Property Tax Exemption Pennsylvania Property tax reduction will be through a homestead or farmstead exclusion Generally most owner occupied homes and farms are eligible for property tax reduction Only a primary residence is eligible for property tax relief

What is the homestead exclusion The homestead exclusion is a way to target real property tax relief to homeowners who have their permanent residence in the taxing jurisdiction school district county or municipality The homestead exclusion reduces the assessed values of homestead properties reducing the property tax on Learn more about the homestead and farmstead exemption and how to apply which you might need to do every three years per 53 Pa C S 8584 a from the Pennsylvania Department of Community and Economic Development and check for details with your county s tax office

Property Tax Exemption Pennsylvania

Property Tax Exemption Pennsylvania

https://startingyourbusiness.com/wp-content/uploads/2019/09/Fillable-Pennsylvania-Exemption-Certificate-Form-REV-1220.png

Nonprofit Charitable Tax Exemption Pennsylvania Association Of

https://pano.org/wp-content/uploads/2019/02/taxs.jpg

Free Tax Prep Assistance And Forms At Birmingham Public Library

https://2.bp.blogspot.com/-NEBYWrRxza0/Vo_g07gEvuI/AAAAAAAAOd0/j1QLSwTsyHY/s1600/5512347305_f2008d7527_o.jpg

Or call 1 888 222 9190 WHAT S NEW INCOME REBATES First the maximum standard rebate is increasing from 650 to 1 000 Second the income cap for both renters and INCOME MAX REBATE HOMEOWNERS 0 to 8 000 1 000 RENTERS 8 001 to 15 000 770 15 001 to 18 000 460 The Homestead Exemption reduces the taxable portion of your property s assessed value With this exemption the property s assessed value is reduced by 80 000 Most homeowners will save about 1 119 a year on their Real Estate Tax bill starting in 2023

Tax exemptions provide tax relief by reducing a property s assessed value Abatements Get a property tax abatement Guidelines for determining which Real Estate Tax abatements you can get for your property Exemptions Get the Homestead Exemption How to apply for the Homestead Exemption if you own your home in Philadelphia Homeowners and renters in Pennsylvania may be eligible to receive up to 1 000 through a standard rebate The amount of money you will receive is based on your income Some applicants may qualify for supplemental rebates as well Supplemental Rebates Supplemental rebates provide an additional 190 to 500 in relief to applicants with the

Download Property Tax Exemption Pennsylvania

More picture related to Property Tax Exemption Pennsylvania

Estate Tax Exemption Level Tax Policy Center

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/statistics/images/estate_exemption_6.png?itok=OC6mQdwq

