Property Tax Rebates And Income Tax Web 9 sept 2023 nbsp 0183 32 Due to the 10 000 limit on itemized deductions for state income and property taxes some taxpayers won t need to include the state refund in their income

Web 17 ao 251 t 2023 nbsp 0183 32 WELFARE These five states are giving income and property tax rebates and economic relief payments Some states continue to give stimulus style payments to Web 7 nov 2019 nbsp 0183 32 In Florida for example the homestead exemption reduces a residential property s assessed value by 50 000 for tax purposes according to Leslie Evans of

Property Tax Rebates And Income Tax

Property Tax Rebates And Income Tax

https://files.taxfoundation.org/20190806144825/Median-Property-Taxes-Paid-by-County-011.png

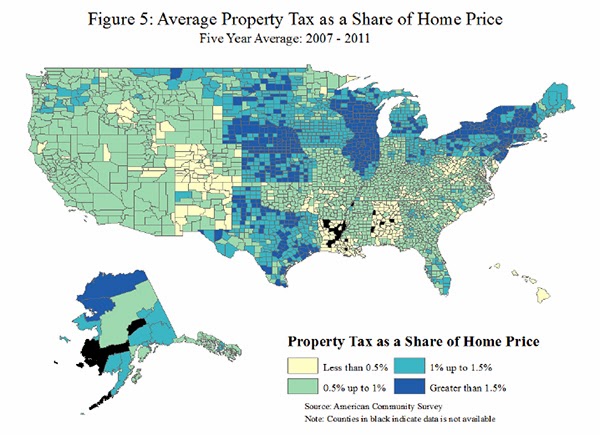

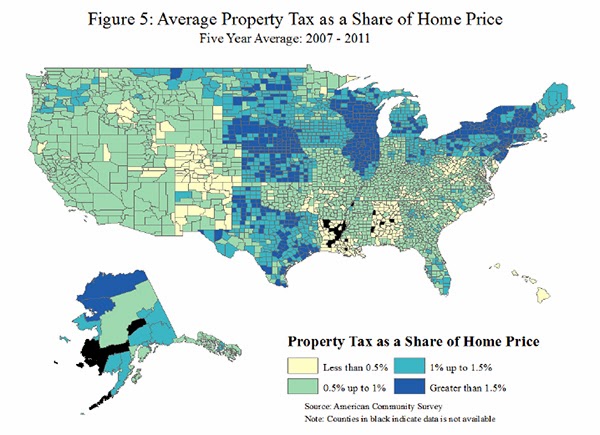

Useful Map Of Property Tax Rates Across The Country with Some

https://static1.squarespace.com/static/55ff4befe4b029a3a1975b6c/55ff4c6de4b06ae6b94dff59/55ff4c73e4b06ae6b94e01c0/1442794793701/

Upstate NY Has Some Of The Highest Property Tax Rates In The Nation

https://assets.website-files.com/5a43cca98192d400018e40cc/620a5fcb6f30fb06bfebd31a_TaxFoundationPropertytaxesMap 2021.png

Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can Web 9 sept 2023 nbsp 0183 32 One time tax rebates The 2023 budget proposal includes about 1 05 billion in proposed tax reductions most of which will come from one time tax rebates to

Web 9 sept 2023 nbsp 0183 32 The 2023 budget proposal includes about 1 05 billion in proposed tax reductions most of which will come from one time tax rebates to eligible Virginians Web Less 2023 Property Tax Rebate 60 of 2023 Property Tax capped at 60 60 Total Property Tax payable 140 Note The Property Tax Rebate will be computed based

Download Property Tax Rebates And Income Tax

More picture related to Property Tax Rebates And Income Tax

Can Someone Explain Personal Property Car Tax To Me R nova

http://taxfoundation.org/sites/taxfoundation.org/files/UserFiles/Image/maps/property_tax_median_rate.jpg

Laguhan At Kabilaan Halimbawa

https://i0.wp.com/realestateinvestingtoday.com/wp-content/uploads/2017/04/property-tax-rates-in-every-state.jpeg

