Claim Tax Rebate On Business Mileage Web 3 mars 2016 nbsp 0183 32 How to claim tax relief on money you ve spent on things like a work uniform and clothing tools business travel professional fees and subscriptions From HM

Web 21 mars 2023 nbsp 0183 32 Claiming a deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to write off their travel as a tax Web Government approved mileage allowance relief rates for the 2023 2024 tax year are Car van 163 0 45 per mile up to 10 000 miles 163 0 25 over 10 000 miles If you carry a

Claim Tax Rebate On Business Mileage

Claim Tax Rebate On Business Mileage

https://images.sampletemplates.com/wp-content/uploads/2017/03/Business-Mileage-Claim-Form1.jpg

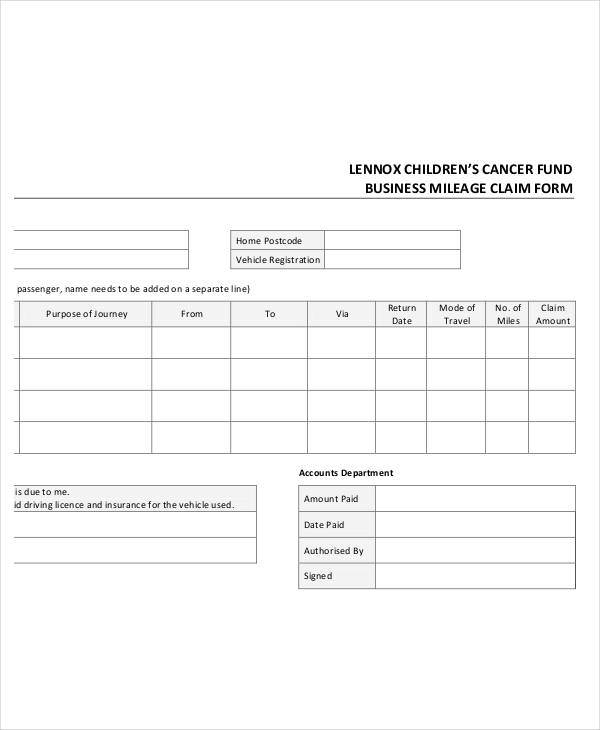

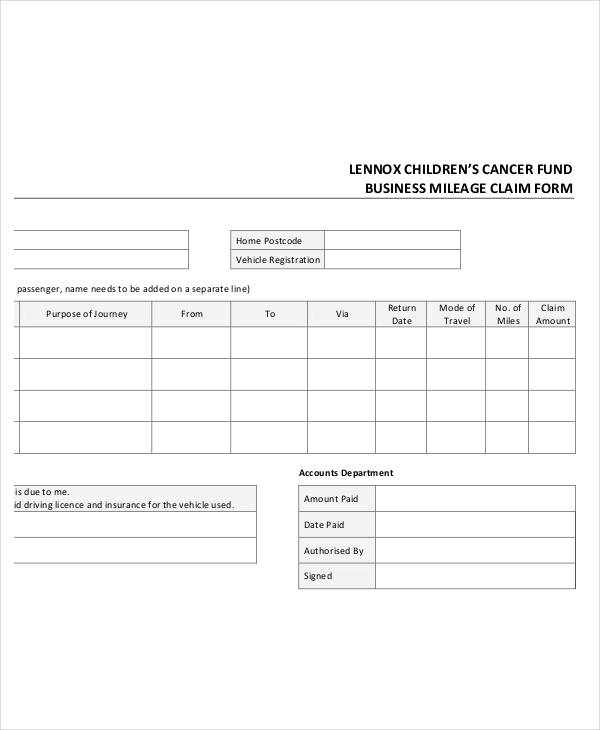

FREE 32 Claim Form Templates In PDF Excel MS Word

https://images.sampleforms.com/wp-content/uploads/2017/03/Business-Mileage-Claim-Form-Template.jpg

How To Claim The Work Mileage Tax Rebate Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2019/02/tax-rebate-work-mileage-2.png