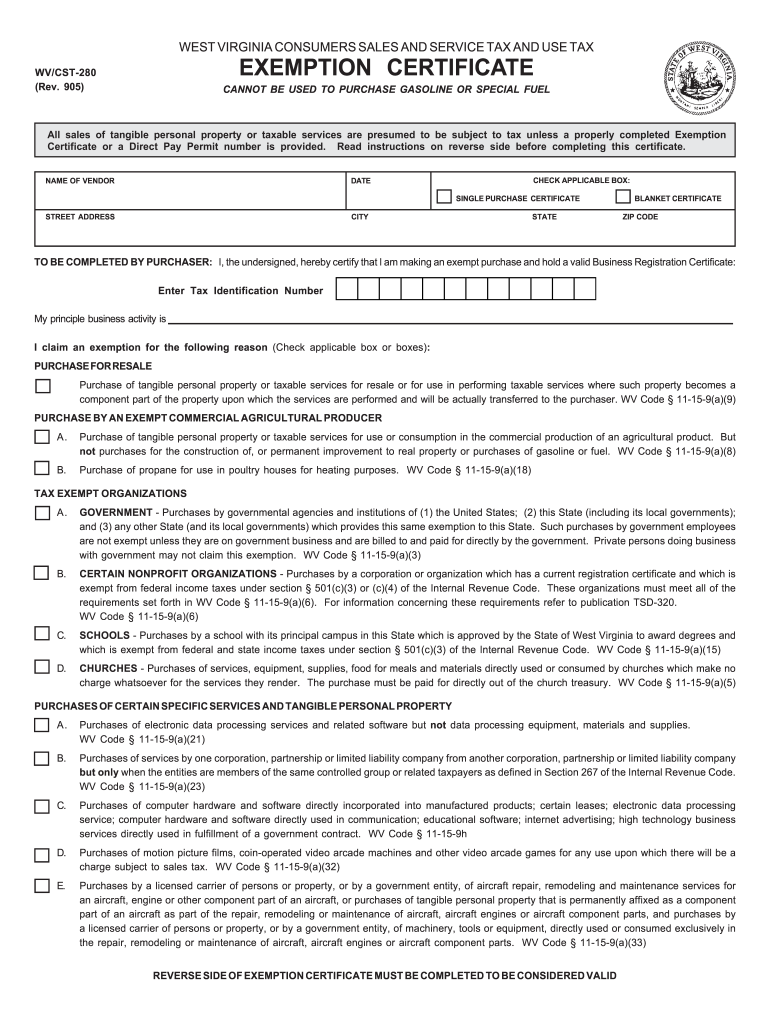

Wv Tax Exempt Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/61/100061744/large.png

