Property Tax Exemption For Seniors In Iowa Iowans age 65 or older are eligible for a property tax exemption worth 3 250 for the assessment year beginning Jan 1 2023 In subsequent years the exemption doubles to 6 500

In other words claimants aged 70 years or older with higher household income are able to qualify for the property tax credit in 2022 and subsequent years Claims may be filed using the Iowa Property Tax Credit Claim 54 001 form with the County Treasurer between January 1 In addition to the homestead tax credit eligible claimants who own the home they live in and are 65 years of age or older on or before January 1 of this year are now eligible for a homestead tax exemption For the assessment year beginning on January

Property Tax Exemption For Seniors In Iowa

Property Tax Exemption For Seniors In Iowa

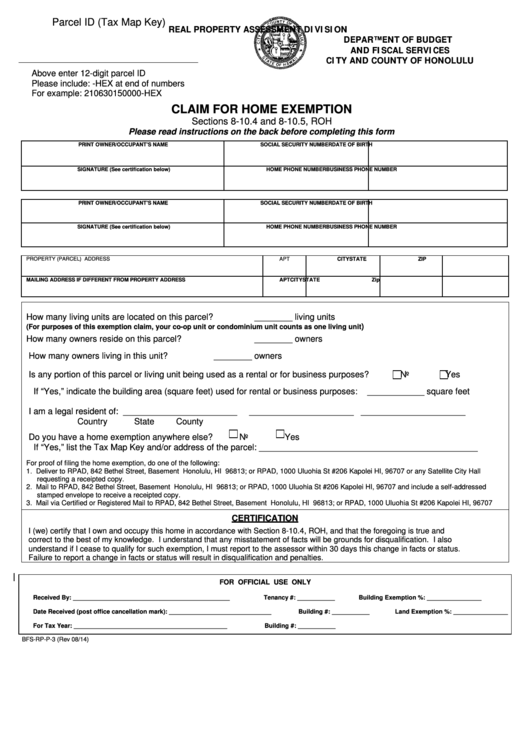

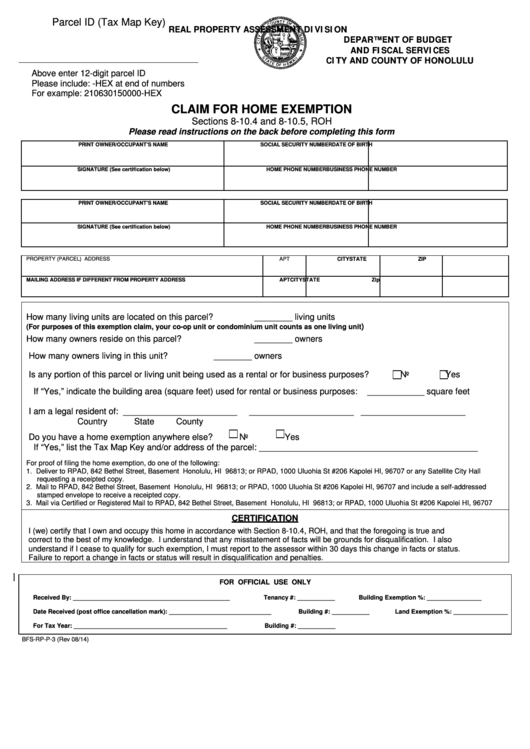

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-claim-for-home-exemption-printable-pdf-download.png

