Can You Claim Tax Back On Business Mileage For more on this specifically you can check out HMRC s website How much mileage you can claim The mileage allowance relief claim is based on HMRC s approved mileage

As an employee you can only claim mileage allowance tax relief if you use your own vehicle for company business If you have a car provided by your company you are able An employee does not need to have a permanent workplace to go back to to get tax relief for travel to a temporary workplace Example 25 no requirement to

Can You Claim Tax Back On Business Mileage

Can You Claim Tax Back On Business Mileage

https://biz-com.co.za/wp-content/uploads/2021/08/Bizcom-Blog-Images-2-1.png

Maximising Your Tax Return 5 Deductions You Need To Know About AR

https://www.aradvisors.com.au/awcontent/aradvisors/images/news/teasers/maximisetaxreturn.jpg

Claiming Back Tax On Business Expenses Small Business UK

https://smallbusiness-production.s3.amazonaws.com/uploads/2010/07/claiming-back-tax-1568x1046.jpeg

If you travel 10 business miles and your employer reimburses you nothing you can claim tax relief on 4 50 10 miles at 45p If you normally pay tax at 20 this 2 Approved mileage rates You can claim your business mileage by working out the qualified miles you ve driven throughout the year from your mileage log and multiplying them by the approved HMRC mileage

When you re self employed either as a sole trader or the director of your own limited company claiming business mileage is a bit of a no brainer as an allowable business expense claiming business The rate of mileage tax relief you can claim is based on the rate of income tax you pay 20 40 or 45 For example 10 000 miles of business travel at 45p per mile 4500

Download Can You Claim Tax Back On Business Mileage

More picture related to Can You Claim Tax Back On Business Mileage

Shedworking Can You Claim Tax Back On Your Garden Office

https://2.bp.blogspot.com/-T6v39Kzz7mU/WlM7Gfc_oSI/AAAAAAAABcs/SrgbG2uMg14lvBsD7-jLHgMSIttD1AEywCLcBGAs/s1600/CM_Devine_Office_Cedar_37.jpg

Claim Tax Back For Working At Home I Hate Numbers

https://www.ihatenumbers.co.uk/wp-content/uploads/2021/07/IHN_Episode_72_cover.png

