Pros And Cons Of Tax Incentives Why are tax incentives ineffective If tax incentives make a significant difference to effective tax rates and companies factor this into their discounted cash flow analysis why do so few of them say that it makes a difference when responding to

Summary This paper provides an updated overview of tax incentives for business investment It begins by noting that tax competition is likely to be a major force driving countries tax reforms and discusses tax incentives as a possible response to this At a political level tax incentives are less restrictive less selective and leave firms the decision of what R D projects to undertake three critical conditions to increase business R D

Pros And Cons Of Tax Incentives

Pros And Cons Of Tax Incentives

https://www.startuptandem.com/wp-content/uploads/2023/05/26.jpg

Advantages And Disadvantages Of Tax Incentives Vs Direct Measures

https://www.researchgate.net/publication/241753926/figure/tbl3/AS:669380245454853@1536604095641/Advantages-and-disadvantages-of-tax-incentives-vs-direct-measures.png

PPT Tax Incentives FDI PowerPoint Presentation Free Download ID

https://image1.slideserve.com/3593802/2-arguments-for-tax-incentives1-l.jpg

World Bank Document Evaluating the Costs and Benefits of Corporate Tax Incentives IN FOCUS Methodological Approaches and Policy Considerations Hania Kronfol and Victor Steenbergen FINANCE COMPETITIVENESS INNOVATION INVESTMENT CLIMATE 2020 The World Bank Group For decades tax incentives have been a major policy tool to spur economic development and attract and retain good jobs In recent years however these incentives have come under heightened

6 Altmetric Explore all metrics Abstract This paper provides an updated overview of tax incentives for business investment It argues that tax competition is likely to be a major force driving countries tax reforms and discusses tax incentives as a possible response to this AT A GLANCE The role of tax incentives in corporate taxation While business tax incentives are used widely concerns have been raised in recent years regarding their effectiveness their impact on public finances and whether they could potentially distort the EU single market

Download Pros And Cons Of Tax Incentives

More picture related to Pros And Cons Of Tax Incentives

PPT Property Tax Incentives 101 Pros And Cons PowerPoint

https://image1.slideserve.com/2537405/property-tax-incentives-101-pros-and-cons-l.jpg

11 Types Of Tax Incentives How They Differ In Their Functionality

https://www.fincyte.com/wp-content/uploads/2020/10/Tax-Incentives-You-Need-To-know.jpg

Public Forum In The 17th Ward Discussing The Pros And Cons Of Tax

https://tinasweettpihl.com/wp-content/uploads/2022/10/Tax-Incentive-Forum-Flyer_HalfSheet_10.17.22-2-1200x1553.png

Tax incentives represent an important policy tool which is widely used by the governments all over the world in pursuit of a variety of goals ranging from stimulating the economic growth and development to encourage certain behaviors or even to address market failures like for the R D incentives or those addressing The use of tax incentives to promote foreign direct investment has been discussed extensively in literature 1 For instance in 2013 Brauner argued that tax incentives do not promote economic growth and therefore tax incentives are not the right tool to attract foreign direct investment 2 Further studies have been

[desc-10] [desc-11]

P E I Businesses See Pros And Cons In New Tax Incentives Biotech Today

https://biotech-today.com/wp-content/uploads/2019/03/pei-1-800x480.jpg

Pros Cons And Examples Of Tax Credit Incentives In Hawaii Talking Tax

https://i.ytimg.com/vi/w5haZkJzlPk/maxresdefault.jpg

https://www.cgdev.org/blog/good-bad-and-ugly-how...

Why are tax incentives ineffective If tax incentives make a significant difference to effective tax rates and companies factor this into their discounted cash flow analysis why do so few of them say that it makes a difference when responding to

https://www.imf.org/en/Publications/WP/Issues/2016/...

