R D Tax Credit Budget 2023 From 1 April 2023 the additional tax relief available for all SMEs will reduce from 130 percent to 86 percent with the cash R D tax credit rate for loss making companies

An enhanced R D tax credit of 27 will be available to loss making R D intensive SMEs those that spend 40 of total expenditure on qualifying R D Eligible Creation of a new simplified scheme RDEC increases and reform Overseas R D changes delayed SME R D Tax Credits techUK advocated strongly to

R D Tax Credit Budget 2023

R D Tax Credit Budget 2023

https://www.nrnamerica.com/wp-content/uploads/2022/04/RD-Tax-Credit-scaled.jpg

R D Tax Credit Statistics 2022 HMRC R D Stats Insights

https://forrestbrown.co.uk/wp-content/uploads/2022/09/513_HMRC-stats-2021_Blog.png

IRS Announces New R D Tax Credit Guidelines

https://mytaxhack.com/wp-content/uploads/2021/11/New-RD-Tax-credit-guidelines1.png

From 1 April 2023 a higher rate of relief for loss making R D intensive SMEs will be introduced SME companies with qualifying R D expenditure that is at There was particularly welcome news for high tech SME businesses with an enhanced R D credit worth 27 for every 100 of R D investment from 1 April 2023

The Research and Development Expenditure Credit RDEC rate for large companies will increase from 13 to 20 The Small and Medium Enterprise SME Under the current rules which end on 31 March 2023 companies spending 100 on R D can obtain a repayable tax credit of 33 35 Under the new rules

Download R D Tax Credit Budget 2023

More picture related to R D Tax Credit Budget 2023

What Is An R D Tax Credit Additional Information Form LimestoneGrey

https://www.limestonegrey.com/wp-content/uploads/2023/07/AIF3.jpg

R D Tax Credit Guidance For SMEs Market Business News

https://marketbusinessnews.com/wp-content/uploads/2019/11/RD-tax-credit-image-499499.jpg

R D Tax Credit Testimonial Finances Made Simple LLC

https://financesmadesimple.net/wp-content/uploads/2021/04/test1-1.png

Implement the enhanced support for R D intensive SMEs that was announced at Spring Budget 2023 providing a higher rate of payable tax credit for In the Autumn Statement 2022 and subsequently in the Spring Budget 2023 Chancellor Jeremy Hunt announced changes to R D Tax Credits for UK businesses

New tax relief for R D intensive SMES The Chancellor announced a brand new credit for loss making SMEs whose qualifying R D expenditure is 40 or Following the review of R D tax reliefs launched at Budget 2021 the government announced the following measures which will generally apply for

