Property Tax Deduction Schedule A Verkko 6 marrask 2023 nbsp 0183 32 You may not deduct certain taxes and fees on Schedule A including but not limited to Federal income taxes Social security taxes Transfer taxes such

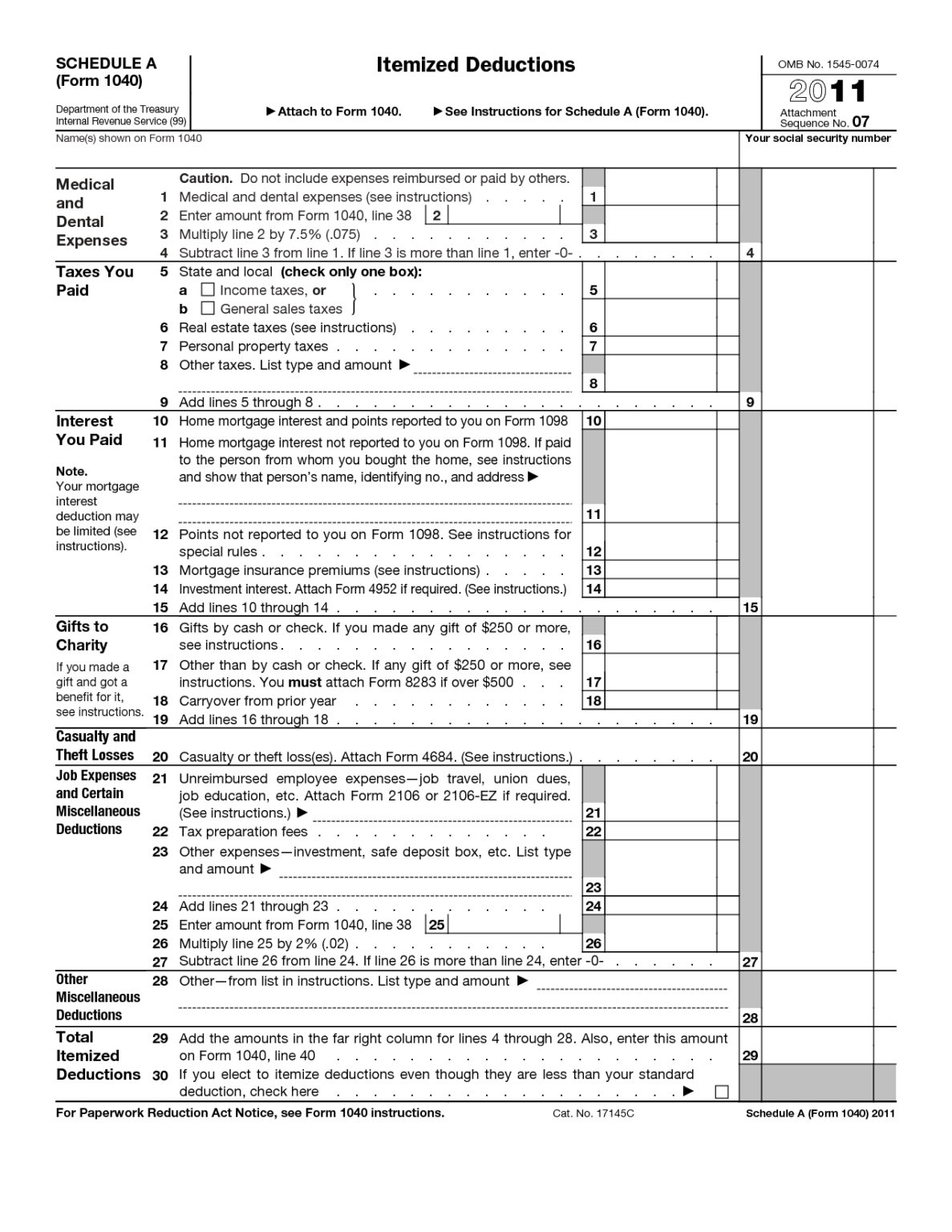

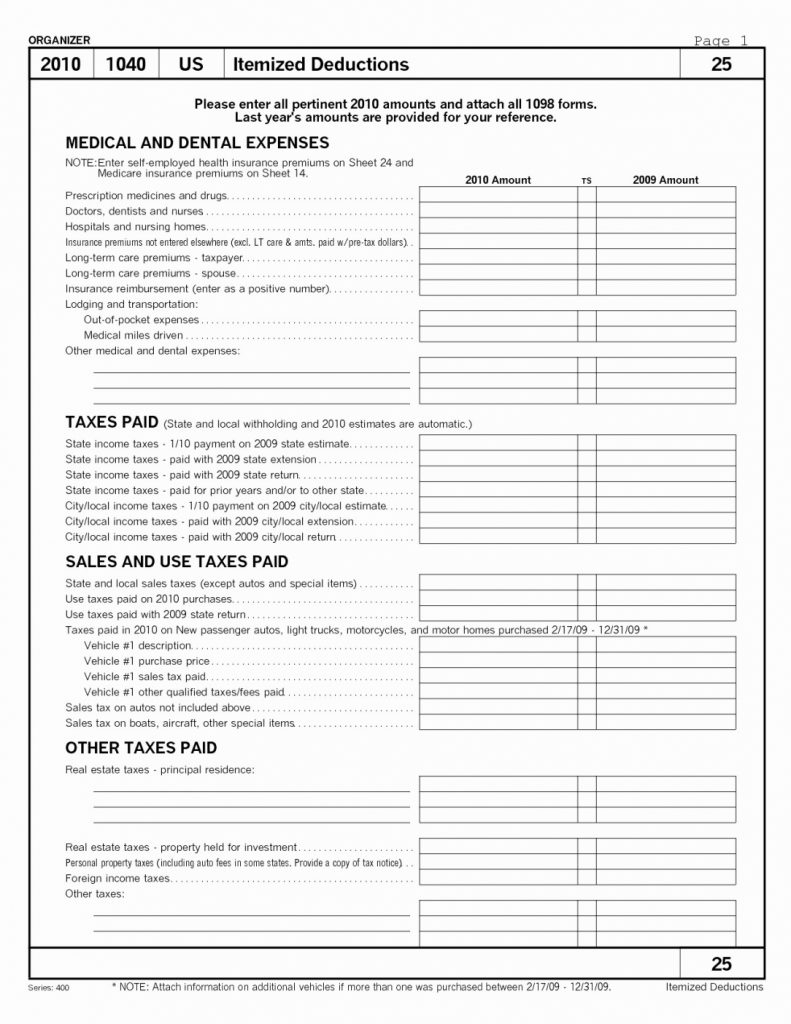

Verkko Information about Schedule A Form 1040 Itemized Deductions including recent updates related forms and instructions on how to file This schedule is used by filers Verkko You can deduct up to 10 000 or 5 000 if married filing separately of state and local taxes including personal property taxes Where to

Property Tax Deduction Schedule A

Property Tax Deduction Schedule A

https://1044form.com/wp-content/uploads/2020/08/8-best-images-of-tax-itemized-deduction-worksheet-irs-1187x1536.png

