Property Tax Exemption For Seniors In Kansas The property tax relief claim K 40PT is for homeowners that were 65 years of age or older with a household income of 23 700 or less and a resident of Kansas all of 2023

K S A 79 201 Ninth Vehicles owned by a 501 c 3 organization that is exempt from property tax under K S A 79 201 Ninth and uses the vehicles to transport the elderly KANSAS PROPERTY TAX RELIEF CLAIM for SENIORS AND DISABLED VETERANS K 40SVR 7 22 DO NOT STAPLE FILE THIS CLAIM AFTER DECEMBER 31 2022 BUT

Property Tax Exemption For Seniors In Kansas

Property Tax Exemption For Seniors In Kansas

https://img.hechtgroup.com/1662568669151.jpg

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

https://www.sanpatricioelectric.org/sites/sanpatricioelectric/files/inline-images/SPEC SALES TAX FORM Example.jpg

County Legislature Increases Senior Citizen Tax Exemption Rodney J

https://i0.wp.com/www.rodneyjstrange.com/wp-content/uploads/2019/05/Elderly-Tax-Exemption-1.jpg?w=504&ssl=1

SAFESR is a property tax refund program administered under the provisions of the Kansas Homestead Act property tax refund SAFESR is also referred to as K 40SVR Property Tax Relief Claim for Seniors and Disabled Veterans Rev 7 23 ENTER THE TOTAL RECEIVED IN 2023 FOR EACH TYPE OF INCOME See instructions 4

All Kansas homeowners are entitled to exempt the first 40 000 of their assessed home value again this year Sen Tyson says more property tax relief is in TOPEKA Kan WIBW The bill cuts property taxes while providing additional tax relief for Kansas veterans and the elderly through property tax refunds House Bill 2239 gives tax

Download Property Tax Exemption For Seniors In Kansas

More picture related to Property Tax Exemption For Seniors In Kansas

Using A 1031 Exchange To Turn A Rental Property Into Your Primary

https://m.foolcdn.com/media/millionacres/images/real_estate_taxes.width-1440.jpg

Homestead Exemption Part II Money Savings With Real Estate Tax

http://nicoleryskamp.michaelsaunders.com/files/2018/02/Homestead-Exemption-part-1.png

Decatur Tax Blog City Promotes Homestead Exemptions

https://1.bp.blogspot.com/-hmwcPUkUFg0/UTX2pUcnTSI/AAAAAAAAAKM/esi75wNjLs4/s1600/Senior+exemption+postcard.JPG

The SAFESR property tax relief claim K 40PT allows a refund of property tax for low income senior citizens that own their home The refund is 75 of the property taxes The Property Tax Relief claim K 40PT allows a refund of property tax for low income senior citizens that own their home The refund is 75 of the property taxes actually

Property Tax Relief claims for seniors and disabled veterans K 40SVR Must have filed a Kansas Homestead Claim in the last 3 years to be eligible to file online To complete a HOUSE BILL No 2440 By Committee on Taxation 3 18 AN ACT concerning property taxation relating to exemptions creating a property tax exemption for homestead

SC ST 8 2016 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/6/967/6967789/large.png

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/50/825/50825271/large.png

https://www.ksrevenue.gov/faqs-taxhomestead.html

The property tax relief claim K 40PT is for homeowners that were 65 years of age or older with a household income of 23 700 or less and a resident of Kansas all of 2023

https://www.ksrevenue.gov/pvdptexemptions.html

K S A 79 201 Ninth Vehicles owned by a 501 c 3 organization that is exempt from property tax under K S A 79 201 Ninth and uses the vehicles to transport the elderly