Web If you received a mileage allowance from your employer but it does not meet the amount allowed by the HMRC you can claim the difference Additionally if your mileage Web 9 juin 2023 nbsp 0183 32 The maximum claim is 10 000 miles at 45p and 1 500 at 25p for a total of 163 4 875 The employer reimburses at 15p per mile for a total of 163 1 725 11 500 at 15p The employee can therefore claim tax relief on

Web 28 mars 2014 nbsp 0183 32 There are special rules for working out the tax relief on motoring expenses paid to employees who use their own vehicles for business travel go to paragraph 9 12 Web 12 juil 2022 nbsp 0183 32 Say you drove your car 14 000 miles for business travel over the last tax year Using the standard mileage allowance rates for 2022 you d calculate the total relief you can claim as follows 10 000 x 163 0 45

Download Claim Tax Rebate On Business Mileage

More picture related to Claim Tax Rebate On Business Mileage

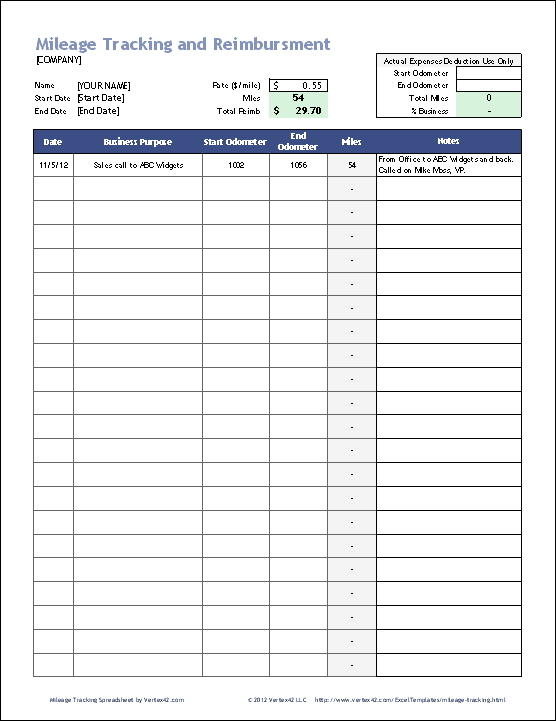

Mileage Claim Form Template

https://minasinternational.org/wp-content/uploads/2021/03/costum-mileage-claim-form-template-word-sample.png