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

https://npr.brightspotcdn.com/dims4/default/42b0372/2147483647/strip/true/crop/758x413+0+0/resize/1760x958!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Fcf%2F92%2Fc1613a8b4b4ba9b8b28ebd901285%2Ftaxrebate.png

Web 8 sept 2023 nbsp 0183 32 IR 2023 166 Sept 8 2023 Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue Web 8 sept 2023 nbsp 0183 32 Florida Solar Panel Costs On average it costs 12 950 to install a 5kW solar panel system in Florida before rebates and incentives A smaller 3kW system may cost

Web 1 f 233 vr 2023 nbsp 0183 32 House Bill 222 which would put about 284 million into property tax rebates In its current form it would provide rebates of up to 500 per homeowner for taxes paid in 2022 and 2023 The Montana Web Property taxes are 15 or more of total income What Has Stayed the Same Forms and Schedules There are no changes to the forms or schedules used for filing a rebate

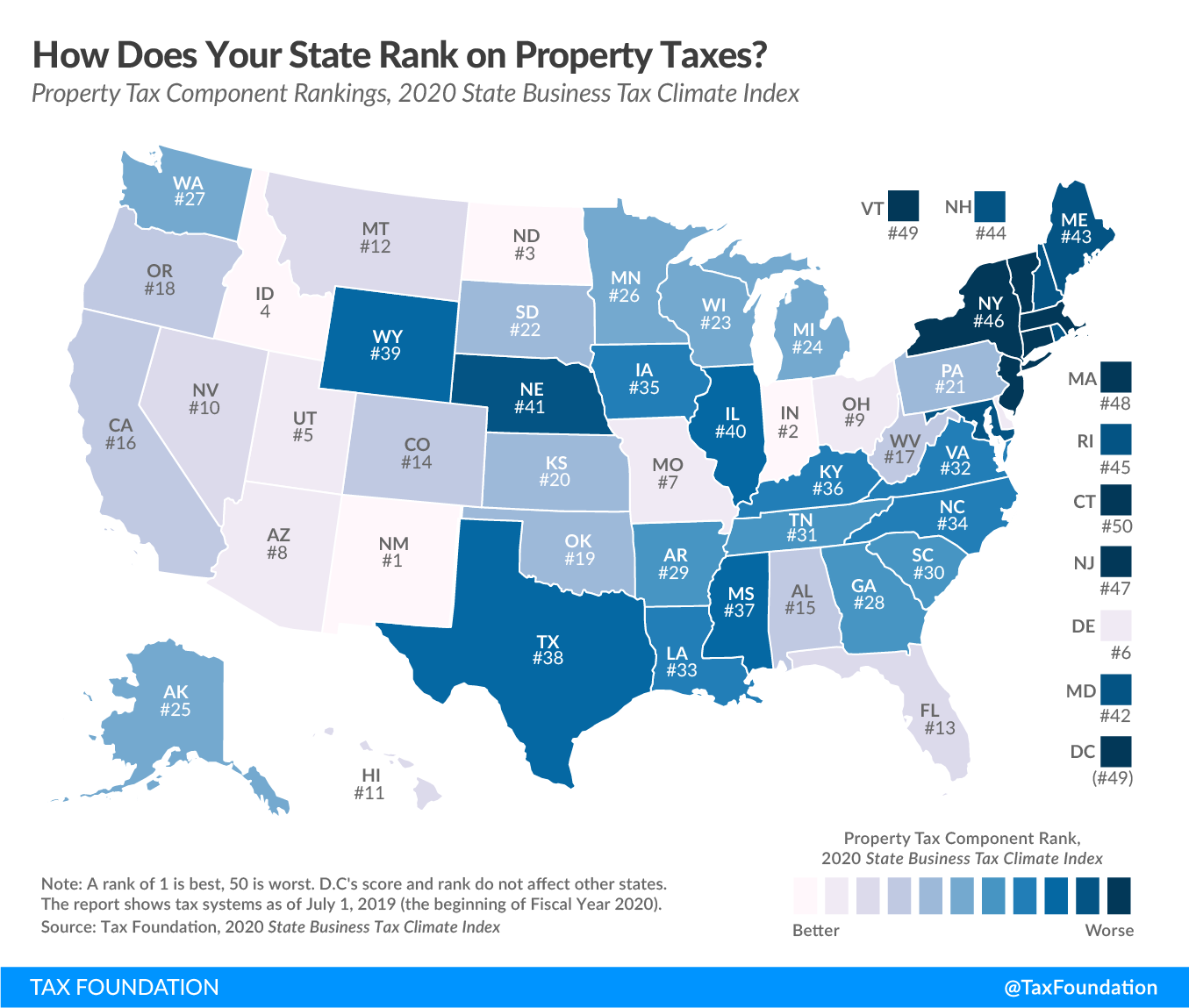

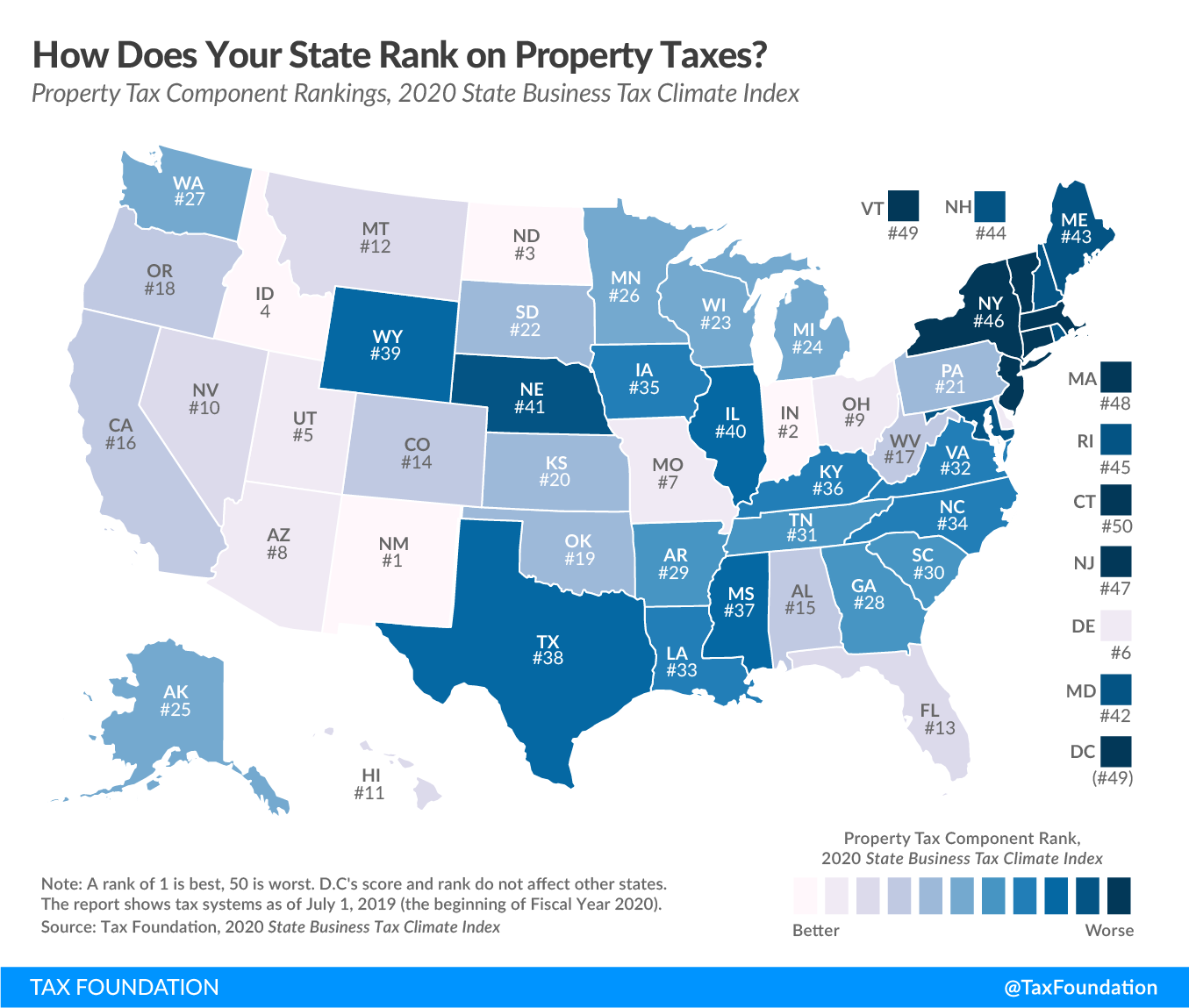

Best Worst Property Tax Codes In The U S Tax Foundation

https://files.taxfoundation.org/20191211110941/Property-SBTCI-19-dv2-01.png

What To Know About Montana s New Income And Property Tax Rebates

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA18ZJcd.img?w=1280&h=720&m=4&q=50

https://www.kiplinger.com/taxes/will-your-state-rebate-check-be-taxed

Web 9 sept 2023 nbsp 0183 32 Due to the 10 000 limit on itemized deductions for state income and property taxes some taxpayers won t need to include the state refund in their income

https://en.as.com/latest_news/these-five-states-are-giving-income-and...

Web 17 ao 251 t 2023 nbsp 0183 32 WELFARE These five states are giving income and property tax rebates and economic relief payments Some states continue to give stimulus style payments to