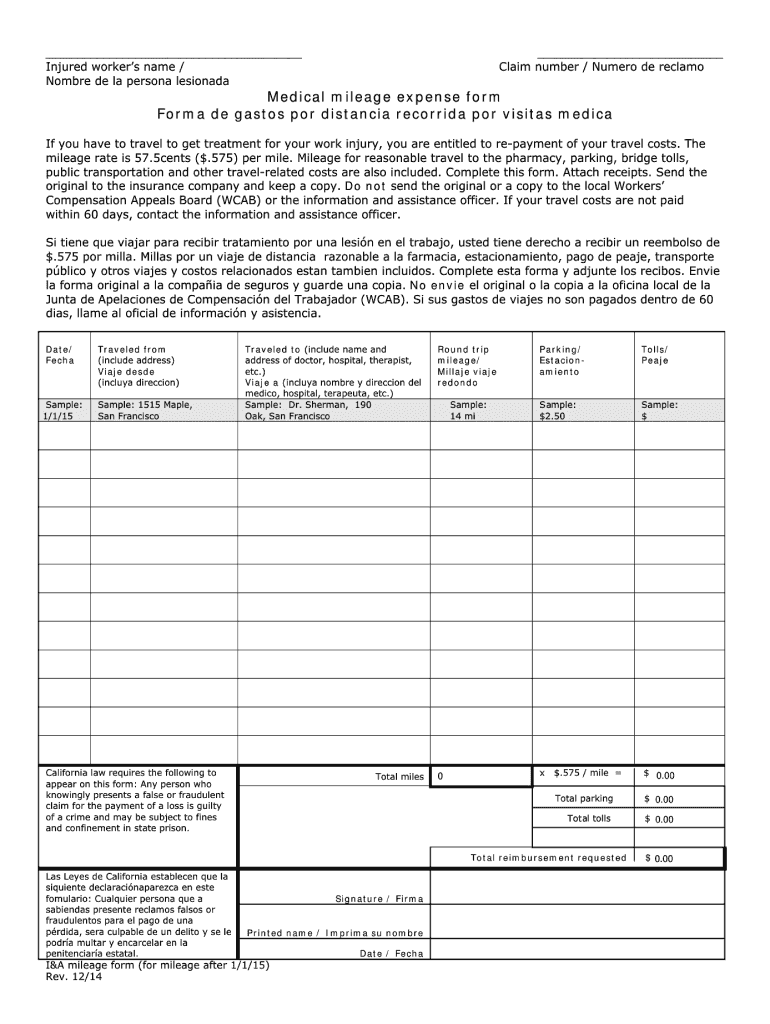

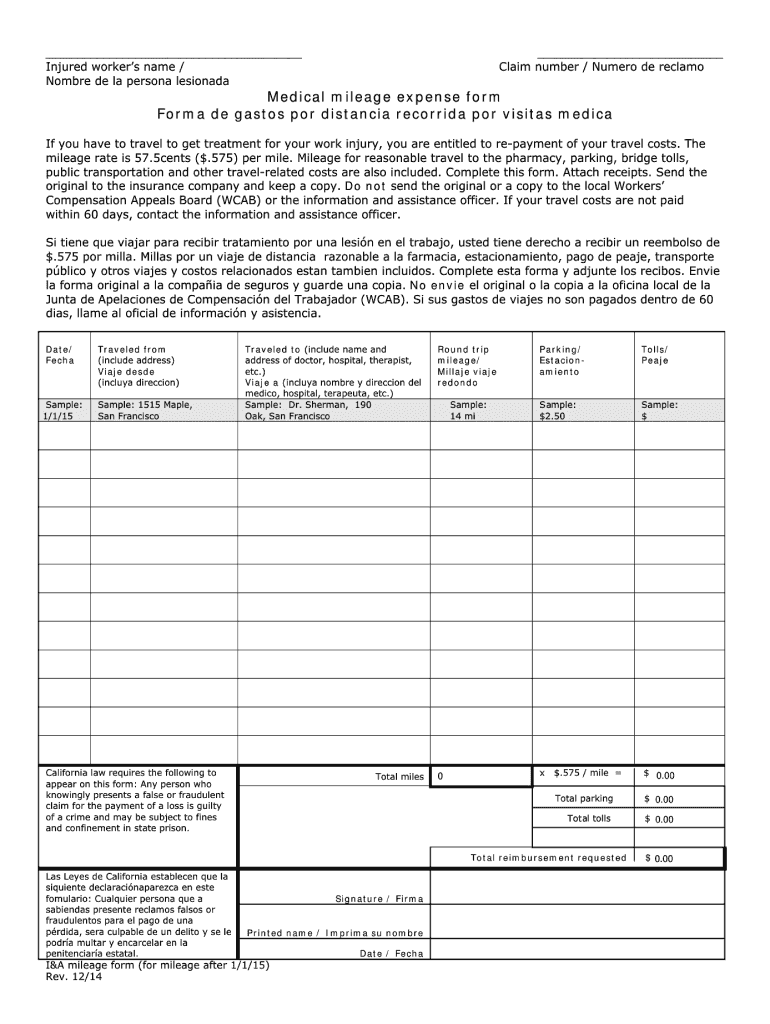

25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes

https://i.pinimg.com/originals/5b/93/c0/5b93c0ebe22d3e39de585887378000ba.jpg

When using your personal vehicle for work you could claim tax relief on the approved mileage rate explained below that covers the cost of owning and running it However you can t claim back on After 10 000 miles the amount that businesses can claim back drops to 25p per mile Business mileage rates are updated by HM Revenue and Customs HMRC every year and published on the gov uk website Here

HMRC needs you to follow their specific mileage tax relief rules and expects you to claim back what you are entitled to from them using either a P87 form or a self assessment To work out whether tax is due on mileage allowance payments multiply the number of business miles travelled by the employee by an approved rate

Can You Claim Tax Back On Air Con Installations

https://www.yourmoney.com/wp-content/uploads/sites/3/2022/08/aircon.jpg

3 Ways To Claim Tax Back WikiHow

https://www.wikihow.com/images/c/ca/Claim-Tax-Back-Step-15-Version-2.jpg

https://www.driversnote.co.uk/hmrc-mileage-guide/mileage-allowan…

For more on this specifically you can check out HMRC s website How much mileage you can claim The mileage allowance relief claim is based on HMRC s approved mileage

https://hrnews.co.uk/an-employees-guide-to...

As an employee you can only claim mileage allowance tax relief if you use your own vehicle for company business If you have a car provided by your company you are able

6 Methods To Reduce Your Tax In Ireland Cronin Co

Can You Claim Tax Back On Air Con Installations

Can You Claim Tax Back On Your Work Wardrobe SBS News

How Do You Claim Tax Back Money co uk

Can You Claim The Home Office Tax Deduction If Ve Been Working Remotely

Mileage Form 2021 IRS Mileage Rate 2021

Mileage Form 2021 IRS Mileage Rate 2021

How To Claim Tax Back After Losing Job Tax Rebate Redundancy

Claim Tax Back On Energy Costs If You Work Remotely MoneyMagpie

Can You Claim Tax Back On Your Work Wardrobe SBS News

Can You Claim Tax Back On Business Mileage - If you pay your travel expenses out of your own pocket for example your company doesn t reimburse you for business travel or you re self employed then you