Property Tax Relief Meaning Tax relief is also available for people affected by natural disasters For example the IRS has historically made tax relief announcements to help individuals and businesses affected by severe

Property tax exemptions subtract a set amount from your tax bill while tax deductions are subtracted from your taxable income You apply deductions when you Senior Citizens and Tax Relief Senior citizens particularly those 65 years of age or older may qualify for exemptions like the standard homestead exemption or the low income senior citizens assessment freeze aimed

Property Tax Relief Meaning

Property Tax Relief Meaning

https://www.texaspolicy.com/wp-content/uploads/2023/02/Property-Tax-Relief-1350x759.jpg

Apply For Historic Property Tax Relief Program City Of Perth Amboy

https://cdnsm5-hosted.civiclive.com/UserFiles/Servers/Server_11204924/Image/News/2022/ANCHOR Program.png

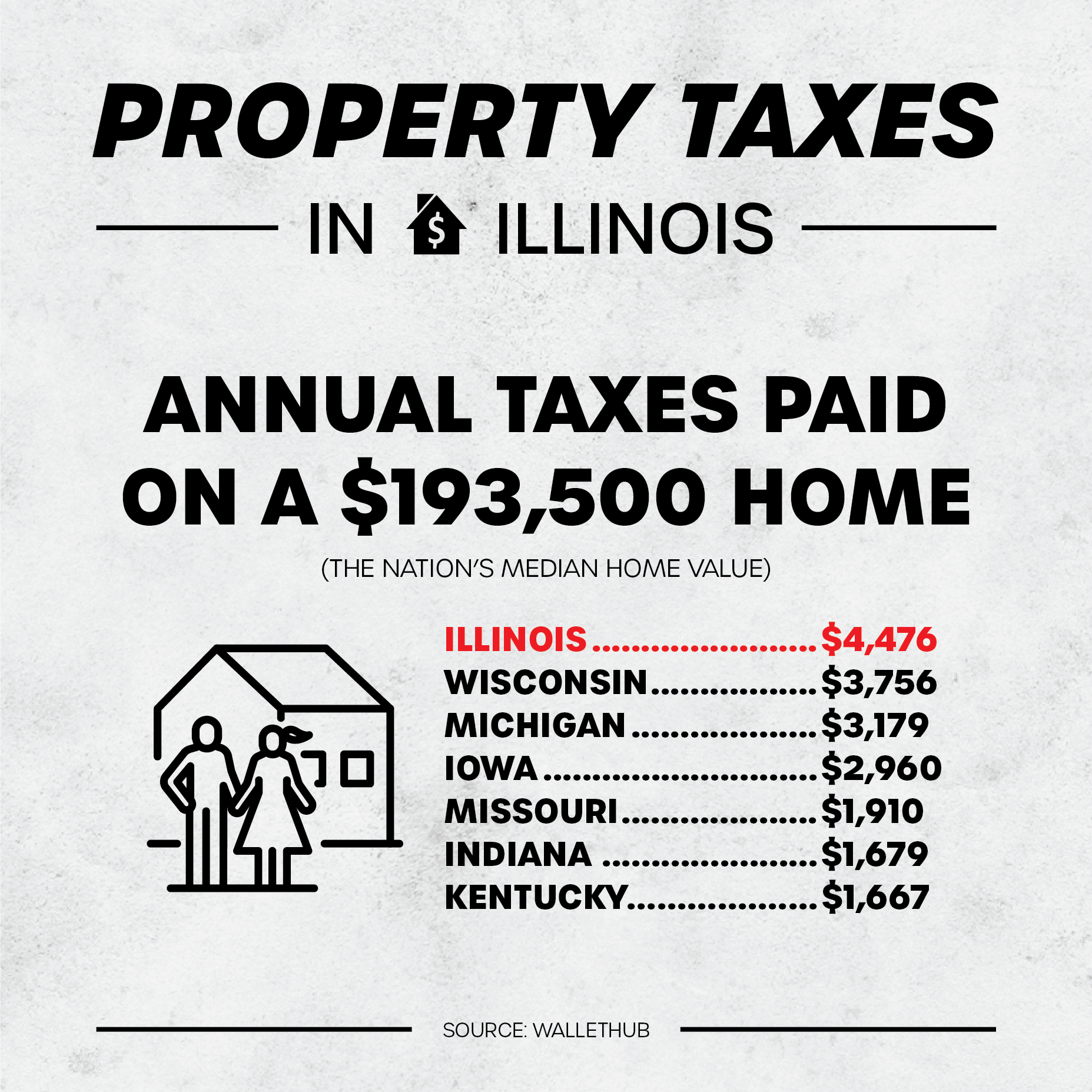

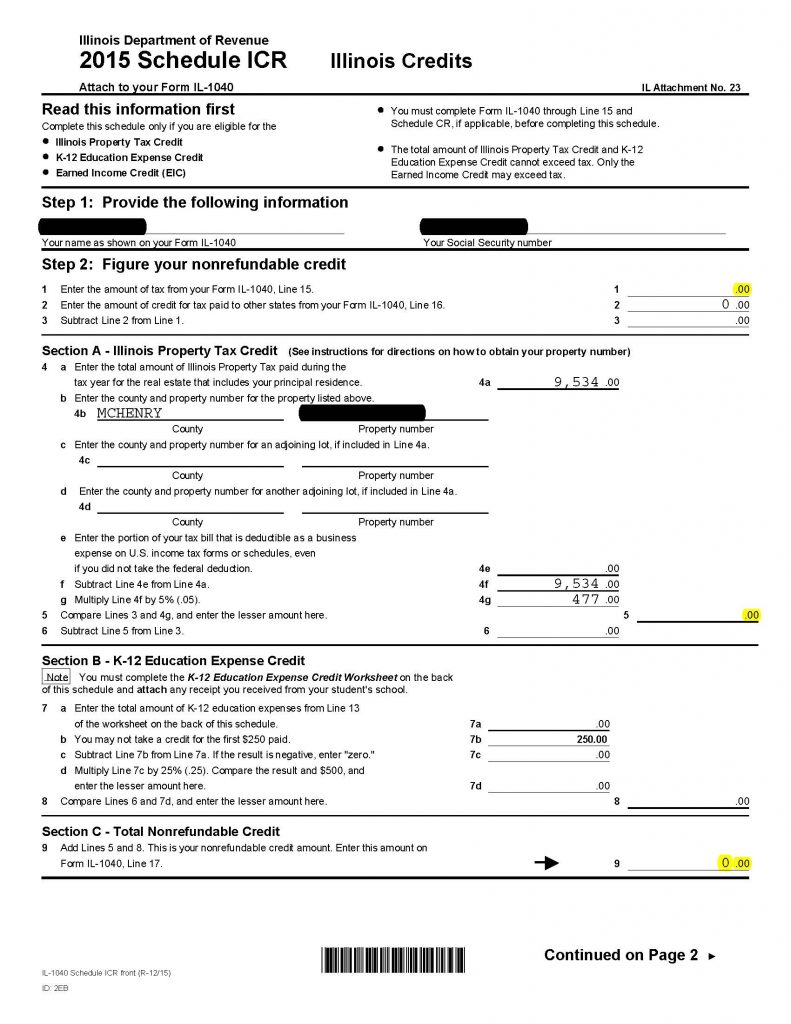

Meaningful Substantive Property Tax Relief In Illinois Is Critical

https://repweber.com/wp-content/uploads/sites/9/2020/01/Property-Taxes-in-Illinois-SQUARE-2.png

The homestead tax exemption can provide surviving spouses with ongoing property tax relief on a graduated scale so homes with lower assessed values First Time Homebuyer Tax Credit Meaning Assessed values generally move in tandem with market values and a higher assessed value typically means a higher tax bill But tax collection practices also vary by state To keep this bill from ballooning year to

Property tax is an ad valorem tax meaning the amount owed is a percentage of the assessed value of the real estate Property tax receipts are the main source of revenue Apply only to homeowners meaning renters who pay a portion of their landlords property taxes each month are excluded Homeowners of all income levels can take advantage of the program Property tax relief

Download Property Tax Relief Meaning

More picture related to Property Tax Relief Meaning

Property Tax Relief Connecticut Sentry CommercialSentry Commercial

https://sentrycommercial.com/wp-content/uploads/2020/04/remarks-property-tax-relief.jpg

Shoreline Area News Senior And Disabled Property Tax Relief Info

https://1.bp.blogspot.com/-MJA0NTUUGZ0/XiVdsmmRIuI/AAAAAAACHXs/_NsUbU09YCcUiQqxcWmsCXOTsvF8WQjSwCLcBGAsYHQ/s1600/property%2Btax%2Brelief%2BFLYER.png