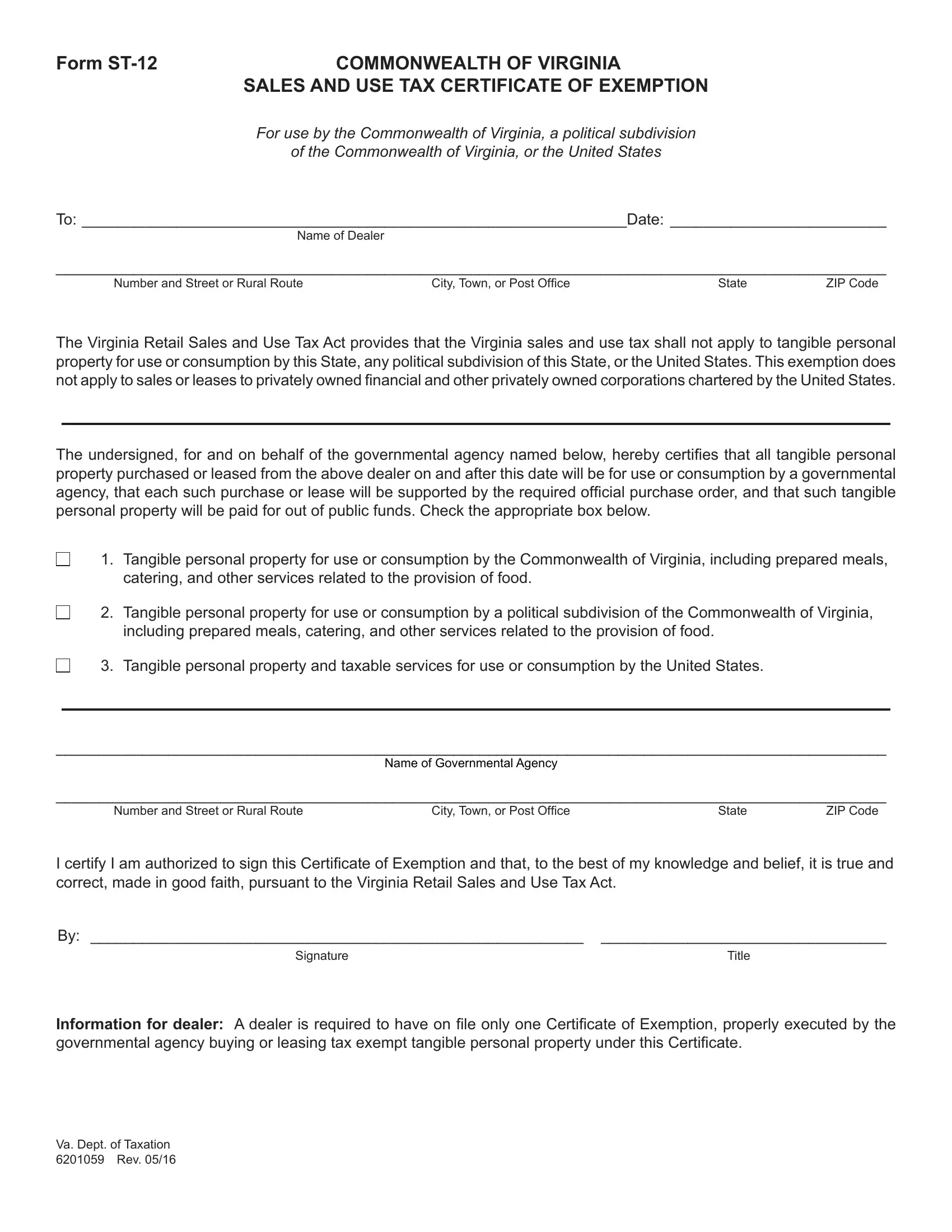

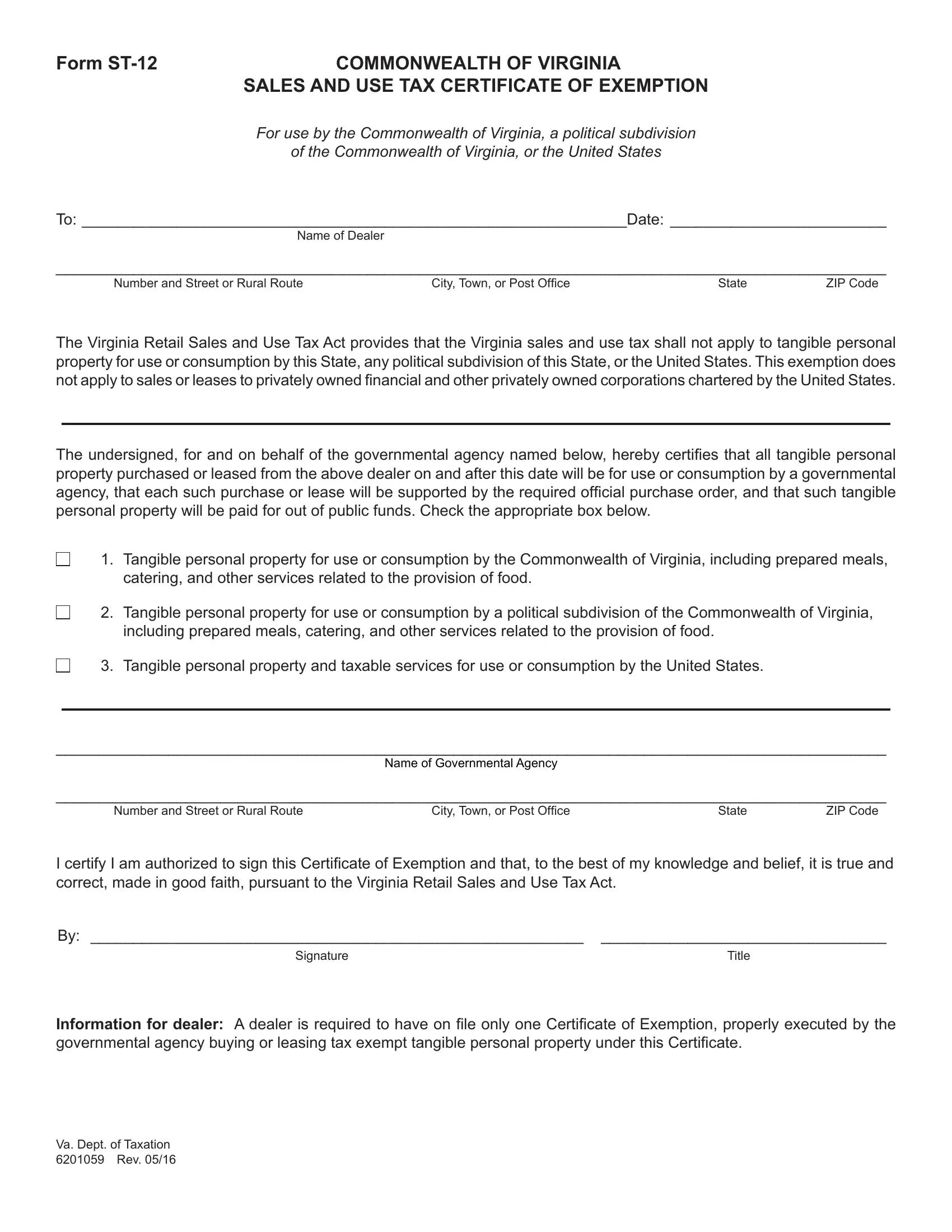

Virginia Sales Tax Exemption PDF Form FormsPal

https://formspal.com/pdf-forms/other/virginia-sales-tax-exemption-form/virginia-sales-tax-exemption-form-preview.webp