Shoreline Area News Property Tax Exemption For Seniors

SC ST 8 2016 Fill Out Tax Template Online US Legal Forms

18 States With Full Property Tax Exemption For 100 Disabled Veterans

Veteran Tax Exemptions By State

Tax Exempt Form Texas Fill Out Sign Online DocHub

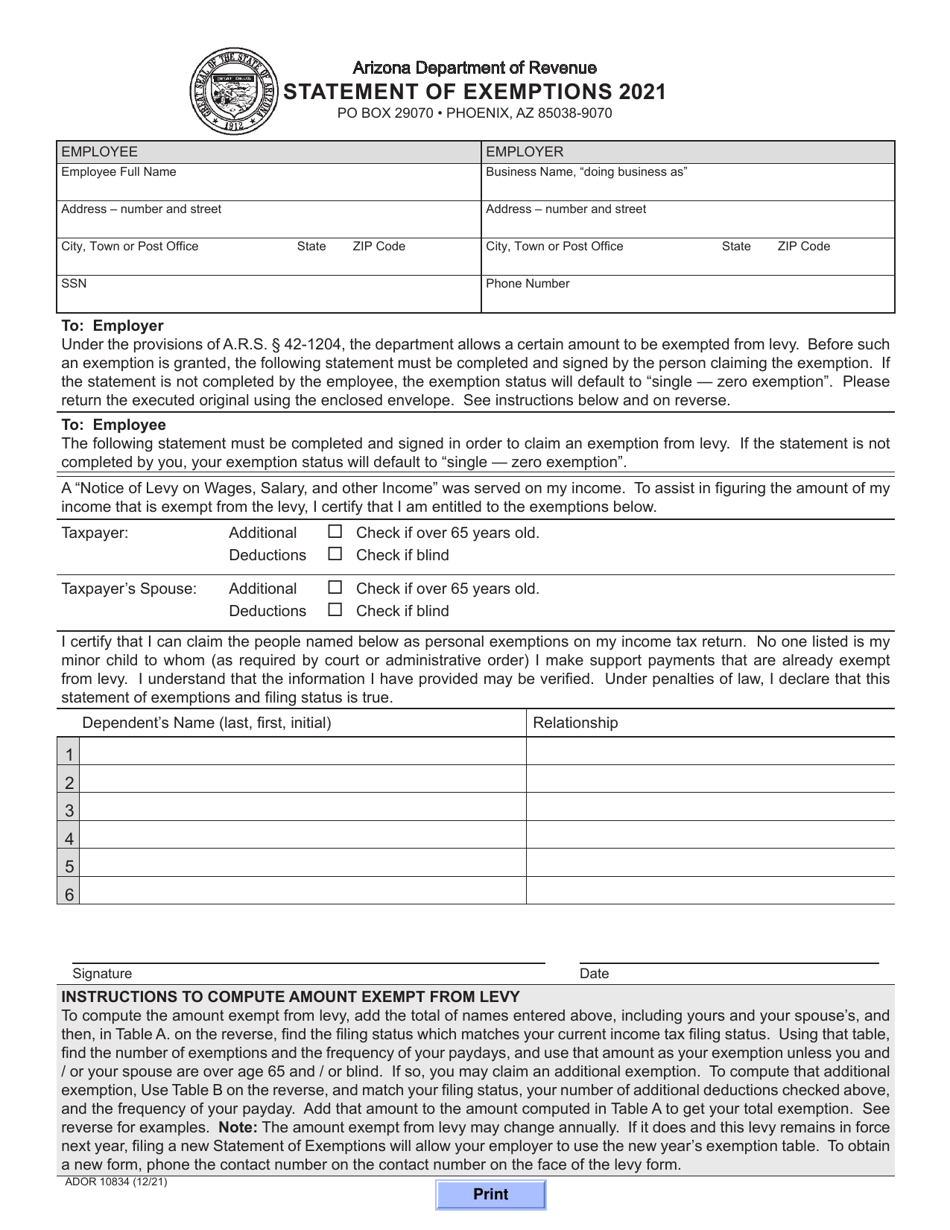

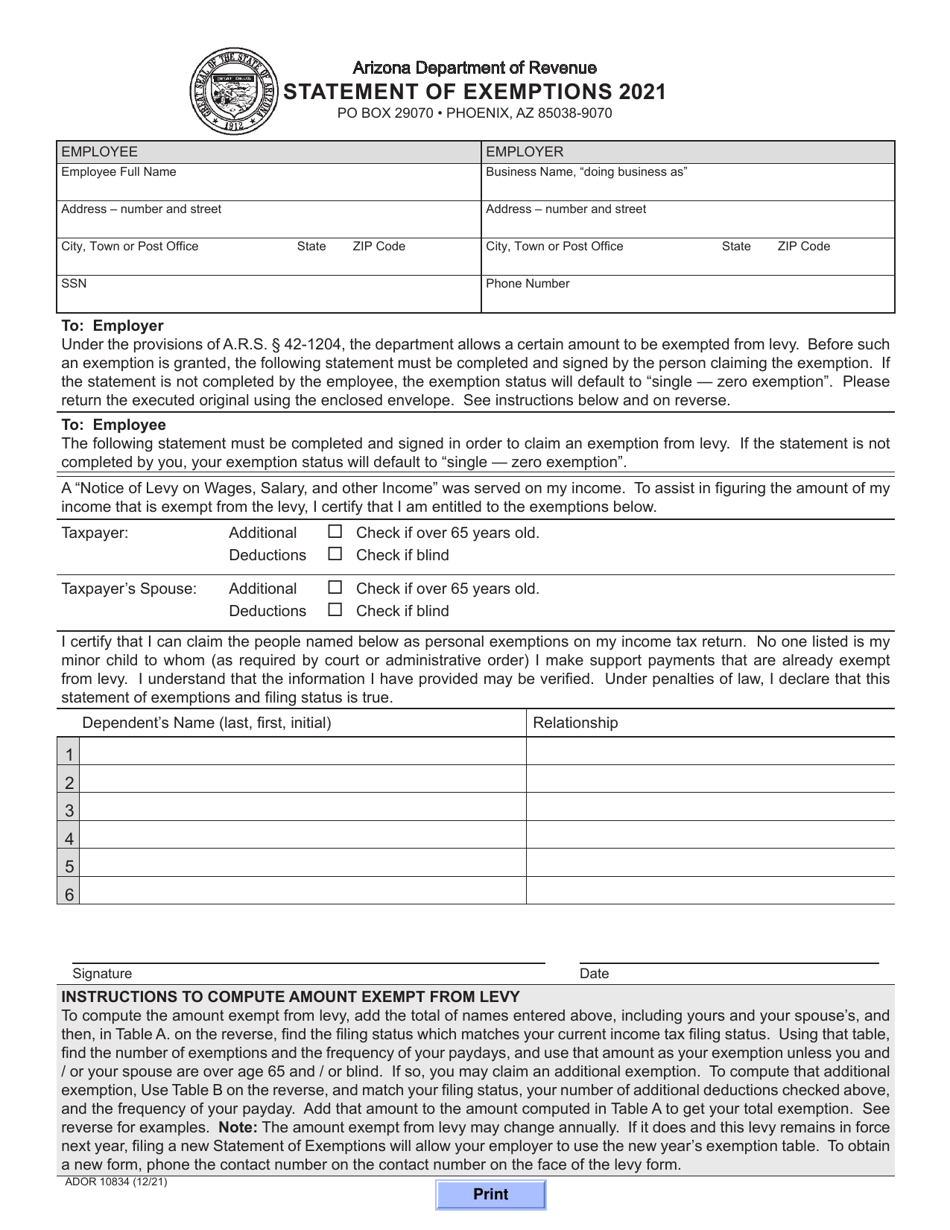

Form ADOR10834 Download Fillable PDF Or Fill Online Statement Of

Form ADOR10834 Download Fillable PDF Or Fill Online Statement Of

