Province Of Manitoba Seniors School Tax Rebate Verkko be residents of Manitoba The maximum Rebate for 2023 is 235 for eligible seniors The Rebate calculation is based on the total of residential school taxes assessed net of the Basic and Seniors Education Property Tax Credit received or receivable

Verkko Eligibility for the Seniors School Tax Rebate How do I know if I am eligible To be eligible for the Seniors School Tax Rebate you or your spouse common law partner must be 65 years of age or older by the end of the year December 31 own your home or be liable for paying the school taxes on your principal residence live in your Verkko Seniors School Tax Rebate Up to 470 Minus 2 0 on family net income over 40 000 Up to 353 Minus 1 5 on family net income over 40 000 Up to 294 Minus 1 25 on family net income over 40 000 Up to 235 Minus 1 0 on family net income over 40 000 Seniors Education Property Tax Credit Up to 400 Minus 1 0 of family net

Province Of Manitoba Seniors School Tax Rebate

Province Of Manitoba Seniors School Tax Rebate

https://www.manitoba.ca/asset_library/en/edupropertytax/school-taxes.jpg

Province Of Manitoba News Releases Canada And Manitoba Provide 7 5

https://www.manitoba.ca/asset_library/mb-gov.png

Manitoba Online Resources For The Care Of The Elderly NICE Canada

https://uploads-ssl.webflow.com/63e3b52a84906f78597ea2dd/63f292897e5f1a74738a4564_manitoba-elderly-online-resources.jpg

Verkko Seniors School Tax Rebate will be up to 235 minus 1 0 on family net income over 40 000 Seniors Education Property Tax Credit will be up to 200 minus 0 5 of family net income Farmland School Tax Rebate will Verkko Seniors School Tax Rebate Manitoba seniors who live in their own homes may be eligible for the Seniors School Tax Rebate Learn more Seniors with income under 40 000 Senior households with family income under 40 000 may be eligible for an additional EPTC of up to 250

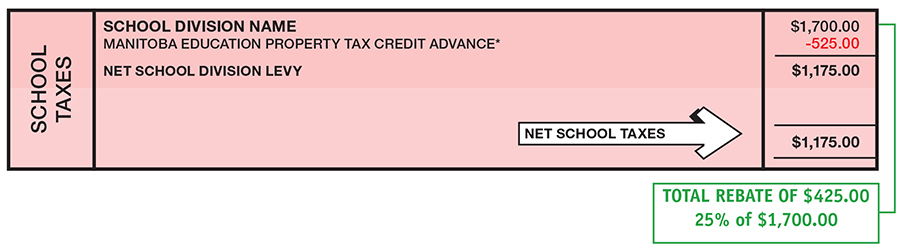

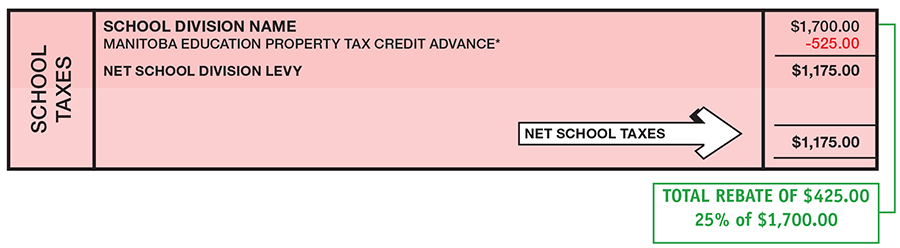

Verkko Property owners will continue to pay education property taxes but will receive the Education Property Tax Rebate in the same month that their municipal property tax payments are due The Education Property Tax Rebate will automatically be issued to property owners no application form will be necessary Verkko be residents of Manitoba The maximum Rebate for 2023 is 235 for eligible seniors The Rebate calculation is based on the total of residential school taxes assessed net of the Basic and Seniors Education Property Tax Credit received or receivable

Download Province Of Manitoba Seniors School Tax Rebate

More picture related to Province Of Manitoba Seniors School Tax Rebate

The Winnipeg Free Press Store

https://wfpquantum.s3.amazonaws.com/images/photostore/large/18897661.jpg

Manitoba Government YouTube

https://yt3.ggpht.com/a/AGF-l79f9TWRLn8XSSrELM1DJpCwvMNKsrw1k6XHuQ=s900-c-k-c0xffffffff-no-rj-mo

Seniors School Tax Rebatate Janice Lukes Councillor Waverley West Ward

https://janicelukes.ca/wp-content/uploads/2016/05/seniors.gif

Verkko 20 tammik 2023 nbsp 0183 32 A majority of Manitobans want the provincial government to cancel education tax rebates planned for this year and spend the money on services instead a poll commissioned by a think tank suggests Verkko 20 toukok 2022 nbsp 0183 32 Residential homeowners and farm property owners are entitled to a rebate of 37 5 per cent of their education property tax this year which is an increase from the 25 per cent rebate issued in

Verkko EDUCATION PROPERTY TAX REBATES C C S M c P143 amended 1 The Property Tax and Insulation Assistance Act is amended by this Part 2 The following is added as Part II 1 PART II 1 GENERAL SCHOOL TAX REBATE Definitions 12 1 The following definitions apply in this Part quot applicable percentage quot means a in relation to farm or Verkko 11 toukok 2023 nbsp 0183 32 This year the School Tax Rebate for residential and farm properties increases to 50 per cent in 2023 from 37 5 per cent in 2022 The average rebate to a homeowner will increase to 774 in 2023 from 581 in 2022 Rebates are delivered the month in which municipal property taxes are due and will begin being received in

[img_title-7]

[img-7]

[img_title-8]

[img-8]

https://www.gov.mb.ca/finance/tao/sstrebate.html

Verkko be residents of Manitoba The maximum Rebate for 2023 is 235 for eligible seniors The Rebate calculation is based on the total of residential school taxes assessed net of the Basic and Seniors Education Property Tax Credit received or receivable

https://www.manitoba.ca/finance/tao/sstr_faq.html

Verkko Eligibility for the Seniors School Tax Rebate How do I know if I am eligible To be eligible for the Seniors School Tax Rebate you or your spouse common law partner must be 65 years of age or older by the end of the year December 31 own your home or be liable for paying the school taxes on your principal residence live in your

[img_title-9]

[img_title-7]

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

Province Of Manitoba Seniors School Tax Rebate - Verkko be residents of Manitoba The maximum Rebate for 2023 is 235 for eligible seniors The Rebate calculation is based on the total of residential school taxes assessed net of the Basic and Seniors Education Property Tax Credit received or receivable