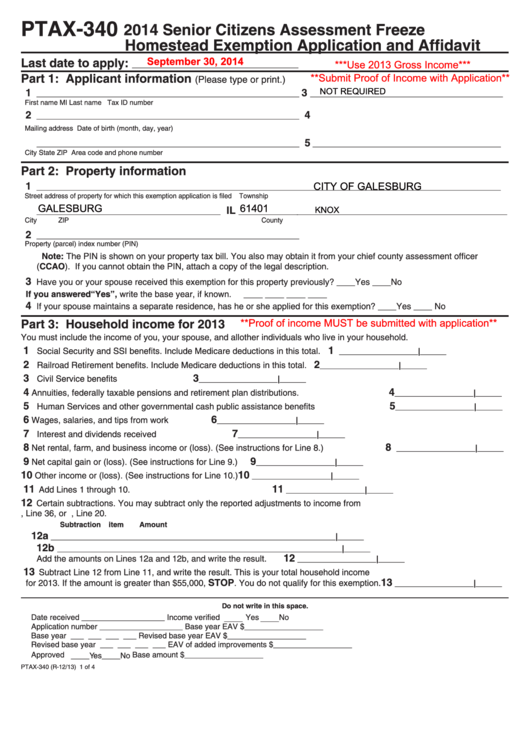

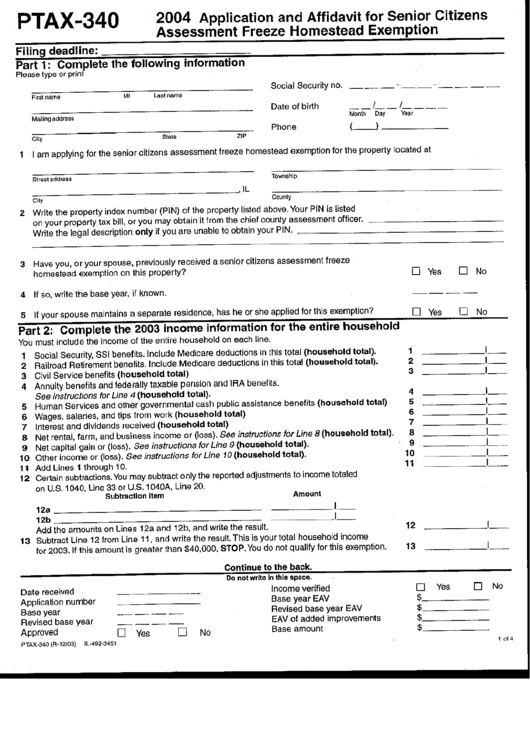

Colorado Homestead Exemption 2024 Ynes Amelita

https://www.countyforms.com/wp-content/uploads/2022/10/form-ptax-340-senior-citizens-assessment-freeze-homestead-exemption.png

Iowans age 65 have until July 1 to apply for a new property tax exemption included in legislation signed into law in May 2023 AARP supported this provision that allows older Iowans to apply for a property tax exemption worth 3 250 for the current assessment year that began on January 1 The bill provides an additional 6 500 homestead property tax exemption for Iowans 65 and older And it more than doubles a property tax exemption for veterans by increasing it to

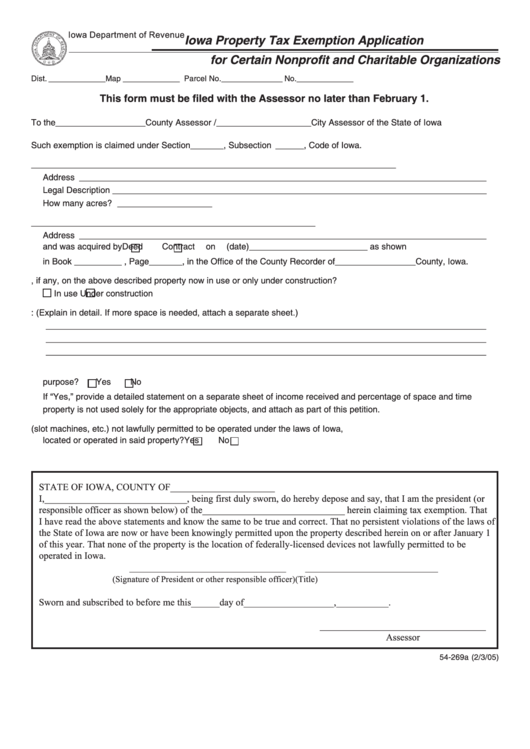

How can Iowan seniors apply for the property tax exemption The Iowa Department of Revenue announced Monday it has amended the homestead tax credit exemption form to allow seniors to apply for Do You Qualify for the Homestead Exemption You must be an Iowa resident and file income taxes in Iowa and own and occupy the property in which you are seeking a homestead credit You may not have a homestead credit on another property in Iowa

Download Property Tax Exemption For Seniors In Iowa

More picture related to Property Tax Exemption For Seniors In Iowa

Mismanaged Idle SSS Assets Justifies Tax Exemption Says BMP

https://1.bp.blogspot.com/-NX8698xLmNQ/Vge5ULTlAeI/AAAAAAAAWSs/Yi11-3oPwKw/s1600/TAX-EXEMPTION.jpg

Form 54 269a Iowa Property Tax Exemption Application For Certain

https://data.formsbank.com/pdf_docs_html/207/2071/207175/page_1_thumb_big.png

Homestead Exemption Part II Money Savings With Real Estate Tax

http://nicoleryskamp.michaelsaunders.com/files/2018/02/Homestead-Exemption-part-1.png

Iowans 65 and older and military veterans will see new property tax exemptions The law provides an additional 6 500 homestead property tax exemption for Iowans 65 and older And it more than The Disabled and Senior Citizens Property Tax Credit and Rent Reimbursement Program provides low income citizens with property tax assistance Homeowners can qualify for a property tax credit while renters can qualify for a reimbursement of rent constituting property taxes paid or 23 percent of annual rent payments

On May 4 2023 Governor Reynolds signed House File 718 establishing a homestead tax exemption for claimants 65 years of age or older In addition to the homestead tax credit eligible claimants who own the home they live in and are 65 years of age or older on or before January 1 of the assessment year are now eligible for a homestead tax On May 4 2023 Governor Reynolds signed House File 718 establishing a homestead tax exemption for claimants 65 years of age or older In addition to the homestead tax credit eligible claimants who own the home they live in and are 65 years of age or older on or before January 1 of the assessment year are now eligible for a homestead tax