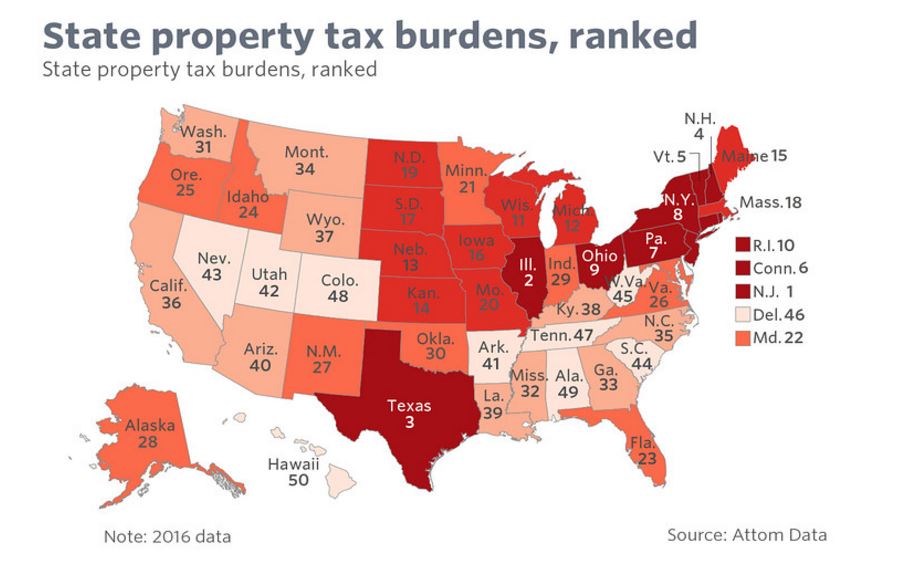

US Property Tax Comparison By State Armstrong Economics

Best Worst Property Tax Codes In The U S Tax Foundation

U S Property Taxes Comparing Residential And Commercial Rates Across

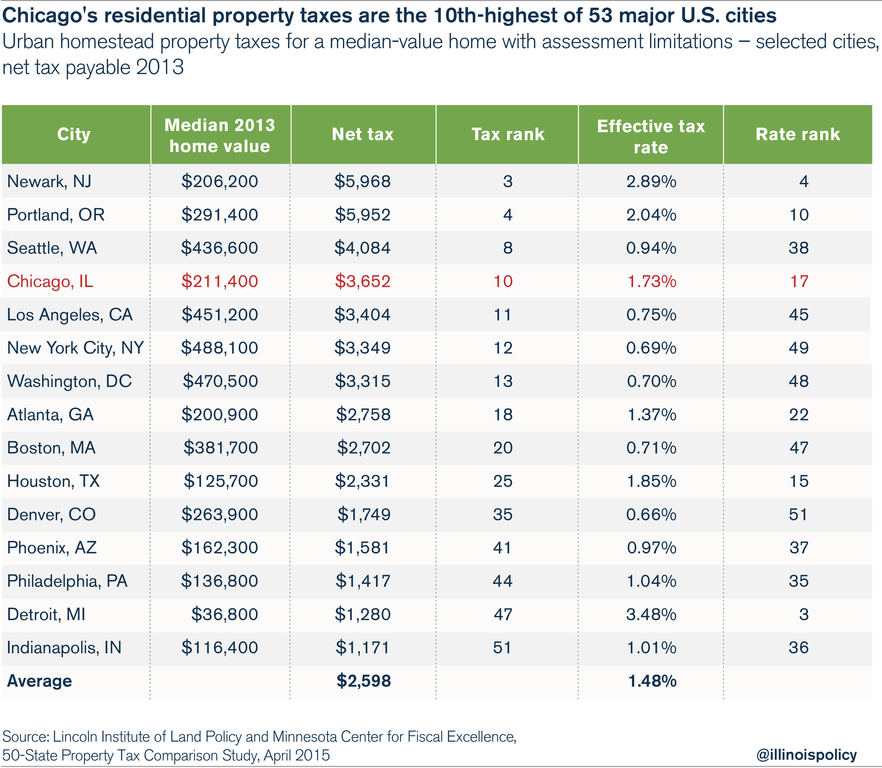

The Chicago Squeeze Property Taxes Fees And Over 30 Individual Taxes

How High Are Property Taxes In Your State Tax Foundation

