Virginia Tax Rebate Eligibility Web 19 sept 2022 nbsp 0183 32 The Virginia Department of Taxation s rebate lookup tool just needs your Social Security number or Individual Tax Identification Number ITIN and your zip code

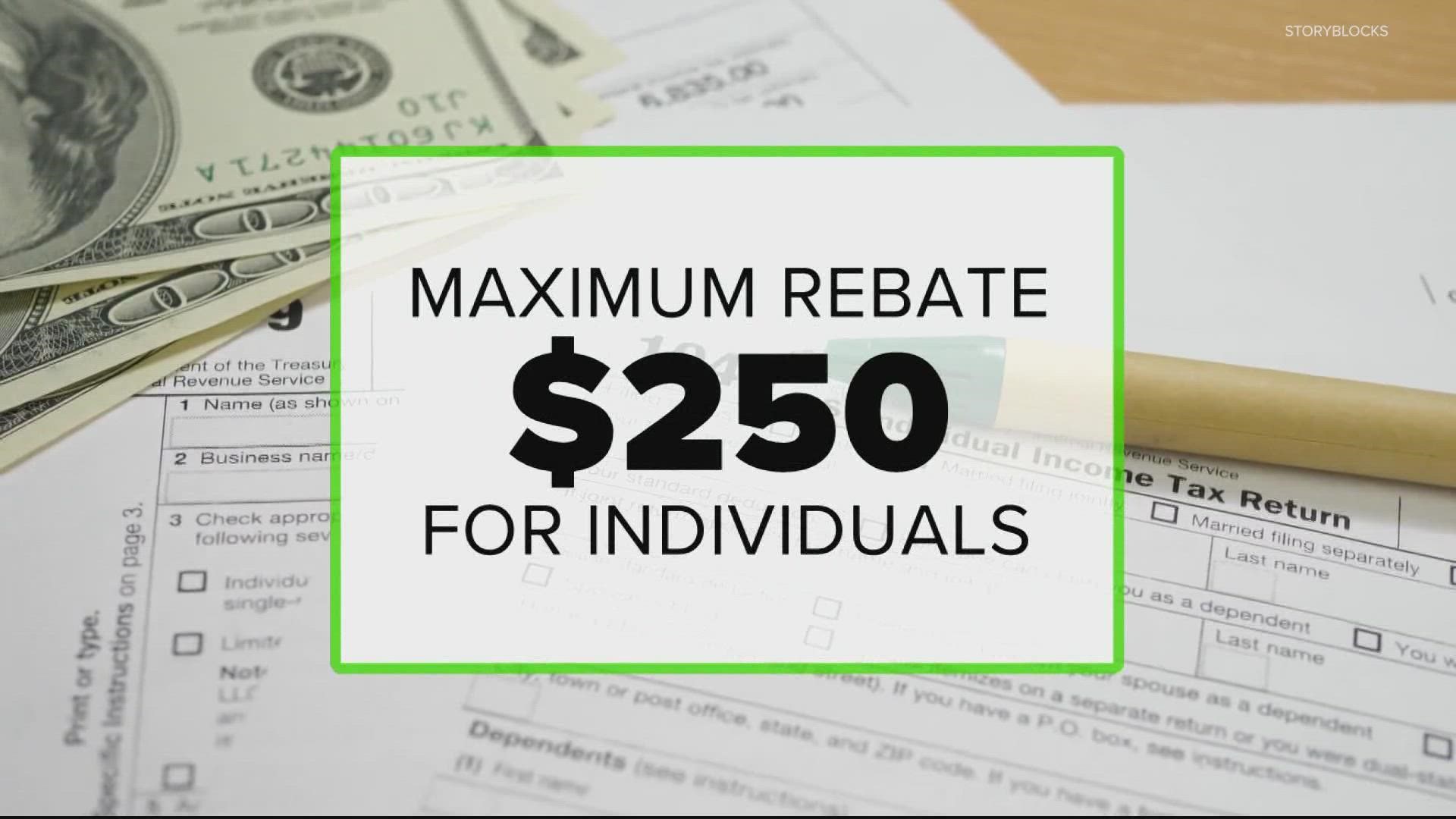

Web 16 sept 2022 nbsp 0183 32 Those who filed individually could be eligible for up to 250 and those who filed jointly could be eligible for up to 500 Here s a breakdown of what Virginia Web 15 sept 2022 nbsp 0183 32 RICHMOND VA This fall approximately 3 2 million eligible taxpayers will receive one time tax rebates of up to 250 if they filed individually and up to 500 if