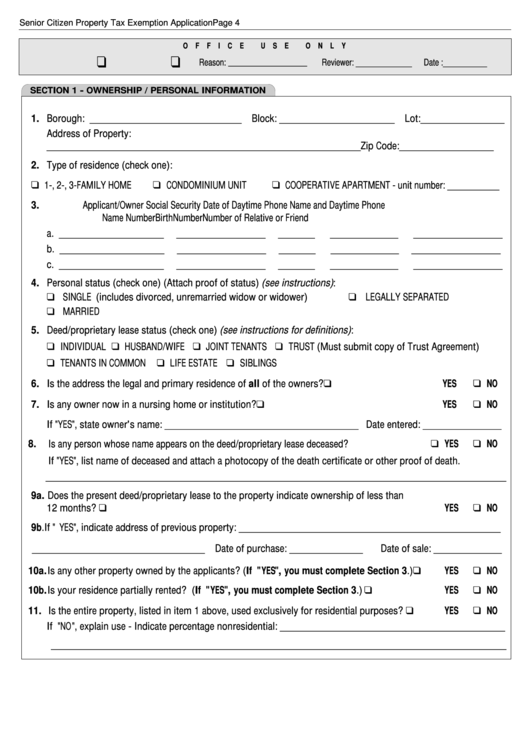

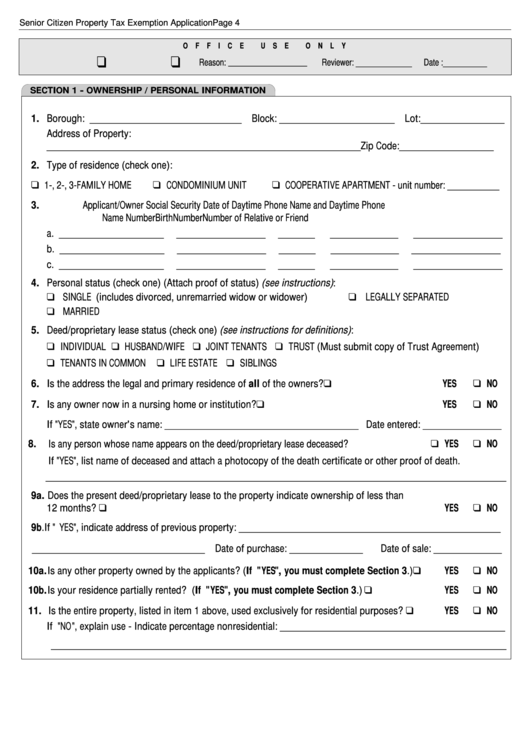

Senior Citizen Property Tax Exemption Application Form Printable Pdf

https://data.formsbank.com/pdf_docs_html/219/2191/219188/page_1_thumb_big.png

Which States Offer Disabled Veteran Property Tax Exemptions Military

https://www.military.net/wp-content/uploads/2023/09/state-property-tax-exemptions-veterans-2048x1152.jpg

https://www.desmoinesregister.com/story/news/...

Iowans age 65 or older are eligible for a property tax exemption worth 3 250 for the assessment year beginning Jan 1 2023 In subsequent years the exemption doubles to 6 500

https://revenue.iowa.gov/taxes/tax-guidance/tax...

In other words claimants aged 70 years or older with higher household income are able to qualify for the property tax credit in 2022 and subsequent years Claims may be filed using the Iowa Property Tax Credit Claim 54 001 form with the County Treasurer between January 1

Tax Exemption Form For Veterans ExemptForm

Senior Citizen Property Tax Exemption Application Form Printable Pdf

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

Looking For Sample Letter For Tax Amnesty For Motor Vehicle Taxes In

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

2021 Form FL DR 501 Fill Online Printable Fillable Blank PdfFiller

2021 Form FL DR 501 Fill Online Printable Fillable Blank PdfFiller

Tax Exemption Certificate Form Fill Out Sign Online DocHub

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

2023 Senior Citizen Exemption Application Form Cook County ExemptForm

Property Tax Exemption For Seniors In Iowa - To apply for the senior property tax exemption you can find it under Homestead Tax Credit and Exemption 54 028 Iowans 65 and older have until July 1st to apply for the new property