Meaningful Substantive Property Tax Relief In Illinois Is Critical

https://repweber.com/wp-content/uploads/sites/9/2020/01/Property-Taxes-in-Illinois01-683x1024.png

The available exemption amount can depend on age disability marital status dependent children living at home and property type Homestead exemption laws vary from state to state and county to county but the October 2024 October 2 Treasury has published The American Rescue Plan Expanding Access to Housing featuring stories about how Treasury programs have helped families

The tax relief that landlords of residential properties get for finance costs is being restricted to the basic rate of Income Tax This is being phased in from 6 April A homestead exemption is when a state reduces the property taxes you have to pay on your home It can also help prevent you from losing your home during economic

First time Home Buyers An Insight To Stamp Duty Land Tax Relief

https://hawklaw.co.uk/wp-content/uploads/2019/06/Hawklaw-first-time-home-buyers-stamp-duty-tax-relief-1024x684.jpg

NJ ANCHOR Property Tax Relief Program Application Deadline Extended To

https://middletownship.com/wp-content/uploads/2022/11/315868169_675151700647024_4862430220857408753_n.jpg

https://www.investopedia.com/terms/t/tax-r…

Tax relief is also available for people affected by natural disasters For example the IRS has historically made tax relief announcements to help individuals and businesses affected by severe

https://www.annuity.org/personal-finance/taxes/property/tax-exemptions

Property tax exemptions subtract a set amount from your tax bill while tax deductions are subtracted from your taxable income You apply deductions when you