Certificate Of Exemption Tax Exemption Sales Taxes In The United States

Jefferson County Property Tax Exemption Form ExemptForm

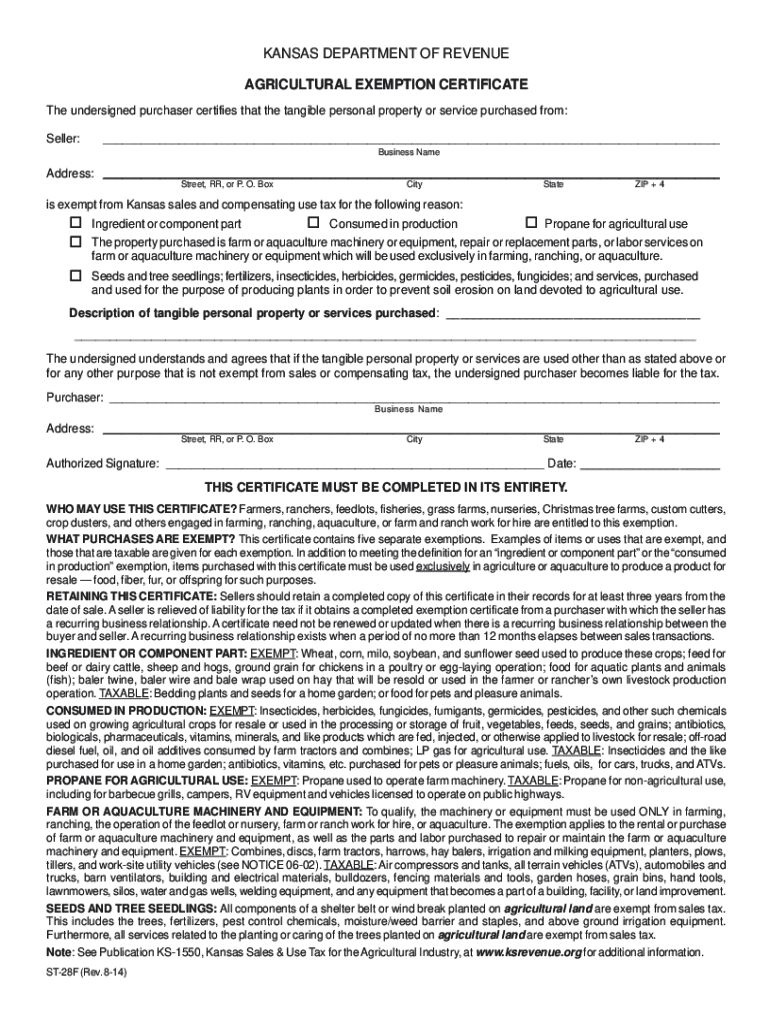

Kansas Exemption Fill Out And Sign Printable PDF Template SignNow

Property Tax Exemption For Seniors In Kansas - TOPEKA Kan WIBW The bill cuts property taxes while providing additional tax relief for Kansas veterans and the elderly through property tax refunds House Bill 2239 gives tax