Property Tax Deduction Limit 2023 Married Jointly The standard deduction amounts for 2023 are Single 13 850 Married filing jointly 27 700 Head of household 20 800 Married filing separately if eligible

The deduction for state and local taxes including real estate taxes is limited to 10 000 5 000 if married filing separately See the Instructions for Schedule A Form 1040 Mortgages you or your spouse if married filing a joint return took out after December 15 2017 to buy build or substantially improve your home called home acquisition debt but only if throughout 2023 these

Property Tax Deduction Limit 2023 Married Jointly

Property Tax Deduction Limit 2023 Married Jointly

https://images.squarespace-cdn.com/content/v1/572ff08b044262a7f8c2405e/8bc7988f-9419-4265-8fc0-3f3f15f81c4e/MFJ+%26+Single

Potentially Bigger Tax Breaks In 2023

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

2022 Tax Brackets Married Filing Jointly Irs Printable Form

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

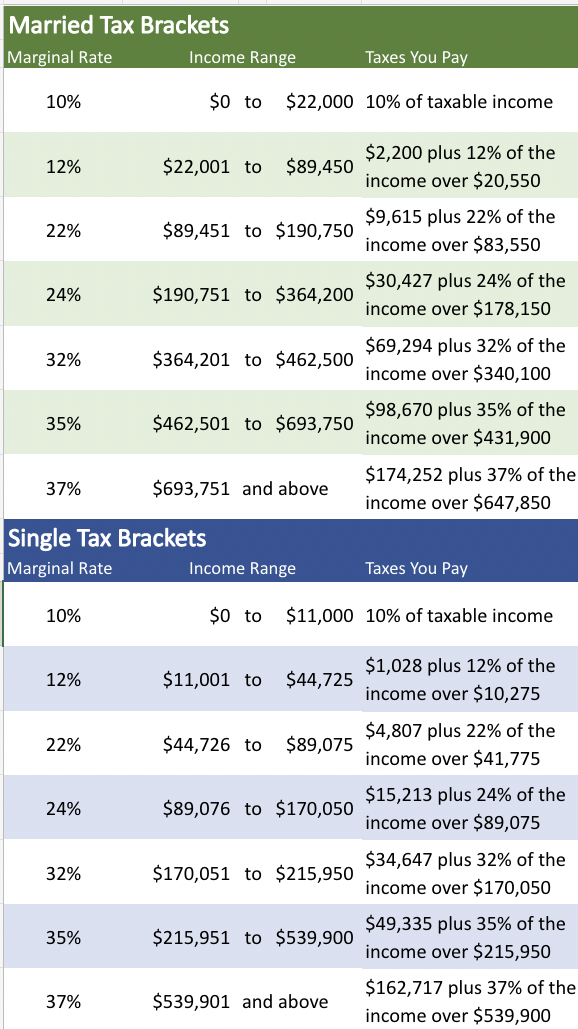

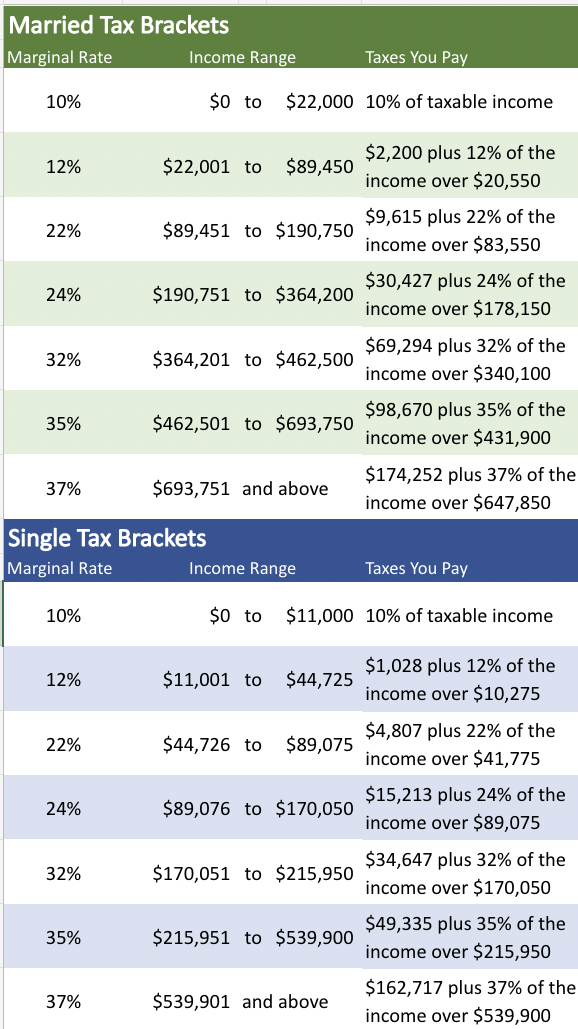

For single taxpayers and those married filing separately the standard deduction rises to 13 850 for 2023 up 900 from the 12 950 in tax year 2022 The In 2023 the standard deduction breaks down like this For single and married individuals filing taxes separately the standard deduction is 13 850 For married couples filing jointly the standard deduction is

As an individual your deduction of state and local income general sales and property taxes is limited to a combined total deduction of 10 000 5 000 if married If you are married and filing jointly or file as a qualifying widow er your 2023 standard deduction jumps to 27 700 Mortgage interest deduction limit 2023 As stated

Download Property Tax Deduction Limit 2023 Married Jointly

More picture related to Property Tax Deduction Limit 2023 Married Jointly

Married Tax Brackets 2021 Westassets

https://i2.wp.com/wpdev.abercpa.com/wp-content/uploads/2018/06/married-filing-jointly-tax-brackets.png

Inflation Impacts 2023 Tax Changes NovaDius

https://cdn.novadius.com/uploads/2022/10/25152220/taxes.png

11 MMajor Tax Changes For 2022 Pearson Co CPAs

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM-1536x1187.png

For spouses filing as married filing separately or married filing jointly the total home mortgage interest and real estate taxes claimed by both spouses combined may not You can only deduct your property taxes if you itemize your deductions on Schedule A of Form 1040 This means that your total itemized deductions must exceed

If you re a homeowner you can claim the property tax deduction up to 10 000 5 000 for married filing separately Read this complete guide before you file The IRS caps the property tax deduction at 10 000 5 000 if you re married filing separately 1 You may think O h good I don t pay that much for property

Standard Deduction Married Filing Jointly And Surviving Spouses Single

https://answerhappy.com/download/file.php?id=165579

Marriage Tax Calculator CarysVeronica

https://imageio.forbes.com/specials-images/imageserve/5dc2fd27f049680007f83766/MFS-2020/960x0.jpg?height=308&width=711&fit=bounds

https://www.usatoday.com/.../standard-deductions-2023

The standard deduction amounts for 2023 are Single 13 850 Married filing jointly 27 700 Head of household 20 800 Married filing separately if eligible

https://www.irs.gov/publications/p530

The deduction for state and local taxes including real estate taxes is limited to 10 000 5 000 if married filing separately See the Instructions for Schedule A Form 1040

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

Standard Deduction Married Filing Jointly And Surviving Spouses Single

2021 Tax Changes And Tax Brackets

IRS 2021 Tax Tables Deductions Exemptions Purposeful finance

2023 Cost Living Adjustments Contribution Limits Bethesda CPA

What Is My Tax Bracket 2022 Blue Chip Partners

What Is My Tax Bracket 2022 Blue Chip Partners

IRS Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Property Tax Deduction Limit 2023 Married Jointly - For 2023 they ll get the regular standard deduction of 27 700 for a married couple filing jointly They also both get an additional standard deduction amount of