Nh Property Tax Rates By Town 2022

Nh Property Tax Rates By Town 2022

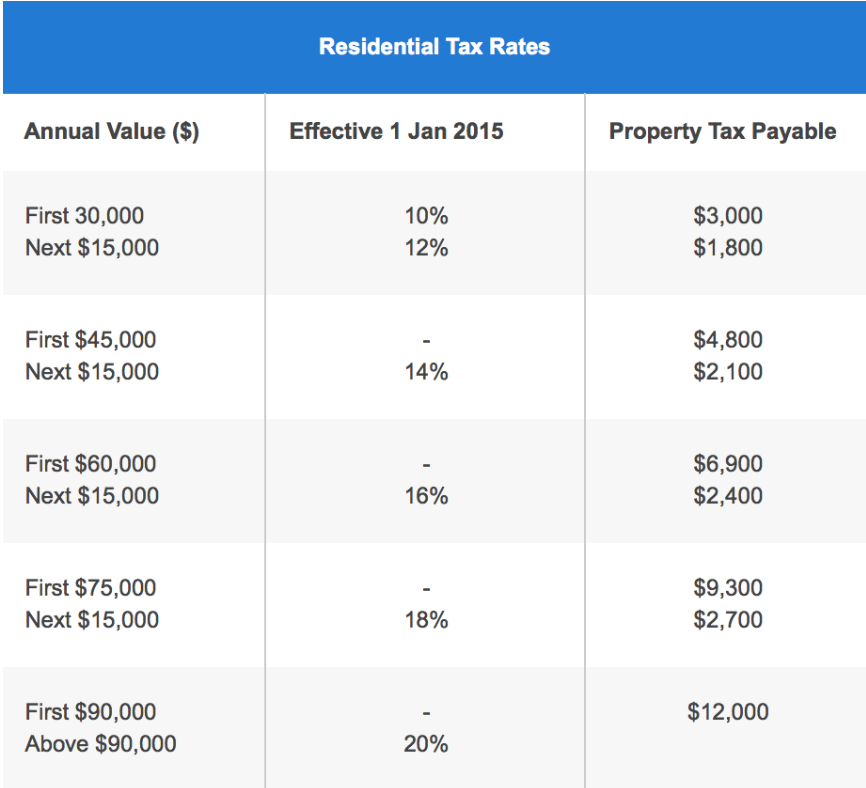

Property Tax For Homeowners In Singapore How Much To Pay Rebates

State Property Taxes Reliance On Property Taxes By State

Best Worst State Property Tax Codes Tax Foundation

Property Tax Rebates And Income Tax - Web The fiscal year 2023 property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less Most