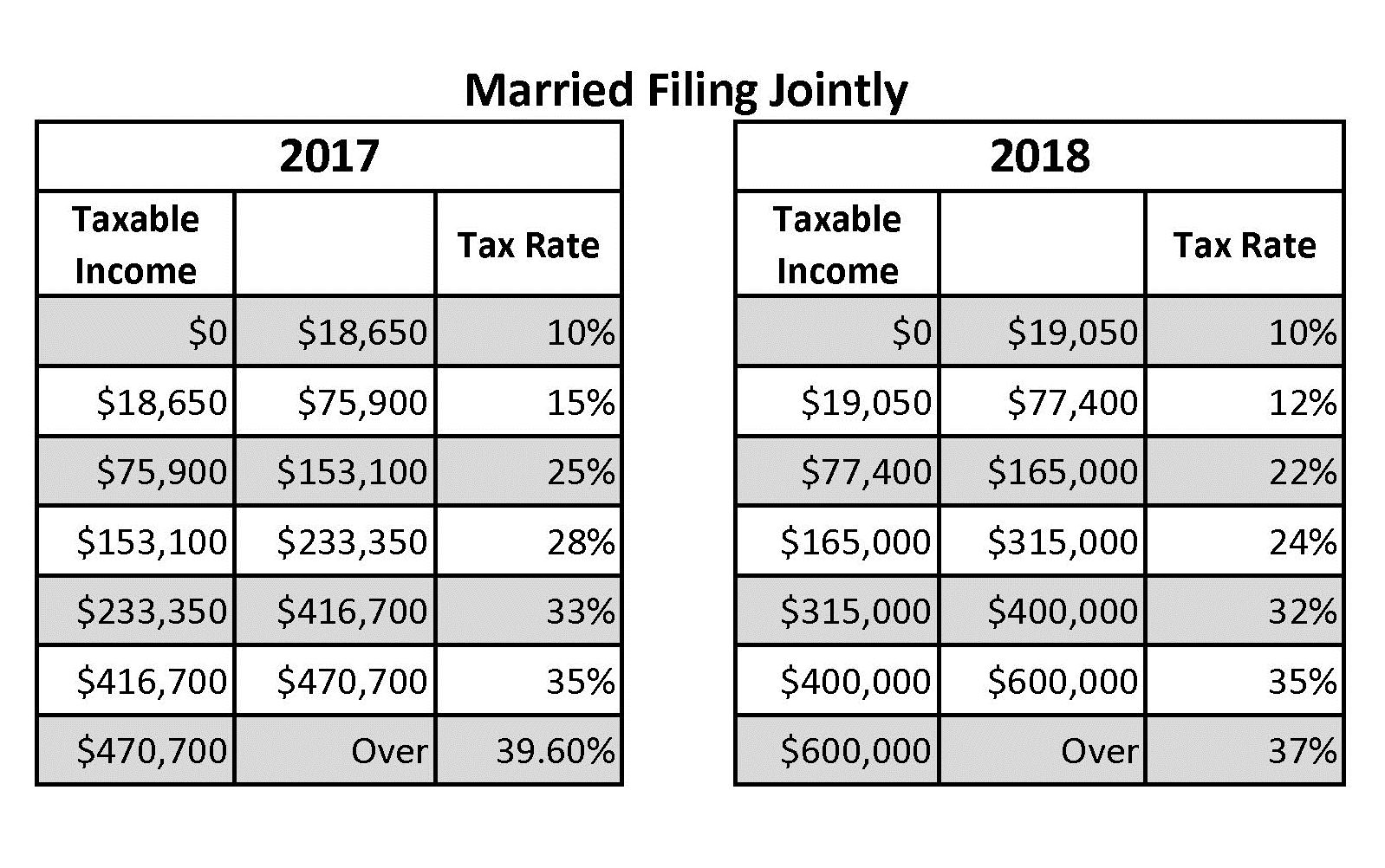

Federal Estate Tax Exemption 2019 Sunset Change Comin

https://www.waller.com/wp-content/uploads/TCJA-Taxupdate.jpg

Property Tax Rent Rebate Program Online filing for the Property Tax Rent Rebate Program is now available for eligible Pennsylvanians to begin claiming rebates on property taxes or rent paid in 2022 Learn More PA Tax Talk Montgomery County Board of Assessment Appeals Court House P O Box 311 Norristown PA 19404 0311 For Questions on the Homestead or Farmstead Exclusion please contact your local tax collector or the Montgomery County Assessment Office at 610 278 3761 office hours 8 30 am to 4 15 pm Monday through Friday

Current through P A Acts 2023 21 Section 5020 204 Exemptions from taxation a The following property shall be exempt from all county city borough town township road poor and school tax to wit 1 All churches meeting houses or other actual places of regularly stated religious worship with the ground thereto annexed necessary Is My Property Exempt From Pennsylvania Real Estate Tax August 19 2014 by Law Offices of Spadea Associates LLC If you own a property that is regularly used by a charity or falls into one of the 8 categories below you may be exempt from paying real estate tax To qualify for an exemption your property must be

Circuit Breaker Tax Exemption Archives California Property Tax

https://i0.wp.com/propertytaxnews.org/wp-content/uploads/2021/11/The-History-of-Property-Taxes-in-California-scaled.jpg?resize=2048%2C1717&ssl=1

Online Tax Online Tax Exemption Certificate

http://www.formsbirds.com/formimg/pennsylvania-sales-use-and-hotel-occupancy-tax/20978/rev-1220-pennsylvania-exemption-certificate-l1.png

https://dced.pa.gov/local-government/property-tax...

Property tax reduction will be through a homestead or farmstead exclusion Generally most owner occupied homes and farms are eligible for property tax reduction Only a primary residence is eligible for property tax relief

https://extension.psu.edu/understanding-the...

What is the homestead exclusion The homestead exclusion is a way to target real property tax relief to homeowners who have their permanent residence in the taxing jurisdiction school district county or municipality The homestead exclusion reduces the assessed values of homestead properties reducing the property tax on

The Estate Tax The Motley Fool

Circuit Breaker Tax Exemption Archives California Property Tax

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Veteran Tax Exemptions By State