Texas Property Tax Relief Plan Here s Who Would Benefit

First time Home Buyers An Insight To Stamp Duty Land Tax Relief

Property Tax Relief Claim

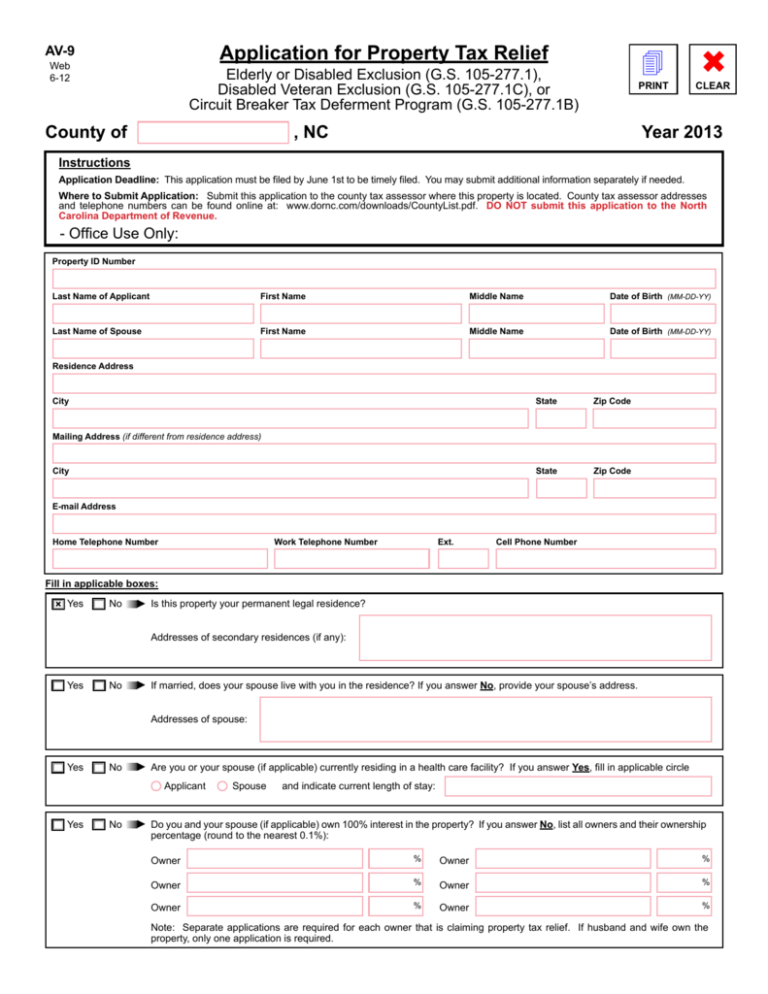

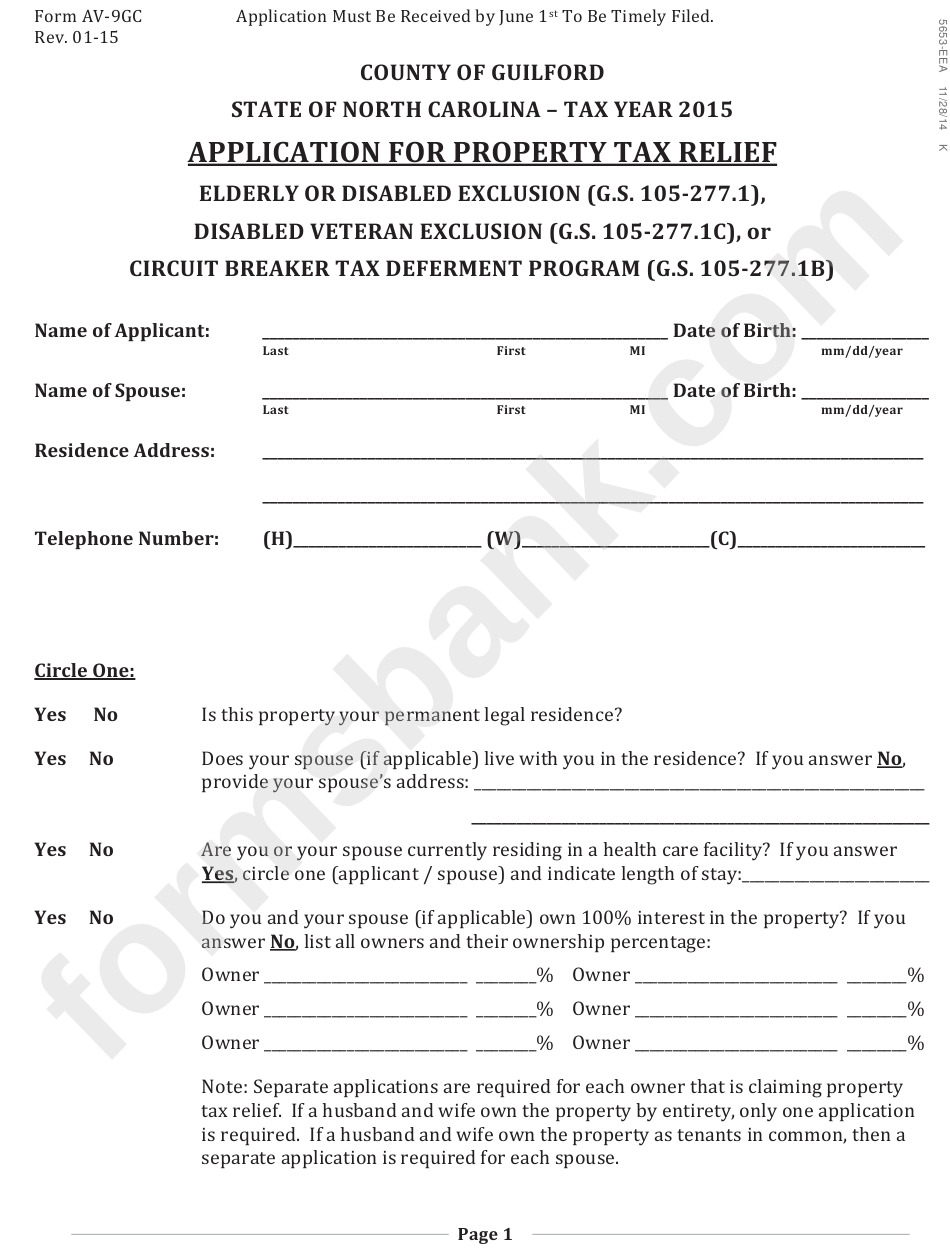

Application For Property Tax Relief

Texas Property Tax Relief Your Questions Answered

Form Av 9gc Application For Property Tax Relief Printable Pdf Download

Form Av 9gc Application For Property Tax Relief Printable Pdf Download

Tennessee Property Tax Relief Program HELP4TN Blog HELP4TN

Providing Some Property Tax Relief For Low Income Seniors Steve Reick

People Working From Home Due To COVID 19 Can Avail Of Tax Relief Extra ie

Property Tax Relief Meaning - NC 2024 08 Oct 1 2024 The Internal Revenue Service announced today tax relief for individuals and businesses in the entire state of North Carolina that were