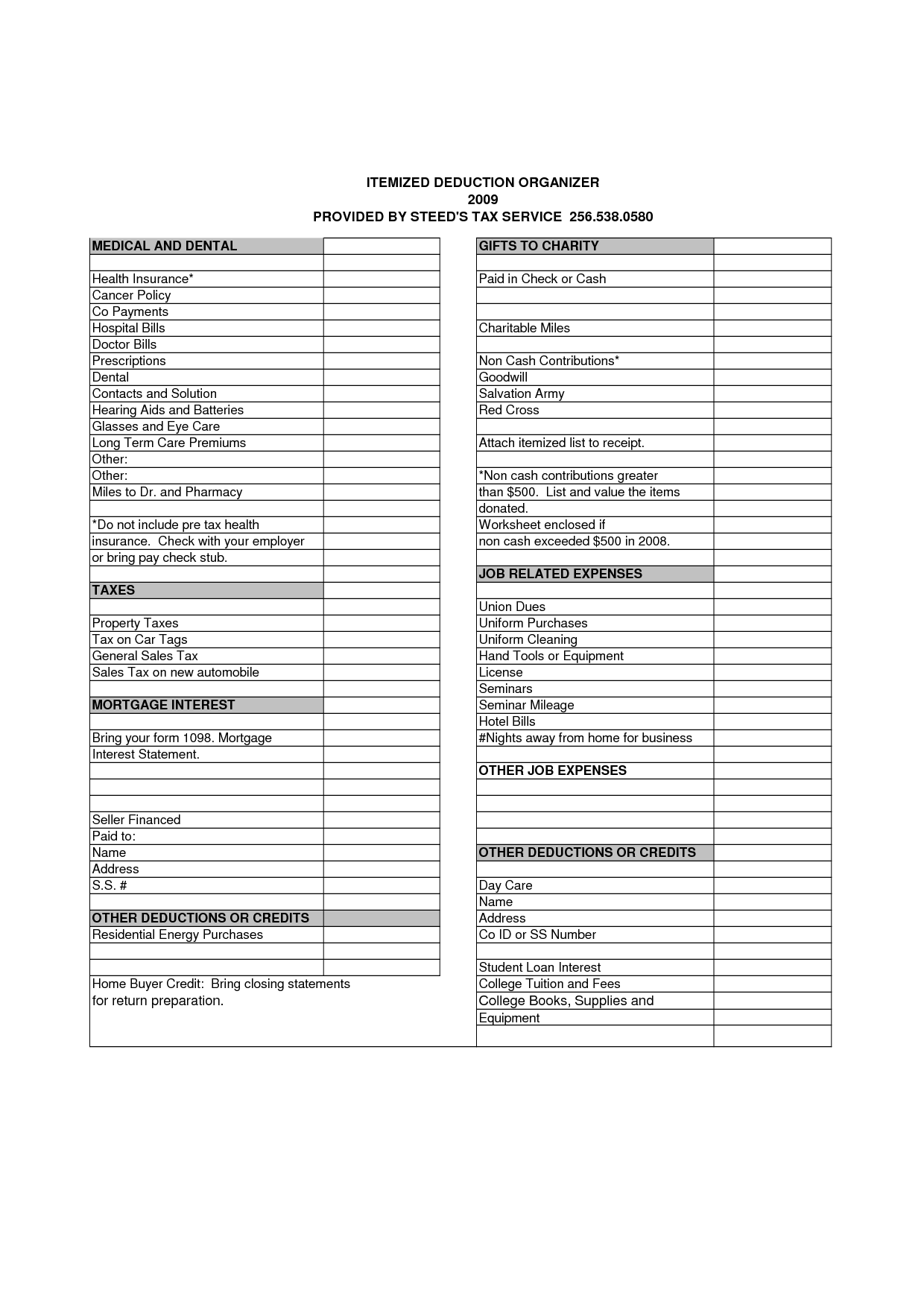

Printable Itemized Deductions Worksheet

https://www.worksheeto.com/postpic/2009/10/list-itemized-tax-deductions-worksheet_449386.png

Printable Itemized Deductions Worksheet

https://www.pdffiller.com/preview/391/382/391382225/large.png

Verkko 2 helmik 2023 nbsp 0183 32 Schedule A is an IRS form used to claim itemized deductions on a tax return Form 1040 See how to fill it out how to Verkko Schedule A Taxes You Paid The itemized deduction for state and local taxes and sales and property taxes is limited to a combined total deduc tion of 10 000 5 000

Verkko 20 tammik 2023 nbsp 0183 32 Individuals can deduct personal property taxes paid during the year as an itemized deduction on Schedule A of their federal tax returns at least up to a point This deduction was unlimited until Verkko 31 maalisk 2023 nbsp 0183 32 The property tax deduction is one of many benefits of being a homeowner but you don t need to own a house to get this tax break there are other ways to qualify Get ready for simple tax

Download Property Tax Deduction Schedule A

More picture related to Property Tax Deduction Schedule A

Standard Deduction How Much It Is How It Works Benzinga

https://s3.amazonaws.com/wp-uploads.benzinga-money.prod/wp-content/uploads/2019/03/28192259/Screen-Shot-2019-03-28-at-3.22.37-PM.png

Tax Deduction Checklist

https://image.slidesharecdn.com/dbfdb9b6-0f34-4f43-8ab3-80075fcf9db2-150429225231-conversion-gate02/95/taxdeductionchecklist-1-638.jpg?cb=1430348002

Laurenstuckeydesigns If I Bought A Home Tax Deductions

https://www.paisabazaar.com/wp-content/uploads/2020/02/tax.jpg

Verkko Schedule A Limitation on the deduction for state and local taxes You can t deduct more than 10 000 5 000 if married filing separate of your total state and local Verkko SCHEDULE A Form 1040 Department of the Treasury Internal Revenue Service Itemized Deductions Attach to Form 1040 or 1040 SR Go to www irs gov ScheduleA