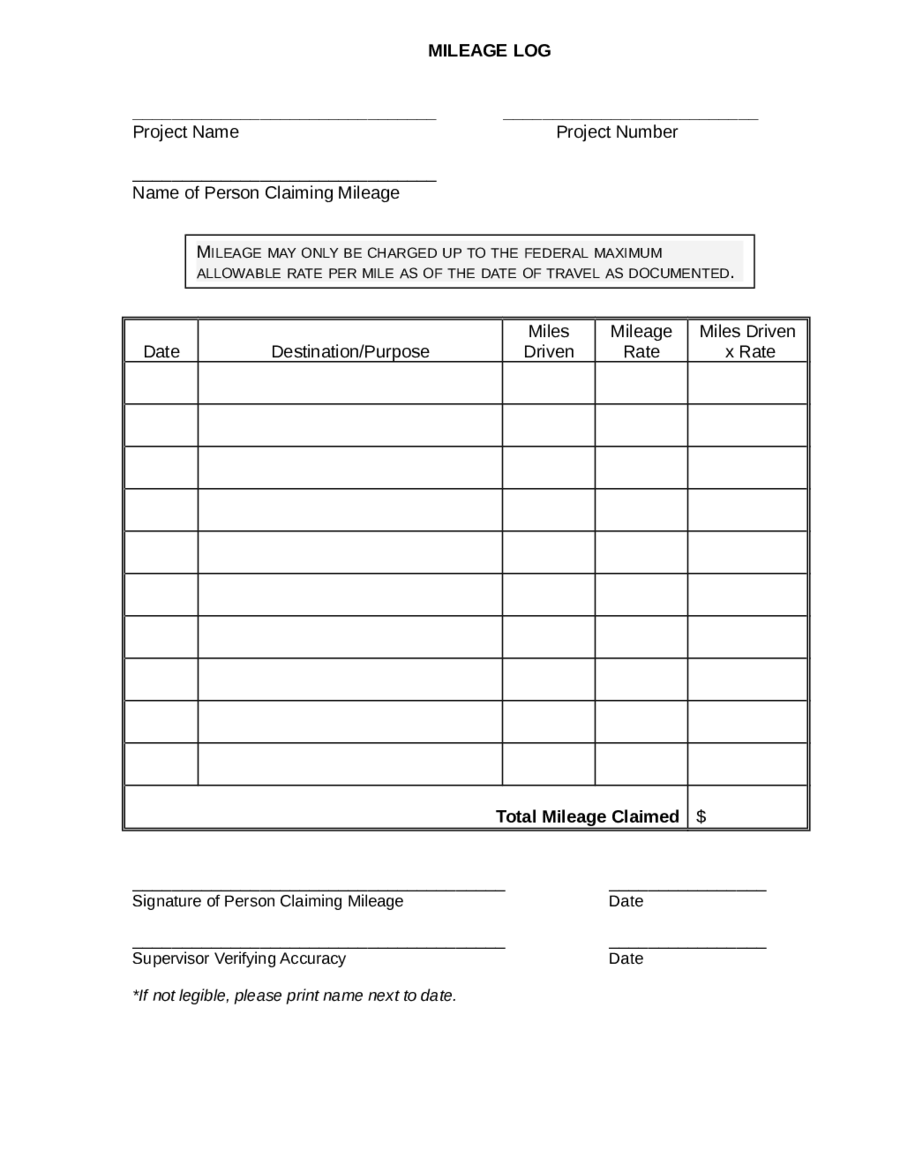

2023 Mileage Log Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/yum/mileage-log-form-0266145.png

Mileage Log Template For Taxes New Mileage Spreadsheet For Taxes

https://i.pinimg.com/originals/74/27/72/74277222a9d4830d0a5d5265e743fb9c.jpg

Web 30 d 233 c 2019 nbsp 0183 32 The maximum that can be paid tax free is calculated as the number of business miles for which a passenger is carried multiplied by a rate expressed in pence Web MILEAGE ALLOWANCE If You Are Required To Use Your Own Vehicle For Work You May Be Able To Claim Mileage Allowance Rebate From HMRC Based On The Number

Web You claim back tax relief for expenses of employment such as business mileage as part of a tax rebate claim It means keeping track of your mileage expenses and how far you Web 24 f 233 vr 2022 nbsp 0183 32 Knowing when you can claim expenses or tax relief for driving on business is obviously good for your bank balance But at the same time getting mileage wrong

Hmrc Private Mileage Claim Form Erin Anderson s Template

https://www.ionos.co.uk/startupguide/fileadmin/StartupGuide/Vorlagen_KMU/Mileage_log_template_UK.PNG

Mileage Reimbursement Form Excel Charlotte Clergy Coalition

https://charlotteclergycoalition.com/wp-content/uploads/2018/08/mileage-reimbursement-form-excel-mileage-log-with-reimbursement-log.jpg

https://www.gov.uk/guidance/claim-income-tax-relief-for-your...

Web 3 mars 2016 nbsp 0183 32 How to claim tax relief on money you ve spent on things like a work uniform and clothing tools business travel professional fees and subscriptions From HM

https://money.usnews.com/money/personal-finance/taxes/articles/...

Web 21 mars 2023 nbsp 0183 32 Claiming a deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to write off their travel as a tax