Illinois Tax Exemption Form

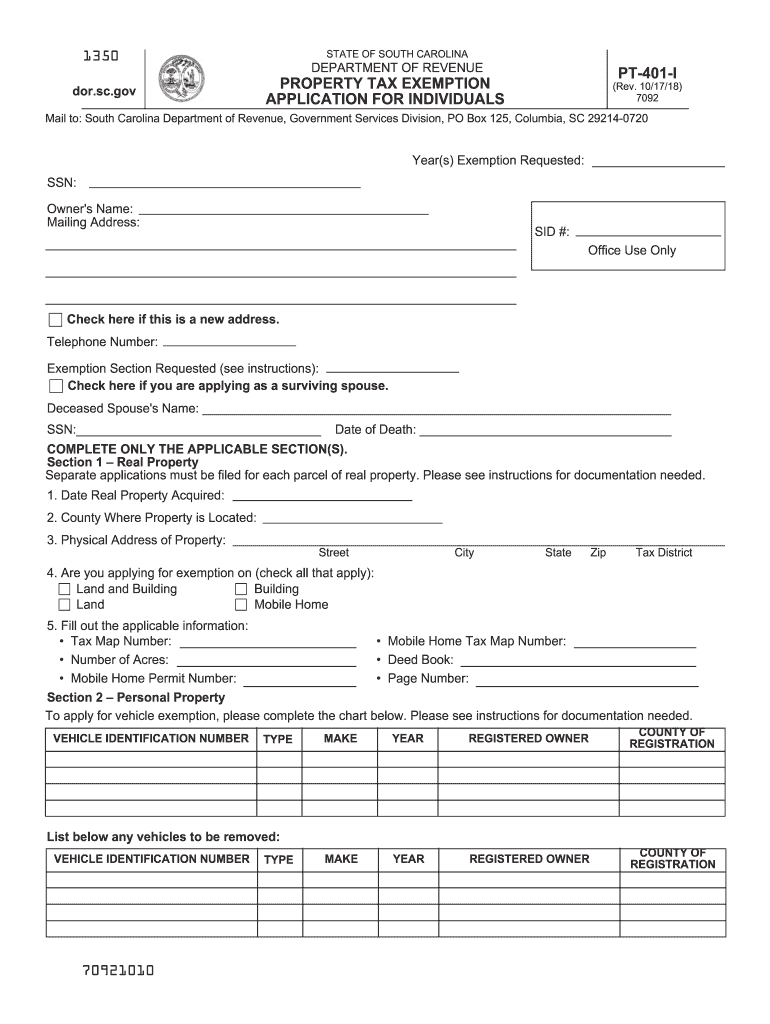

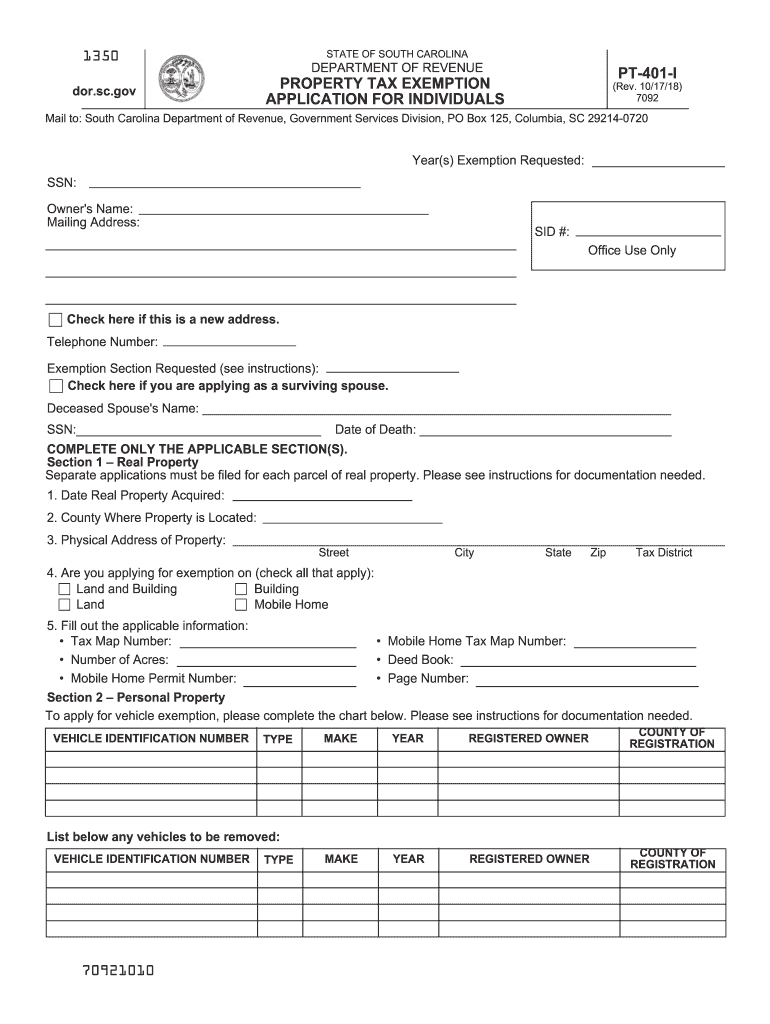

Pt 401 1 Fill Out And Sign Printable PDF Template SignNow

Pt 401 1 Fill Out And Sign Printable PDF Template SignNow

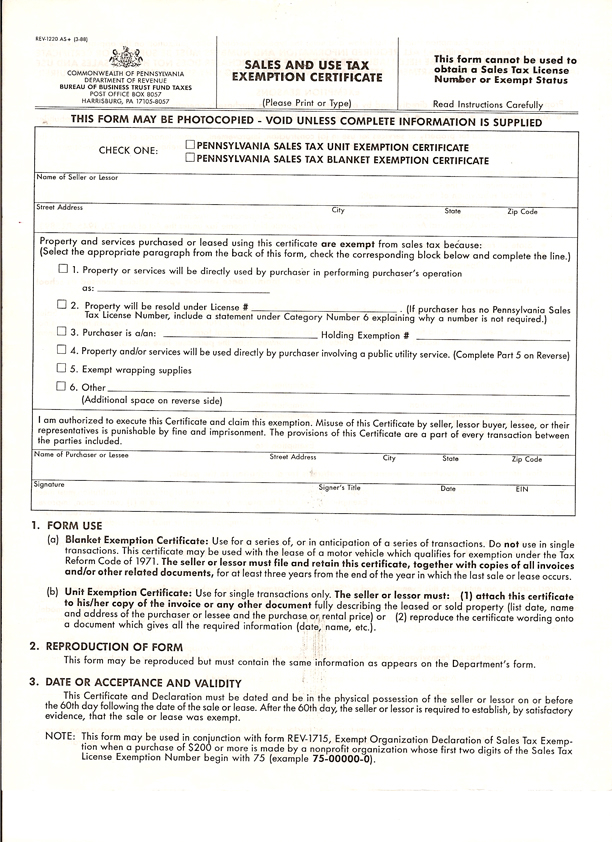

Pa Exemption Certificate Fill Out And Sign Printable PDF Template

CLLA Bankruptcy Blog Debtor Not Allowed To Claim Exemption On Proceeds

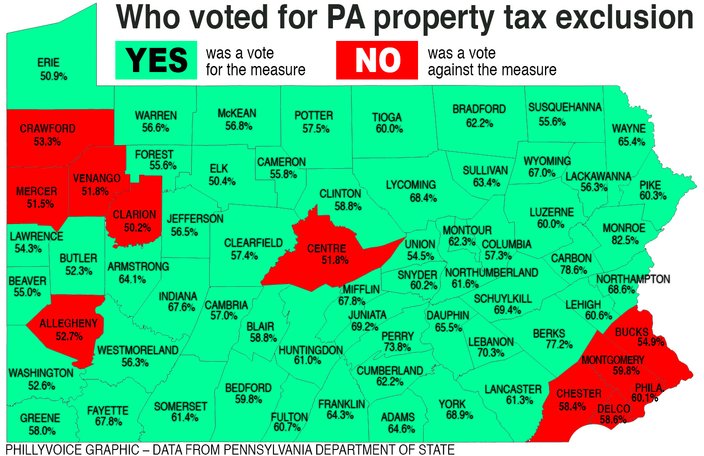

MAP Here s Who Voted For Property Tax Exclusion In Pennsylvania

Property Tax Exemption Pennsylvania - The Pennsylvania Constitution and state tax related statutes provide that property owned by a local political subdivision or municipal authority is not subject to taxation if the property is actually and regularly used for public purposes xvi xvii Likewise the state s Open Space Law Act 442 states that any open space interest