Virginia Tax Rebate Eligibility

Virginia Tax Rebate Eligibility

https://www.tax-rebate.net/wp-content/uploads/2023/04/Virginia-Tax-Rebate-2023-Eligibility.jpg

STIMULUS CHECK VIRGINIA VIRGINIA TAX REBATE CHECK WHEN ELIGIBILITY

https://i.ytimg.com/vi/Ls4llWmMkJ0/maxresdefault.jpg

Youngkin Comes Through For Virginia Taxpayers With Tax Rebate Got My

https://www.usmessageboard.com/attachments/f-001-3-jpg.701939/

Web 20 sept 2022 nbsp 0183 32 To be eligible for the rebate people have to file by Nov 1 2022 and have a 2021 tax liability Some individuals may not be eligible for the rebate based on how Web 11 ao 251 t 2022 nbsp 0183 32 For Virginians who filed their taxes by July 1 rebate payments will start going out Oct 17 The state tax department says most eligible filers should get the rebate by Oct 31 but late filers should

Web The 2022 Appropriation Act approved a one time tax rebate for eligible taxpayers who file a return by November 1 Rebate for returns filed by July 1 must be issued by October 17 Web 8 f 233 vr 2023 nbsp 0183 32 last updated February 08 2023 If you owed money on your Virginia tax return in 2021 you were in luck in 2022 That s because the Virginia General Assembly passed a law giving some

Download Virginia Tax Rebate Eligibility

More picture related to Virginia Tax Rebate Eligibility

1099 G 1099 INTs Now Available Virginia Tax

https://www.tax.virginia.gov/sites/default/files/inline-images/1099-g-2022.png

Virginia Tax Rebate 2022 Being Split As Income Between 2022 And 2023

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/d789d31d-e5d3-4fa7-b215-46d52d786ff9.default.png

Most Virginia 2022 Tax Stimulus Rebates Aren t Taxable Kiplinger

https://cdn.mos.cms.futurecdn.net/jkK57oRHLZEpn8jwG5rYvN-1600-80.jpg

Web Virginians with lower income may qualify for one of several income based tax credits New Virginia Earned Income Tax Credit Refundable Credit for Low Income Individuals Web 15 sept 2022 nbsp 0183 32 RICHMOND Va WSET This fall approximately 3 2 million eligible taxpayers will receive one time tax rebates of up to 250 if they filed individually and up

Web 11 juil 2022 nbsp 0183 32 Virginia filers who experienced a tax liability in 2021 are eligible for a one time tax rebate The Virginia Department of Taxation announced that qualifying single Web 1 juil 2022 nbsp 0183 32 Increased standard deduction Beginning with 2022 Virginia individual income tax returns the standard deduction will increase to 8 000 for single filers and 16 000 for married couples filing jointly provided certain revenue targets are met If those targets are not met then the standard deduction will increase to 7 500 and 15 000

If You Haven t Yet Filed Your 2021 Income Taxes In Virginia A Deadline

https://wset.com/resources/media/2d83b333-1881-4cb5-a880-b8d4adc33736-large16x9_AP22172781631843.jpg?1655987737896

Best Employer Retention Credit 2021 Free Eligibility Test Fast ERC

https://online.pubhtml5.com/nerc/nyrw/files/large/3.jpg

https://www.wavy.com/news/local-news/virginia-tax-rebates-see-if-youre...

Web 19 sept 2022 nbsp 0183 32 The Virginia Department of Taxation s rebate lookup tool just needs your Social Security number or Individual Tax Identification Number ITIN and your zip code

https://www.wsls.com/news/virginia/2022/09/16/heres-how-to-check-if...

Web 16 sept 2022 nbsp 0183 32 Those who filed individually could be eligible for up to 250 and those who filed jointly could be eligible for up to 500 Here s a breakdown of what Virginia

Franchise Payroll Tax Rebate Eligibility Check Claims Risk Free

If You Haven t Yet Filed Your 2021 Income Taxes In Virginia A Deadline

Stacks Of American Currency Credit Getty Images

VIRGINIA STIMULUS CHECK 2022 CAR TAX REBATE FROM ROANOKE HOW MUCH

Virginia Tax Rebate Questions Answered Wusa9

Virginians Getting One Time Tax Rebates Up To 500 NBC4 Washington

Virginians Getting One Time Tax Rebates Up To 500 NBC4 Washington

IRS Payroll Tax Rebates For 2020 2021 2022 Free ERTC Eligibility Test

Individual Income Tax Rebate

Virginia Tax Rebate 2023

Virginia Tax Rebate Eligibility - Web 19 sept 2022 nbsp 0183 32 Eligibility for the one time rebates a result of huge revenue surpluses filling up state coffers depends on how much a filer owed in state taxes for 2021 To help