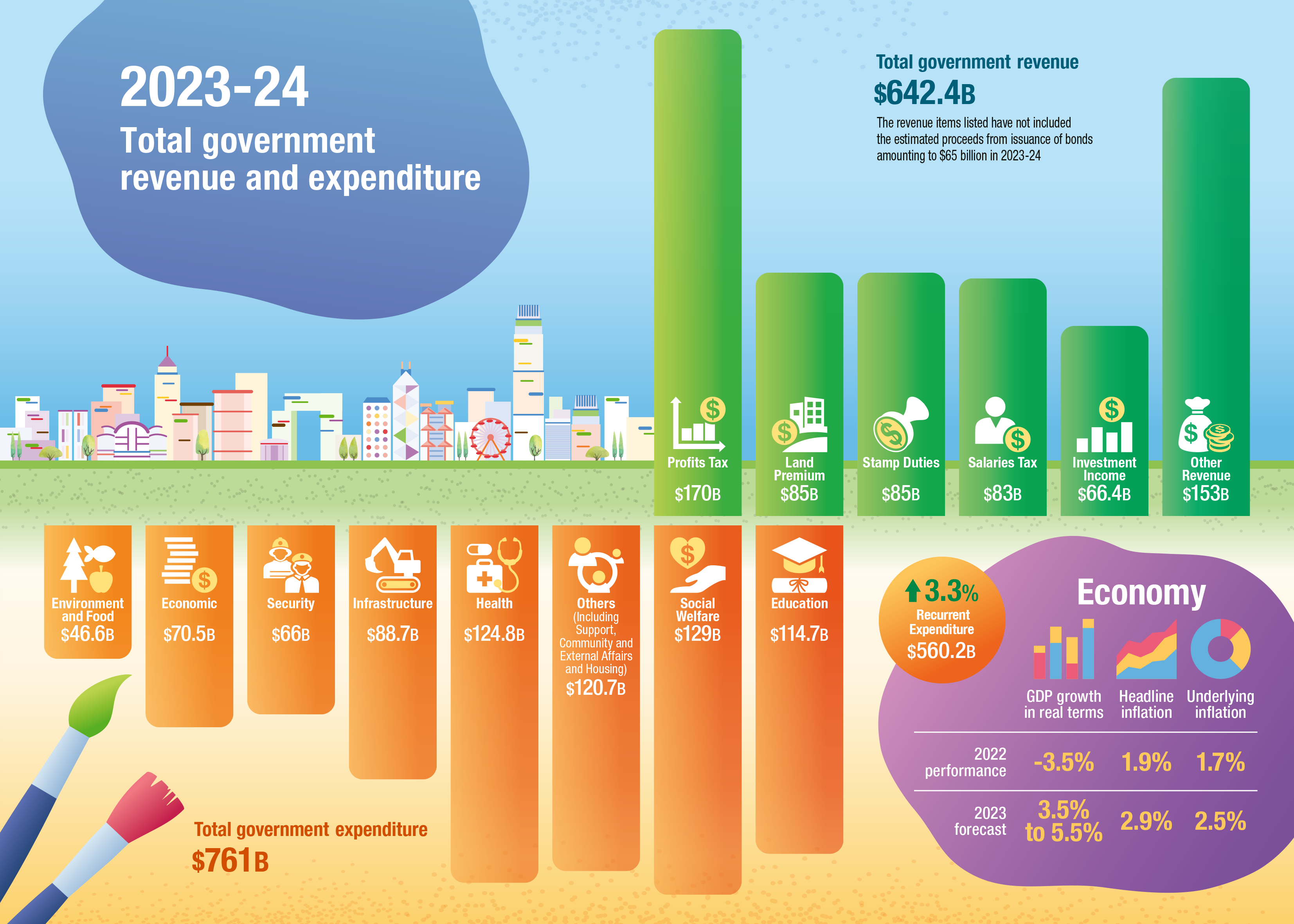

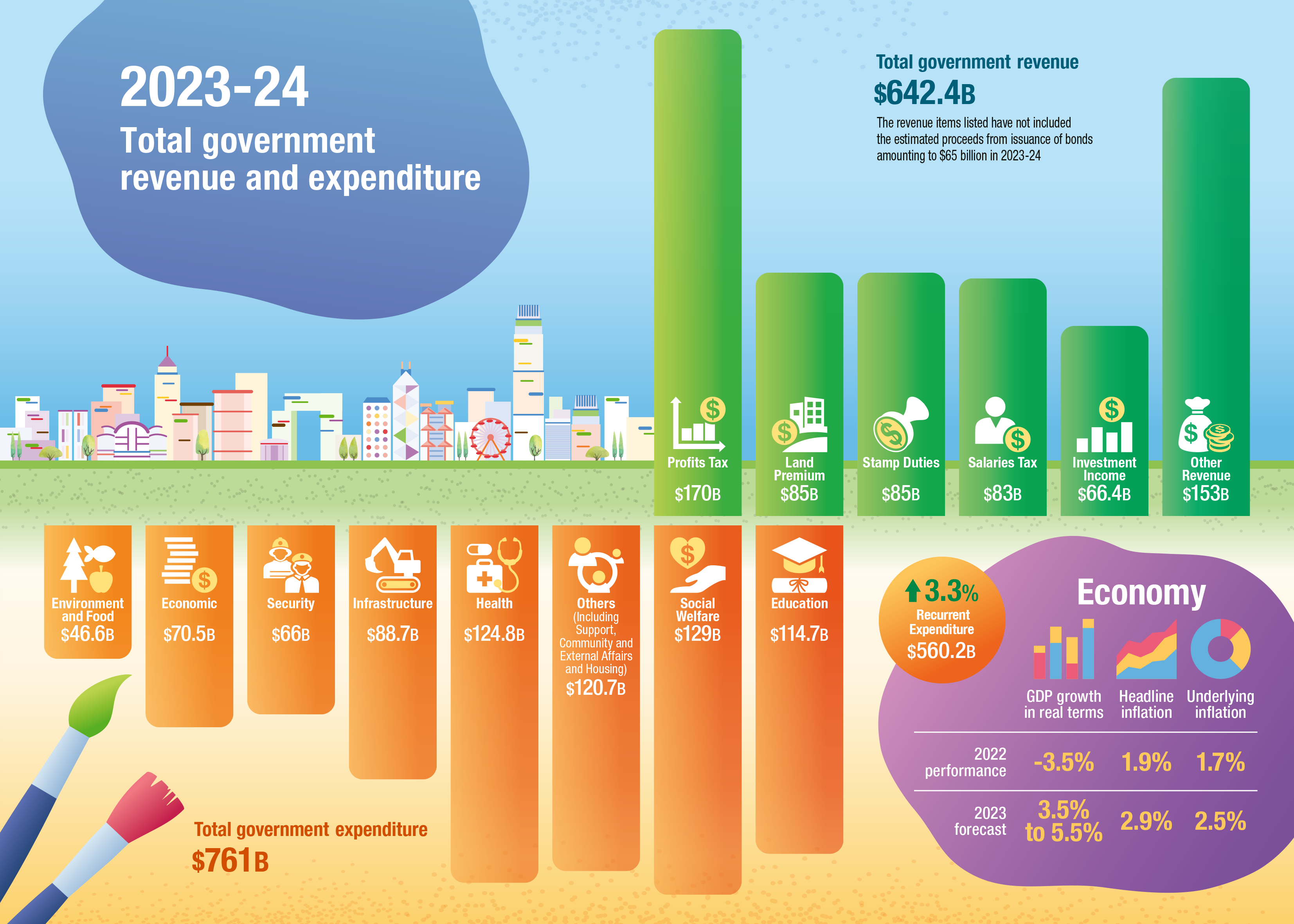

The 2023 24 Budget Public Finance

https://www.budget.gov.hk/2023/eng/images/Budget2023Leaflet-EN-BarChart.png

Small Businesses May Be Eligible For Up To 250 000 In Tax Credits

https://gusto.com/wp-content/uploads/2018/04/RD-tax-credit-graph-Gusto-1024x768.jpg

https://kpmg.com/uk/en/home/insights/2023/03/tmd...

From 1 April 2023 the additional tax relief available for all SMEs will reduce from 130 percent to 86 percent with the cash R D tax credit rate for loss making companies

https://www.pinsentmasons.com/out-law/news/budget...

An enhanced R D tax credit of 27 will be available to loss making R D intensive SMEs those that spend 40 of total expenditure on qualifying R D Eligible