10 Excel Mileage Log Templates Excel Templates

Hmrc Private Mileage Claim Form Erin Anderson s Template

Work Mileage Allowance Relief Greater Manchester

Template Mileage Claim Form HQ Printable Documents

FREE 47 Claim Forms In PDF

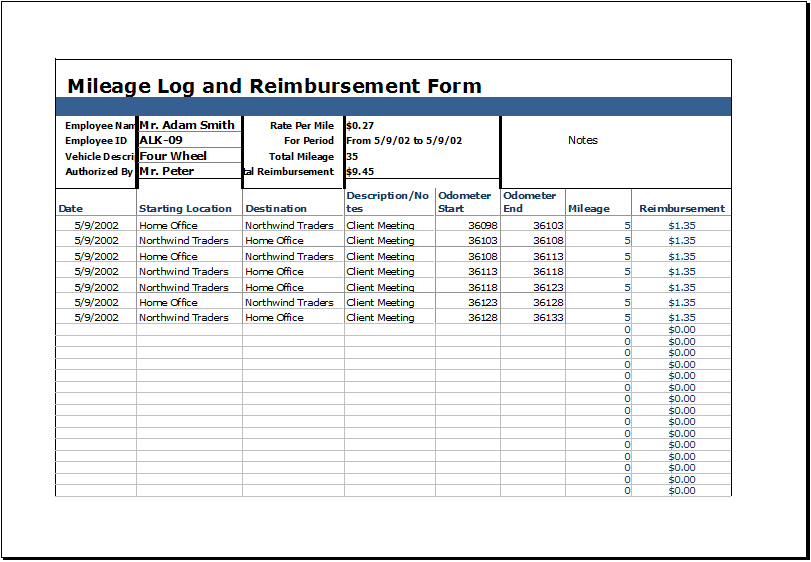

Vehicle Mileage Log With Reimbursement Form Word Excel Templates

Vehicle Mileage Log With Reimbursement Form Word Excel Templates

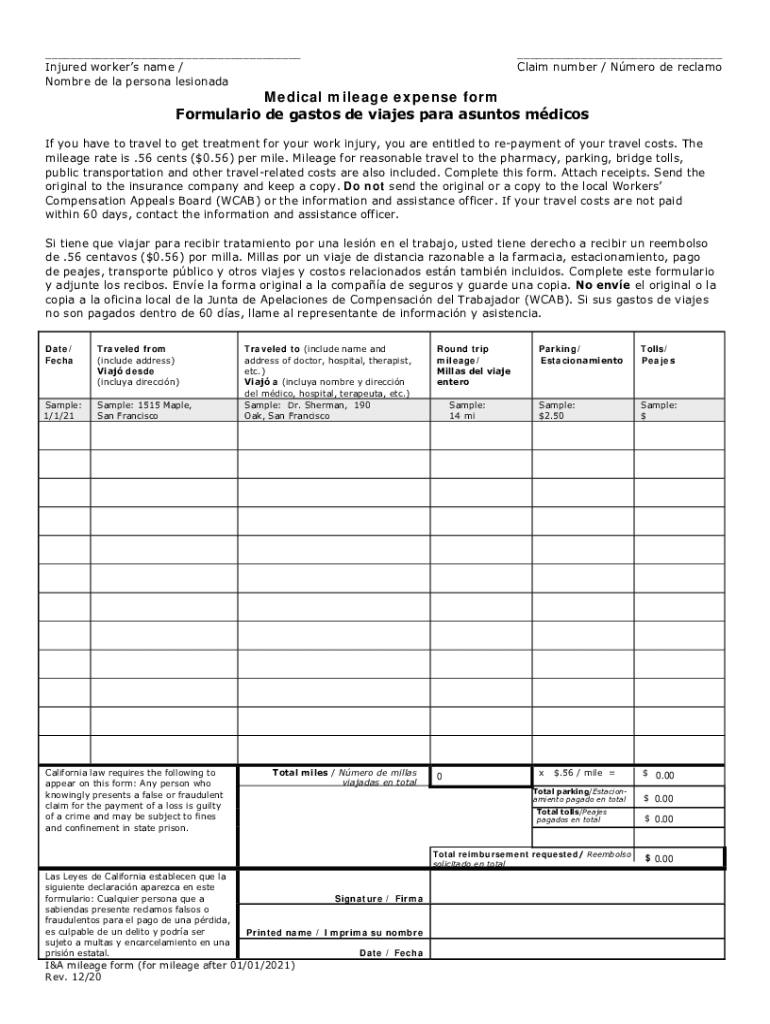

2020 CA I A Mileage Form Fill Online Printable Fillable Blank

5 Free Mileage Tracking Log And Mileage Reimbursement Form Template

Download Form P87 For Claiming Uniform Tax Rebate DNS Accountants

Claim Tax Rebate On Business Mileage - Web 45p per mile for the first 10 000 miles you travel for work in a year After that the rate drops to 25p These are called Approved Mileage Allowance Payments AMAP If your