Verkko SCHEDULE A Form 1040 Department of the Treasury Internal Revenue Service 99 Itemized Deductions Go to www irs gov ScheduleA for instructions and the latest Verkko 5 huhtik 2023 nbsp 0183 32 1 The IRS caps the property tax deduction at 10 000 5 000 if you re married filing separately 1 You may think O h good I don t pay that much for

The Standard Deduction And Itemized Deductions After Tax Reform

https://www.coastalwealthmanagement24.com/wp-content/uploads/2018/03/The-Standard-Deduction-and-Itemized-Deductions-After-Tax-Reform-Coastal-Wealth-Management.gif

10 2014 Itemized Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2009/12/tax-deduction-worksheet_449398.png

https://www.irs.gov/taxtopics/tc503

Verkko 6 marrask 2023 nbsp 0183 32 You may not deduct certain taxes and fees on Schedule A including but not limited to Federal income taxes Social security taxes Transfer taxes such

https://www.irs.gov/forms-pubs/about-schedule-a-form-1040

Verkko Information about Schedule A Form 1040 Itemized Deductions including recent updates related forms and instructions on how to file This schedule is used by filers

What Your Itemized Deductions On Schedule A Will Look Like After Tax

The Standard Deduction And Itemized Deductions After Tax Reform

Printable List Of Tax Deductions Form Fill Out And Sign Printable PDF

Tax Deduction Spreadsheet Spreadsheet Downloa Tax Deduction Spreadsheet

Tax Deduction Spreadsheet Spreadsheet Downloa Tax Deduction Sheet Tax

Printable Itemized Deductions Worksheet

Printable Itemized Deductions Worksheet

How To Deduct Property Taxes On IRS Tax Forms Irs Tax Forms Mortgage

Tax Deduction Worksheet Small Business Tax Small Business Tax

Realtor Tax Deductions Worksheet Complete With Ease SignNow

Property Tax Deduction Schedule A - Verkko 27 helmik 2023 nbsp 0183 32 Schedule A is used by filers who itemize their deductions on Form 1040 or Form 1040 SR The total of all allowable itemized deductions is then entered