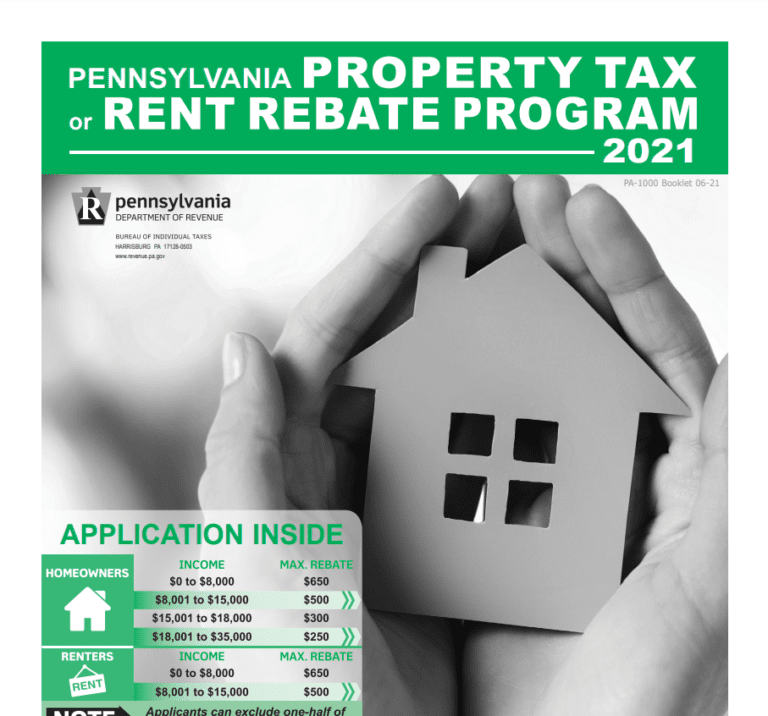

Property Tax Rebate For 2024 Application deadline JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX

There are three ways to apply for the Property Tax Rent Rebate Program online by mail or in person Applicants are encouraged to apply online for the fastest review process Learn more about your options to ensure your application is submitted correctly by the June 30 2024 filing deadline Apply Online The PTRR program is now open for eligible Pennsylvanians to apply for rebates on property taxes and rent paid in 2023 Thanks to Governor Shapiro leading the charge on the historic expansion of the PTRR program there are nearly 175 000 people who are newly eligible for a rebate

Property Tax Rebate For 2024

Property Tax Rebate For 2024

https://asapapartmentfinders.com/wp-content/uploads/2016/12/tax-rebate.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

About the Property Tax Rent Rebate Program Rebates will be distributed beginning July 1 2024 as required by law New or first time filers should anticipate that it will take additional time to review their applications and process their rebates The deadline to apply is June 30 2024 The Anchor program June 15 2022 Gov Phil Murphy announces agreement with Assembly Speaker Craig Coughlin and Senate President Nick Scutari on property tax relief measures A former state treasurer and the chief data officer for a key state department are among the policy experts Gov Phil Murphy and lawmakers picked to advance a planned

Under the expansion crucial updates will be in place when the Department of Revenue in January 2024 opens the filing period to submit applications for property taxes and rent paid in 2023 First the maximum standard rebate will increase from 650 to 1 000 The Property Tax Rent Rebate program has been a lifeline for hundreds of Property Tax Relief Programs Affordable New Jersey Communities for Homeowners and Renters ANCHOR Affordable New Jersey Communities for Homeowners and Renters ANCHOR ANCHOR Benefit Payments We expect to release several large batches of ANCHOR benefits starting January 2 2024

Download Property Tax Rebate For 2024

More picture related to Property Tax Rebate For 2024

How To Get Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189550-Z9C3QJVKXYFO4N04VXT7/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_2.jpg

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

http://static1.squarespace.com/static/5d8d4c603aab2563d4a30208/t/62ebf2c02ff2b767de17f485/1659630272071/2022-8-4+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg?format=1500w

PROPERTY TAXES PAY YOUR SECURED REAL PROPERTY TAXES View Property Tax Bill Fiscal Tax Year 2023 24 runs from July 1 2023 through June 30 2024 and the Tax Roll Year is 2023 24 Five Pay Plan A five year payment plan that allows defaulted property taxes to be paid in 20 percent increments of the redemption amount with interest along The rebate amount can be up to 1 044 a year and if you apply by April 15 2024 you could receive up to a 1 600 TABOR refund 800 for single filers In 2023 this program could provide more than 7 million in relief to Coloradans ensuring seniors and Coloradans with disabilities can heat and remain in their homes

The expansion Increases the maximum standard rebate from 650 to 1 000 Increases the income cap from 35 000 to 45 000 for homeowners Increases the income cap from 15 000 to Pennsylvania s Property Tax Rent Rebate program is now open Gov Josh Shapiro announced on Tuesday The maximum standard rebate is now 1 000 up from 650 after Shapiro signed bipartisan

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

2023 Rent Rebate Form Printable Forms Free Online

https://www.pdffiller.com/preview/47/686/47686220/large.png

https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PTRR/Documents/2023_pa-1000_inst.pdf

Application deadline JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRentRebateProgram/Ways-to-Apply

There are three ways to apply for the Property Tax Rent Rebate Program online by mail or in person Applicants are encouraged to apply online for the fastest review process Learn more about your options to ensure your application is submitted correctly by the June 30 2024 filing deadline Apply Online

Where To Mail Pa Property Tax Rebate Form Amended Printable Rebate Form

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Residents Can File Property Tax Rent Rebate Program Applications Online Lower Bucks Times

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

PROPERTY TAX REBATE Information Flyer Warminster Heights

PROPERTY TAX REBATE Information Flyer Warminster Heights

Homeowner Renters District 16 Democrats

Tax Rebate For Individual It Is The Refund Which An Individual Can Claim From The Income Tax

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

Property Tax Rebate For 2024 - You will receive your 2024 Property Tax bill from Dec 2023 On this page Understanding property tax Property tax payment Understanding property tax Property tax is a tax on ownership of property whether it is rented out owner occupied or vacant Our Taxes Our Nation