Summary This paper provides an updated overview of tax incentives for business investment It begins by noting that tax competition is likely to be a major force driving countries tax reforms and discusses tax incentives as a possible response to this

Incentives Definition Types Function Examples And Benefits 2023

P E I Businesses See Pros And Cons In New Tax Incentives Biotech Today

Proportional Tax System Pros And Cons Sonia has Bullock

Infographic Tax Pros And Cons After I Do

Pros And Cons Of The Identified Incentive Options 2 Download Table

Enterprise Zone And Employer Tax Incentives ExactHire

Enterprise Zone And Employer Tax Incentives ExactHire

What Are The PROs And CONs Of Multifamily Homes

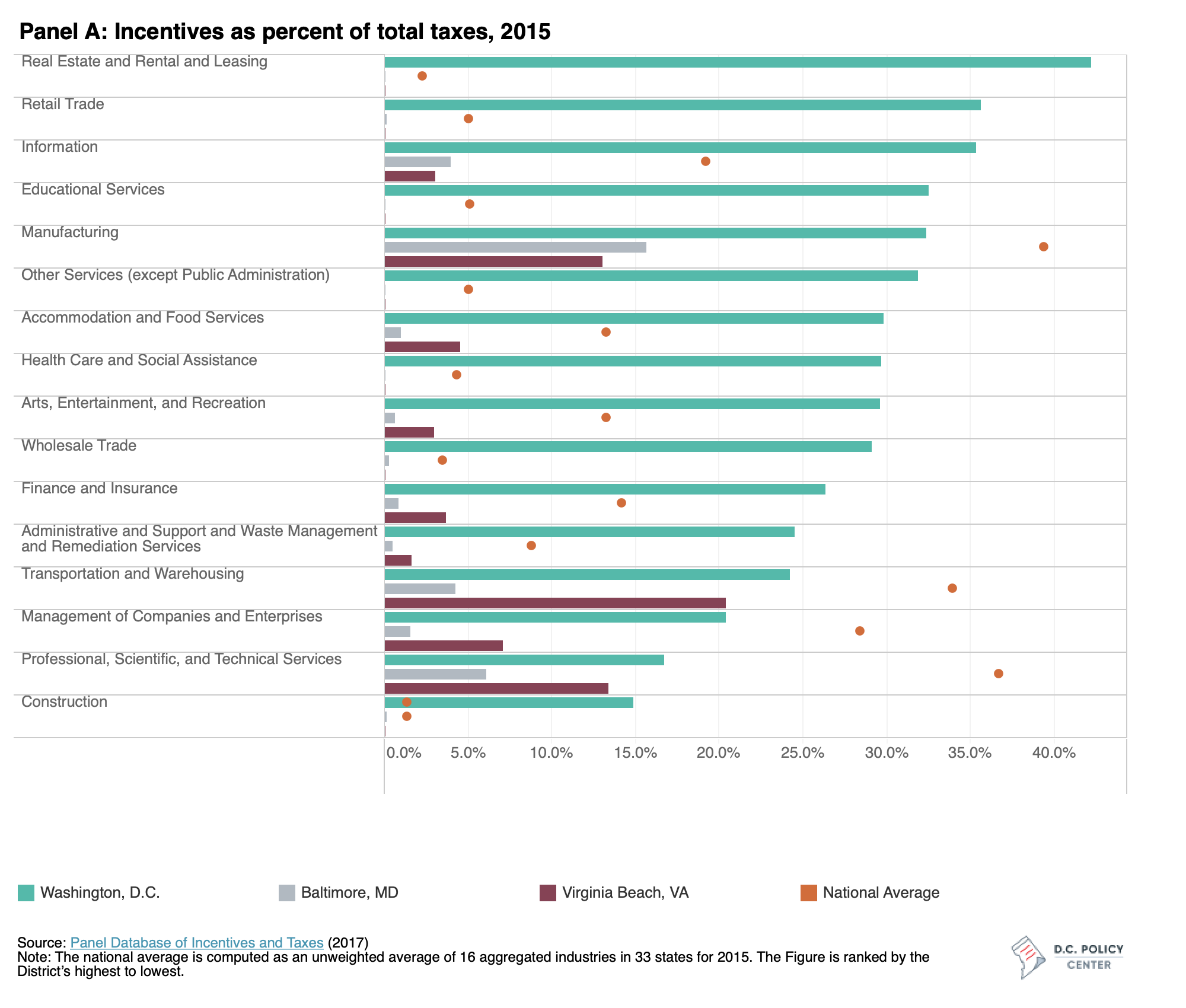

The District s Tax Incentive Strategy Is Unique D C Policy Center

28 Key Pros Cons Of Property Taxes E C

Pros And Cons Of Tax Incentives - World Bank Document Evaluating the Costs and Benefits of Corporate Tax Incentives IN FOCUS Methodological Approaches and Policy Considerations Hania Kronfol and Victor Steenbergen FINANCE COMPETITIVENESS INNOVATION INVESTMENT CLIMATE 2020 The World Bank Group