Expansion Of R D Tax Credit Services

The 2023 24 Budget Public Finance

Research And Development Tax Credit Symposium Internal Use Software

R D Tax Credit Rates And Allowances 2023 WhisperClaims

Key Changes To R D Tax Credit In April 2023 Randee

New R D Regulations Impact Invalid Tax Relief Claims Soars

New R D Regulations Impact Invalid Tax Relief Claims Soars

Upcoming Changes To R D Tax Credits Introducing The Additional

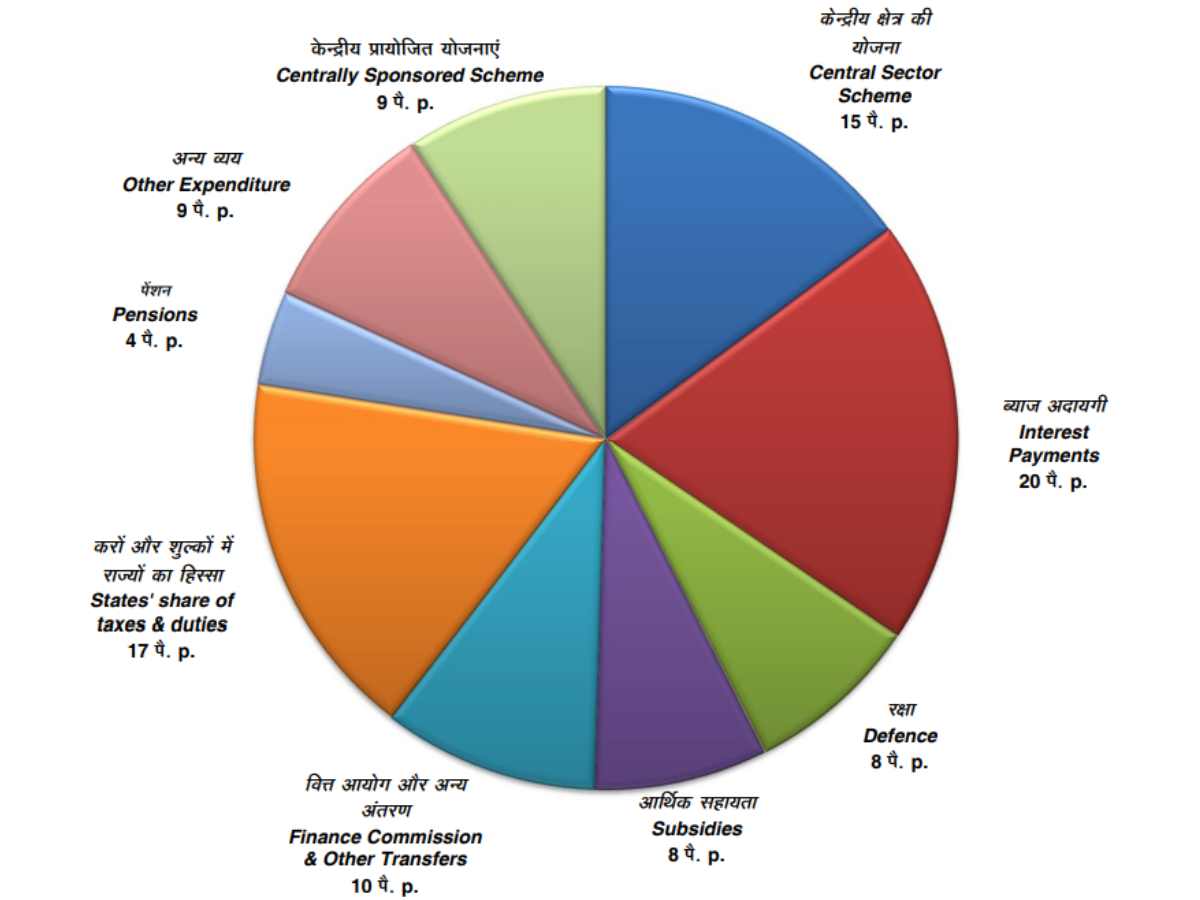

Budget 2023 Where Does Government Spents Its Money Understanding

R D Tax Credit Is Changing In April 2023 Sign Up To Find Out Response

R D Tax Credit Budget 2023 - Under the current rules which end on 31 March 2023 companies spending 100 on R D can obtain a repayable tax credit of 33 35 Under the new rules