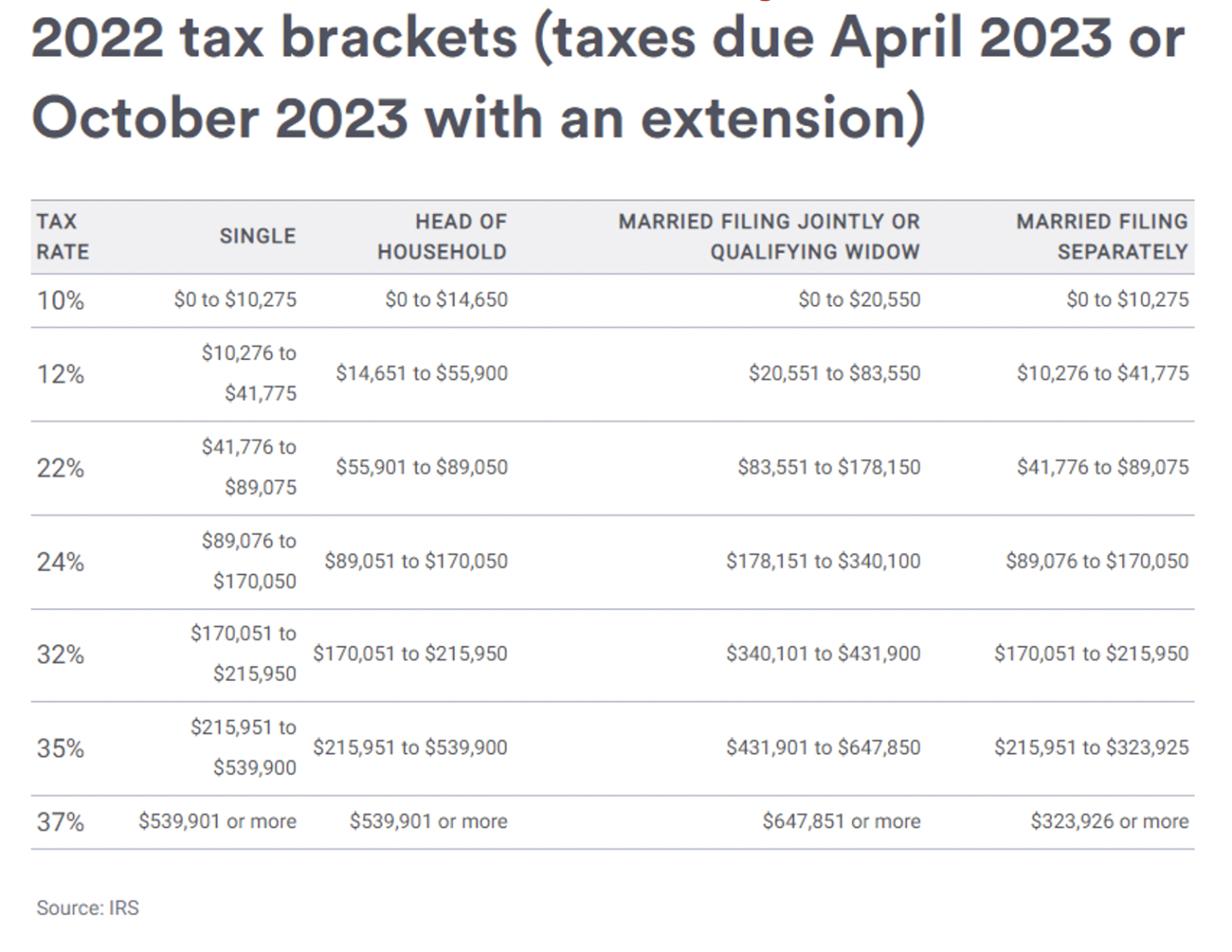

For tax year 2022 the standard deduction is 12 950 for single filers and 25 900 for married couples filing jointly The 2023 standard deduction for married couples filing jointly is 27 700 This applies to taxes filed by April 15 2024 or by Oct 15 2024 with an extension

Property Tax Deduction Limit 2022 Married Filing Jointly

Property Tax Deduction Limit 2022 Married Filing Jointly

https://i2.wp.com/wpdev.abercpa.com/wp-content/uploads/2018/06/married-filing-jointly-tax-brackets.png

11 MMajor Tax Changes For 2022 Pearson Co CPAs

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM-1536x1187.png

2022 Income Tax Brackets And The New Ideal Income

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2021/11/2022-income-tax-rates-married-filing-jointly.png?fit=1456

As an individual your deduction of state and local income general sales and property taxes is limited to a combined total deduction of 10 000 5 000 if married Itemized property tax deductions Starting in 2018 the maximum deduction for state and local taxes SALT is 5 000 for people filing as individuals or as married filing

The capital loss deduction limit is 1 500 each when filing separately vs 3 000 on a joint return When should married couples file taxes separately Despite the numerous If you qualify for an exclusion on your home sale up to 250 000 500 000 if married and filing jointly of your gain will be tax free If your gain is more than that amount or if you

Download Property Tax Deduction Limit 2022 Married Filing Jointly

More picture related to Property Tax Deduction Limit 2022 Married Filing Jointly

Standard Deduction Married Filing Jointly And Surviving Spouses Single

https://answerhappy.com/download/file.php?id=165579

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Potentially Bigger Tax Breaks In 2023

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

The total deduction allowed for all state and local taxes for example real property taxes personal property taxes and income taxes or sales taxes is limited to 10 000 or For spouses filing as married filing separately with a joint obligation for home mortgage interest and real estate taxes the deduction for these items is allowable to the spouse

Therefore the tax free limit for married couples filing their returns jointly is not applicable in India However there are certain deductions and exemptions available If you re a homeowner you can claim the property tax deduction up to 10 000 5 000 for married filing separately Read this complete guide before you file

Marriage Tax Calculator CarysVeronica

https://imageio.forbes.com/specials-images/imageserve/5dc2fd27f049680007f83766/MFS-2020/960x0.jpg?height=308&width=711&fit=bounds

IRS Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax

https://www.mondaq.com/images/article_images/1132100a.jpg

https://www.thebalancemoney.com/prop…

The maximum deduction allowed for state local and property taxes combined is 10 000 So if you paid 5 000 in state and local taxes and 10 000 in property taxes you can deduct 5 000 of the

https://money.usnews.com/money/personal-finance/...

For tax year 2022 the standard deduction is 12 950 for single filers and 25 900 for married couples filing jointly

IRS 2021 Tax Tables Deductions Exemptions Purposeful finance

Marriage Tax Calculator CarysVeronica

What Is My Tax Bracket 2022 Blue Chip Partners

2021 Tax Changes And Tax Brackets

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

Irs Tax Table 2022 Married Filing Jointly Latest News Update

Irs Tax Table 2022 Married Filing Jointly Latest News Update

2022 Tax Brackets Lashell Ahern

2022 To 2023 Tax Brackets TAX

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Property Tax Deduction Limit 2022 Married Filing Jointly - This limit is 10 000 for single filers and married couples filing jointly and 5 000 for married couples filing separately This means that if you pay more than